Principal Life Insurance Review (Coverage Comparisons & More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1879 |

| Current Executives | CEO – Daniel J. Houston CFO – Deanna D. Strable |

| Number of Employees | 16,475 |

| Total Sales / Total Assets | $14,237,200,000 / $243,036,100,000 |

| HQ Address | 711 High St. Des Moines, IA |

| Phone Number | 1-800-986-3343 |

| Company Website | www.principal.com |

| Premiums Written-Individual Life | $1,796,131,700 |

| Financial Standing | +1.00% From the Previous Year |

| Best For | High-risk Applicants, Flexible Term Policies |

Get Your Rates Quote Now |

|

If you have a family that depends on your income, you owe it to them (and to yourself) to purchase a life insurance policy. And a good policy can be the difference between financial security and financial ruin in the event of an unexpected death.

Shopping for life insurance might seem like an intimidating process for several reasons.

First, nobody wants to plan for their own death. Second, there are dozens of options available from nearly 1,000 life insurance companies.

However, with the right knowledge of how life insurance works, as well as a solid assessment of your financial needs, shopping for life insurance, can be as simple as shopping for any other product.

Principal is one of the largest providers of life insurance in the world and has been providing families with quality life insurance coverage for nearly 150 years.

This extensive review is designed to give you a complete overview of the company, preview their policy offerings, and give you tips to help decide if Principal is the right insurer for your family.

Start comparing life insurance rates now by using our FREE quote tool above.

Table of Contents

Principal’s Ratings

The following third-party ratings give insight into Principal’s financial strength, business practices, and quality of customer service.

A.M. Best

A.M. Best ratings measure an insurer’s financial strength and its ability to pay all its policy obligations.

Principal has a superior A+ rating, meaning they have an excellent ability to meet their financial commitments.

Better Business Bureau (BBB)

The Better Business Bureau assigns one of 13 letter grades based on factors such as time in business, open complaints, resolved complaints, and federal action against a company.

Principal holds a perfect A+ rating.

Moody’s

Similar to A.M. Best, Moody’s long-term obligation ratings measure an insurer’s credit risk. Principal holds a good rating of A1, representing a low credit risk.

Standard & Poor’s (S&P)

Standard & Poor’s (S&P) ratings also measure an insurer’s credit risk. Principal earned a very strong A+ rating, again representing a low credit risk.

NAIC Complaint Index

The National Association of Insurance Commissioners Complaint Index or NAIC compares the number of complaints registered against an insurer each year with that of other companies.

The NAIC sets the index at an average score of 1.00. Principal has a current score of 0.21, well below the industry standard.

J.D. Power

J.D. Power’s annual U.S. Life Insurance Study measures overall customer satisfaction in four areas: annual statement and billing, customer interaction, policy offerings, and price.

Principal scored three out of five in the 2018 study, with a three out of five score in every category.

Company History

Principal Financial Group began life in 1879 as The Bankers Life Association. Edward A. Temple founded the company to provide low-cost life insurance for his fellow bankers in Iowa.

Over the next 20 years, the company expanded, selling policies in 21 states. In 1941, they began offering group life insurance, after which their expansion continued.

By 1985, Bankers Life Association had grown into a full financial services provider, selling annuities and managing retirement accounts in addition to their core life insurance business.

That growth prompted their name change to Principal Financial Group.

Principal sells insurance life insurance through two subsidiaries:

- Principal Life Insurance Company

- Principal National Life Insurance Company

Principal National is licensed to sell policies in all states but New York. Principal Life is licensed to sell in all 50 states and Puerto Rico.

Principal’s Market Share

As of 2018, Principal holds a 0.68 percent market share, representing $1,796,131,700 in direct written premiums.

Here’s a look at how that compares to the top 10 life insurers.

| Rank | Company | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | Northwestern Mutual Life Insurance Company | $10,547,469,000 | 8.20% |

| 2 | Lincoln National Corporation | $7,467,869,000 | 5.80% |

| 3 | New York Life Insurance Group | $7,331,015,000 | 5.70% |

| 4 | Massachusetts Mutual Life Insurance Company | $6,171,213,000 | 4.80% |

| 5 | Prudential Financial | $5,806,118,000 | 4.50% |

| 6 | John Hancock Life Insurance Company | $4,651,894,000 | 3.60% |

| 7 | State Farm | $4,593,999,000 | 3.60% |

| 8 | Transamerica | $4,567,999,000 | 3.60% |

| 9 | Pacific Life | $3,770,584,000 | 2.90% |

| 10 | MetLife | $3,724,165,000 | 2.90% |

| 24 | Principal Financial Group | $2,108,396,107 | 0.68% |

Get Your Rates Quote Now |

|||

Principal’s Position for the Future

Principal isn’t among the top life insurance companies in terms of market share, but the company as a whole is large and in a solid financial position for the future.

They have been on the Fortune 500 list for 25 consecutive years with a current rank of number 210 and number 207 on the Fortune Global 500 list.

The company has nearly $250 billion in assets. Unless they completely divest the business, there’s no reason to think they won’t be selling life insurance for another 150 years.

Principal’s Online Presence

Principal offers the ability to request a quote, pay your premiums, and file a life insurance claim on its website.

They also have an active social media presence.

Both their Facebook and Twitter pages are actively updated with information on the company and its offerings.

As you can see, both also provide general and financial advice.

Principal’s Commercials

Here’s a look at a recent Principal commercial.

Principal’s current ad campaign focuses solely on their investment and retirement services instead of life insurance.

Principal in the Community

Principal is committed to giving back to the communities in which it operates. It does so through the following initiatives.

Volunteerism:

Principal encourages employees to volunteer for causes important to them. To facilitate that, the company formed the Principal Volunteer Network.

The program offers a benefit called Volunteer Time Off (VTO). Through VTO, employees can use eight hours of paid work time per year to volunteer for nonprofit organizations in their community.

Over the past decade, Principal employees have logged over 295,000 hours of volunteer time.

Sponsorships:

Principal sponsors a wide range of organizations, projects, events, and programs in their hometown of Des Moines, Iowa. They specifically choose those that help improve the quality of life in their community.

Charitable Giving:

For more than 100 years, Principal has given to the United Way. Their last campaign pledged a total of $8.3 million to United Way groups nationwide.

Principal also sponsors the Principal Charity Classic, an annual PGA Tour of Champions golf tournament. Over the past decade, the tournament has raised nearly $10 million for Iowa children’s charities.

During that time, they also awarded more than $100 million in grants to various nonprofit organizations.

Principal’s Employees

Principal employs just over 16,000 people worldwide.

Glassdoor employee reviews for Principal averaged 3.7 out of five stars based on over 900 reviews. Nearly 80 percent of current employees say they would recommend the job to a friend.

Principal is ranked on the following notable lists:

- #93 Forbes America’s Best Employers

- #5 Forbes Best Employers for Women

- #55 Forbes Best Employers for Diversity

- #105 Forbes Best Employers for New Grads

Shopping for Life Insurance

If you’re reading this guide, you’ve likely already realized the importance of owning a life insurance policy. If you still haven’t, consider this.

2018 Insurance Barometer Study from Life Happens and LIMRA:

- 35 percent of households would be financially affected within one month of the primary wage earner’s death.

- 90 percent agree that the primary wage earner should carry insurance.

- 60 percent of all people living in the United States have life insurance.

- 20 percent of those with a policy feel their coverage is insufficient.

If you’re one of those without coverage (or someone with insufficient coverage), here are some key things to keep in mind as you shop.

In general, life insurance needs to cover two types of obligations: immediate and future.

Immediate obligations are the things your family will need to pay soon after your death (either in full or on a regular basis). These include:

- Funeral costs

- Medical bills

- Mortgage balances

- Personal loans

- Credit card debt

Future obligations are all the expenses (either planned or unexpected) that you want money set aside for after your death. They include:

- Income replacement

- Spouse’s retirement

- Emergency savings fund

- Children’s college tuition

A life insurance agent or financial planner can help you determine exactly how much coverage you’ll need to meet all those obligations.

For now, here is an example using a basic life insurance calculator:

A husband and father of two is the majority wage earner in his family, with a wife who works full time. He has an annual salary of $85,000.

The family has a remaining mortgage balance of $70,000 and a balance of $10,000 on a car loan.

The mortgage is the largest regular expense. With it paid, the family will have less need for his income. Because the wife works as well, he plans to leave them only five years’ worth of his salary for expenses and savings.

He would also like to leave each child $35,000 to cover the average cost of four-years in-state tuition at a public university.

After factoring in an average funeral cost of around $7,500, his insurance needs are as follows:

- Immediate need: $70,000 mortgage + $10,000 car loan + $7,500 funeral costs = $87,500

- Future need: $400,000 income replacement + $70,000 college fund = $495,000

- Total need: $582,500

That total means he should purchase a life insurance policy with a face value of around $600,000.

Average Principal Male vs Female Life Insurance Rates

The following table illustrates how Principal’s average annual rates on a 10-year, $250,000 policy in key demographics compare to the average of the top 10 insurers by market share.

| Demographic | Annual Premium: Male | Versus Average Top 10 Insurers | Annual Premium: Female | Versus Average Top 10 Insurers |

|---|---|---|---|---|

| 25-year-old Non-Smoker | $128.64 | -$49.90 | $118.08 | -$42.49 |

| 25-year-old Smoker | $435.72 | +$113.96 | $364.92 | +$116.17 |

| 35-year-old Non-Smoker | $130.68 | -$54.36 | $121.80 | -$44.11 |

| 35-year-old Smoker | $490.92 | +$130.69 | $412.08 | +$125.90 |

| 45-year-old Non-Smoker | $215.28 | -$52.61 | $192.72 | -$47.53 |

| 45-year-old Smoker | $1,005.36 | +$367.85 | $779.64 | +$286.44 |

| 55-year-old Non-Smoker | $467.76 | -$57.19 | $362.76 | -$44.18 |

| 55-year-old Smoker | $2,191.92 | +$827.83 | $1,640.64 | +$649.01 |

| 65-year-old Non-Smoker | $660.84 | -$612.28 | $811.08 | -$69.58 |

| 65-year-old Smoker | $5,589.00 | +$2,343.95 | $3,499.08 | +$1,263.77 |

| Average Non-Smoker | $320.64 | -$165.27 | $321.29 | -$49.58 |

| Average Smoker | $1,038.98 | +$146.75 | $1,339.27 | +$488.26 |

Get Your Rates Quote Now |

||||

Principal is a bargain for non-smokers compared to the average, but smokers pay significantly extra.

Coverage Offered

Principal offers a solid selection of both term and permanent life insurance policies. You can also choose from several riders to further tailor your coverage.

Types of Coverage Offered

Life insurance policies fall into one of two general categories, term or whole. Term life policies only pay if the death occurs within a set time frame, usually between 10 and 30 years.

Whole policies have no term and pay whenever a death occurs, regardless of age. Some also build cash value by allocating a portion of your premiums into an interest-bearing account.

They can also come with two benefit options: fixed and increasing.

With a fixed death benefit, the policy premiums decrease over time as the cash value increases, so the payout is always equal to the initial face value.

With an increasing death benefit, the premiums and face value remain the same over time. As the cash value increases, the overall death benefit increases.

Whole policies have multiple variations: traditional whole life policies, universal life policies, guaranteed universal life policies, indexed universal life policies, variable life policies, and variable universal life policies.

Principal offers term, universal, indexed universal, and variable universal policies.

Term

A term policy is payable only if the death of the insured occurs within a specified time period, usually between 10 and 30 years.

Once the term has passed, the insurer cancels the coverage. There are generally no refunds on the premiums paid. Most policies can also be converted to a whole policy before they expire or renewed for an additional term.

The specifics of Principal’s term policy are as follows:

- Term: 1, 10, 15, 20, and 30 years

- Convertibility: Convertible to a permanent policy before year seven on a 10-year, before year 12 on a 15-year, before year 15 on a 20-year, and before year 20 on a 30-year

- Minimum: $200,000

- Maximum: $1 million

- Issue Age: 20-80

The term policy can be customized with the following riders:

- Accidental death benefit rider: Pays a benefit in addition to the death benefit of the policy if the insured dies as a result of qualifying accidental injuries

- Child rider: Pays a death benefit to the insured parent upon the death of an eligible child

- Conversion extension rider: Allows the conversion option to extend to the end of the full level premium period or age 70, whichever comes earlier

- Waiver of premium rider: Waives the policy premiums if the insured becomes totally disabled

Universal

A traditional whole life policy (sometimes called ordinary life) is the most common form of permanent insurance. A portion of your annual premiums is placed in an account that grows at a fixed interest rate (typically around 3-8 percent).

That savings element means the policy has the potential to grow a tax-deferred cash value beyond the face value of the policy, payable to the policyholder.

Universal policies are a more flexible version of traditional whole life.

They offer the same permanent coverage and cash value growth of a traditional plan, while also allowing the flexibility to set monthly premiums, change coverage amounts, and make lump-sum payments to keep premiums low.

Universal policies also allow for loans or withdrawals from the cash value that must be paid back with interest. Any portion not repaid will be deducted from the benefit upon the insured’s death.

The specifics of Principal’s plan are as follows:

- Flexibility: Increase is available at any time; decreases are allowed after the first year

- Guaranteed Interest: 2 percent

- Minimum: $25,000

- Maximum: None (Subject to individual consideration and underwriting limits)

- Issue Age: 0-85

The policy can be customized with the following riders:

- Chronic illness death benefit advance rider: Provides an advance of a portion of the death benefit if a chronic illness occurs

- Surrender value enhancement rider: Provides high early cash surrender value for use in business cases

- Life paid-up rider: Offers over-loan protection, with a one-time charge when the rider is exercised

- Terminal illness death benefit advance rider: Provides an advance of a portion of the death benefit if diagnosed with a terminal illness

Indexed Universal

Indexed universal policies differ from basic universal policies in the way they grow their cash value.

Instead of growing at a fixed rate set by the insurer, indexed policies allocate the cash value to an account that grows according to an equity index such as the S&P 500 or the NASDAQ-100.

The specifics of Principal’s plan are as follows:

- Flexibility: Increase is available at any time; decreases are allowed on or after the first year

- Guaranteed Interest: 2 percent

- Minimum: $50,000

- Maximum: None (Subject to individual consideration and underwriting limits)

- Issue Age: 20-85

The policy can be customized with the following riders:

- Chronic illness death benefit advance rider

- Surrender value enhancement rider

- Life paid-up rider

- Terminal illness death benefit advance rider

Variable Universal

With variable policies, you invest your cash value directly in stocks, bonds, and money market mutual funds, similar to an IRA or 401(k).

Variable policies come with the greatest risk, but also some of the highest growth potential.

Variable-universal policies combine the benefits of universal and variable insurance; you get the flexibility of adjustable premiums and face values with the potential for significant growth.

The specifics of Principal’s policy are as follows:

- Flexibility: Increase is available at any time; decreases are available after the first year

- Guaranteed Interest: 2 percent

- Minimum: $100,000

- Maximum: None (Subject to individual consideration and underwriting limits)

- Issue Age: 0-85

The policy can be customized with the following riders:

- Chronic illness death benefit advance rider

- Surrender value enhancement rider

- Life paid-up rider

- Terminal illness death benefit advance rider

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Factors That Affect Your Rate

Anything that increases your risk of an early death increases the chances the insurer will have to pay out on your policy. That higher risk classification will result in a higher premium.

Let’s take a look at some of the most common factors that affect your rate.

Demographics

Several demographic factors influence your life insurance premiums in a big way.

Age: Age is one of the most important factors in determining insurability.

Naturally, older people are closer to death than younger people.

An older person applying for a life insurance policy is at greater risk of dying before the policy grows enough to be profitable than a younger person.

The insurer passes along that risk in the form of higher premiums. Every year you wait to buy makes your policy more expensive.

Gender: You might not think it would, but gender also plays just as large of a role.

Statistically, men have shorter life expectancies than women. For that reason, women almost always pay lower premiums than men of the same age and health.

Current Health & Family Medical History

The healthier you are, the longer you are likely to live. Healthy people represent less of a risk to an insurer.

To determine your overall health, insurers will require you to fill out a health questionnaire and may request access to your medical record. Some may require a complete medical exam and submit samples of your bloodwork.

Even if a policy does not require a medical exam, underwriters still have access to public prescription and Medical Information Bureau (MIB) records.

Be honest about your health history because the insurer has easy access to the truth because if the underwriter discovers that you lied, your application will likely be denied.

Most insurers will also examine the health history of your immediate family to identify any potential hereditary medical issues such as a history of heart disease, diabetes, or cancer.

High-Risk Occupations

The Bureau of Labor Statistics’ Census of Fatal Occupational Injuries shows that some jobs (such as police officers and firefighters) have a higher risk of accidental death than others.

A high-risk occupation will also translate to a higher insurance risk classification, which ultimately leads to higher premiums.

High-Risk Habits

High-risk habits outside of work can also result in costlier life insurance.

The most common high-risk habit that insurers look for is smoking. Tobacco users almost universally pay higher rates than their non-smoking counterparts in every demographic.

Principal’s rates are particularly prohibitive for smokers.

For example, the average 25-year-old male non-smoker pays around $230 per year for a 30-year, $250,000 policy. A 25-year-old smoker pays $800 for the same policy.

That’s an extra $17,100 paid over the entire term.

In addition to smoking, insurers will also look to see if you pursue any high-risk hobbies outside of your occupation, such as skydiving, flying, or racing.

A single experience won’t get you a higher premium, but a regular hobby could place you in a higher risk category.

Veteran or Active Military Status

Military status falls under the category of high-risk occupations. Most insurers charge higher rates to active duty military service members, and some don’t sell them policies at all.

Getting the Best Rate with Principal

Insurers set their base premiums on three factors: mortality, interest, and company expenses. Each successive level of risk raises your premium from those base rates.

Insurers use statistical mortality tables to estimate how many people are likely to die each year in every demographic. If they insure people in demographics with a high risk of death, they’ll raise their rates on them to minimize losses.

Rates are also influenced by current interest rates. Insurers make their money by investing the premiums you pay in bonds, stocks, and mortgages. If there is a low expected return on those investments due to market concerns, they could raise premiums to compensate.

They also factor in all their operating expenses. Like any company, the more they spend on maintaining their business, the more of that cost they pass onto their customers.

Rates can also vary from state to state, though the NAIC is currently encouraging states to adopt laws that would provide more uniformity nationwide.

With so many variables influencing rates, how do you get the best price on life insurance?

A lot of these factors are beyond your control, especially gender and family medical history. The best way to lower your costs is to improve the areas you can control. Some of them are simple.

First, lead a healthy lifestyle. Blood pressure level, Body Mass Index, and cholesterol are key measures on a medical exam. A healthy diet and regular exercise can dramatically improve them.

You should also read some information on the medical exam process, so you know what to expect.

If you do smoke, you need to quit as soon as you can. Going cold turkey right before applying for a policy might not cut it. Some insurers require you to be tobacco-free for an extended period before you can claim a non-smoking rate.

Next, buy early. As previously discussed, waiting to buy insurance will increase your premiums. Rates always increase with time.

For example, the average 10-year, $500,000 policy for a 35-year-old male, non-smoker, is around $180 per year. That same policy for a 45-year-old costs $350. That 10-year jump nearly doubles the cost.

Finally, pay your premiums on time. Like any bill, late payments result in penalties and could even lead to the cancellation of your policy.

If you have a policy canceled for non-payment, you can expect additional fees to get it reinstated or higher rates at the next insurer.

| Age | $250,000: Male | $250,000: Female | $500,000: Male | $500,000: Female |

|---|---|---|---|---|

| 25 | $10.72 | $9.84 | $14.88 | $13.13 |

| 30 | $10.81 | $9.99 | $15.05 | $13.42 |

| 35 | $10.89 | $10.15 | $15.23 | $13.74 |

| 40 | $12.99 | $11.90 | $19.43 | $17.24 |

| 45 | $17.94 | $16.06 | $29.31 | $25.55 |

| 50 | $25.03 | $21.44 | $43.49 | $36.31 |

| 55 | $38.98 | $30.23 | $71.40 | $53.90 |

| 60 | $61.60 | $43.01 | $116.64 | $79.45 |

| 65 | $106.09 | $67.59 | $205.63 | $128.63 |

Get Your Rates Quote Now |

||||

In the table above, we’ve compiled a list of average monthly sample rates for a 10-year term for non-smokers at key ages to give you an idea of how much a term life policy might cost.

Principal’s Programs

Principal offers little in the way of additional life insurance resources on its website aside from a couple of blog posts, a life insurance FAQ, and a few videos.

Those few resources do contain good information, but if you’re looking for a one-stop-shop to answer all your general life insurance questions, you might be better off consulting a third party.

Canceling Your Policy

If you need to cancel your policy, you can do so at any time, although early termination of some term plans could result in penalties.

There are generally no refunds on premiums when you cancel a life insurance policy. For a term policy, you would only receive a refund on prepaid premiums for an upcoming period.

For a whole policy, you’ll be refunded any prepaid premiums as well as a surrender value. The surrender value is the cash value of your policy minus any surrender fees.

How to Cancel

The only way to cancel your policy is through your life insurance agent or by requesting a cancellation form from customer support.

You’ll need to fill out the form and submit it either electronically or via mail.

You can reach customer support through your member portal or by phone at 800-986-3343.

How to Make a Claim

The overall process of filing a death benefit claim with Principal follows general industry-standard steps:

- Initiate a claim

- Fill out company-specific paperwork

- Submit the paperwork along with a death certificate and any other requested documents

- Choose a disbursement method

- Receive the benefits

You can locate the individual life claims packet through a quick search of the Principal website or by visiting the member portal. You can also request one by calling customer service.

Upon initiating a claim, you must provide a policy number, the insured’s date of death, and a death certificate. If the insurer requires any other documentation, it’ll be listed in the claim package.

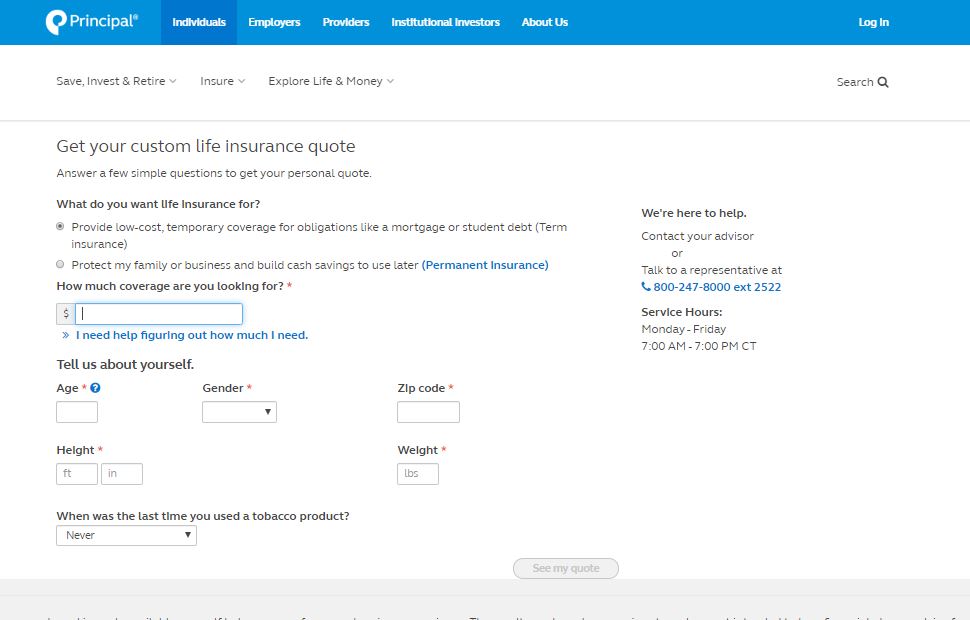

How to Get a Quote Online

Principal offers instant quotes for term policies on their website.

#1 – Go to the Quote Tool

From the homepage, go to the term life insurance page and select the Get My Quote option on the left.

#2 – Enter Your Information

The tool will ask you to enter your desired coverage amount, followed by some brief personal information.

#3 – Get Your Quote

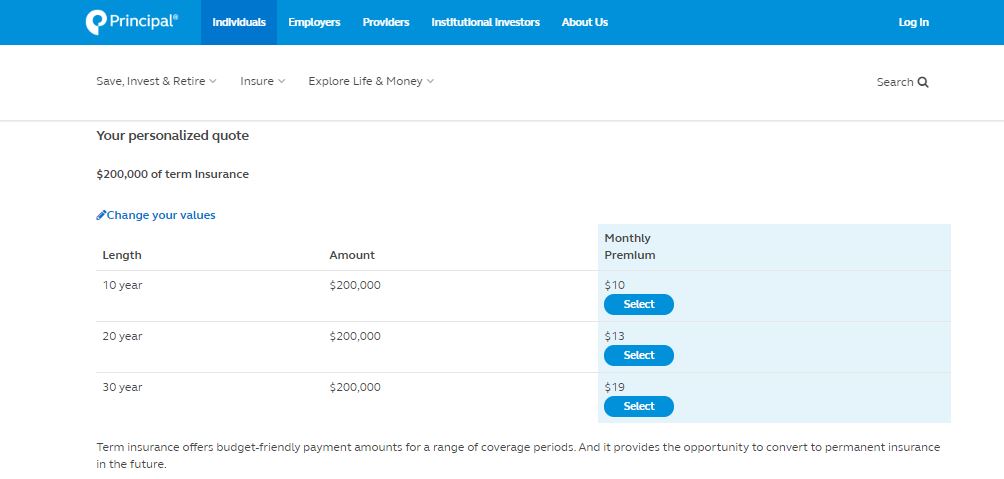

Once you submit your information, the tool will give you monthly rates for a 10-, 20-, and 30-year term. Select your desired length.

#4 – Schedule a Meeting with an Agent

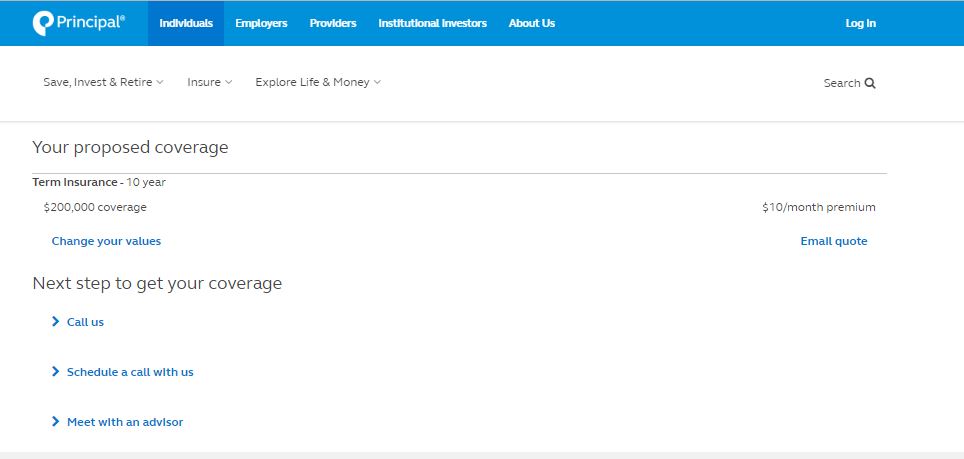

After you select your desired length, you’ll be directed to a page where you can have the quote emailed directly to you.

You can also schedule a call with customer service or meet with an independent advisor to discuss the next steps in purchasing coverage.

Design of Website/App

The Principal website is simple to navigate and offers a good amount of general information on their policy offerings. To get specific details, you’ll need to talk to an agent.

Principal has an app for managing retirement accounts, but not life insurance policies.

Pros & Cons

As with any company, there are pros and cons to shopping with Principal. Here are some of the biggest.

Pros

- Good selection of term and whole policy options

- Good selection of additional riders

- Easy access to online quotes

- Below-average rates for non-smokers on many term policies

Cons

- Above-average rates for smokers

- $200,000 minimum face value on term policies

- No burial/final expense insurance

The Bottom Line

Principal isn’t one of the largest life insurance companies, but they are one of the oldest and among the most financially stable.

They don’t have the most policy options, but what they do, they do well. They cover all the basics with term, universal, indexed, and variable policies. The only things they’re missing are a traditional whole plan and final expense insurance.

If you’re a healthy non-smoker, you owe it to yourself to get a quote from Principal. Most can get quality coverage for a great price.

Smokers, on the other hand, should probably make some price comparisons with other providers before making a decision. Principal’s smoking rates were above average for nearly every age and gender.

Principal’s FAQs

Here are some frequently asked questions about Principal and their policy offerings.

#1 – Does Principal offer a no-exam life insurance policy?

Yes. Principal’s underwriting process allows for the possibility of no medical exam for qualified applicants. Qualification is based on age, product, face amount, and personal medical history.

#2 – Does Principal offer any supplemental coverage?

Principal offers supplemental disability income insurance and retirement savings protection.

#3 – Does Principal offer group life insurance?

Yes. Principal does offer employer-sponsored life insurance plans. You can’t choose who your employer uses for insurance coverage, but if they do offer Principal plans, all the preceding information applies.

#4 – How do I make a payment on my Principal life insurance premiums?

You can have your payments automatically debited from your checking account every month by filling out an authorization form or make electronic payments from a savings or checking account online.

#5 – How easy is it to change my beneficiary?

You’ll need to fill out a beneficiary change form, which you can fill out and submit directly online or by mail. You can access the form through your member portal or directly on the individual insurance page.

#6 – Can I make withdrawals on my Principal life insurance policy?

All of Principal’s permanent insurance policies allow you to take out loans against your cash value. Loans must be paid back with interest, or you risk decreasing or forfeiting your death benefit.

#7 – How long does it take for Principal to pay death benefits on a life insurance policy?

Death benefits are typically paid within 30 days of processing the completed claim packet. The benefit also accrues 2 percent interest between the day the claim is filed and the day it is paid.

#8 – Are the life insurance benefits taxable?

Life insurance benefits are non-taxable when they are paid directly to a beneficiary, such as a spouse or a child. However, if you name your estate as the beneficiary, the benefits become a part of the estate and are then subject to estate taxes.

#9 – Are all Principal life insurance policies available in all states?

Yes. Principal is licensed to sell all its policies in every state through one of its two affiliates.

Start comparing life insurance rates now by using our FREE quote tool below.

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption