Liberty Mutual Life Insurance Review (Coverage Comparisons & More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1912 |

| Current Executives | CEO - David H. Long CFO - Christopher L. Peirce |

| Number of Employees | 50,000 |

| Total Sales / Total Assets | $42,685,000,000 / $125,989,000,000 |

| HQ Address | 175 Berkeley Street, Boston, MA 02116 |

| Phone Number | 1-800-290-7933 |

| Company Website | www.libertymutual.com |

| Premiums Written - Individual | $1,079,731,188 |

| Financial Standing | Up 12,605.90% from Previous Year |

| Best For | Strong Financial Ratings |

Get Your Rates Quote Now |

|

Shopping for life insurance can seem overwhelming. You may not know where to start or what kind of coverage you’re looking for. When it comes to protecting your family in the future, you want to make sure you have all the best possible options.

Liberty Mutual Insurance offers a wide variety of insurance policies, including car, home, and life insurance designed to protect your family. Founded in 1912, Liberty Mutual has grown exponentially to a company with over 50,000 employees and a net worth of more than $42 billion.

This overview will give you the information you need to determine if Liberty Mutual is the right life insurance company for you.

Get a FREE life insurance quotes instantly by clicking the tool above.

Table of Contents

Liberty Mutual’s Ratings

The following ratings provide an overview of Liberty Mutual’s financial standing, creditworthiness, and relationship with its customers.

A.M. Best

A.M. Best’s credit ratings are forward-looking, objective opinions regarding an insurer’s creditworthiness. Liberty Mutual currently has an A (excellent) rating from A.M. Best. This indicates Liberty Mutual can meet its financial obligations to its policyholders.

Better Business Bureau (BBB)

Ratings from the (BBB) are not based on financial criteria. Instead, they represent the BBB’s opinion of how a business interacts with its customers.

The BBB assigns companies ratings on a scale from A+ (highest) to F (lowest). Liberty Mutual has an A rating with the BBB, indicating minimal unresolved customer complaints.

Liberty Mutual is a BBB-accredited business.

Moody’s

Moody’s long-term obligation ratings measure a company’s credit risk. Liberty Mutual has an A2 (good) rating from Moody’s. Companies with an A2 rating are stable and financially secure.

Standard & Poor’s (S&P)

Similar to A.M. Best and Moody’s, S&P’s long-term credit ratings measure a company’s credit risk. Liberty Mutual has an A (strong) rating, indicating strong financial security.

NAIC Complaint Index

The National Association of Insurance Commissioners’ (NAIC) complaint index compares a company’s performance to other companies in the market. The complaint index is set to 1.00, so if a company has a complaint index of 2.00, their complaint index is twice as high as expected.

Liberty Mutual currently has a complaint index of 7.61. The NAIC reports the company had 73 closed complaints in 2018.

This number is a significant decrease from the previous year, where the company had a complaint index of 15.39. In 2017, the NAIC reported that 92 complaints were filed against Liberty Mutual.

J.D. Power

J.D. Power’s annual U.S. Life Insurance Study measures overall customer satisfaction in six areas:

- Application and orientation

- Communications

- Interaction

- Product offerings

- Price

- Statements

The study scores companies on a 1,000 point scale. in 2019, Liberty Mutual scored 788.4 points and a four out of five-star rating.

Company History

Founded in 1912, Liberty Mutual was created to provide workers’ compensation insurance. The company quickly expanded and in 1918 introduced its first auto insurance policy.

Liberty Mutual built its first home office in Boston in 1937. In 1973, Liberty Mutual opened its first office outside North America, in the United Kingdom.

In addition to providing a variety of insurance policies, Liberty Mutual has also worked to make advancements in safety. In 1946, the company helped create an emergency stop switch for escalators. Their safety advancement efforts continued in 1957 when the company partnered with Cornell to create a safety car.

The company also created the first battery-powered prosthetic elbow in 1967.

Over the years, Liberty Mutual has continued to create innovative products. In 2016, the company created Solaria Labs to create and test experimental new products based on customer-centric research.

Solaria Labs is focusing on next-generation vehicles, connected life, and sharing economy. Solaria Labs bases its ideas on customer research and data. After gathering research from customers, the team then tests the products with customers.

Liberty Mutual’s Market Share

In 2016, Liberty Mutual had .70 percent of the market share with $1,092,333,298 written in direct premiums.

The following year, the company’s market share dropped slightly to .66 percent. Liberty Mutual had $1,079,731,188 in direct written premiums in 2017.

In 2018, Liberty Mutual’s market share dropped so significantly it was no longer in the NAIC’s top 125 companies. This is due to a major shift in the company’s life insurance operations.

That same year, Liberty Life Assurance Company of Boston, Liberty Mutual’s life insurance subsidiary, was sold to Lincoln Financial Group. The move was part of a purchase agreement between Liberty Mutual and the Lincoln National Life Insurance Company.

After the change of ownership, Liberty Life reinsured its individual life and annuity business to Protective Life Insurance Company.

Liberty Mutual’s Position for the Future

Liberty Mutual is in a good position for the future after bouncing back from significant losses in 2017. The company suffered a huge net loss due to the catastrophic hurricane season that year.

The claims from hurricanes Harvey, Irma, and Maria totaled $1.2 billion. Liberty Mutual only brought in $17 million in profits that year, $989 million less than the previous year. In 2018, Liberty Mutual was able to recover from its losses from the year before. The company closed its $3.3 billion deal with Lincoln National in mid-2018.

Profits jumped from $17 million in 2017 to $2.2 billion in 2018, a 12,606 percent increase in profits.

Given the company’s strong financial ratings and demonstrated ability to recover from significant losses, Liberty Mutual is in a good position for the future.

Liberty Mutual’s Online Presence

In addition to its website, Liberty Mutual has a Facebook page, Twitter account, LinkedIn account, and YouTube channel. The company has 2,010,764 likes on Facebook and 98,000 followers on Twitter. Liberty Mutual also has a separate Twitter account to answer questions from customers.

The company’s social media platforms are updated every few days.

Liberty Mutual’s YouTube channel has 46,500 subscribers and 288 videos. The company’s videos have amassed almost 50 million views.

The Liberty Mutual website has a customer service portal to let policyholders virtually manage their accounts. Even if you don’t have an online account, you can still pay your bill and get ID cards without having to log in.

The website also has a customer support page that allows you to do the following:

- Manage your account

- Change your policy

- Update your billing

- Manage an existing claim

- Submit third-party claims

Liberty Mutual’s website has a quote tool and a find an agent tool that will give you the contact information for a local agent after you enter your ZIP code.

The website also has coverage calculators for auto, home, and renters insurance to help you determine how much coverage you should buy.

Liberty Mutual’s Commercials

Liberty Mutual’s commercials focus on their home and auto coverage rather than their life insurance policies. Many of the company’s commercials are similar and usually feature someone discussing their customizable coverage while standing in front of the Statue of Liberty.

All of the commercials end with the company’s famous jingle. Let’s take a look at some of the standard Liberty Mutual commercials:

Here’s another one.

These commercials focus on Liberty Mutual’s customizable home and auto insurance policies. The phrase “only pay for what you need” is repeated throughout multiple ads.

Liberty Mutual also has a series of commercials featuring LimuEmu and Doug. These commercials also focus on Liberty Mutual’s “only pay for what you need” coverage.

One of Liberty Mutual’s more popular ads features an actor flubbing his lines. The ad is short, but still emphasizes the “only pay for what you need” coverage. Within the first month of being posted to Liberty Mutual’s YouTube channel, this ad amassed more than 2.3 million views.

Liberty Mutual in the Community

Founded in 2003, the Liberty Mutual Foundation seeks to support organizations that help people experiencing homelessness, advance access for people with disabilities, and expand educational opportunities for low-income students. The foundation provides funding for single- and multi-year program grants.

The foundation has partnered with Youth with Disabilities, an organization that trains other non-profits and teaches them how to strengthen disability inclusion within their organization.

Liberty Mutual has an education initiative that strives to improve educational opportunities for disadvantaged youth.

The Liberty Mutual Foundation also works with organizations that help individuals and families experiencing homelessness. The foundation prioritizes funding for organizations that provide emergency shelter, food, and medical supplies for homeless people and families.

The company also works with organizations that focus on homeless youth.

This initiative began after grant recipients across all three areas of the foundation’s focus reported growing numbers of homeless youth. In 2017 and 2018, the Liberty Mutual Foundation committed almost $2.4 million to 24 local and two national grants for organizations helping homeless youth. The grants went to organizations located in Boston, Seattle, and Dallas.

In 2015, the Boston Business Journal named Liberty Mutual as the top charitable contributor in Massachusetts.

Liberty Mutual also has an employee service program called Liberty Torchbearers. The Liberty Torchbearers hold an annual day of community service called Serve with Liberty in May. In 2019, more than 24,000 employees participated in Serve with Liberty.

The company has a program called Give with Liberty that encourages employee charitable giving. Give with Liberty allows employees to donate to qualifying social service organizations through online pledges or payroll deduction.

Liberty Mutual matches 50 cents to every dollar that is donated without a limit.

The company’s Volunteer with Liberty program was created to support and celebrate Liberty Mutual employees that do community service work with non-profits on their own time. The program also gives employees a chance to win $250 for their favorite nonprofit organization.

Through the Serve with Liberty program, 1,111 agencies were served across 19 countries. 2,049 community service projects were completed worldwide and employees served 80,227 hours.

The Give with Liberty program has led to $18 million in contributions, with an average employee gift of $502. Through Give with Liberty, 7,387 charities received donations.

In 2018, Liberty Mutual’s corporate and employee giving totaled more than $44.5 million.

Liberty Mutual’s Employees

Though Liberty Mutual is based in Boston, the company has 50,000 employees working across the globe. Liberty Mutual offers careers in multiple areas, including analytics, claims, customer service, human resources, inside sales, investments, marketing, and underwriting.

The company has received the following recognition and awards:

- Fortune 500’s Best Workplaces for Diversity – 2019

- Forbes Magazine’s Best Employers for New Graduates – 2018 and 2019

- Great Place to Work – 2016, 2017, 2018, and 2019

- People Magazine’s Companies that Care – 2019

- Forbes Magazine’s Best Employers for Women – 2018 and 2019

- Forbes Magazine’s Best Large Employers – 2018

- Forbes Magazine’s Best Employers for Diversity – 2018

- Fortune and Great Place to Work’s Best Workplaces for Diversity – 2017

According to Great Place to Work, 91 percent of employees feel good about the way Liberty Mutual contributes to the community. Ninety-one percent of employees also said they were made to feel welcome when they joined the company.

The average tenure of a Liberty Mutual employee is two to five years. Here’s the breakdown of employees’ average tenure at Liberty Mutual:

- Less than two years – 20 percent

- Two to five years – 27 percent

- Six to 10 years – 18 percent

- 11-15 years – 12 percent

- 16-20 years – 9 percent

On Glassdoor, Liberty Mutual employees have given the company 3.3 out of five stars. Sixty-nine percent of Liberty Mutual employees approve of the CEO and gave the overall senior management 2.8 out of five stars.

Liberty Mutual has a short-term assignment program for employees. The program lets employees learn and develop new skills by working in a different department or location.

The company has made diversity and inclusion part of the company’s core values. As part of its commitment to diversity and inclusion, Liberty Mutual has the following employee resource groups:

- Amigos – Dedicated to the Latino and Hispanic community, Amigos is a resource to connect and empower Liberty Mutual’s Latino and Hispanic employees.

- LEEAP – Leading and Empowering Asian American Professionals seeks to bring employees’ awareness about Asian Americans’ cultural strengths and impacts in business.

- LEADA – Liberty Employees of African Descent works to build and grow together with continuous support and professional development.

- Pride – Promotes an inclusive working environment for LGBTQ employees.

- WE – Empowers women and engages men to create a culture of communication and inclusivity.

- Valor – Engages and empowers military members, veterans, and their families.

Liberty Mutual has also been named a military-friendly employer for the second year in a row. This recognition means Liberty Mutual is committed to creating meaningful and sustainable opportunities for the military community.

Shopping for Life Insurance

In the 2018 Life Insurance Barometer Study from Life Happens and LIMRA, more than a third of households would feel the financial impact within one month if the primary wage earner died. When you’re shopping for life insurance, you want to make sure you’ll choose a policy that provides your family with financial security.

Here are some things to keep in mind as you figure out what kind of coverage and how much coverage is right for you and your family.

The first thing to consider when buying life insurance is the immediate financial obligations your family will have. Immediate costs that would need to be covered could include funeral and burial costs, medical bills, mortgages, loans, and any other outstanding debt.

You’ll also need to think about long-term expenses. These costs include income replacement, child care, and college tuition.

Before you buy life insurance, make sure you know how much coverage you need so your family will be protected financially.

Average Liberty Mutual Male vs Female Life Insurance Rates

The following table shows the rates for a $100,000 term life policy for 10 and 20-year terms for male and female non-smokers.

| Age | $100,000/10-Year: Male | $100,000/10-Year: Female | $100,000/20-Year: Male | $100,000/20-Year: Female |

|---|---|---|---|---|

| 25 | $20.79 | $16.83 | $22.14 | $17.73 |

| 30 | $21.15 | $17.01 | $22.50 | $18.09 |

| 35 | $21.42 | $17.19 | $24.03 | $20.16 |

| 40 | $22.05 | $17.64 | $29.70 | $24.48 |

| 45 | $25.47 | $21.51 | $39.06 | $32.04 |

| 50 | $40.32 | $32.94 | $64.98 | $50.49 |

| 55 | $55.35 | $39.15 | $95.58 | $67.05 |

| 60 | $95.58 | $59.76 | $166.86 | $107.01 |

Get Your Rates Quote Now |

||||

The table below shows the rates for a $100,000 term life policy for 10 and 20-year terms for smokers.

| Age | $100,000/10-Year: Male | $100,000/10-Year: Female | $100,000/20-Year: Male | $100,000/20-Year: Female |

|---|---|---|---|---|

| 25 | $27.90 | $20.61 | $33.84 | $24.93 |

| 30 | $28.35 | $21.42 | $34.02 | $26.28 |

| 35 | $29.34 | $22.59 | $39.06 | $32.49 |

| 40 | $38.88 | $30.33 | $58.59 | $46.08 |

| 45 | $57.78 | $46.80 | $86.13 | $65.79 |

| 50 | $107.19 | $85.41 | $141.84 | $104.58 |

| 55 | $149.85 | $107.37 | $207.54 | $138.96 |

| 60 | $257.13 | $175.41 | $334.53 | $228.06 |

Get Your Rates Quote Now |

||||

This table shows the rates for a $250,000 term life policy for 10 and 20-year terms for non-smokers.

| Age | $250,000/10-Year: Male | $250,000/10-Year: Female | $250,000/20-Year: Male | $250,000/20-Year: Female |

|---|---|---|---|---|

| 25 | $31.28 | $20.70 | $33.30 | $23.40 |

| 30 | $31.73 | $20.93 | $33.75 | $25.20 |

| 35 | $32.40 | $21.38 | $39.60 | $30.15 |

| 40 | $35.55 | $24.98 | $55.13 | $42.53 |

| 45 | $44.33 | $33.75 | $78.53 | $62.33 |

| 50 | $81.68 | $63.68 | $144.68 | $107.78 |

| 55 | $119.25 | $80.10 | $220.95 | $149.85 |

| 60 | $220.95 | $130.50 | $399.83 | $250.65 |

Get Your Rates Quote Now |

||||

The following table shows the rates for a $250,000 term life policy for 10 and 20-year terms for smokers.

| Age | $250,000/10-Year: Male | $250,000/10-Year: Female | $250,000/20-Year: Male | $250,000/20-Year: Female |

|---|---|---|---|---|

| 25 | $56.25 | $36.23 | $70.43 | $44.10 |

| 30 | $59.63 | $38.03 | $71.55 | $50.40 |

| 35 | $62.78 | $43.65 | $82.58 | $66.15 |

| 40 | $86.40 | $65.03 | $125.33 | $97.65 |

| 45 | $133.20 | $105.98 | $192.60 | $146.70 |

| 50 | $255.38 | $202.28 | $342.68 | $238.73 |

| 55 | $360.90 | $254.03 | $499.05 | $324.68 |

| 60 | $626.40 | $424.35 | $818.10 | $551.48 |

Get Your Rates Quote Now |

||||

The table shows the rates for a $500,000 term life policy for 10- and 20-year terms for non-smokers.

| Age | $500,000/10-Year: Male | $500,000/10-Year: Female | $500,000/20-Year: Male | $500,000/20-Year: Female |

|---|---|---|---|---|

| 25 | $42.75 | $27.00 | $45.45 | $35.55 |

| 30 | $43.20 | $28.35 | $49.05 | $36.90 |

| 35 | $44.10 | $29.70 | $60.30 | $45.00 |

| 40 | $45.45 | $36.45 | $84.15 | $63.45 |

| 45 | $68.40 | $55.35 | $123.75 | $95.85 |

| 50 | $124.20 | $98.55 | $245.70 | $173.25 |

| 55 | $178.20 | $111.15 | $380.70 | $247.05 |

| 60 | $296.55 | $172.35 | $648.90 | $390.60 |

Get Your Rates Quote Now |

||||

The table shows the rates for a $500,000 term life policy for 10- and 20-year terms for smokers.

| Age | $500,000/10-Year: Male | $500,000/10-Year: Female | $500,000/20-Year: Male | $500,000/20-Year: Female |

|---|---|---|---|---|

| 25 | $80.10 | $61.20 | $104.40 | $76.05 |

| 30 | $86.85 | $65.70 | $117.90 | $86.40 |

| 35 | $94.05 | $74.25 | $139.50 | $109.80 |

| 40 | $135.90 | $99.45 | $210.60 | $162.45 |

| 45 | $205.65 | $155.70 | $324.00 | $243.45 |

| 50 | $328.50 | $258.30 | $504.90 | $372.60 |

| 55 | $457.65 | $315.90 | $739.80 | $507.15 |

| 60 | $724.50 | $468.00 | $1,099.35 | $776.70 |

Get Your Rates Quote Now |

||||

Up next are the types of coverage offered by Liberty Mutual.

Coverage Offered

In addition to life insurance, Liberty Mutual offers other types of insurance, including:

- Auto and vehicle insurance

- Property insurance

- Accident insurance

- Critical illness insurance

- Pet insurance

- Tuition insurance

Liberty Mutual also offers business insurance. The company’s business insurance coverage can include:

- Commercial auto

- Equipment breakdown

- Excess liability

- General liability

- Mergers and acquisitions

- Property

- Workers’ compensation

Now let’s take a closer look at the life insurance policies offered by Liberty Mutual.

Types of Coverage Offered

As we’ve mentioned, Liberty Mutual’s life insurance went through a major shift in 2018 after the company’s life insurance subsidiary was sold to Lincoln National.

After the sale, Liberty Life reinsured its individual life and annuity business to Protective Life Insurance Company. Let’s take a look at the policies that are still available:

Term

Term life insurance policies guarantee payment of a death benefit during a specific time. For example, if you take out a $250,000 policy for a 20-year term and you die within the 20-year term, your beneficiary will receive $250,000.

The policy will eventually expire if the insured does not die within the specified time. You can renew your term policy, but your premium will be based on your age at the time of the renewal, so your premium will go up.

Term life insurance is a great option if you want to make sure your family is protected, but don’t have the budget for a pricier whole life insurance policy.

Your term life insurance premium will remain level for the covered term.

Whole

Unlike term life insurance, whole life policies provide permanent coverage. Whole life insurance policies are guaranteed to remain in force for the insured’s entire lifetime as long as premiums are paid.

For example, if you took out a whole life insurance policy at age 35 and died at age 75, your beneficiaries would receive the full death benefit. However, if you had taken out a term life insurance policy for 20 years at age 35 and didn’t renew the policy, your beneficiaries would not receive anything when you died at 75.

Whole life policies also offer the opportunity to accumulate cash value, which grows tax-deferred. The whole life insurance coverage also offers immediate access to the principal.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Factors That Affect Your Rate

As you shop for life insurance, there are many factors that can cause your life insurance premiums to go up. Your age, gender, health, career, and hobbies can all affect the price of your policy.

Let’s break down what these factors are and how they could affect your life insurance premium.

Demographics

Demographics play a significant role in your life insurance premium. Your age and gender are major factors in the price you pay for your life insurance policy.

As you age and it becomes more likely your life insurance company will have to pay out your policy, your premium will go up. This is why it’s better to buy life insurance when you’re younger so you’re locked into a lower rate.

For example, a 30-year-old male with a $250,000 and 20-year term life policy with Liberty Mutual will pay a $33.75 premium. A 50-year-old male with the same policy will pay $144.68.

Gender can also affect your rate. Women have a longer life expectancy than men. The average life expectancy for a woman is 86.5 years and the average life expectancy for a man is 84.

Since women are expected to live longer than men, their life insurance premiums are lower.

For example, a 45-year-old female will pay $62.33 for a $500,000 20-year term life insurance policy with Liberty Mutual. A 45-year-old man will pay $78.53 for the same policy.

Current Health & Family Medical History

Your past and present health conditions also affect your premium, along with your family’s medical history. Since healthy people are expected to live longer, they pay less for life insurance.

A medical questionnaire is usually part of a life insurance application. On the application, you’ll probably be asked questions about your medical history, medications you’re taking, and prior diagnoses.

After an underwriter reviews your application, they’ll ask for your medical records and view your Medical Information Bureau profile.

A paramedical service will come to you for an exam, where they’ll take blood and urine samples, record your height and weight, and take your vitals. If you have a history of serious medical conditions such as heart disease, other tests may be needed.

Even if your life insurance company doesn’t require a full medical exam, they’ll still have access to your medical records through the Medical Information Bureau.

A personal history or family history of serious illness will likely lead to higher premiums.

High-Risk Occupations

Your job could also lead to a higher premium on your life insurance policy. If you have a high-risk occupation, your rate will be higher. High-risk occupations are considered more dangerous than average jobs because they have a higher number of fatal work-related injuries and accidents.

In 2018, the Bureau of Labor Statistics found that the following industries had the highest number of fatal work-related injuries:

- Construction

- Transportation and warehousing

- Professional and business services

- Agriculture, forestry, fishing, and hunting

- Government

- Manufacturing

The Bureau of Labor Statistics reported 1,008 fatal work injuries in the construction industry in 2018.

Police officers and firefighters are also considered to be in high-risk occupations. If your job is considered a high-risk occupation, your insurance premium will be higher.

High-Risk Habits

Your habits and hobbies could also negatively affect your life insurance premium. Smoking is the habit that will have the most significant effect on the price of your policy.

Across all age groups and genders, smokers pay more for life insurance. For example, a 40-year-old woman who doesn’t smoke will pay $17.64 for a $100,000 10-year term life insurance policy with Liberty Mutual. A smoker of the same age and gender with the same policy will pay $30.33.

Other high-risk habits insurance companies look for include private aviation, skydiving, bungee jumping, and scuba diving. A one-time skydiving experience won’t affect your premium, but the price of your policy will go up if insurance companies find a pattern of high-risk habits.

Veteran or Active Military Status

Active military members are also considered to be in a high-risk occupation. They’ll pay much higher life insurance premiums than people in regular occupations. Some insurance companies won’t provide coverage for active military members.

Getting the Best Rate with Liberty Mutual

Now that you have an overview of Liberty Mutual, let’s discuss how you can get the best rate from the company.

The first step in getting a good rate with a life insurance company is to get a quote. When you get a quote, you can assess what expenses you need to be covered and get an estimate of how much that coverage will cost.

By determining what exactly you want to be covered, you can make sure you aren’t overpaying for coverage that doesn’t suit your family’s needs.

Life insurance isn’t usually a top priority for most young people. However, the younger you are, the lower your rates will be. Buying life insurance when you’re younger will lock you into a much lower premium.

As we’ve previously mentioned, your health can also have a major impact on the price of your policy. If you keep yourself in good health, your premiums will remain low and stable. If there’s a serious illness in your personal or family health history, your premiums will go up.

Think about these factors as you shop for life insurance to make sure you’re getting the best rate possible.

Liberty Mutual’s Programs

Though Liberty Mutual doesn’t have many programs geared toward life insurance, the company does offer programs for its home and auto coverage. Policyholders can bundle their home and auto insurance for a lower price.

In partnership with HowStuffWorks®, Liberty Mutual has created MasterThis™, a section of its website that provides articles to help you master certain topics. The articles are about topics relating to cars, driving, home, and severe weather. Articles on the following topics are available:

- Car repairs

- Buying a car

- Driving in winter

- Teen driving

- Home repairs

- Moving tips

- Preparing for severe weather

The company also has a Coverage 101 section on its website that breaks down complicated information about insurance for customers. Coverage 101 provides simplified information on home and auto insurance, along with an insurance glossary so you don’t get lost in the jargon while you’re shopping for insurance.

Canceling Your Policy

Although some life insurance policies have the flexibility to adjust your coverage, you may find that your policy is no longer working for you and your family. You do have the ability to cancel your life insurance policy, but you may have to pay a cancellation fee.

Let’s take a look at how to cancel your Liberty Mutual life insurance policy.

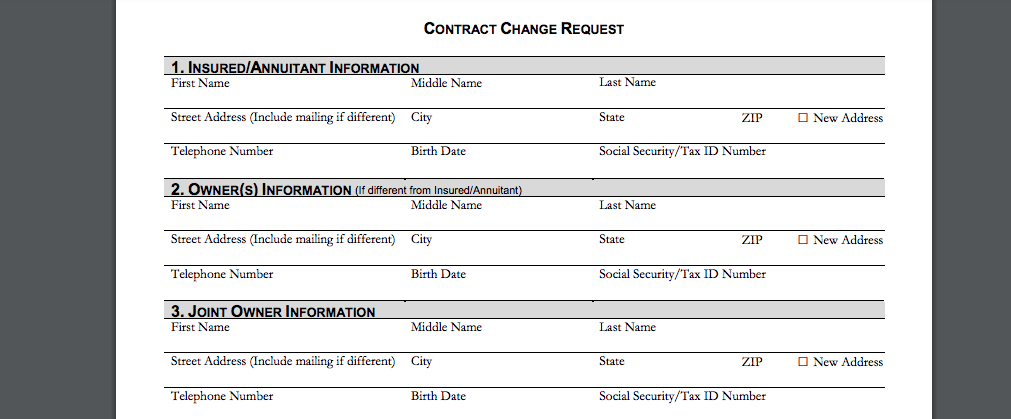

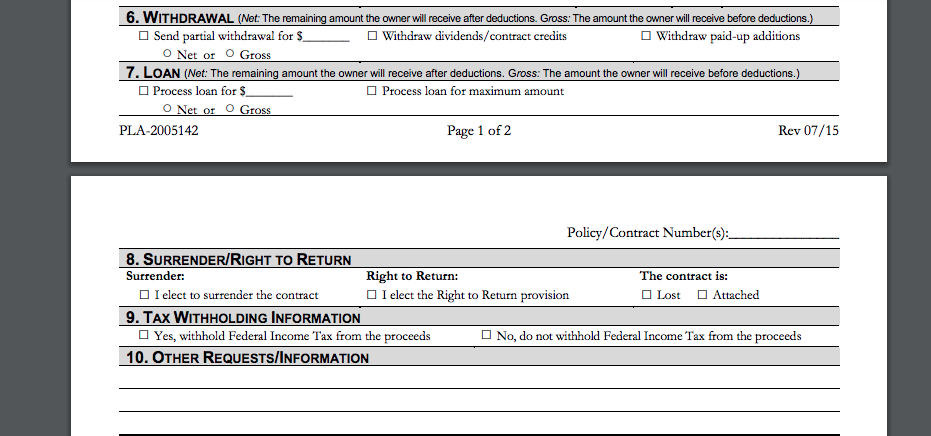

How to Cancel

To cancel your life insurance policy with Liberty Mutual, you have to fill out and submit a contract change request form. Let’s break down the steps you need to take to complete the form.

#1 – Fill Out Your Personal Information

Fill out your personal information and the information for other policyholders including name, address, phone number, and Social Security number.

#2 – Fill Out Withdrawal or Surrender Information

Fill out the withdrawal and surrender information so the company knows how you want to receive your payment.

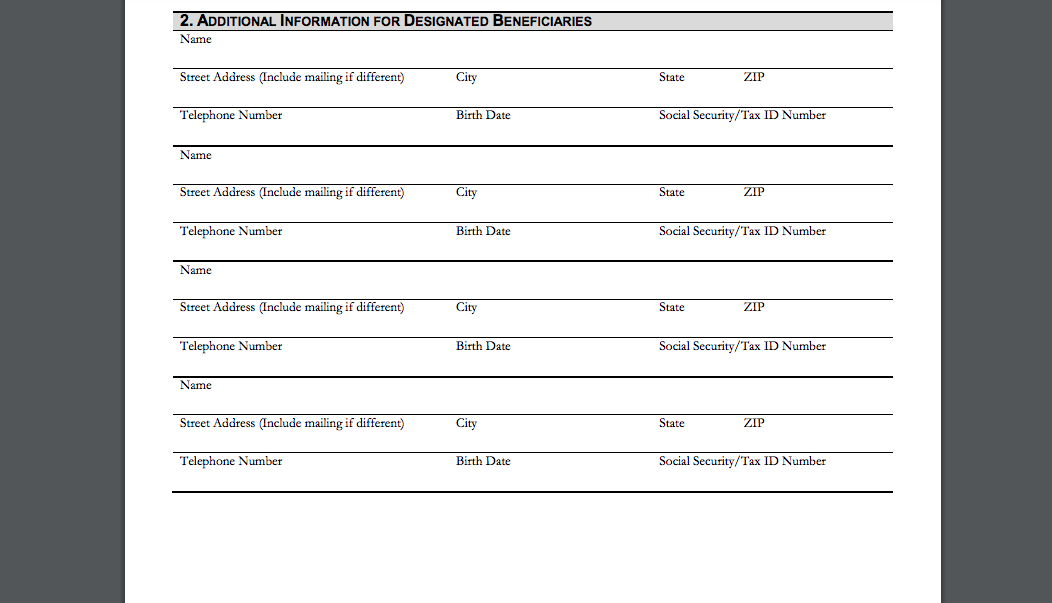

#3 – Fill Out Beneficiary Information

Depending on the type of policy you’re canceling, you may not need to fill out this portion of the form. If it’s needed, all you have to do is fill out your beneficiaries’ personal information.

Once this final section of the form is completed, you can submit the form.

How to Make a Claim

Liberty Mutual has an option on its website to make a claim for a home or car insurance policy but doesn’t allow you to submit a claim for a life insurance policy.

The company doesn’t specify how to file a life insurance claim on the website, but the process generally follows an industry standard.

First, you’ll need to notify the company of the insured’s death. Then, you’ll need to submit a death certificate and any other requested supplemental documents. Most insurance companies will have you fill out a claims packet.

Once you submit the packet and required documentation, the company will review your claim. After the claim is approved, the beneficiaries will receive payment.

The wait time between claim approval and payment varies between companies.

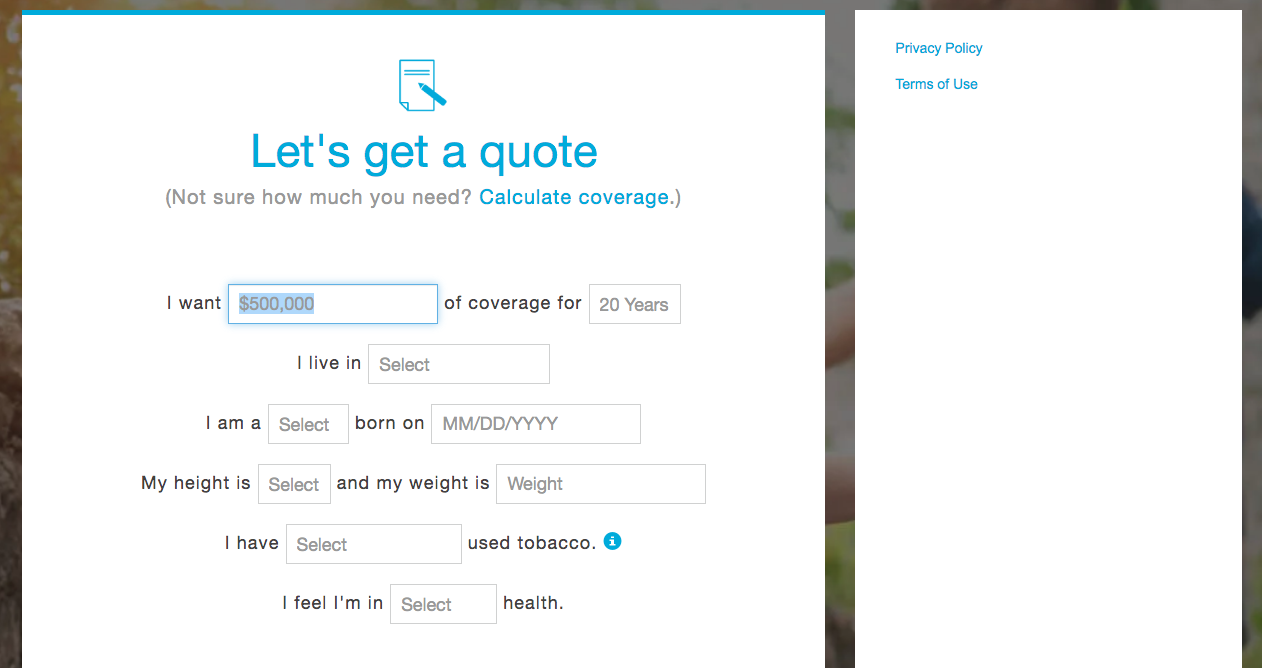

How to Get a Quote Online

Now that you’ve learned about Liberty Mutual, you’ll want to find out what exactly they can offer you. Here’s how you get a life insurance quote with Liberty Mutual:

#1 – Click Get a Quote Button

Click the blue Get a quote button on the life insurance webpage.

#2 – Fill Out Personal and Health Information

Fill out how much coverage you want and how long you want it for. Then, fill out your personal information including your state of residence, gender, and birth date. Finally, fill out your health information including your height and weight, tobacco use, and health status.

#3 – Click the See My Quote Button

After you’ve filled out the necessary information, click the green button to get your quote.

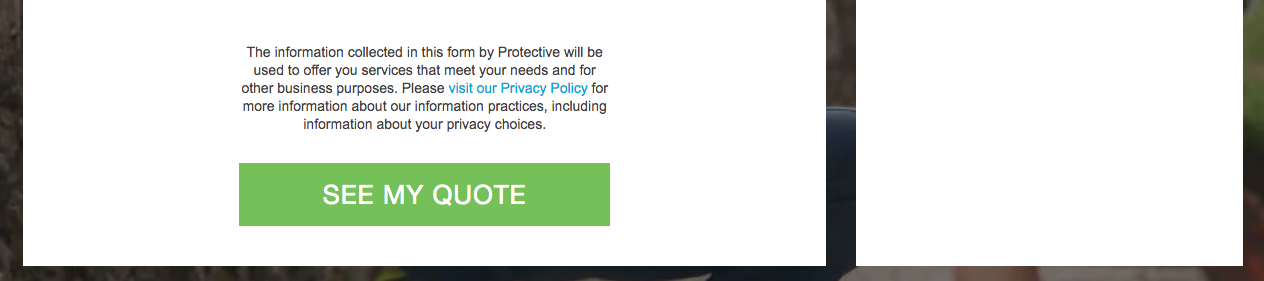

Design of Website/App

Overall, the Liberty Mutual website is user-friendly. The website is easy to navigate and the white background makes the text easily readable.

On the website’s homepage, you can easily access quote tools for auto, home, renters, and condo insurance. However, you have to go to the specific life insurance webpage to access the life insurance quote tool.

As you scroll down the website, you can easily find information customers need such as online policy access, finding a local agent, and roadside assistance.

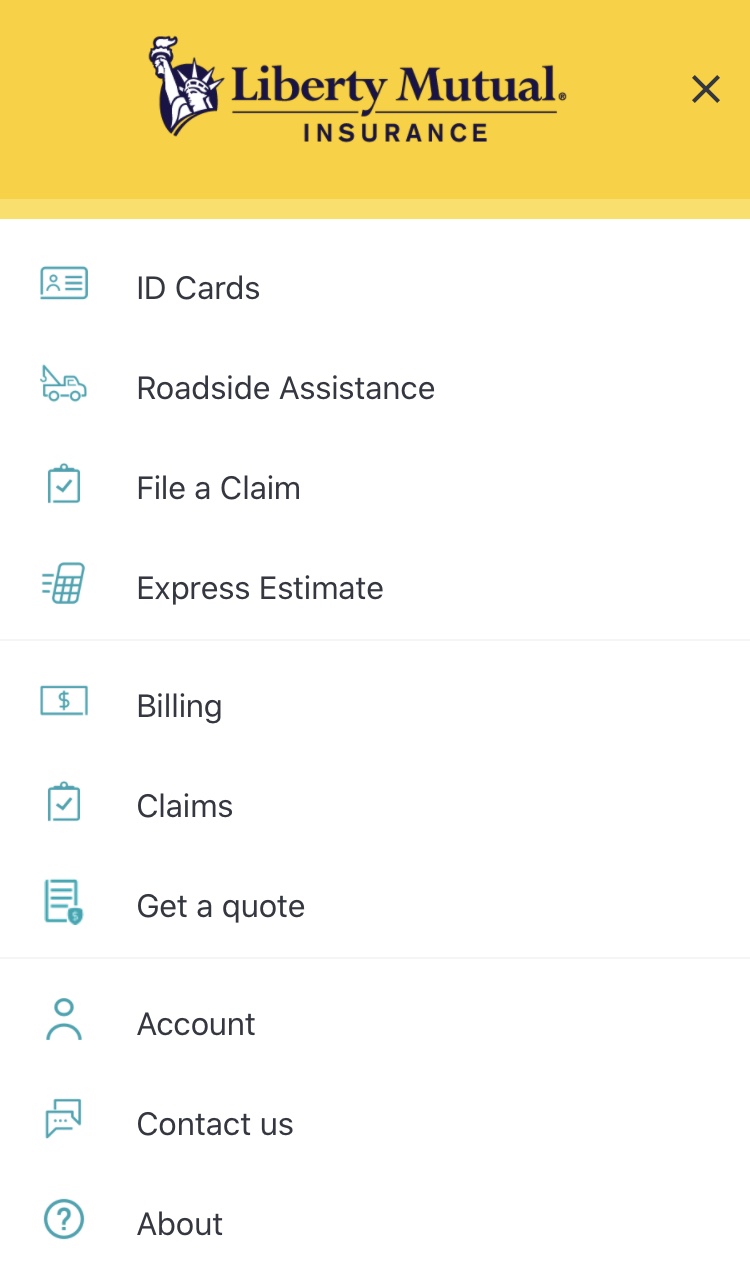

Liberty Mutual also has a mobile app. The app allows customers to access their ID cards, request roadside assistance, and file a claim. The layout of the app is simple and clean and makes it easy to use.

The app is well-reviewed by customers and currently has a 4.8 out of five stars on the Apple App Store. The rating is based on more than 28,000 reviews.

Pros & Cons

Before you buy a policy with Liberty Mutual, you should know both the advantages and disadvantages of the company. Let’s take a look at the pros and cons of Liberty Mutual.

Pros

Since Liberty Mutual is a mutual company, they answer to the policyholders. This means the company’s priority is the needs of customers rather than investors.

Another advantage of Liberty Mutual is its strong financial ratings. Across the board, Liberty Mutual has been rated as financially stable and secure. Even after a tough year in 2017, the company was able to bounce back and make a huge profit.

Cons

The main disadvantage with Liberty Mutual life insurance is its limited selection of policies since its subsidiary was sold. Though you may still be able to find a policy that works for you, the company’s options are much smaller than its competition.

There is also very little information about the policies online, so you’ll have to contact an agent directly to learn more.

The Bottom Line

Though Liberty Mutual now has more limited life insurance options, you may still find the company is the right choice for you and your family. The company does have very strong financial ratings and is considered stable with a low credit risk.

As you shop for life insurance, use this guide to determine if Liberty Mutual is the best company to help you protect your family.

Liberty Mutual’s FAQs

#1 – How do I update my contact information?

You can use the company’s customer service portal to change your contact information. Once you update your information, the changes go into effect immediately.

#2 – How do I make a payment online?

You can use the company’s customer service portal to make a payment online. You can even make a payment without an online account by visiting the company’s website and clicking on Skip login and pay.

#3 – What discounts do I qualify for?

When you use one of Liberty Mutual’s quote tools, you answer questions to help the company determine what discounts you’re eligible for. If you’re eligible for a discount, the discount will be listed along with your quote.

Ready to get started comparing rates? Enter your ZIP into our free life insurance quote tool below to find your rates!

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption