Life Insurance & Your Estate: Tips & Tricks (Comparisons & More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

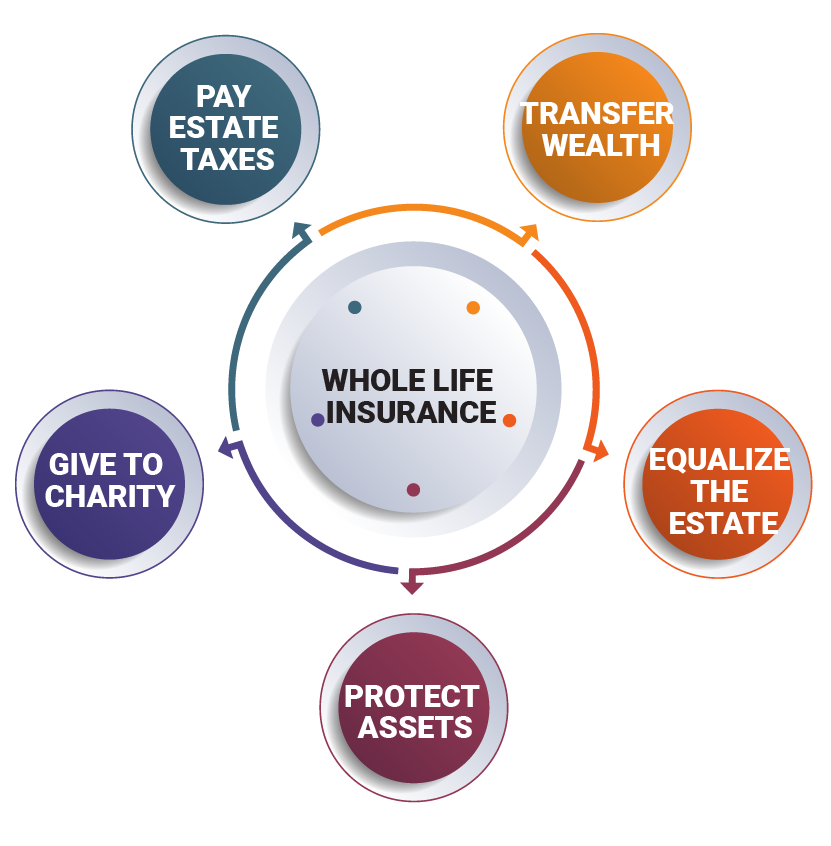

- A life insurance policy can preserve the overall value of your estate

- A death benefit can pay estate taxes for your heirs

- A whole policy can protect your cash assets from creditors

- The money from a policy can preserve a family business

Life insurance is primarily used to protect your family against debt if you pass unexpectedly. If you have large, outstanding obligations such as mortgages, medical bills, and personal loan balances, the benefit from a life insurance policy can pay them, saving your family from financial ruin.

However, even if you and your family have already achieved financial security and have little to no debt, you can still benefit from life insurance. That same benefit can be used to ensure that your hard-earned wealth is passed on according to your exact wishes.

If you want to protect assets, preserve a business, or leave a charitable legacy, a life insurance policy can be a crucial part of your estate plan.

The process is more complicated than if you were buying simple life insurance coverage, as it involves more research, planning, and decision-making on your end, but the potential benefit outweighs the extra work.

This guide will help in your planning by giving you a complete overview of the role life insurance plays in your estate, the best types of policies for the job, how to purchase them, and how to create a solid plan.

You can find the best life insurance policy for your estate plan now by using our FREE quote tool above to compare rates.

Table of Contents

Top Providers of Life Insurance

There are nearly 1,000 life insurance companies in the United States. Each of them has multiple policy types, different customization options, and varying prices.

It can be difficult to sift through all of those choices to find the best company. One of the easiest things to do is start with the top-ranking companies and then work your way down.

| Rank | Companies | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | MetLife | $10,877,337,000 | 6.7% |

| 2 | Northwestern Mutual | $10,550,806,000 | 6.5% |

| 3 | New York Life | $9,385,843,000 | 5.8% |

| 4 | Prudential | $9,170,883,000 | 5.6% |

| 5 | Lincoln National | $8,825,314,000 | 5.4% |

| 6 | MassMutual | $6,874,972,000 | 4.2% |

| 7 | Transamerica | $4,867,311,000 | 3.0% |

| 8 | John Hancock | $4,657,312,000 | 2.9% |

| 9 | State Farm | $4,636,147,000 | 2.9% |

| 10 | Securian | $4,426,864,000 | 2.7% |

| 11 | Guardian Life | $4,055,519,000 | 2.5% |

| 12 | Pacific Life | $3,770,584,000 | 2.3% |

| 13 | Nationwide Mutual | $3,365,469,000 | 2.1% |

| 14 | AIG | $3,346,570,000 | 2.1% |

| 15 | AXA | $3,097,395,000 | 1.9% |

| 16 | Voya | $2,668,108,000 | 1.6% |

| 17 | Brighthouse | $2,525,047,000 | 1.6% |

| 18 | Protective Life | $2,406,629,000 | 1.5% |

| 19 | Primerica | $2,376,601,000 | 1.5% |

| 20 | Torchmark | $2,367,072,000 | 1.5% |

Get Your Rates Quote Now |

|||

The policies written by these 20 companies represent nearly 65 percent of all life insurance business. The remaining 35 percent is split among approximately 700 other companies.

It’s a pretty safe bet that one of the top 20 companies will have the policy to suit your needs. If not, they’re at least a good place to start looking as you figure out which coverage is right for you.

Curious about how much life insurance might cost you? Before we go any further, let’s look at some sample rates.

Sample Life Insurance Quotes

To give you an idea of just how much a whole policy might cost, here are average monthly sample rates from some of the top 10 insurers by market share for non-smokers at key ages.

| Age | $100,000 – Male | $100,000 – Female | $250,000 – Male | $250,000 – Female | $500,000 – Male | $500,000 – Female |

|---|---|---|---|---|---|---|

| 25 | $93.70 | $84.91 | $201.90 | $179.97 | $396.07 | $352.22 |

| 30 | $107.71 | $97.35 | $238.33 | $211.60 | $468.50 | $415.25 |

| 35 | $128.24 | $112.93 | $289.26 | $251.86 | $569.70 | $495.33 |

| 40 | $153.90 | $132.15 | $350.98 | $299.62 | $692.47 | $590.19 |

| 45 | $190.79 | $156.17 | $434.71 | $365.30 | $859.29 | $720.90 |

| 50 | $234.90 | $191.66 | $538.74 | $449.58 | $1,066.47 | $888.81 |

| 55 | $294.84 | $243.17 | $678.64 | $574.34 | $1,344.73 | $1,137.02 |

| 60 | $399.24 | $311.63 | $895.65 | $735.39 | $1,777.01 | $1,457.58 |

| 65 | $528.00 | $421.69 | $1177.24 | $978.84 | $2,338.00 | $1,942.51 |

Get Your Rates Quote Now |

||||||

Smokers can expect to pay significantly higher rates. Now, let’s talk about how life insurance companies determine those rates, staring with how life insurance works.

How Life Insurance Works

A life insurance policy is a contract between you and the insurer. In exchange for a regular fee, the insurance company promises to pay a guaranteed lump-sum payment to your loved ones upon your death.

Before reading this guide, you should familiarize yourself with some key terms. Here is a quick glossary of the ones you’re most likely to come across.

| Term | Definition |

|---|---|

| Agent | An authorized insurance representative who sells and services policies |

| Beneficiary | The person designated by the policyholder to receive the proceeds from a life insurance policy |

| Death Benefit | A tax-free lump sum of money paid to the beneficiary upon the death of the insured |

| Face Amount | The amount of coverage provided by a life insurance policy |

| Final Expenses | Expenses incurred at the time of a person's death such as funeral costs, current liabilities, and taxes |

| Policy | The legal document stating the terms of the life insurance contract |

| Policyholder | The owner of the policy, typically the insured |

| Premium | The money paid to the insurance company in exchange for coverage |

| Risk Classification | The process which determines the risk associated with an applicant, which decides how much the insured’s premiums differ from the standard |

| Underwriter | The person who reviews the life insurance application, assigns a risk classification, decides if the applicant is acceptable, and determines the premium rate |

Get Your Rates Quote Now |

|

The basic life insurance process consists of the following steps:

- The customer fills out a life insurance application and a medical questionnaire.

- The insurer sends the application to an underwriter.

- The underwriter reviews the application to determine the risk of insuring the customer.

- The underwriter may ask the customer to complete a full medical exam.

- The underwriter either approves or denies the application.

- If approved, the underwriter assigns a risk classification, which determines the premium rate.

- The policy goes into effect and the customer begins making regular premium payments.

- If the premiums are current when the customer dies, the life insurer pays out the guaranteed face value of the policy.

Life insurance policies fall into one of two general categories: term or whole.

Term life insurance provides temporary coverage for a specified period, usually between 10 and 30 years. Once that term expires, the insurer cancels the coverage unless you opt to renew for a new term.

Watch the below video for a quick overview of term life insurance.

Whole life insurance provides permanent coverage for as long as you live.

For example, if a 40-year-old woman buys a $500,000, 20-year term policy, that coverage ends at age 60. If she dies before 60, the insurer pays her beneficiaries $500,000. If she dies any time after, they don’t pay anything.

If the same woman purchased a $500,000 whole life insurance policy, the coverage would never end. As long as her premium payments were current at the time of her death, the insurer would pay her beneficiaries $500,000, regardless of her age.

What Life Insurance Covers

The beneficiary can use the death benefit from a life insurance policy any way they want, but it is generally used to cover two types of obligations: immediate and future.

Immediate obligations are those expenses that need to be paid soon after your death. They include:

- Funeral costs

- Medical bills

- Mortgage balances

- Personal loans

- Credit card debt

Future obligations are expenses (some planned, some not) that need to be paid in the years following your death. They might include:

- Income replacement

- Spouse’s retirement

- Children’s college tuition

- Emergency savings fund

What role does life insurance play in estate planning?

The proceeds from a life insurance policy are generally exempt from taxes. Because of that, they can be very beneficial in several areas of estate planning.

Read on for detailed information on each of these areas.

Estate Taxes

If you’re leaving behind a large estate, your heirs could be on the hook for a significant tax bill. The current maximum estate tax rates are nearly 40 percent. That amount is due in cash within nine months of your passing.

If you aren’t leaving behind cash assets, your heirs may have to use personal funds to cover the tax debt.

Their inheritance could end up being more of a burden than a blessing.

Because the death benefit from a life insurance policy is tax-free, your heirs could use that money to pay the estate taxes, thereby preserving the value of the estate and saving them from having to dip into their own pockets.

Wealth Transfer

If you are passing on a significant amount of cash, you can use a life insurance policy to protect your heirs from the tax burden.

Instead of simply leaving the death benefit to pay the tax bill on your cash assets, you can funnel all of those assets into the cash account of a whole life insurance policy.

You can establish an irrevocable life insurance trust that owns the policy for you, thereby removing it from your estate.

Watch the following video for an overview of life insurance trusts:

An irrevocable life insurance trust ensures that the proceeds from the life insurance policy pass tax-free to your beneficiaries. This includes both the guaranteed benefit and the cash value funded by your assets.

Estate Equalization

Estate equalization is the process in which an estate is divided equally among all heirs. This can be difficult if the estate consists of more than just cash, which is easily split and distributed.

A life insurance policy is an easy way to ensure estate equalization while preserving those non-cash assets. One common example is when you want to pass on a family business as part of your estate.

If you have heirs who are not interested in being a part of the business (or did less to contribute to its success than others who might have been directly involved), the heirs who are interested in the business may be forced to liquidate it to divide the assets fairly.

However, the proceeds from a life insurance policy can ensure that the cash-minded heir gets their share, while the business-minded heirs get to keep the business.

Asset Protection

If you need to protect your assets against liens and creditors, life insurance could be a practical part of your strategy.

Laws vary from state to state, but most consider the proceeds from a life insurance policy to be uncollectible assets.

In some states, creditors can collect on the cash value of a life insurance policy, but not the death benefit.

If you live in one of those states, you can use the previously discussed irrevocable life insurance trust to protect your cash value from creditors.

Charitable Giving

Charities are often used to shelter heirs against estate taxes, and the benefits from a life insurance policy can help protect them even further.

Charitable donations are estate tax-deductible. If you name a charity as one of your beneficiaries, that money won’t be subject to estate taxes when you die.

Likewise, you can establish a charitable remainder trust to hold your life insurance policy. When you die, your heirs receive the death benefit from the policy and a charity receives the remaining cash value.

Your heirs get a tax-free inheritance and a worthy cause gets a sizable donation. Everybody wins.

Types of Life Insurance Best Suited for Estate Planning

As discussed earlier, life insurance policies fall into one of two general categories, term or whole.

Term life insurance provides temporary coverage for a specified period, usually between 10 and 30 years. Once that term expires, the insurer cancels the coverage unless you opt to renew for a new term.

Whole policies have no term and pay whenever a death occurs, regardless of age. Some also build cash value by allocating a portion of your premiums into an interest-bearing account.

Watch the video below for a quick overview of whole life insurance:

Whole life policies are best suited to estate planning as they are guaranteed to pay when you die. If you plan your estate around a term policy, your coverage could expire before you die, leaving your estate plans in jeopardy.

Policies that build a cash value also provide you with additional options (as illustrated earlier), especially when it comes to wealth transfer and charitable giving. With term life, there is no cash value, so your choices would be limited.

Whole life has the following variations suitable for estate planning:

- Traditional whole life

- Universal life

- Indexed universal

- Guaranteed universal life

- Variable life

- Variable universal life

Traditional Whole Life

A traditional whole life policy (sometimes called ordinary life) is the most common form of permanent insurance. It’s also one of the simplest.

Your cash account operates similar to a traditional savings account. A portion of your annual premiums is placed in an account that grows at a fixed interest rate (typically around 3–8 percent).

This makes it the least risky option. You are always guaranteed to see positive growth in your cash value. It doesn’t depend on the stock market, which could experience a downturn at any time.

That simplicity and safety do come at the cost of flexibility. You often can’t change your death benefit or adjust your premium payments like you can with other whole life options.

Universal Life

Universal life policies offer the flexibility to set monthly premiums, change coverage amounts, and make lump-sum payments to keep premiums low while maximizing cash value.

The cash value of a universal policy grows at a fixed rate, similar to a traditional whole life policy.

These policies offer more flexibility than the traditional option, but less than other universal and variable options, particularly when it comes to how your cash value is invested.

Indexed Universal Life

Indexed universal life policies offer all of the flexibility of a universal policy, with the additional benefit of choosing how you invest your premiums.

These policies allow the owner to allocate the cash value amounts to an equity index account such as the S&P 500 or the Nasdaq 100, rather than simply growing at a rate set by the insurer.

Your growth isn’t guaranteed like it is with a fixed-interest account, so indexed universal policies are a bit riskier.

However, that risk comes with the potential for higher returns than a traditional whole or universal policy.

Some policies also come with the option to take a break from the index and temporarily invest in the stable, traditional savings account.

Guaranteed Universal Life

Guaranteed universal life policies exist somewhere between a term policy and a traditional whole policy. They offer fixed premiums and guaranteed no-lapse coverage.

Unlike most permanent life insurance policies, guaranteed universal policies don’t accumulate a cash value that you can access.

They are more like term policies that simply don’t expire as long as you pay your premiums, which could be a drawback for someone who wants to incorporate their policy into their estate.

You can’t funnel additional cash into a guaranteed universal policy to transfer wealth. As far as estate planning is concerned, a guaranteed universal policy is best used to cover estate taxes.

Variable Life

Variable policies allow you to invest your cash value in stocks, bonds, and money market mutual funds, similar to an IRA or 401(k). These policies come with the greatest risk, but also some of the highest growth potential.

Depending on how the stock market performs, you could lose some of your cash value and possibly see your face value decrease.

However, many policies do come with a minimum death benefit guarantee.

Variable Universal Life

As their name implies, variable universal policies combine the benefits of a universal and a variable policy.

Variable universal policies come with the adjustable premiums and face values of a universal policy, along with the potential for the high investment returns of a variable savings account.

Along with the same benefits, they also come with the same investment risks.

Shopping for Life Insurance Quotes

As you can see, life insurance can be a valuable component of your estate plan. You also have a lot of options when choosing a policy to meet that need.

If you’re ready to purchase a policy to protect your estate, here is some information that can help you get the best policy from the best provider at the best price.

Factors That Affect Rates

There is no industry-standard price for life insurance. Rates vary for everyone. Your premiums are determined by several factors, primarily the following.

- Age – Age is a key factor in determining insurability. The older you are, the closer you are to death. The longer you wait to buy a policy, the higher your rate will be.

- Gender – Statistically, women live longer than men. Because of that, women typically pay lower premiums.

- Health history – Healthy people have longer life expectancies. A longer life expectancy means lower premiums. To determine your overall health, insurers may require a complete medical exam.

- Family medical history – Many diseases are hereditary. Because of that, most insurers will also inquire about the health history of your immediate family.

- Occupation – Some jobs are more dangerous than others. If your job has a higher risk of injury or accidental death than most, you can expect higher premiums.

- High-risk habits – Insurers will also inquire about high-risk habits such as flying, racing, mountain climbing, or any other regular activity with high injury risk.

- Tobacco use – The most common high-risk habit that insurers look for is tobacco use. Smokers pay higher rates than their non-smoking counterparts in every demographic.

Do rates change over time?

Premiums on term insurance can increase annually depending on the type of policy you choose, but they are generally fixed for the life of the term. The only time you should expect an increase is if you renew your policy for an additional term once the original one expires.

Whole rates are also generally fixed, but you do have more flexibility in how you pay them. Depending on the type of whole policy you choose, your payments could vary from year to year.

With universal policies, you can change the amount and frequency of your premium payments. For example, you can pay higher premiums or a lump sum early, then pay less later.

Even though you don’t have to pay on a set schedule, you do still need to pay a minimum amount each year to keep your policy active. Some policies also come with a limited pay option. You can pay for the policy in full over 10–20 years so you aren’t still paying premiums long into your life.

For policies with increasing death benefits, you can sometimes reduce or stop your out-of-pocket premiums by using your cash value to pay them instead.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

How much coverage do you need?

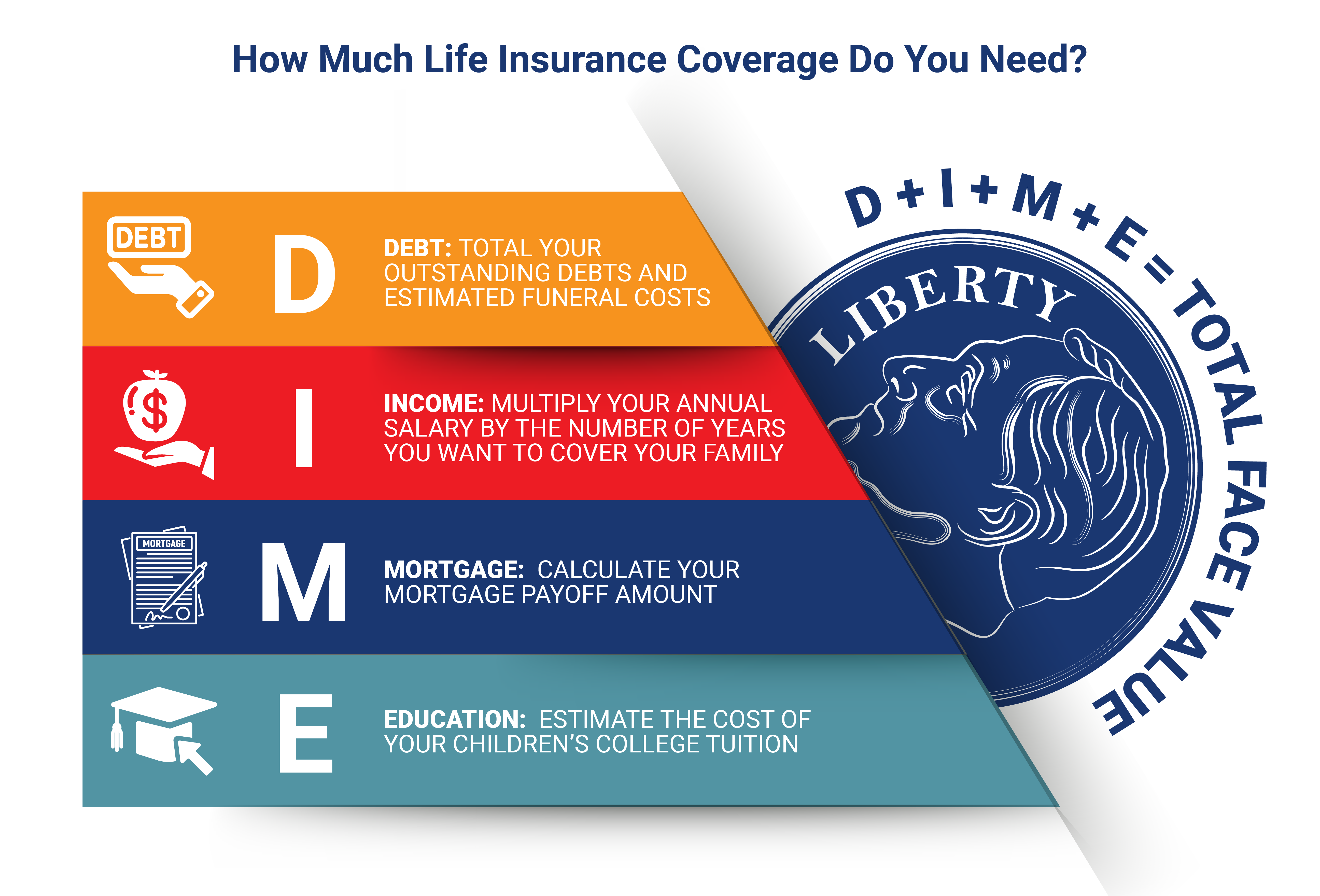

As discussed earlier, a life insurance policy needs to cover two types of obligations: immediate and future.

The most common among those are income replacement for a spouse, tuition savings for a child, mortgage balances, and miscellaneous debts.

A life insurance agent or financial planner can help you determine exactly how much coverage you’ll need, but there are simple formulas you can use to give yourself a general idea.

One popular method used by many online insurance calculators is the DIME method. DIME is an acronym which stands for the following:

- D – Debt

- I – Income

- M – Mortgage

- E – Education

Adding up your total obligations in those four categories will give you the minimum face value you need.

Here’s a quick example. A husband and father of one is shopping for life insurance. His annual salary is $75,000.

The family has a remaining mortgage balance of $125,000 and $7,500 in credit card debt. They also plan to save $30,000 for their child’s college tuition.

The mortgage is the largest annual expense. With it gone, his wife will be less dependent on his income and can live on hers alone. Therefore, he plans to leave her only five years’ worth of his salary as an emergency fund should any unforeseen financial problems arise.

After factoring in an average funeral cost of around $7,500, the man’s insurance needs are as follows:

- Debt – $7,500 credit card + $7,500 funeral costs = $15,000

- Income – $375,000

- Mortgage – $125,000

- Education – $30,000

- Total need – $545,000

To meet all of those obligations, he would need a life insurance policy with a face value of around $550,000.

If you’re also using your life insurance policy as part of an estate plan, you’ll also need to factor in the following potential obligations:

- Total potential tax bill for your estate

- Amount needed to equalize an estate with non-cash assets

- Costs of establishing a trust

- Desired charitable giving amounts

You’ll need to add the total amount from these obligations to any debt and savings obligations to determine the appropriate face value.

What if your coverage needs change?

If either your future financial obligations or current situation changes during the life of your policy, you have some options for adjusting your coverage.

There are plenty of situations that might necessitate additional life insurance coverage, such as:

- Marriage

- Birth of a child

- Purchase of a new home

- Increase in overall estate value

Some traditional whole policies allow you to increase your coverage during certain periods, or before a certain age. There could be additional fees involved, and you’ll likely be required to take a new medical exam.

Most universal policies allow you to increase the face value of your policy before a specified cutoff age. You can also decrease your coverage to a minimum amount without forfeiting your policy.

How to Get the Best Rate

You can’t control certain cost-increasing factors such as gender, medical history, or occupation. If you want to get the lowest possible rates, the best thing to do is to change all the factors you can.

#1 – Make Healthy Choices

Blood pressure, body mass index (BMI), and cholesterol are key measures on a medical exam. Try to improve them through diet and exercise. Also, read up on the medical exam process so you know what to expect.

Watch the video below for some tips on taking the medical exam:

If you do smoke, quit. It’s also important that you quit as soon as you can. Most insurers require you to be tobacco-free for at least a year before you can claim a non-smoking rate.

To verify, they’ll make you take either a blood or urine test to prove how long it’s been since you’ve had tobacco in your system.

#2 – Buy Early

You can’t control the year you were born, but you can control at what age you purchase a life insurance policy. The longer you wait, the older you’ll be when you apply for coverage. The older you are, the higher the premiums you’ll pay.

For example, the average $500,000 whole life policy for a 40-year-old male non-smoker is around $700 per month. That same policy for a 45-year-old costs $860 per month.

That five-year jump increases the price by 22 percent, which works out to an around $2,000 extra per year.

#3 – Pay Your Premiums on Time

Like any bill, late payments result in costly penalties and could lead to the cancellation of your policy. If you have a policy canceled for non-payment, you can expect additional fees to get it reinstated, or higher rates at the next insurer.

How to Create an Estate Plan That Includes Life Insurance

A lawyer or financial planner can help you craft the perfect estate plan for your needs, but for now, here are some basic steps you should take when incorporating a life insurance policy into your estate.

#1 – Calculate Your Net Worth

Determine how much you’ll be passing on, and how much you need to protect. That number will help you choose the appropriate life insurance face value to make sure your assets are safe when they get passed to your heirs.

#2 – Research Estate Taxes

Determine which of your assets are taxable and how much your heirs can expect to pay when that bill comes due.

Again, calculating that amount is crucial to deciding how large of a life insurance policy you’ll need to offset those costs.

#3 – Decide Between a Will or a Trust

Many of the life insurance and estate planning strategies discussed in this guide require you to establish a trust. A life insurance policy can still be beneficial to your estate if you have a will instead.

If you simply want to leave a death benefit for your heirs to pay estate taxes, you don’t have as much need to establish a trust. You can own the policy yourself and state in your will how you want the death benefit distributed and used.

You’ll need to decide which is best to protect your estate.

#4 – Purchase a Life Insurance Policy

In addition to those previously discussed, here are some more things to keep in mind while you shop for a life insurance policy for your estate.

Medical Exams

When applying for whole life, many insurers will require you to fill out a health questionnaire and may request your medical records. Some will also require a complete medical exam and bloodwork.

The basic life insurance medical exam process looks like this:

- The customer fills out a life insurance application and medical questionnaire

- The insurer schedules an in-home medical exam

- The medical examiner conducts a brief oral interview

- The examiner measures height, weight, and vitals, then takes a urine sample, blood sample, and oral swab

- Lab results are sent to the underwriter for review

- The insurer will assign a risk classification and inform the applicant of final premiums

Some life insurance policies advertise the fact that they don’t require a medical exam, which could be beneficial for those with preexisting conditions. However, if you’re healthy, it could end up costing you more.

A young person might not see much of a difference in rates between an exam and no-exam policy, but older people will see a higher rate.

When a policy doesn’t require a medical exam, the insurer automatically assumes you are in a higher risk pool, whether it’s true or not. They pass that risk along to you in the form of increased premiums.

Depending on your health, taking the exam could get you placed in a lower risk category than the insurer might otherwise assign.

Tips for Finding the Best Policy

Here are some important tips to remember when it comes time to purchase a policy.

#1 – Buy From a Reputable Company

Make sure the company you’re buying from is reliable. Start by researching an insurer’s market share. If they have a lot of policies written, they’re more likely to be an established, respectable company.

If you’ve never heard them advertised and you can’t find their name on the first few pages of an internet search, you might want to look elsewhere.

The easiest thing to do is to start with the top-ranking companies discussed earlier.

From there, read company reviews that focus on policy offerings, financial stability, and reputation. You can also do your own research on those metrics by using the following resources.

- Third-party rating agencies such as A.M. Best, the Moody’s Investors Service, and Standard & Poor’s (S&P) measure an insurer’s financial strength and its ability to pay all of its policy obligations.

- J.D. Power’s annual U.S. Life Insurance Study measures overall customer satisfaction in four areas: annual statement and billing, customer interaction, policy offerings, and price.

- The Better Business Bureau uses 13 factors such as time in business, open complaints, resolved complaints, and legal action against a company to assign one of 13 letter ratings, A+ through F.

- The National Association of Insurance Commissioners Complaint Index compiles the number of complaints filed against an insurer each year and compares it to those of other companies.

#2 – Compare Policies

Once you have a list of reputable companies, compare the policy offerings of each to find the one that fits the needs of your estate.

Make sure you compare policies of the same type. Researching a guaranteed universal policy from one insurer and a variable universal policy at another isn’t going to give you an accurate comparison. Both are different policies with their own benefits, drawbacks, and costs.

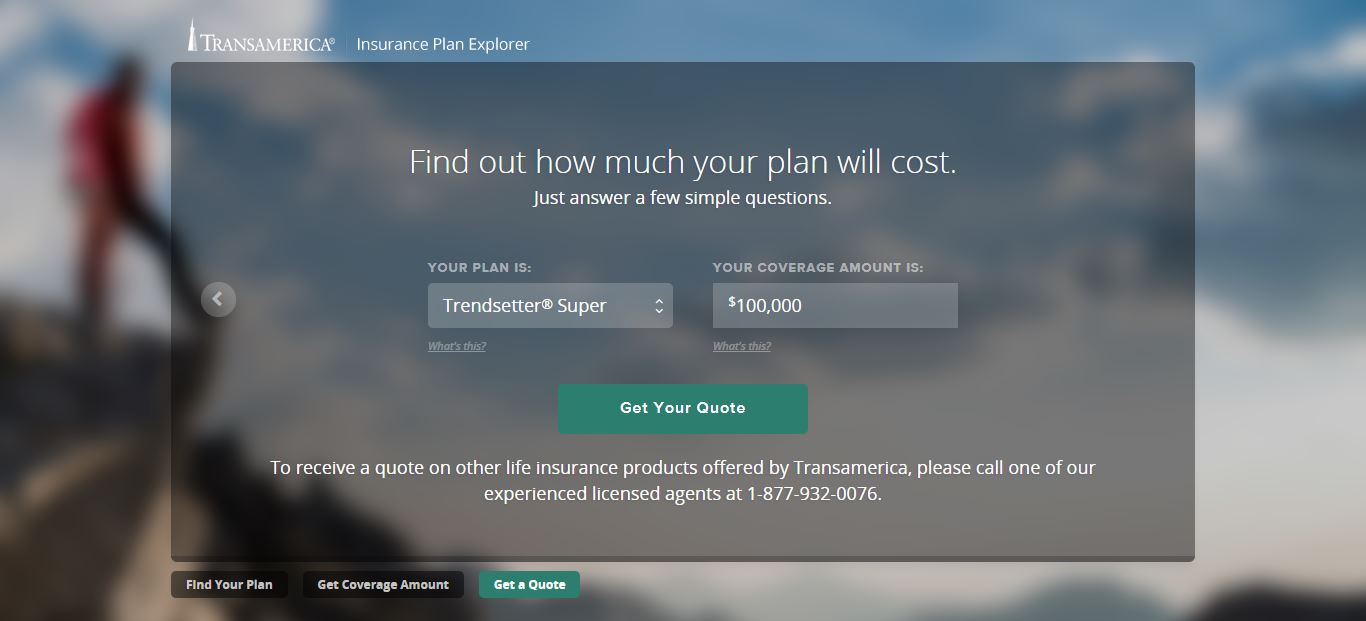

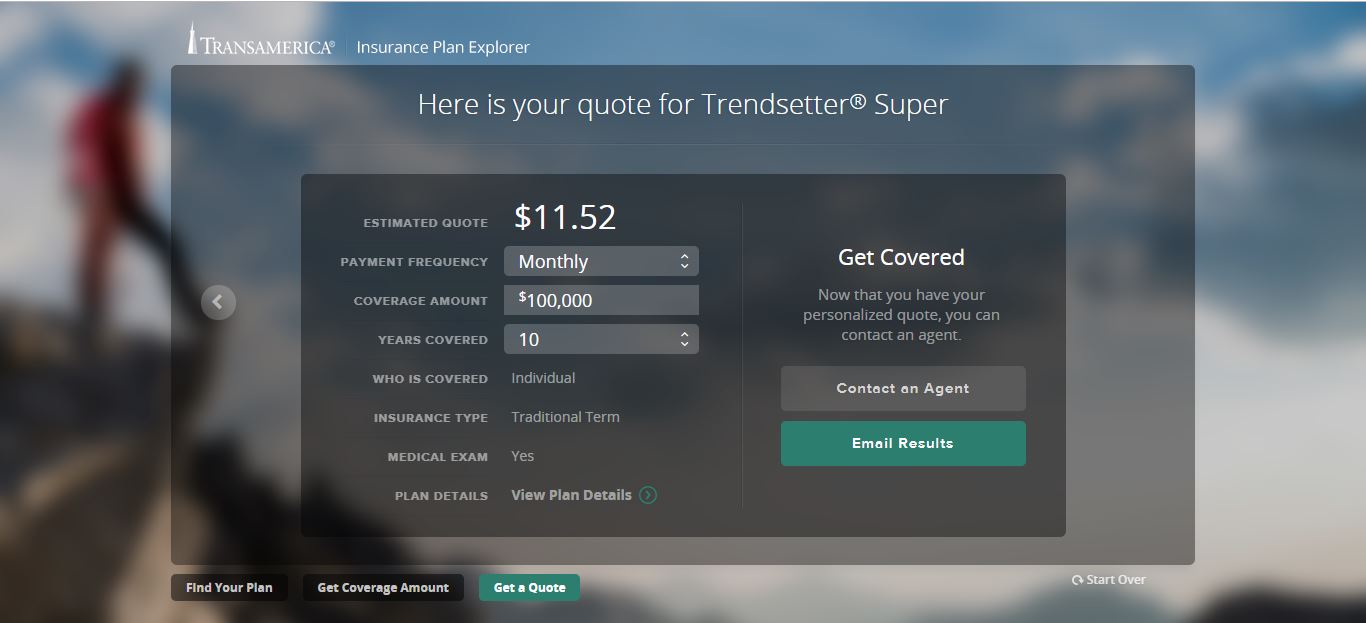

#3 – Get Quotes

Quotes are an easy way to compare policy costs between insurers. Quotes are available online through convenient quote tools or local insurance agents.

Try to find the policy with the greatest benefit for the lowest price.

Whole life insurance has a lot of additional factors that influence its premiums. Because of that, few companies give online quotes for permanent coverage, but some do.

Many insurers have quote tools on their website.

You simply choose your desired coverage, enter some basic personal information, and the tool will return an estimated cost.

There are also independent quote tools (like the ones on this page) which will provide you with quotes from multiple insurers at once. You can quickly compare prices without having to visit multiple websites.

#4 – Name an Executor & Beneficiaries

You need to decide who will be in charge of overseeing the estate and who will benefit from the life insurance policy. The executor and the beneficiary (or successor trustee if you’ve given your life insurance policy to a trust) are sometimes the same person.

There are advantages and disadvantages to this.

Naming the same person minimizes expenses and streamlines the process. Naming different people provides checks and balances so that no one person has complete control, but can slow down the process.

Depending on the size of your estate, being an executor could be both difficult and time-consuming. Because of that, many people hire professional firms to handle the estate as not to burden the beneficiaries with the responsibility.

Professional executors charge significant fees. If your estate is large enough to justify hiring a professional executor, you should also factor that cost into the face value of your life insurance policy.

#5 – Establish Directives

When making an estate plan, you should establish both a medical care directive and a power of attorney.

A medical care directive names a specific person to make health care decisions for you if you are unable to do so yourself.

Even if you have legal documents specifying your wishes for medical care, you can’t anticipate every situation. There might be a time when you need someone you trust to make a judgment call in a circumstance for which you didn’t plan.

Likewise, a power of attorney appoints a person or organization to make legal decisions on your behalf if you are ever unable to do so.

Watch the video below for a brief overview on power of attorney:

Establishing a medical directive and power of attorney ensures that your medical care and your estate plan are both executed according to your wishes.

#6 – Reassess as Necessary

As your personal and financial situation changes, so should your estate plan. Plan on revisiting it regularly to make sure it still meets your needs.

Pros & Cons

Incorporating a life insurance policy into your estate plan can be an effective strategy, but it does have its drawbacks.

| Pros | Cons |

|---|---|

| Minimizes taxes for your heirs | Not very flexible, especially when using an irrevocable trust |

| Protects your assets from creditors, including preserving a business for future generations | Can be expensive when reaching face values high enough to cover taxes on a large estate |

Get Your Rates Quote Now |

|

You should carefully weigh these pros and cons before making a decision.

The Bottom Line

If you’re leaving behind a significant amount of assets after you die, the government and creditors are going to want their cut. After they take their share, there will be less for your heirs, whom you intended all of the assets to go to in the first place.

A life insurance policy can be an effective way of preserving your estate for your heirs by paying tax bills and protecting assets from creditors, among other strategies.

If you don’t have an estate plan in place, you should consider making one that incorporates a whole life policy. If you already have a plan, maybe it’s time to reassess and see what role, if any, life insurance can play.

Still have questions on the benefits of a whole life policy? Want to know more about the life insurance process in general? Check out our many in-depth guides on the site. You’ll find complete information on every subject touched upon here.

You can also use the quote tool at the bottom of this page to compare quotes instantly from multiple insurers to see how they compare to the average sample rates in this guide. Start comparing life insurance rates now.

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption