Exclusive: Life Insurance Myths Debunked (Comparisons & More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

- Most life insurance myths are false

- Life insurance is more affordable than you might think

- You can obtain coverage even if you have a preexisting medical condition

- Seniors can still qualify for life insurance

- Your current coverage might be insufficient

If you’re married or have children, purchasing life insurance is one of the most important decisions you can make. An unexpected death could leave your family with limited income and a growing stack of bills.

A life insurance policy can provide your family with financial security long after you’re gone by leaving a substantial sum of money to pay immediate funeral costs, as well as any expenses that arrive in the future.

Admittedly, life insurance can be a confusing topic that leaves you with a lot of questions. With so many companies, policy types, variations, tax implications, and price differentials, the buying process can seem overwhelming.

There are also some common myths about life insurance that further muddy those waters. These misconceptions keep many people from asking the right questions and making the best financial decisions for their families.

This guide is designed to help make those decisions easier by giving you a general overview of the life insurance process and setting the record straight on some of the most prevalent life insurance myths.

Start comparing life insurance rates now by using our FREE quote tool above.

Table of Contents

Top Life Insurance Companies

It can be difficult to sift through all of those choices to find the best life insurance company. If you’re looking for a reputable insurer, one of the best things to do is start with the top-ranking companies and then work your way down.

| Rank | Companies | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | MetLife | $10,877,337,000 | 6.7% |

| 2 | Northwestern Mutual | $10,550,806,000 | 6.5% |

| 3 | New York Life | $9,385,843,000 | 5.8% |

| 4 | Prudential | $9,170,883,000 | 5.6% |

| 5 | Lincoln National | $8,825,314,000 | 5.4% |

| 6 | MassMutual | $6,874,972,000 | 4.2% |

| 7 | Transamerica | $4,867,311,000 | 3.0% |

| 8 | John Hancock | $4,657,312,000 | 2.9% |

| 9 | State Farm | $4,636,147,000 | 2.9% |

| 10 | Securian | $4,426,864,000 | 2.7% |

| 11 | Guardian Life | $4,055,519,000 | 2.5% |

| 12 | Pacific Life | $3,770,584,000 | 2.3% |

| 13 | Nationwide Mutual | $3,365,469,000 | 2.1% |

| 14 | AIG | $3,346,570,000 | 2.1% |

| 15 | AXA | $3,097,395,000 | 1.9% |

| 16 | Voya | $2,668,108,000 | 1.6% |

| 17 | Brighthouse | $2,525,047,000 | 1.6% |

| 18 | Protective Life | $2,406,629,000 | 1.5% |

| 19 | Primerica | $2,376,601,000 | 1.5% |

| 20 | Torchmark | $2,367,072,000 | 1.5% |

Get Your Rates Quote Now |

|||

The policies written by these 20 companies represent nearly 65 percent of all life insurance business. There’s a good chance that one of them will have the policy to suit your needs.

Sample Rates

To give you an idea of how much life insurance coverage might cost you, here is a look at monthly sample premiums for a non-smoker with one of the top-10 life insurers in the country.

20-Year Term

| Age | $100,000 – Male | $100,000 – Female | $250,000 – Male | $250,000 – Female | $500,000 – Male | $500,000 – Female |

|---|---|---|---|---|---|---|

| 25 | $11.03 | $10.02 | $22.10 | $12.91 | $23.19 | $19.04 |

| 30 | $11.12 | $10.07 | $15.31 | $13.02 | $23.85 | $19.26 |

| 35 | $11.12 | $10.07 | $15.42 | $13.02 | $24.07 | $19.26 |

| 40 | $12.65 | $11.12 | $17.94 | $15.21 | $29.10 | $23.63 |

| 45 | $14.57 | $13.31 | $21.55 | $19.69 | $36.32 | $32.60 |

| 50 | $18.60 | $17.20 | $30.19 | $27.02 | $53.60 | $47.26 |

| 55 | $24.51 | $20.61 | $42.88 | $34.35 | $78.98 | $61.91 |

| 60 | $35.88 | $27.48 | $71.10 | $50.86 | $135.41 | $94.94 |

| 65 | $51.06 | $37.76 | $109.82 | $75.14 | $212.85 | $143.51 |

Get Your Rates Quote Now |

||||||

Premiums on term insurance can increase annually, depending on the type of policy you choose, but they are generally fixed for the life of the term. The only time you should expect an increase is if you renew your policy for an additional term once the original expires.

Whole

| Age | $100,000 – Male | $100,000 – Female | $250,000 – Male | $250,000 – Female | $500,000 – Male | $500,000 – Female |

|---|---|---|---|---|---|---|

| 25 | $93.70 | $84.91 | $201.90 | $179.97 | $396.07 | $352.22 |

| 30 | $107.71 | $97.35 | $238.33 | $211.60 | $468.50 | $415.25 |

| 35 | $128.24 | $112.93 | $289.26 | $251.86 | $569.70 | $495.33 |

| 40 | $153.90 | $132.15 | $350.98 | $299.62 | $692.47 | $590.19 |

| 45 | $190.79 | $156.17 | $434.71 | $365.30 | $859.29 | $720.90 |

| 50 | $234.90 | $191.66 | $538.74 | $449.58 | $1,066.47 | $888.81 |

| 55 | $294.84 | $243.17 | $678.64 | $574.34 | $1,344.73 | $1,137.02 |

| 60 | $399.24 | $311.63 | $895.65 | $735.39 | $1,777.01 | $1,457.58 |

| 65 | $528.00 | $421.69 | $1177.24 | $978.84 | $2,338.00 | $1,942.51 |

Get Your Rates Quote Now |

||||||

As you can see, premiums on whole policies are anywhere from 200 to 600 percent higher than term policies at the same age and face value.

Whole rates are also generally fixed, but you do have more flexibility in how you pay them. Depending on the option you choose, your payments could vary from year to year.

With universal policies, you can change the amount and frequency of your premium payments.

Some whole policies also come with a limited pay option. You can pay for the policy in full over 10–20 years so that you aren’t still paying premiums into your retirement years.

Final Expense

Final expense policies guarantee acceptance with no medical exam. Because of that, the insurer automatically assumes you are in a higher risk pool, whether it’s true or not.

Because of the increased risk, final expense policies charge high premiums relative to their low death benefits.

The following table provides the cumulative average monthly rates of some of the top 10 insurers by market share for a $10,000 policy.

| Age | $10,000 - Male | $10,000 - Female |

|---|---|---|

| 40 | $24.02 | $20.43 |

| 45 | $27.16 | $22.65 |

| 50 | $43.20 | $32.91 |

| 55 | $50.06 | $38.89 |

| 60 | $57.86 | $45.98 |

| 65 | $71.02 | $55.60 |

| 70 | $88.55 | $69.69 |

| 75 | $114.80 | $91.51 |

| 80 | $163.18 | $126.89 |

| 85 | $230.74 | $181.52 |

Get Your Rates Quote Now |

||

As you can see, final expense policies can sometimes cost ten times as much as comparable term policies. Premiums on final expense policies are generally fixed.

Now, let’s cover some basics about life insurance.

What is life insurance?

A life insurance policy is a contract between you and the insurer. In exchange for a regular monthly fee, the insurance company promises to pay a guaranteed lump-sum payment to your loved ones upon your death.

Before reading this guide (or doing any other life insurance research) you should familiarize yourself with some key terms. Here is a quick glossary of the ones you’re most likely to come across.

| Term | Definition |

|---|---|

| Agent | An authorized insurance representative who sells and services policies |

| Beneficiary | The person designated by the policyholder to receive the proceeds from a life insurance policy |

| Death Benefit | A tax-free lump sum of money paid to the beneficiary upon the death of the insured |

| Face Amount | The amount of coverage provided by a life insurance policy |

| Final Expenses | Expenses incurred at the time of a person's death such as funeral costs, current liabilities, and taxes |

| Policy | The legal document stating the terms of the life insurance contract |

| Policyholder | The owner of the policy, typically the insured |

| Premium | The money paid to the insurance company in exchange for coverage |

| Risk Classification | The process which determines the risk associated with an applicant, which decides how much the insured’s premiums differ from the standard |

| Underwriter | The person who reviews the life insurance application, assigns a risk classification, decides if the applicant is acceptable, and determines the premium rate |

Get Your Rates Quote Now |

|

Now that you know the language, let’s take a brief look at how life insurance works.

How Life Insurance Works

Once you apply for a life insurance policy, the insurer sends your application to an underwriter, who reviews it and determines your risk, which is how likely you are to die and force a payout on their end.

To determine your health risk, the insurer may require you to take a medical exam.

Once your application is approved, the insurer sets a premium price based on your risk classification. Your policy is active as long as you pay those premiums. If your premium payments are current when you die, the life insurer pays out the guaranteed face value of the policy to your assigned beneficiary.

Life insurance policies fall into one of two general categories: term or whole.

Term life insurance provides temporary coverage for a specified period, usually between 10 and 30 years. Once that term expires, the insurer cancels the coverage unless you opt to renew for a new term.

Whole life insurance provides permanent coverage for as long as you live.

For example, if a 30-year-old man buys a $250,000, 20-year term policy, that coverage ends at age 50. If he dies before 50, the insurer pays $250,000. If he dies any time after, they don’t pay anything.

On the other hand, let’s imagine that the same man purchased a $250,000 whole life insurance policy. As long as his premium payments were current at his time of death, the insurer would pay his beneficiaries $250,000, regardless of his age.

What Life Insurance Covers

An unexpected death has the potential to burden your family with a long list of expenses. Some of them have an immediate impact, while others might not be felt for years.

The best way to protect your family against them is through a life insurance policy with a death benefit large enough to pay each cost as it arises.

The beneficiary can use the death benefit from a life insurance policy any way they want, but it is generally used to cover two types of obligations: immediate and future.

Immediate obligations are those expenses that need to be paid soon after your death. They include:

- Funeral costs

- Medical bills

- Mortgage balances

- Personal loans

- Credit card debt

Future obligations are expenses — both planned and unexpected — that need to be paid in the years following your death. They include:

- Income replacement

- Spouse’s retirement

- Children’s college tuition

- Emergency savings fund

Who Should Buy Life Insurance

If you want to leave money behind when you die — for whatever reason — you should consider purchasing a life insurance policy. More specifically, those in the following situations can benefit greatly from life insurance coverage.

- Spouses – Life insurance protects your spouse from shared debts they would be obligated to pay, while also providing income replacement and emergency savings.

- Parents – Death benefits can pay for the costs of raising a child, as well as future needs like college tuition.

- Estate Planners – Those leaving behind significant assets can use the tax-free benefit from a life insurance policy to preserve the estate by using the payout to either establish a strong trust or pay the tax bill.

Top Myths About Life Insurance

First of all, you may be wondering why are there so many myths about life insurance? You’re not alone. Many people wonder why life insurance is a product that is so misunderstood.

There may be some misconceptions about other lines of insurance like home and auto insurance, but no other product is as misunderstood as life insurance.

There are so many myths surrounding this line of insurance because it is the entire purpose of the product is to protect against a topic many do not want to discuss–death.

Because it is such a touchy topic and the benefit is one that you will never be around to collect, many people make emotional decisions when they buy or are in denial when they choose not to buy.

Those who are planning for their future or who know the importance of financial preparedness need to know who they can trust and who they cannot when they are getting advice on whether or not to buy coverage.

While many licensed agents are honest and trustworthy, they do have an agenda when they are selling you a policy.

Your friends and family may have nothing but good intentions when they give you advice, but unless they are a financial consultant or they have experience with the insurance industry you have to take what you hear with a grain of salt.

Trusting the myths that are going around to be truths can be a huge mistake. The problem is that the myths have been going around for so long they have been ingrained in the minds of many.

By believing these myths to be true, you could not only put your assets at risk, you could also put your family at risk because you assumed that life insurance was not an important tool for your current stage in life.

Misconceptions about life insurance tend to fall in one of three categories: the need for life insurance, the buying process, and the death benefit itself.

Read on for the truth about each.

Myths About Need

According to the 2018 Insurance Barometer Study from Life Happens and LIMRA, 35 percent of households would be financially impacted within one month of the primary wage earner’s death. Still, almost half of all adults in the country don’t have any life insurance.

Of those who do have a life insurance policy, 20 percent feel their coverage is insufficient.

Many people don’t have the coverage they need because myths make them think their current coverage is sufficient or that they don’t need a policy at all.

#1 – Young, Healthy People Don’t Need Life Insurance

Life insurance has less to do with your health and more to do with your familial status and financial obligations. If you have a spouse or children that depend on you financially, you need life insurance.

Accidental death can happen to anyone, regardless of health.

If you do die unexpectedly, your family could be stuck with significant debt. Watch the below video for a quick look at how life insurance benefits are used to cover those debts.

In the Life Insurance Barometer Study, 90 percent of people agreed that the primary wage earner should carry insurance, regardless of age or health.

#2 – Stay-at-Home Parents Don’t Need Life Insurance

A stay-at-home parent might not be an income provider, but they still contribute financially to the family by offsetting childcare costs, among many other things.

If that parent were to die unexpectedly, the remaining parent would need to start paying for childcare. The benefit from a life insurance policy can cover that cost.

#3 – Only the Primary Income Provider Needs Life Insurance

As in the previous example, a spouse — regardless of salary — tends to contribute in some way to the finances of the household. That contribution would need to be replaced in the event of their death.

That spouse could also leave behind debts that could further burden the primary income provider without a life insurance policy to pay them. If nothing else, there are sure to be funeral and burial costs if that spouse dies unexpectedly. The average funeral costs around $7,500.

A 2018 survey from the Federal Reserve found that 40 percent of Americans would struggle to pay an unexpected $400 bill. How much more would they struggle to pay a $7,500 funeral bill?

A low face value life insurance policy would protect the family from that burden and offer some peace of mind during what is likely to be a difficult time.

So, while a secondary income provider might not need as much coverage as the primary wage earner, it’s still smart to look into a life insurance policy for both.

#4 – Employer-Provided Life Insurance is Sufficient

Death benefits for group insurance are often much lower than an individual term life policy. Many face values max out at $25,000–$50,000. Sometimes, your total coverage is limited to one to two times your annual salary.

Even if a group plan allows you to purchase additional coverage, it is still likely to be less than you could get with an individual policy.

Group life insurance is also less reliable. Your coverage only lasts as long as your employment. If you quit or are let go, your coverage is canceled. Plus, since your employer owns the policy, they can end their contract with the insurer and discontinue your benefit at any time.

Group policies also aren’t as flexible as individual policies. Some don’t allow you to increase or decrease face values at all, while others only let you make changes during open enrollment periods.

If a major life change necessitates additional coverage, you may not be able to get it with your group plan.

Group life insurance is an excellent benefit that should be taken advantage of, but it probably shouldn’t be your only coverage.

#5 – People With Adult Children No Longer Need Life Insurance

Life insurance does more than cover the costs of raising a child in the event of an unexpected death. You might have less need for a high-value policy, but life insurance still has many uses after your children are grown, such as:

- Retirement income for a spouse

- Funeral costs

- Charitable donations

Also, some larger debts (like mortgages) can last for years after your children have reached financial independence.

#6 – A Term Policy Is All Anyone Needs

A term policy is indeed sufficient for most families, but there are plenty of situations when the permanent, guaranteed coverage of a whole policy is better.

Planning an Estate

If you’re leaving behind a large estate, the recipients could be faced with a large tax bill. The current maximum estate tax rates are nearly 40 percent. Proceeds from life insurance policies are typically tax-free. Your beneficiaries can use the death benefit from a whole policy to pay the estate taxes.

Protecting Assets

If you need to protect your assets against liens and creditors, most states consider the proceeds from a life insurance policy to be uncollectible assets.

The proceeds from a whole life insurance policy can also be used to create a trust, which can be an effective way to transfer large assets like real estate or businesses.

Preserving a Business

If you own a business, the proceeds from a whole life insurance policy can be used to cover any financial losses resulting from your death. It can also provide the money necessary to keep it running into the future.

Saving for Retirement

Whole life insurance policies aren’t subject to limits like an IRA or 401(k). You can pay as much extra premium as you’d like to increase your cash value.

If you’ve already reached your max contribution to your retirement accounts, you can achieve additional tax-deferred growth through your whole life investments.

Establishing Long-Term Care

If you’re the primary caregiver for a spouse or loved one with special needs, the proceeds from a whole life policy can be used to ensure they get the care they need long after you’re gone.

#7 – Everyone Needs Life Insurance

Life insurance is important and has a wide range of benefits for people in many different financial situations, but it isn’t necessary for everyone. There are certain groups of people who might not need a life insurance policy.

You might not need a policy if you are:

- Single – If nobody is dependent on your income or shares any of your debts, there is less reason to leave behind a death benefit.

- Debt-free – If you don’t have any major debts, there is less need for a high face-value life insurance policy.

- Self-insured – If your savings are enough to cover your debts, future financial obligations, and funeral costs it isn’t as necessary to pay for a life insurance policy designed for the same purpose.

A policy could still prove beneficial to these groups, but it isn’t as necessary as it might be for others.

Myths About Buying

Myths involving high premiums, complicated choices, and intimidating medical exams can scare people away from the buying process before they even take the first step toward an application.

#1 – Life Insurance Is Too Expensive

Whole policies can get very expensive, but term coverage is among the cheapest form of life insurance. Premiums vary based on risk factors, but for the most part, coverage is very affordable.

Most people can get significant coverage for pennies a day.

To illustrate that, here is a breakdown of the combined average annual premium of the top 10 insurers by market share for a 20-year, $100,000 term policy for key demographics.

Aetna Average Life Insurance Rates – Male vs Female

| Demographics | Annual Rates – Male | Annual Rates – Female |

|---|---|---|

| 35-Year-Old Non-Smoker | $165.91 | $178.54 |

| 25-Year-Old Non-Smoker | $178.54 | $160.57 |

| 45-Year-Old Non-Smoker | $185.04 | $165.91 |

| 55-Year-Old Non-Smoker | $240.25 | $185.04 |

| 65-Year-Old, Non-Smoker | $267.89 | $240.25 |

| 35-Year-Old Smoker | $286.18 | $321.76 |

| 25-Year-Old Smoker | $321.76 | $248.75 |

| 45-Year-Old Smoker | $360.23 | $286.18 |

| 55-Year-Old Smoker | $493.20 | $360.23 |

| 65-Year-Old Smoker | $637.51 | $493.20 |

| Average Non-Smoker | $406.94 | $267.89 |

| Average Smoker | $991.63 | $637.51 |

Get Your Rates Quote Now |

||

For a 25-year-old non-smoker, that works out to less than $0.50 per day.

#2 – Life Insurance Choices Are Overwhelming or Too Complicated

There are indeed a lot of options available, but it’s not as overwhelming as you’d think. As previously mentioned, life insurance fits into one of two general categories: term or whole.

There can be a lot of policy options, but they are all slight variations on those basic types.

The biggest decision is whether you need temporary or permanent coverage. After that, you just need to narrow down which variation best meets your financial need.

Term

Term life insurance provides coverage for a specified period, usually between 10 and 30 years. Once that period expires, so does the coverage. Term policies are generally meant to cover final expenses and outstanding debts in the event of an unexpected death.

Watch the below video for a quick overview of term life insurance.

Term life has the following variations.

- Level – Premiums never increase, and the amount of the death benefit remains the same throughout the entire term.

- Increasing – The death benefit increases each year you have the policy at an established rate. As the death benefit goes up, so does the premium.

- Decreasing – The face value decreases annually as you pay down the personal debts you bought it to protect against. Premiums are lower from the beginning, so they don’t decrease.

- Renewable – These policies allow you to extend or renew your life insurance coverage for an additional term after the expiration date with no new medical exam.

- Convertible – These policies allow you to convert your term policy into a whole policy at any time, usually without a new medical exam.

Whole

Whole life insurance doesn’t expire and pays a death benefit regardless of the age you die.

In addition to a guaranteed death benefit, most whole policies also include a savings account that builds a cash value either at a fixed interest rate or through investments similar to a retirement account.

Whole policies come in the following variations.

- Traditional – A portion of your premiums is placed in an account that grows at a fixed interest rate, usually around three to eight percent.

- Universal – The cash value grows at a fixed rate like a traditional policy, but includes the flexibility to set monthly premiums, change coverage amounts, and make lump-sum payments to keep premiums low while maximizing cash value.

- Indexed Universal – These policies have the flexibility of universal policies, while also allowing you to allocate your cash to an equity index account such as the S&P 500 or the Nasdaq 100, rather than growing at a rate set by the insurer.

- Guaranteed Universal – These policies don’t accumulate a cash value. They are more like term policies that never expire and have flexible premiums.

- Variable – These policies allow you to invest your cash value in stocks, bonds, and money market mutual funds, similar to an IRA or 401k.

- Variable Universal – These policies combine the benefits of a universal and variable policy.

#3 – People With Medical Conditions Don’t Qualify for Life Insurance

Many insurers cover people with preexisting medical conditions (even those who are HIV positive). You’ll likely pay higher premiums, but you can still qualify. There are also no-exam term policy options that offer guaranteed acceptance.

If any of those policies are too cost-prohibitive given your condition or you’re denied coverage, you can get a low face value final expense policy to pay your funeral costs.

Final expense insurance (sometimes called burial insurance) is a special type of whole life policy.

Final expense policies offer the same guaranteed, lifetime coverage of a traditional whole policy, but with much smaller face values.

Face values typically range from $2,000–$25,000. It won’t be enough to cover large debts, but it can take the burden of final expenses away from your beneficiary.

There is often a life insurance option for everyone, regardless of any medical condition.

#4 – Seniors Don’t Qualify for Life Insurance

Many life insurers offer Guaranteed Universal Life insurance which provides guaranteed coverage up until a specified age, often reaching as high as 120.

#5 – You Can Take out a Life Insurance Policy on Anyone

You can’t secretly take out life insurance on anyone you want. You can own and pay for a policy on someone else’s behalf depending on the relationship (spouse, romantic partner, parent, etc.).

However, that person must fill out and sign the application, as well as give you consent to be the policy owner and make policy decisions.

#6 – You Shouldn’t Use Life Insurance as an Investment

Whole life insurance is often marketed as an investment because of the growing cash value component. However, many financial planners today will tell you that you’re better off buying a term policy and investing the difference in a more traditional account.

This advice is probably true for most, but there are plenty of situations where a whole policy could be a smart investment. As previously discussed, if you’ve maxed out your contributions to an IRA or 401(k), you can make unlimited tax-deferred contributions to a whole life policy.

You can use the cash value from a whole policy to supplement your retirement income later in life through a combination of withdrawals and policy loans.

A whole policy can also be a good investment for your estate, one that ensures it gets passed on at maximum value to your heirs.

#7 – You Should Always Get Return-of-Premium With a Term Life Policy

Return-of-Premium (ROP) is a rider that you can add to many term policies. With it, the insurer will return your premiums at the end of the term, minus the additional cost of the rider.

The return-of-premium rider can be very expensive, and might not be worth it for young, healthy individuals with low annual premiums. If you die during the term, your beneficiary will receive the same death benefit they would without the rider.

There is no additional disbursement to compensate for all the extra money you paid for the return-of-premium option.

#8 – Life Insurance Premiums Are Tax-Deductible

For the most part, you can’t deduct the cost of life insurance on your taxes.

The only time the premiums from a life insurance policy are tax-deductible is if you set up the policy in a charitable trust, with all of the proceeds going directly to the charity when you die.

#9 – Term Life Policies Are Always Renewable at the Same Rate

You’re most likely going to see an increase when you renew a term policy. When you renew, you’re starting a new term at an older age than your original policy.

Older age always translates to increased premiums. The main benefit of renewing a term policy is that your approval is guaranteed without a new medical exam. Your costs will increase because of age, but they might not increase as much as they would after the results of a new medical exam.

Because your policy will renew at a higher rate, it’s important to choose a long enough term the first time, so you don’t have unnecessary renewals and increases.

Here’s a list of things to consider when determining a term length:

- Number of years your spouse will depend on your income (years to retirement)

- Number of years dependent children will be living with you

- Number of years until co-signed debts (such as a mortgage) are paid in full

- Number of years until your savings grow enough to cover future obligations

You should choose a term that lasts until the last of these milestones is reached. Afterward, you’ll have less need for insurance coverage.

#10 – You Can’t Convert a Term Life Policy to Whole Life

Many insurers will allow you to convert a term policy to a whole policy either during a specific timeframe within the term or at the end of it. Some let you convert whenever you want.

A converted whole policy will come with much higher premiums. You may also be required to take a new medical exam depending on how long has passed since the initial one.

The opposite isn’t true. You can’t convert a whole policy to a term policy. If you decide that you no longer need permanent coverage, you’ll have to cancel your whole policy and apply for a new term policy.

Myths About Death Benefits

Some myths about death benefits cause people to purchase either too much or too little coverage.

#1 – Life Insurance Policies Can Be Purchased in Any Amount

All life insurance policies have limits. Some have firm limits established by the insurer. For example, one company might not write term policies over $1 million, regardless of your financial situation. Others limit coverage amounts for people with specific medical conditions or those over a certain age.

For those without a firm limit, the total coverage you can buy is based on personal financial considerations.

If you’re wealthy enough, the insurer will allow you to purchase a policy with an extremely high face value. However, they won’t approve a face value they think you can’t afford, much like a bank would deny a car loan for a vehicle way above your pay grade.

#2 – Life Insurance Coverage Shouldn’t Be More Than Twice Your Annual Salary

Everyone’s coverage needs vary. Depending on your financial obligations, you could need a face value much higher than twice your salary. As discussed earlier, a life insurance policy needs to cover two types of obligations: immediate and future.

The most common among those are immediate debts, income replacement for a spouse, mortgage balances, and tuition savings for a child.

A life insurance agent can help you determine exactly how much coverage you’ll need, but there are simple formulas you can use to give yourself a general idea.

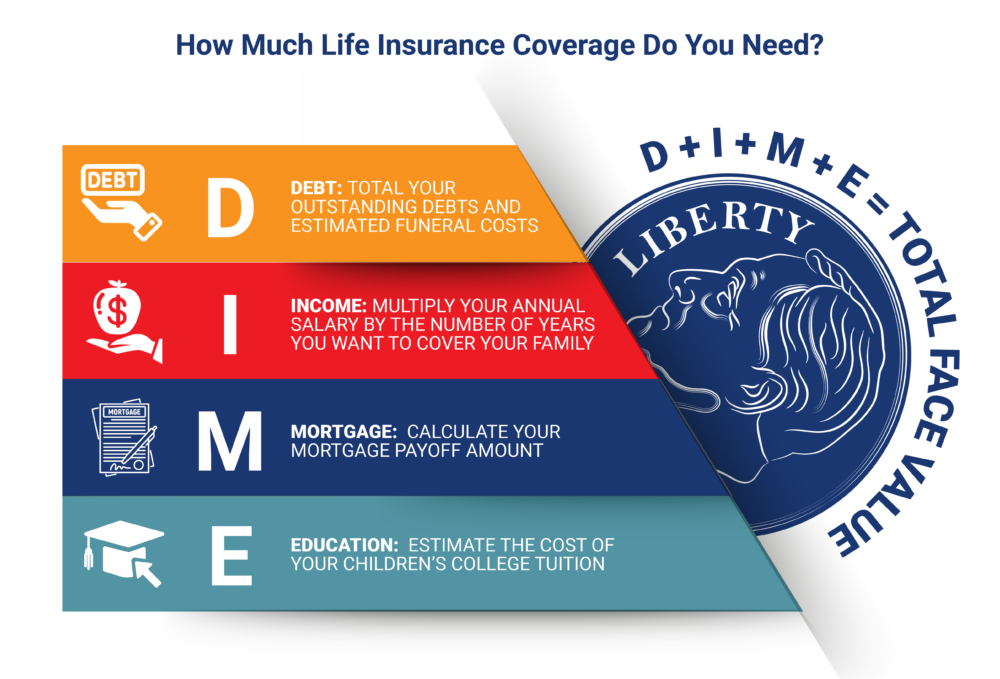

One popular method used by many online insurance calculators is the DIME method. DIME is an acronym which stands for the following:

- D – Debt

- I – Income

- M – Mortgage

- E – Education

Adding up your total obligations in those four categories will give you the minimum face value you need.

Here is a quick example:

A husband and father of one has an annual salary of $75,000. The family has a remaining mortgage balance of $100,000, and $10,000 left on a car loan. He wants to leave five years’ worth of salary for his wife. He also wants to leave $30,000 in a college savings fund for their child.

After factoring in an average funeral cost of around $7,500, the man’s insurance needs are as follows:

- Debt – $10,000 car loan + $7,500 funeral costs = $17,500

- Income – $375,000

- Mortgage – $100,000

- Education – $30,000

- Total need – $522,500

To meet all of those obligations, he would need a life insurance policy with a face value of around $550,000.

#3 – Beneficiaries Have to Pay Taxes on the Life Insurance Death Benefit

Life insurance benefits are non-taxable when they are paid directly to a beneficiary, such as a spouse or a child. However, if you name your estate as the beneficiary, the benefits become a part of the estate and are then subject to estate taxes.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Shopping for Life Insurance Quotes

If you shared any of those misconceptions about life insurance, things should be a little clearer for you now. If so, you might be ready to start shopping for a life insurance policy.

If so, here is some information that can help you get the best policy from the best provider at the best price.

Average Cost of Life Insurance

Your life insurance costs will depend largely on what type of policy you choose. For example, a term policy will be significantly cheaper than a whole policy. There can also be a lot of variation within those categories. A $500,000 policy will cost more than a $100,000 policy.

Also, rates change based on personal factors.

Factors That Affect Life Insurance Rates

There is no industry-standard price for life insurance. Rates vary for everyone. Your premiums are determined by several factors, primarily the following.

- Age – Age is one of the most important factors in determining insurability. The older you are, the closer you are to death. The longer you wait to buy a policy, the higher your rate will be.

- Gender – Statistically, women live longer than men. Because of that, they typically pay lower premiums.

- Health History – Healthy people have longer life expectancies. Longer life expectancy translates to lower premiums. To determine your overall health, insurers may require a complete medical exam.

- Family Medical History – Because many diseases are hereditary, most insurers will also inquire about the health history of your immediate family.

- Occupation – Some jobs are more dangerous than others. If your job has a higher risk of injury or accidental death than most, you can expect higher premiums.

- High-Risk Habits – Insurers will also inquire about high-risk habits such as flying, racing, mountain climbing, or any other regular activity with high injury risk.

- Tobacco Use – The most common high-risk habit that insurers look for is tobacco use. Smokers pay higher rates than their non-smoking counterparts in every demographic.

How to Get a Life Insurance Quote

Quotes are an easy way to compare prices between companies and policies. There are two main ways to get one: online or through an agent.

Online

Whole life insurance has a lot of additional factors that influence its premiums. Because of that, few companies give online quotes for permanent coverage.

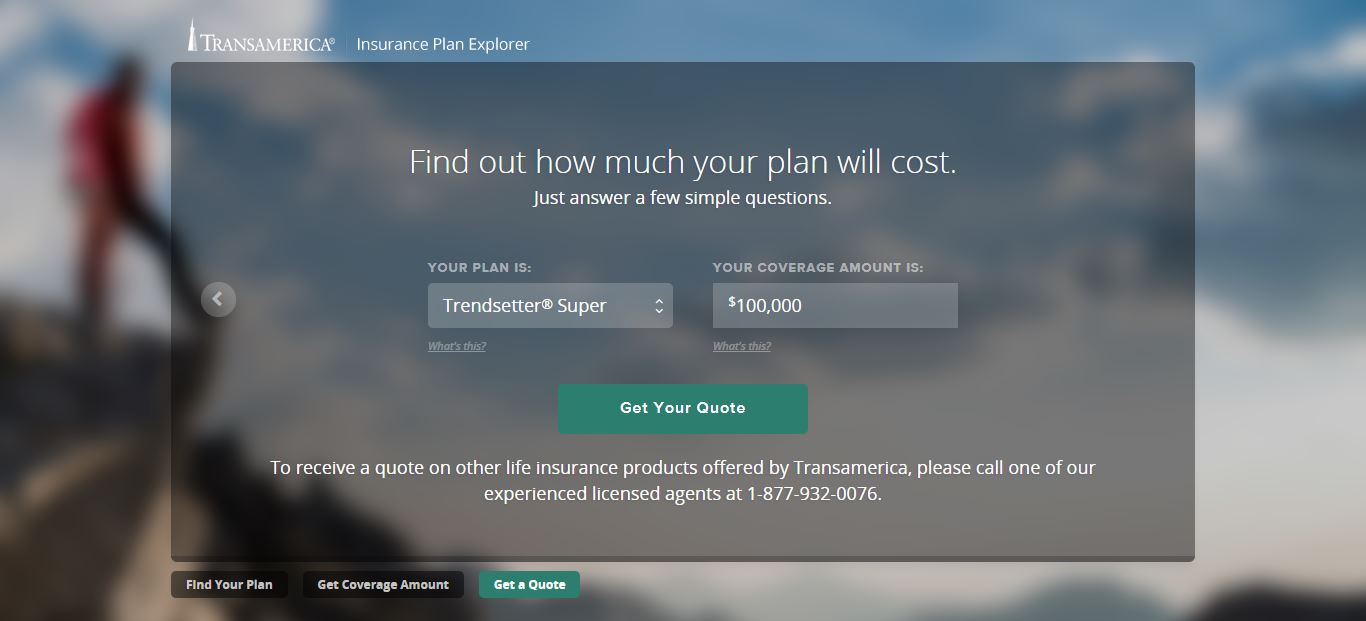

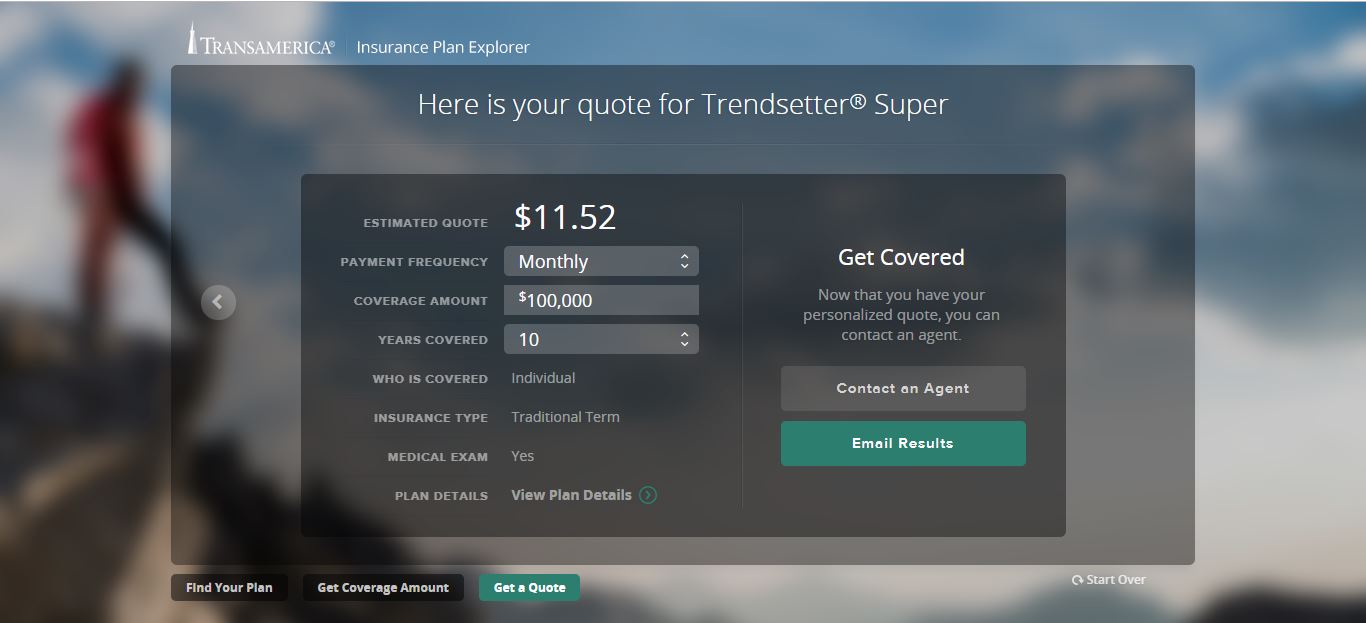

On the other hand, many insurers provide term quotes through quote tools on their websites.

You simply choose your desired coverage, enter some basic personal information, and the tool will return an estimated cost.

There are also independent quote tools (like the ones on this page), which will provide you with quotes from multiple insurers at once. You can quickly compare prices without having to visit multiple websites.

Some insurers also sell term policies directly online. After getting your quote, you can immediately apply for the policy without having to go through an agent.

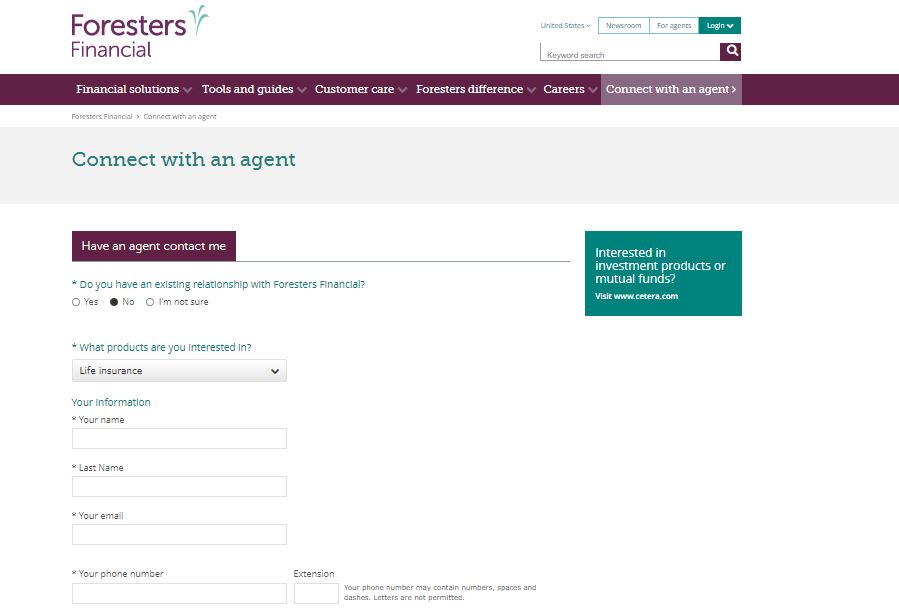

Agents

A majority of life insurance policies are sold through agents. Even though many insurers give online quotes and have online applications, you still have to talk to an agent to complete the sale.

Insurance agents fall into one of two categories: independent agents or captive.

An independent agent is free to shop and sell policies from multiple agencies to find the best policy for their clients.

A captive agent works for a single insurer and will only market and sell their employer’s policies. They more closely resemble customer service agents than they do insurance brokers.

If you want to compare costs and policies across multiple insurers, you can only do so with an independent agent.

Most insurers have an agent finder tool on their websites. Just like the quote tool, you enter some basic personal information, location, and type of coverage you want, and an agent will contact you to discuss your options.

Keep in mind that company websites rarely make it clear if they are connecting you to a captive agent or an independent one.

If you already know that you want to compare multiple providers, it might be better for you to find an independent agency on your own, rather than wait to be referred by an insurer.

That way, you can be sure you’re getting an agent who can present you with a lot of options.

Medical Exams

When applying for term life, insurers will require you to fill out a health questionnaire and may request your medical records. Some will also require a complete medical exam and bloodwork.

Watch the below video for some tips on taking the medical exam.

The basic life insurance medical exam process looks like this:

- The customer fills out a life insurance application and a medical questionnaire.

- The insurer schedules an in-home medical exam.

- The medical examiner conducts a brief oral interview.

- The examiner measures height, weight, and vitals, then takes a urine sample, blood sample, and oral swab.

- Lab results are sent to the underwriter for review.

- The insurer will assign a risk classification and inform the applicant of final premiums.

Some term life insurance policies advertise the fact that they don’t require a medical exam, which could be beneficial for those with preexisting conditions. However, if you’re healthy, it could cost you in the long run.

A young person might not see much of a difference in rates between an exam and no-exam policy, but older people can expect to pay more.

As mentioned, a no-exam policy represents a greater risk to the insurer. They pass that risk along to you in the form of increased premiums. Depending on your health, taking the exam could get you placed in a lower risk category than the insurer might place you in without it.

How to Find the Best Life Insurance Provider

Here are some important tips to remember as you shop for life insurance.

#1 – Buy From a Reputable Company

Make sure the company you’re buying from is reliable. Start by researching an insurer’s market share. If they have a lot of customers, they’re more likely to be an established, respectable company.

If you’ve never heard them advertised and you can’t find their name on any notable lists after a quick internet search, you might want to look elsewhere.

The easiest thing to do is to start with the top-ranking companies.

From there, read company reviews that focus on policy offerings, financial stability, and reputation. You can also do your own research by using the following resources.

- Third-party rating agencies like A.M. Best, the Moody’s Investors Service, and Standard & Poor’s (S&P) measure an insurer’s financial strength and its ability to pay all of its policy obligations.

- J.D. Power’s annual U.S. Life Insurance Study measures overall customer satisfaction in four areas: annual statement and billing, customer interaction, policy offerings, and price.

- The Better Business Bureau uses 13 factors such as time in business, open complaints, resolved complaints, and legal action against a company to assign one of thirteen letter ratings, A+ through F.

- The National Association of Insurance Commissioners Complaint Index compiles the number of complaints filed against an insurer each year and compares it to that of other companies.

#2 – Compare Policies

Once you have a list of reputable companies, compare the policy offerings of each to find the one that suits you best.

Make sure you compare policies of the same type. Comparing a guaranteed universal policy from one insurer to an indexed universal policy at another isn’t going to give you the clearest picture. They are different policies with unique benefits, drawbacks, and fluctuations in cost.

#3 – Get Quotes

Quotes are an easy way to compare policy costs between insurers. Quotes are available online through convenient quote tools or local insurance agents.

Try to find the policy with the greatest benefit for the lowest price.

The Bottom Line

Life insurance isn’t the easiest topic to discuss. Nobody wants to think about their death, let alone sit down and make a plan for it. The subject is further complicated by common myths that turn people off from the buying process.

We designed this guide to demystified life insurance and clear up any doubts you may have had. After reading it, we hope you have a clearer understanding of the importance of life insurance and also how simple it can be to obtain coverage.

Regardless of your budget, medical history, and financial need, there is a life insurance policy for you and your family. Financial security and peace of mind are only a few steps away.

Still have questions? Be sure to check out our many in-depth guides on the site. You’ll find complete information on every subject touched upon here.

You can also use the quote tools on this page to instantly compare quotes from multiple insurers to see how they compare to the average sample rates in this guide.

Start comparing life insurance rates now by using our FREE quote tool below.

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption