MassMutual Life Insurance Review (Coverage Comparisons & More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1851 |

| Current Executives | CEO - Roger W. Crandall |

| CFO - Elizabeth Ward | |

| Number of Employees | 8,844 |

| Total Assets | $265,812,600,000 |

| Headquarters Address | 1295 State Street, Springfield, MA 01111 |

| Phone Number | 1-800-272-2216 |

| Company Website | www.massmutual.com |

| Premiums Written - Individual Life | $6,171,213,000 |

| Premiums Written - Group Life | $1,440,794,000 |

| Financial Standing | -22.4% from Previous Year |

| Best For | No Exam Term Policies |

Get Your Rates Quote Now |

|

Purchasing a personal life insurance policy is one of the most important decisions you can make for your loved ones. It can be the difference between financial security or financial ruin after your death.

With so much at stake, it can be challenging to decide which company is best suited to meet your needs.

MassMutual is one of the oldest life insurers in the country. Since 1851, they have provided people with the peace of mind that comes from knowing their families will be taken care of after they’re gone.

In that time, they have grown to become the fourth-largest provider of individual life insurance, with over $6 billion in direct written premiums.

This review is designed to give you a complete overview of the company and guide you through all their policy options to help you make the best purchase decision.

Start comparing life insurance rates now by using our FREE tool above!

Table of Contents

MassMutual’s Ratings

The following third-party ratings give insight into MassMutual’s financial strength, business practices, and quality of customer service.

A.M. Best

A.M. Best ratings measure an insurer’s financial strength in terms of its ability to pay all of its policy commitments.

MassMutual has the highest possible rating of A++, meaning they have a superior ability to meet their financial obligations.

Better Business Bureau (BBB)

The Better Business Bureau uses 13 factors such as time in business, open complaints, resolved complaints, and legal action against a company to assign one of thirteen letter ratings, A+ through F.

MassMutual currently holds an above-average B- rating.

Moody’s

Like A.M. Best, Moody’s long-term obligation ratings assess an insurer’s credit risk. MassMutual holds a high-quality Aa3 rating, the fourth-highest possible.

This means they are a high-quality company with low credit risk.

Standard & Poor’s (S&P)

S&P (Standard and Poor’s) ratings also measure an insurer’s credit risk. MassMutual earned a very strong AA+ rating, the second-highest of 21 overall scores.

NAIC Complaint Index

The National Association of Insurance Commissioners Complaint Index compares the number of complaints registered against an insurer each year with that of other companies.

The index is set at an average score of 1.00. MassMutual has a current score of 0.12, much lower than the industry standard.

J.D. Power

J.D. Power’s annual U.S. Life Insurance Study measures overall customer satisfaction in four areas: annual statement and billing, customer interaction, policy offerings, and price.

MassMutual scored 3/5 in the latest study.

Company History

MassMutual was founded on May 15, 1851, in Springfield, Massachusetts, as the Massachusetts Mutual Life Insurance Company. Since then, it has grown to become one of the largest life insurers in the nation.

As its name implies, MassMutual is a mutual company. It is unique among most businesses in that there are no shareholders. Instead, the company is owned by its customers.

Owners of participating whole life policies can vote on board members and are eligible for profit sharing. MassMutual has consistently paid dividends to its eligible policyholders since the 1860s.

MassMutual also owns several subsidiaries, two of which are traditional life insurers: C.M. Life Insurance Company and MML Bay State Life Insurance Company.

The third company, Haven Life, was founded in 2014. It holds the distinction of being the first simple, streamlined solution to buying term life insurance policies completely online.

That said, who better to explain the company’s long history than the company itself?

MassMutual’s Market Share

In 2018, MassMutual was responsible for 4.8 percent of all individual life insurance business in the country, with $6,171,213,000 in direct written premiums.

They are also responsible for 2.7 percent of all group life insurance policies, with $701,120,304 in premiums written.

MassMutual (as the Massachusetts Mutual Life Insurance Company) sells life insurance policies in all 50 states, Washington D.C, and Puerto Rico. Policies may be underwritten by either subsidiary, C.M. Life Insurance Company or MML Bay State Life Insurance Company, in all states but New York.

From 2015 – 2018, Mass Mutual rose two spots from the sixth- to the fourth-largest writer of individual life insurance policies. Subsequently, they fell out of the top 10 writers of group insurance policies from their previous position of seventh.

MassMutual’s individual life insurance business is on a steady upward trend. In the past four years, their market share increased nearly an entire percentage point from 3.90 to 4.80, with an increase in direct written premiums from $4,765,228,000 to $6,171,213,000.

Their group insurance business has shown significant fluctuation. It rose from 4.20 market share in 2015 to 4.60 in 2016, then fell to 4.10 in 2017, after which it continued to fall beyond the top 10.

MassMutual’s Position for the Future

MassMutual reported record revenue in 2018, as evidenced in its climb from number five to number four in market share. Between its life insurance and annuity businesses, the company had $30.8 billion, a 20-percent increase over the prior year.

MassMutual approved an estimated $1.72 billion dividend payout to eligible participating policy owners in 2019, its highest payout ever and the 151st consecutive year it has paid a dividend.

The insurer has the same positive outlook for the future it has had for the last century and a half.

As of 2018, MassMutual is nearly an entire percentage point behind New York Life in market share. They are not likely to catch up anytime soon, but could further solidify their number four spot in the coming years.

When former top-three insurer MetLife stopped selling individual life insurance policies in 2016, MassMutual acquired the company’s U.S. retail advisor force. That force consists of over 4,000 advisors across the country.

The impact of that acquisition can be seen in MassMutual’s steady climb in market share.

With that force now focused on selling MassMutual policies and picking up the business MetLife left on the table, the insurer will likely continue to grow its 0.3 percent lead over the number fifth company, Prudential.

And while on the surface it does look like MassMutual’s group insurance business may be in a bit of a spiral, keep in mind that the margins between competitors on that list are very narrow.

A less-than $40 million decrease in written premiums from $1,480,022,000 in 2016 to $1,440,794,000 in 2017 resulted in a 0.5 percent loss in market share. On the other hand, it took an increase of nearly $430 million from $5,741,452,000 in 2017 to $6,171,213,000 in 2018 for the company to gain only 0.3 percent in market share in individual life.

Despite the decline in group business, MassMutual is still in a strong position for the future.

MassMutual’s Online Presence

MassMutual offers the ability to pay bills, file a life insurance claim, and apply for specific term policies through its website.

While you can apply for the MassMutual® Direct Term policy online, you must contact an agent for all others.

Insurance agents fall into one of two categories: independent or captive. An independent agent is free to shop and sell policies from multiple agencies to find the best policy for their clients.

A captive agent works for a single insurer, and will only market and sell their employer’s policies. MassMutual employs a large retail force of captive agents.

MassMutual’s Commercials

MassMutual’s “Moments You Plan For” ad campaign focuses mainly on their financial planning business and less on life insurance.

MassMutual in the Community

The Mass Mutual Foundation uses the company’s years of financial experience to help communities and local social organizations increase their financial strength and broaden their impact.

Read on to learn about the initiatives MassMutual utilizes.

Live Mutual Project

The Live Mutual Project partners with outside organizations and community groups to identify the financial challenges facing those in underprivileged neighborhoods.

They work to bridge the gap between the people and the resources they need to find housing, jobs, loans, and other means of financial support through education and grant money.

FutureSmart™

FutureSmart™ believes that financial education is key to achieving economic independence. Since 2014, the program has delivered a digital financial literacy curriculum to over one million students nationwide.

LifeBridge™

LifeBridge™ is a free life insurance program that helps children in low-income families pay education expenses if their insured parent or guardian passes away during the policy’s term.

Mutual Impact™

Through their Mutual Impact™ program, MassMutual matches employee contributions to local non-profit organizations. They also encourage employees to volunteer with the grantee organizations, providing them the time to do so.

MassMutual’s Employees

MassMutual currently employs nearly 9,000 people nationwide in a variety of positions.

Overall, Glassdoor employee reviews for MassMutual average 3.7/5 stars. In addition, 67 percent of current employees say they would recommend the job to a friend.

MassMutual consistently ranks among the best places to work on multiple national lists, many of which show the company’s commitment to diversity and inclusion.

Here are the most notable awards from the past year:

- Forbes: America’s Best Employer for Diversity (2019)

- Human Rights Campaign Corporate Equality Index: Perfect score of 100 (2019)

- National Association for Female Executives: Top Company for Executive Women (2018)

- Working Mother Top 100 Best Company: Inducted into the Working Mother Hall of Fame, earning a place on the 100 Best Companies list for over 15 years

- Disability Equality Index® (DEI): Best Place to Work for Disability Inclusion (2019)

- Diversity Best Practices Inclusion Index Company: (2019)

Shopping for Life Insurance

According to the 2018 Insurance Barometer Study from Life Happens and LIMRA, about 60 percent of all people living in the United States were covered under either an individual or group life policy.

Among those covered, one in five feels they have insufficient coverage. So, the question is: how much coverage is enough?

If you’re one of the 40 percent in need of life insurance or one of the 12 percent without sufficient coverage, there are some important things to keep in mind as you shop for a policy.

In general, life insurance needs to cover two types of obligations: immediate and future.

Immediate obligations include things that will need to be paid soon after death, such as funeral costs, medical bills, mortgage balances, and any other outstanding debt.

Your future obligation is the money you want to leave your loved ones to cover any planned or surprise expenses down the road. These might include funds for a child’s college tuition or unplanned medical expenses.

It also needs to take into consideration how many years’ worth of your annual salary you want to leave your family if maintaining their lifestyle is dependent on your current income.

One of MassMutual’s many retail agents can help you determine the right coverage for your current financial situation, but to give you an idea, here is an example using a basic life insurance calculator.

Imagine you’re the primary wage earner of a family of three with an annual salary of $75,000. You have a remaining mortgage balance of $75,000 and an outstanding credit card balance of $5,000.

You have a stay-at-home spouse and a 12-year-old child. Your spouse plans to go back to work when the child goes to college, so you’d like to leave seven years’ worth of income to cover that gap.

You’d also like to leave $25,000 to cover the cost of that college education. After factoring in an average funeral cost of around $7,500, your insurance needs are as follows:

- Immediate: $75,000 mortgage + $5,000 credit card + $7,500 funeral costs = $87,500

- Long-term: $482,468 income replacement + $25,000 college tuition = $507,468

- Total: $594,968

That total means you would need a life insurance policy with a face value of around $600,000.

(Note: Insurance agents typically calculate income replacement at 70 – 75 percent of your annual salary. They adjust the number for inflation and also assume the death benefit will be placed in an interest-bearing account to make up the difference.)

Average MassMutual Male vs Female Life Insurance Rates

The following table illustrates how MassMutual’s average rates for males and females in key demographics compare to the average of the top 10 insurers by market share.

| Demographic | Annual Premium: Male | Versus Average Top 10 Insurers | Annual Premium: Female | Versus Average Top 10 Insurers |

|---|---|---|---|---|

| 25-year-old Non-Smoker | $147.00 | -$31.54 | $132.00 | -$28.57 |

| 25-year-old Smoker | $230.00 | -$91.76 | $200.00 | -$48.75 |

| 35-year-old Non-Smoker | $151.00 | -$34.04 | $137.00 | -$28.91 |

| 35-year-old Smoker | $281.00 | -$79.23 | $235.00 | -$51.18 |

| 45-year-old Non-Smoker | $230.00 | -$37.89 | $209.00 | -$31.25 |

| 45-year-old Smoker | $460.00 | -$177.51 | $387.00 | -$106.20 |

| 55-year-old Non-Smoker | $451.00 | -$73.95 | $373.00 | -$33.94 |

| 55-year-old Smoker | $990.00 | -$374.09 | $770.00 | -$221.63 |

| 65-year-old Non-Smoker | $1,049.00 | -$224.12 | $763.00 | -$117.66 |

| 65-year-old Smoker | $2,066.00 | -$1,179.05 | $1,391.00 | -$844.31 |

| Average Non-Smoker | $405.60 | -$80.31 | $322.80 | -$163.11 |

| Average Smoker | $805.40 | -$380.33 | $596.60 | -$589.13 |

Get Your Rates Quote Now |

||||

Coverage Offered

MassMutual offers a wide variety of term, whole life, universal, and variable universal options to meet every financial need. You can also choose from multiple riders to further tailor your policy.

Types of Coverage Offered

Life insurance policies fall into one of two general categories: term or whole. Term policies only pay if the death occurs within a set time frame, usually between 10 – 30 years.

Whole policies have no term and pay whenever a death occurs, regardless of age. Whole policies have multiple variations: traditional whole life, universal life, and variable universal life.

Each policy type is defined by the NAIC as follows:

- Term: A term life insurance policy is payable only if the death of the insured occurs within a specified period or before a specified age. Once the term has passed, the insurer cancels the coverage. There are generally no refunds on the premiums paid.

- Whole: A whole life insurance policy covers you as long as you live. You pay a fixed premium over a specific period to receive a fixed, guaranteed death benefit. Insurers typically charge higher premiums in the earlier years of the plan, with the additional premium invested at a set rate to cover the eventual payout. That savings element means the policy has the potential to grow a tax-deferred cash value, either paid to the policyholder or applied to premium payments. Whole policies also allow for loans or withdrawals from the cash value.

- Universal: Universal life insurance policies are more flexible than whole life plans. You are able to set monthly premiums and change coverage amounts. You can choose either a fixed death benefit or an increasing death benefit equal to the original face value plus your cash value amount.

- Variable Universal: Variable universal life policies offer a variable savings account that allows you to invest your cash value in stocks, bonds, and money market mutual funds rather than growing at a fixed rate like whole and standard universal policies. They come with the greatest risk, but also the most growth potential.

Riders can be added to each policy to customize your coverage further. MassMutual offers the following riders for both term and whole policies:

- Disability Waiver of Premium Rider: If you become disabled, your premiums will be waived until age 65 or to the end of the policy term.

- Guaranteed Insurability Rider (GIR): Guarantees you the right to purchase additional insurance, without proof of good health, at specified dates in the future.

- Additional Life Insurance Rider (ALIR): Allows you to make payments in addition to your base premiums to increase your policy’s death benefit and accelerate its cash value growth.

A life insurance agent can help you determine which policies and riders best fit your financial situation.

Term

MassMutual offers several traditional term policies. Most term policies have level premiums that are guaranteed for a specific period of time (usually 10 or 20 years). After this, premiums increase.

You can convert many of these policies to whole or universal policies without any further medical exams or going through the underwriting process again.

- Minimum Face Amount: $100,000

- Maximum Face Amount: Subject to individual consideration and underwriting limits

- Issue Age: 18-75

They also offer the MassMutual® Direct Term, which you can purchase directly through a simple online application with instant approvals.

- Minimum Face Amount: $100,000

- Maximum Face Amount: $3,000,000

- Issue Age: 18-64

Whole

MassMutual’s whole life policies are unique in that, in addition to the guaranteed death benefit and growing cash value, they also make you eligible to receive the previously discussed dividends.

Dividends are not guaranteed, but MassMutual has consistently shared profits with its eligible policyholders since 1869.

- Minimum: $100,000

- Maximum: Subject to individual consideration and underwriting limits

- Issue Age: 15-85

Universal

MassMutual offers multiple universal life policies. Some offer a guaranteed death benefit as long as you pay a specified amount of premiums.

Others offer a steadily increasing benefit based on the accumulated face value (dependent on premiums paid) plus the policy’s cash value.

- Minimum: $100,000

- Maximum: Subject to individual consideration and underwriting limits

- Issue Age: 15-85

Variable Universal

The variable universal life policies at MassMutual give you the option to allocate your premiums to multiple investment options or to a Guaranteed Principal Account (GPA).

The GPA grows at a fixed interest rate, which means it has lower growth potential, but also less risk.

- Minimum: $100,000

- Maximum: Subject to individual consideration and underwriting limits

- Issue Age: 15-85

Factors That Affect Your Rate

Anything that increases your chances of dying early increases the chances the insurer will have to pay out on your policy. That risk is passed on to you in the form of higher premiums.

Let’s take a look at some of the most common factors affecting your rate.

Demographic

Age is one of the most important factors in determining insurability. The more time has passed, the closer you are to death. Advanced age affects your premiums and can sometimes limit the face value of your policy.

Gender also plays a key role. Statistically, women have a longer life expectancy than men. For that reason, rates for women are almost always lower than those for men.

Your marital status could also indirectly influence your rate, as a marriage most often comes with shared finances and responsibilities.

A single individual with no children wouldn’t have as much future need. On the other hand, a married individual must consider the financial needs of a spouse and children after death.

Higher coverage equals higher premiums.

Current Health & Family Medical History

The healthier you are, the cheaper your policy.

Insurers will require you to fill out a health questionnaire and may request access to your medical record. Some may require a complete medical exam and bloodwork.

Because many diseases have a hereditary component, many insurers will also examine the health history of your immediate family.

Underwriters will also take into account any prescription medications you’ve ever taken. Even if a policy does not require a medical exam, underwriters have access to public prescription and Medical Information Bureau (MIB) records.

High-Risk Occupations

Some jobs are inherently riskier than others. For example, a firefighter is more likely to die on the job than a computer programmer. The more dangerous the occupation, the more likely an insurer will have to pay a death benefit, resulting in higher premiums.

If you’re curious where your job falls on the spectrum, the Bureau of Labor Statistics’ Census of Fatal Occupational Injuries shows the jobs with the highest mortality rates.

High-Risk Habits

Risky habits also translate to higher premiums. Tobacco use sits at the top of that list.

For example, at MassMutual, a 45-year-old male non-smoker pays around $230 per year for a 10-year, $100,000 policy. A 35-year-old smoker pays double, $460, for the same. That’s an extra $2,300 paid over the life of the plan.

In addition to smoking, insurers will also ask about any other high-risk hobbies, such as skydiving or any other extreme sport that has a high potential for injury.

Frequency is key. A single scuba diving excursion on your honeymoon isn’t going to increase your rate, but a monthly ski trip might.

Veteran or Active Military Status

Military status falls under the category of high-risk occupations. Most insurers charge higher rates to active duty military service members, and some don’t sell them policies at all.

Getting the Best Rate with the MassMutual

A few lifestyle changes and a little expediency could be the difference between an expensive and affordable life insurance policy.

The previously discussed factors can skew your rates in either direction of the company’s base premiums. Insurers base premiums on three factors: mortality, interest, and company expenses.

Insurers use statistical mortality tables to estimate how many people in specific demographics are going to die each year. They then increase their rates to minimize their losses based on how many people in that demographic they insure.

They also adjust premiums based on current interest rates. Insurers increase their profits by investing the premiums you pay in bonds, stocks, mortgages, and the like. If they expect a lower rate of return on those investments, they may raise premiums to compensate.

Insurers also factor in their own overhead expenses. The more they spend selling and servicing policies, the more costs they’ll pass onto you. Rates can also vary from state-to-state, though the NAIC is currently encouraging states to adopt laws that would provide more uniformity nationwide.

So, with all these variables, the question is: how do I get the best rates?

You can’t control your gender or family medical history, and it isn’t always possible to simply trade a risky profession for a safer one. The best thing to do is to change what you can — eat better, exercise, monitor your blood pressure and cholesterol, quit smoking, avoid high-risk situations, etc.

If you are planning on quitting tobacco, sooner is better than later. Some insurers require you to be tobacco-free for an extended period before you can claim a non-smoking rate.

You can’t control your age, but you can choose to buy insurance now rather than wait. A policy today is cheaper than a policy tomorrow.

Statistically, the older you are, the more likely you are to die during your term or before your universal policy matures to its guaranteed benefit. Therefore, the older you are, the higher the rate.

For example, a 30-year, $100,000 policy with MassMutual for a 25-year-old non-smoking male is quoted at $168 per year. That same policy for a 45-year-old costs $325.

That 20-year wait costs an extra $4,710 over the life of the policy.

It’s also important to pay on time. Like any bill, late or non-payments on term policies result in penalties and could lead the insurer to cancel your policy.

As is to be expected, MassMutual offers its lowest rates to young, female non-smokers. However, if you’re a smoker determined to keep up the habit, MassMutual might offer you one of the lowest rates around.

The average of their annual premiums for all male smokers is around $380 less compared to the average of the other top 10 insurers, and their average for females is about $590 less.

The premiums for universal life policies are dependent on many variables. As a result, MassMutual requires you to talk to one of their retail agents to receive a quote.

To give you an idea of how much a term life policy might cost, we’ve compiled a list of sample rates for a MassMutual 10-Year Direct Term for non-smokers.

| Age | $100,000: Male | $100,000: Female | $250,000: Male | $250,000: Female | $500,000: Male | $500,000: Female |

|---|---|---|---|---|---|---|

| 25 | $9.23 | $8.36 | $11.10 | $10.23 | $15.68 | $13.93 |

| 30 | $9.23 | $8.53 | $11.10 | $10.45 | $15.68 | $13.93 |

| 35 | $9.31 | $8.88 | $11.30 | $10.45 | $16.08 | $14.38 |

| 40 | $10.53 | $10.10 | $13.70 | $12.63 | $20.88 | $17.83 |

| 45 | $12.97 | $11.58 | $19.80 | $17.83 | $33.08 | $29.13 |

| 50 | $16.97 | $14.62 | $27.63 | $23.70 | $48.73 | $38.73 |

| 55 | $24.10 | $20.28 | $44.38 | $33.93 | $80.93 | $59.18 |

Get Your Rates Quote Now |

||||||

MassMutual’s Programs

MassMutual’s website doesn’t offer a lot in the way of resources, as most pages are designed to guide you to one of their retail agents. However, the resources they do provide can prove helpful.

MassMutual’s learning center consists of a blog covering a wealth of financial topics related to its multiple businesses, including life insurance.

The blog is updated frequently, and all the posts contain valuable information. If you have questions about life insurance, a quick keyword search in the blog should find you the answers you need.

MassMutual’s website is host to SpecialCare™, a resource for individuals caring for loved ones with special needs.

It includes multiple articles detailing the life insurance, long-term care insurance, and investment options offered by the company to help ensure your loved one is taken care of for the rest of their life.

It also connects you with one of MassMutual’s uniquely trained special needs planners, who can help you establish a life care plan.

Canceling Your Policy

If you need to cancel your life insurance policy for any reason, here’s what you need to know.

MassMutual doesn’t list any cancellation fees for their term policies, but there are generally fees for canceling any policy early in the term. Universal policies also typically come with surrender fees, which is a charge deducted from the cash value of a plan when you cancel.

For a term policy, you will only receive a refund on any premiums you prepaid for an upcoming period.

For a universal policy, MassMutual refunds any prepaid premiums as well as the surrender value of your policy. The surrender value is the cash value of your policy minus any surrender fees.

The only way to cancel a MassMutual life insurance policy is to contact your sales agent or by calling customer service at 1-800-272-2216.

You are free to cancel any policy at any time, though early termination of some term plans could result in penalties.

How to Make a Claim

The overall process of filing a death benefits claim with MassMutual follows general industry-standard steps:

- Initiate a claim

- Fill out company-specific paperwork

- Submit the paperwork along with a death certificate and any other requested documents

- Choose a disbursement method

- Receive the benefits

Read on to learn about the specifics of making a claim.

Filing a claim with MassMutual is fairly simple, with multiple ways to initiate the process.

You can start a claim online, over the phone, or with your sales agent.

- Online: The online claim center includes a simple form asking for both the requester’s and the insured’s personal information.

- Phone: 1-800-272-2216.

- Agent: Contact your local MassMutual financial professional.

After calling or filling out the online form, MassMutual will send you a claim package within three days. The package includes a complete claim form as well as a checklist of all documentation required to process the claim, in addition to the standard death certificate.

Once you fill out the form and gather all required documents, you can submit the packet by mail, email, or fax.

- Mail: Massachusetts Mutual Life Insurance Company DMS, 1295 State Street, Springfield, MA 01111

- Email: lifeclaimsemail@massmutual.com

- Fax: 1-866-329-4527

An examiner will begin reviewing your claim within two business days, and the company will process your benefit payment within 10 business days.

You will then need to choose one of the following payment options: installments with interest, lump sum, or an interest-bearing account with check-writing privileges.

Upon initiating a claim, you must provide a policy number, the insured’s date of death, and a death certificate. If the insurer requires any other documentation, they will list it in the claim package.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

How to Get a Quote Online

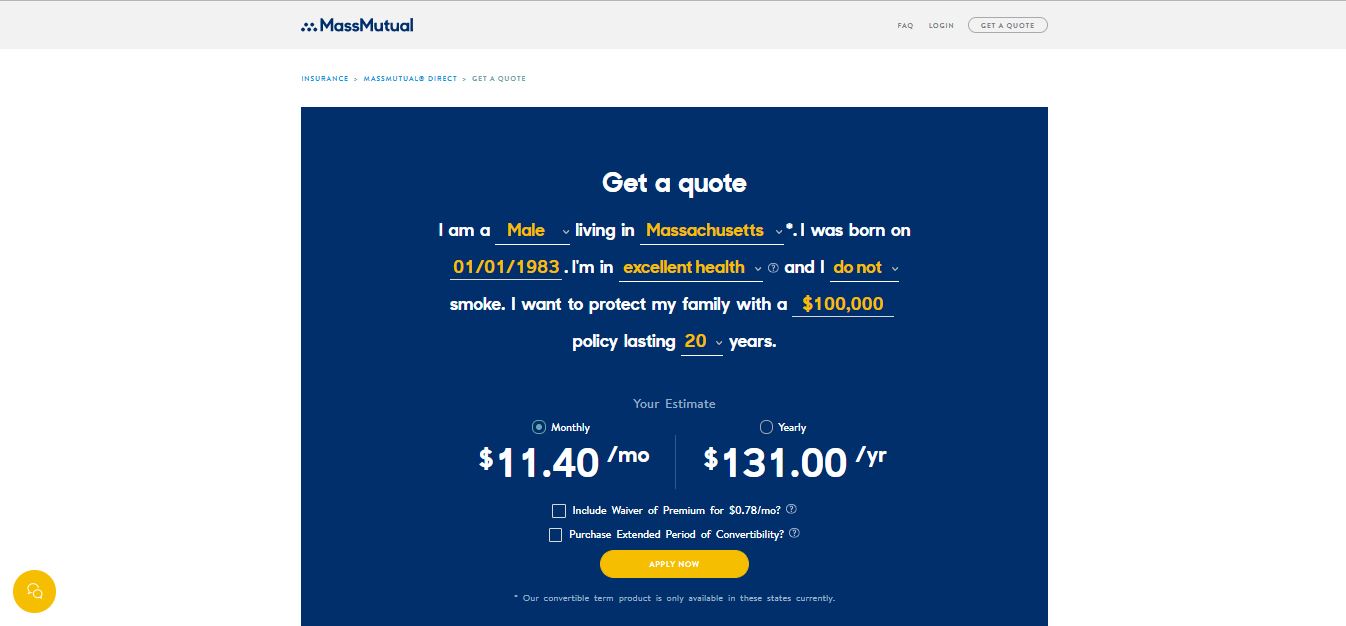

MassMutual only offers online quotes for their MassMutual® Direct Term policy.

#1 – Go to the Policy’s Application Page

From there, you’ll have the opportunity to use their online quote tool.

#2 – The First Step is to Enter Your Basic Information into the Quote Tool

#3 – Once You Have Your Quote, You Can Decide Whether to Continue with the Application Process

If you do decide to proceed with the application process, be prepared to answer quite a few more questions.

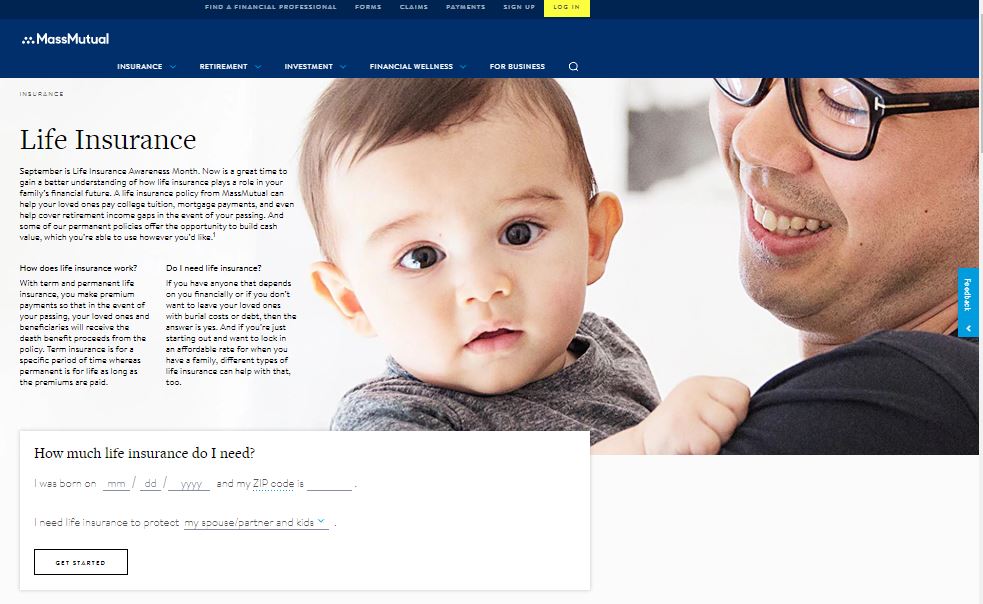

Design of Website/App

In today’s digital age, the MassMutual website is likely to be the first place you look for information on their life insurance policies. Let’s take a look at their overall web experience.

The MassMutual website is well designed, and navigation is simple; however, detailed policy information is virtually non-existent.

Also, some valuable resources, such as the blog, are buried in the footer at the bottom of the page. If you navigated straight to the life insurance pages using the header, you might never know that valuable resource existed.

A lot of answers to general life insurance questions can be found in the MassMutual blog, but if you’re looking for specific details on the company’s policy offerings, you likely won’t find them.

The MassMutual website really serves as a starting point to give you a brief overview of their financial products and guide you to a local sales agent to get the specifics.

The website is visually appealing and easy to navigate, both of which are a benefit to the overall experience.

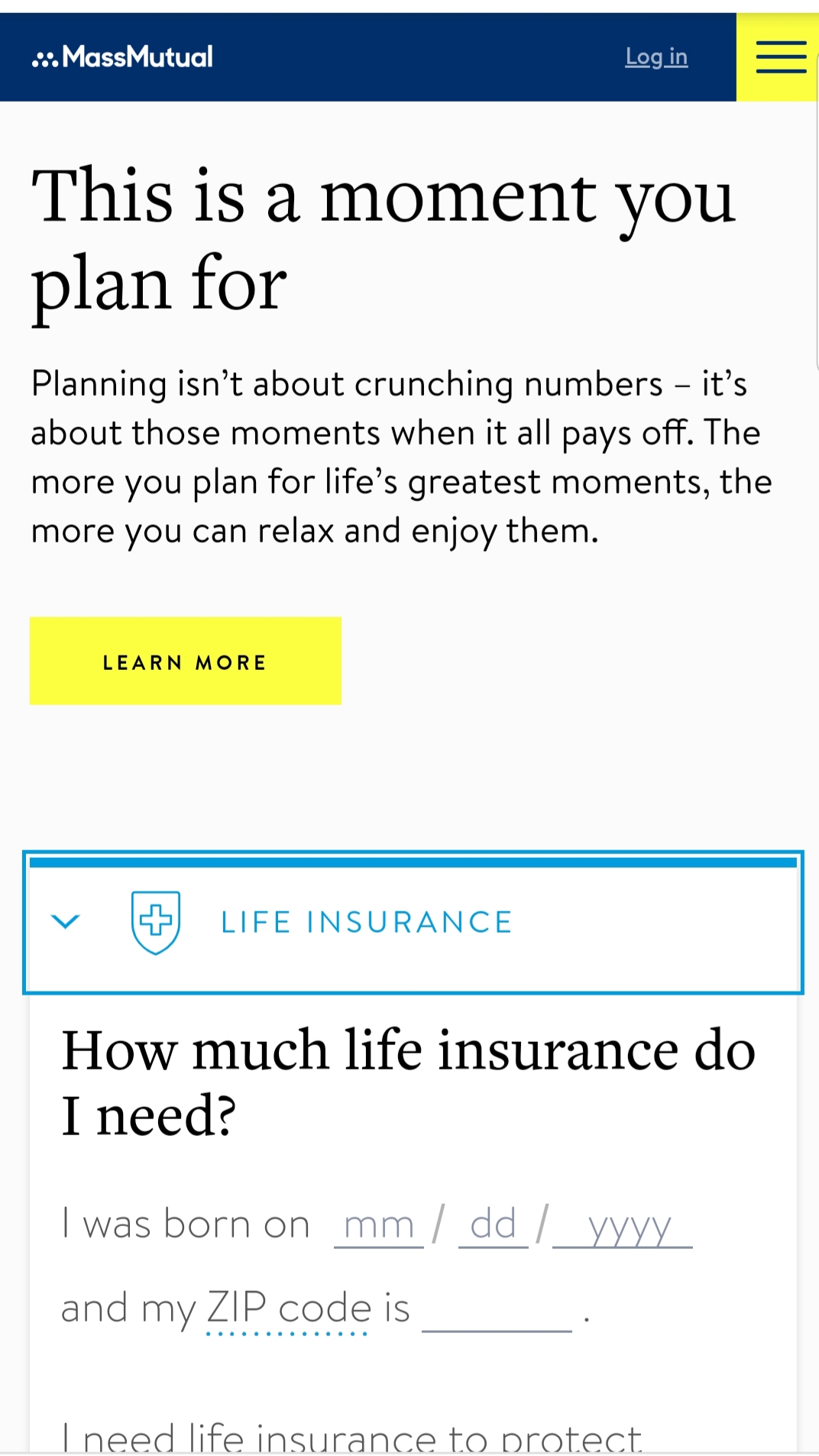

The site is also optimized for mobile viewing.

Each page is streamlined to be viewed on any device, including the quote tool.

The only thing that takes away from that experience is that the site provides so little concrete information. If you’re more of a self-service shopper, you might find the site frustrating.

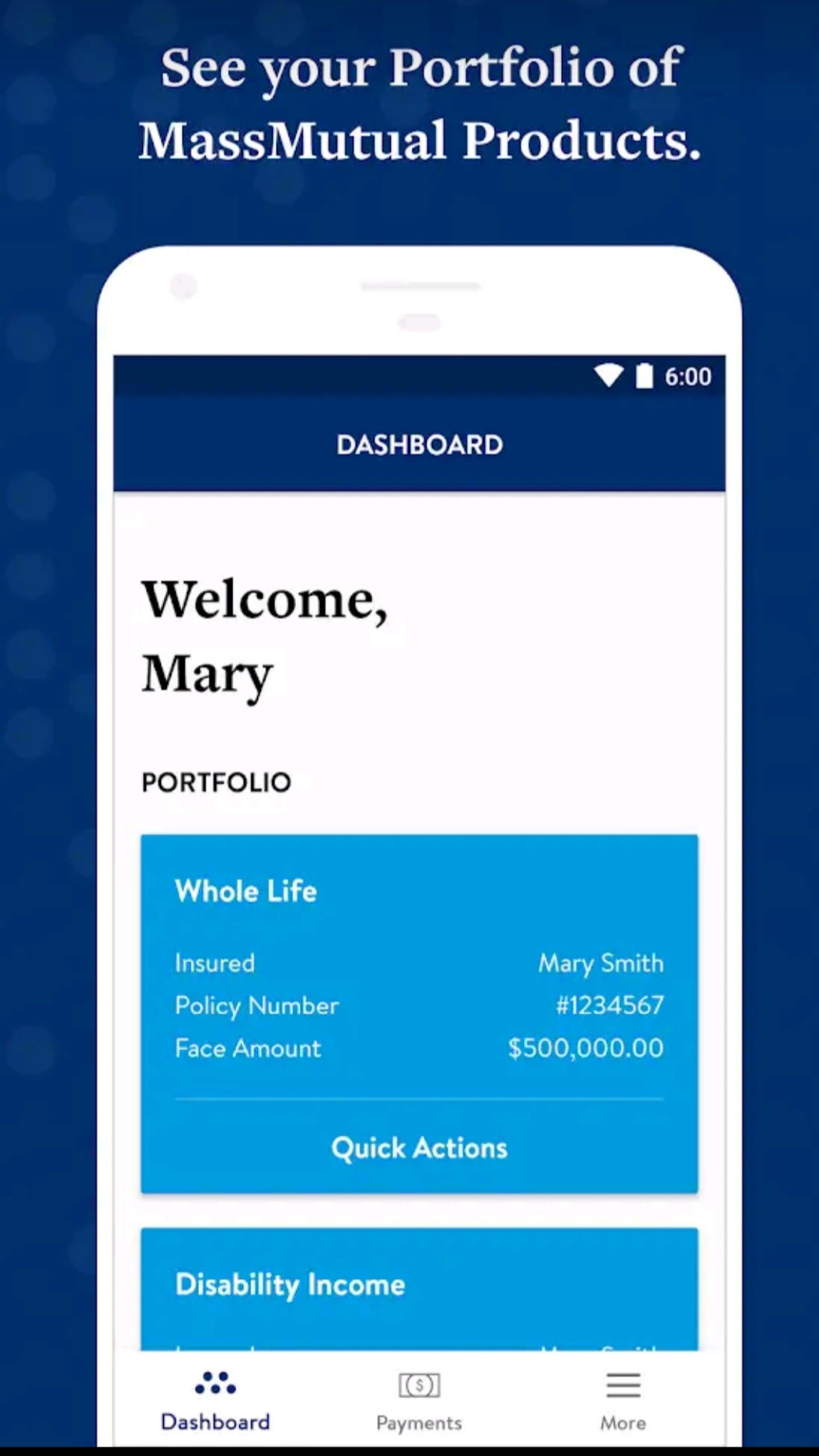

The MassMutual Insurance app allows you to view and manage your life insurance policy.

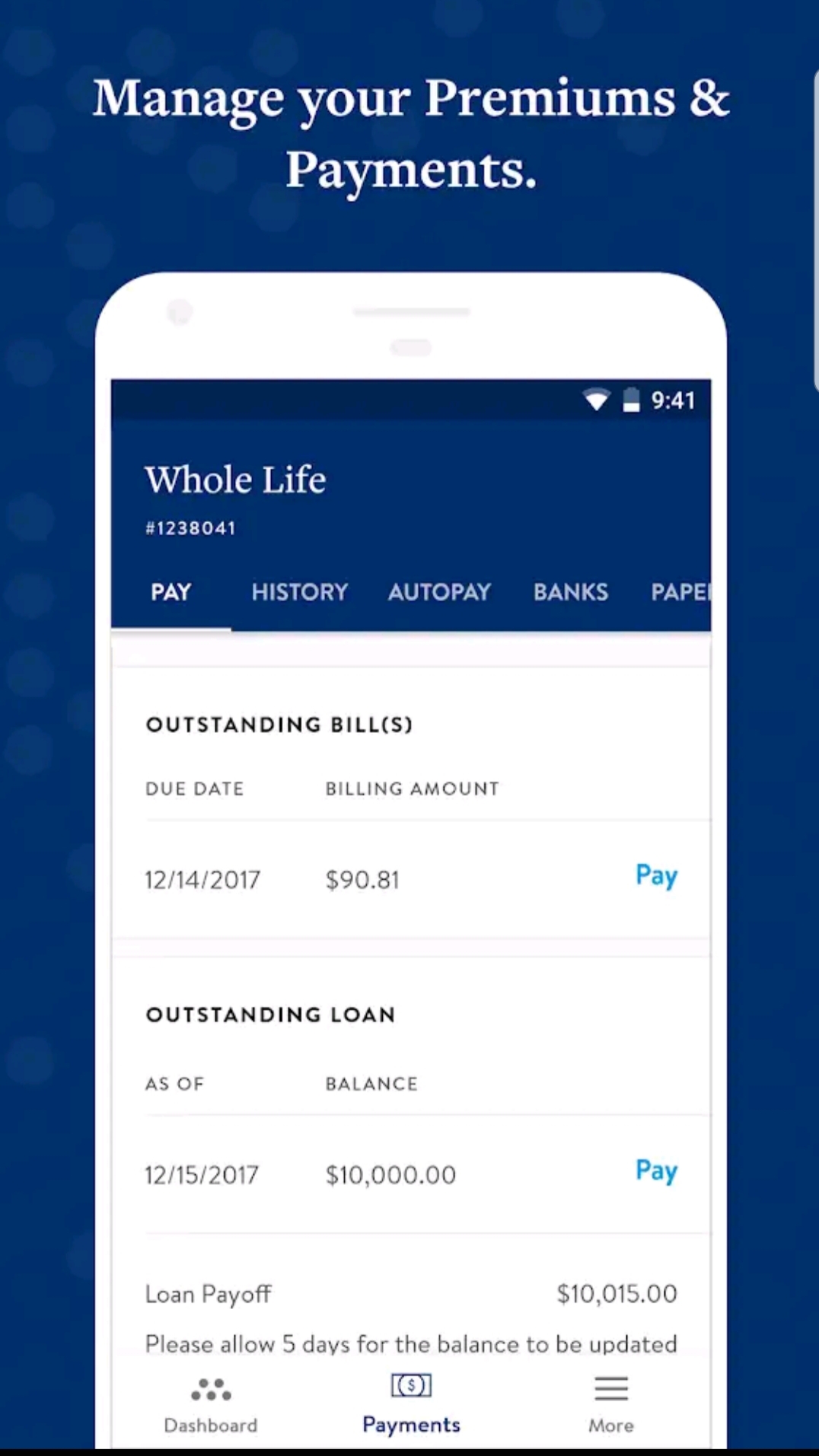

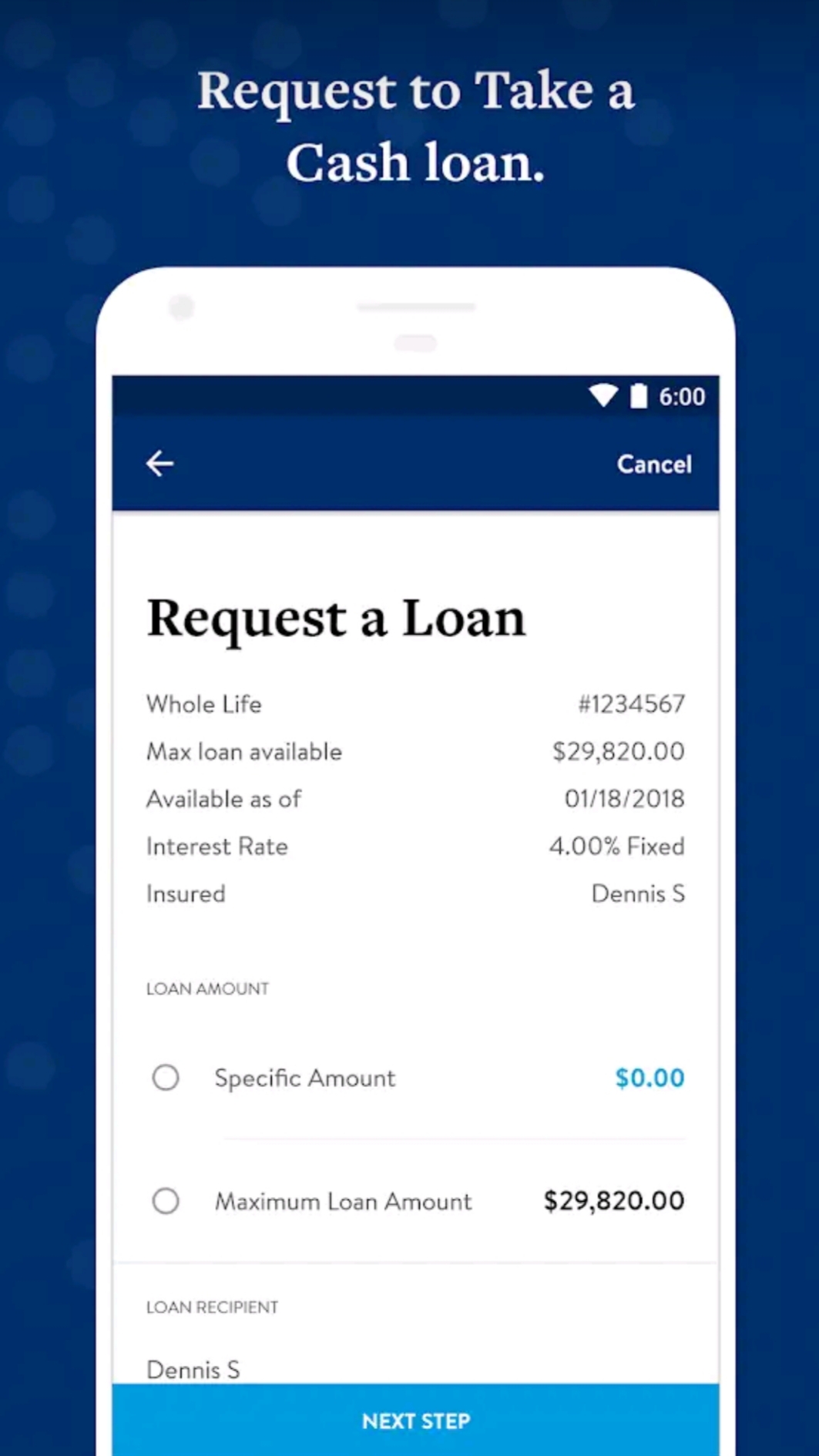

With the MassMutual app, you can view your policy, make payments, review your investment information, and request loans on cash value for universal and variable universal policies.

Most users agree the app is helpful and easy to use. It currently has an overall 4.5/5 rating in the App Store based on 817 reviews. The only recurring complaint is the app needs more specific investment information for variable universal policies.

The app has a simple yet intuitive design, similar to most online banking apps. Upon opening, a dashboard displays all your basic policy details.

From there, you can easily navigate to payment options and investment information.

The loan center allows you to request a loan against your policy’s cash value.

Overall, the design is a plus.

Pros & Cons

As with any company, there are benefits and drawbacks to shopping for life insurance with MassMutual. Here’s a look at the biggest.

Pros

- MassMutual is one of the largest insurers in the country, with some of the strongest financial ratings

- They offer a wide range of coverage options

- They have some of the lowest rates for smokers among the top 10 insurers

- MassMutual® Direct Term allows you to apply for a term life policy online with instant approval

Cons

- No online quote for most policies

- No online application for most policies

- Does not offer standard riders such as accelerated or accidental death benefits, spouse coverage, or child coverage

The Bottom Line

MassMutual is one of the largest individual life insurance providers, and they are among the most financially stable. They don’t have as many policy options as some competitors, but those they do offer have good coverage at some of the most affordable prices.

Their annual premiums for a basic term policy in each key demographic came in significantly lower than the average premium of the other top 10 insurers, especially for smokers.

If you want a highly customizable policy, you might find their offerings limited. However, if you want a basic life insurance policy at a low premium, MassMutual might be the company for you.

MassMutual’s FAQs

Here are some frequently asked questions about MassMutual and its policy offerings.

#1 – Does MassMutual offer a no-exam life insurance policy?

Yes. MassMutual® Direct Term allows you to apply for a term life policy online with no exam and instant approval. A similar no-exam whole life policy, Simplified Whole Life, is no longer offered.

#2 – Does MassMutual offer any supplemental coverage?

Yes. MassMutual offers disability income, long-term care, and Medicare supplements as separate policies.

#3 – How do I make a payment on my MassMutual life insurance premiums?

You can have your payments automatically debited from your checking account every month by filling out an authorization form.

You can also pay them directly online or via mail on a quarterly, semi-annual, or annual basis. Online payments can be made either on the website or the MassMutual app.

#4 – How easy is it to change my beneficiary?

Many policy changes, including updating your beneficiary, can be completed using your online account, either on the website or mobile app.

#5 – Can I make withdrawals on my MassMutual life insurance policy?

Some of MassMutual’s whole and universal life policies allow for a partial withdrawal or partial surrender on interest accrued during specific periods.

You can also take out loans against your cash value. The process is simple and can even be completed using the app.

#6 – How long does it take for MassMutual to pay death benefits on a life insurance policy?

Death benefits are processed within 10 days of receiving the completed claims packet and typically paid within 30 days.

#7 – Are the life insurance benefits taxable?

Life insurance benefits are non-taxable when they are paid directly to a beneficiary, such as a spouse or a child. However, if you name your estate as the beneficiary, the benefits become a part of the estate and are then subject to estate taxes.

#8 – Are all MassMutual life insurance policies available in all states?

Yes. MassMutual is licensed to sell all of its policies in every state.

Start comparing life insurance rates now by entering your ZIP code in our FREE tool below!

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption