Global Atlantic Life Insurance Review 2020 (Comparisons + Quotes)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

| Key Info | Company Specifics |

|---|---|

| Year Founded | 2004 |

| Current Executives | Chairman & CEO - Allan Levine President - Rob Arena |

| Number of Employees | 200 |

| Total Sales / Total Assets | $6,072,000,000 / $89,556,000,000 |

| HQ Address | 4 World Trade Center, 51th Floor 150 Greenwich Street New York, NY 10007 |

| Phone Number | 1-441-294-1821 |

| Company Website | www.globalatlantic.com |

| Premiums Written - Individual Life | $918,284,970 |

| Financial Standing | $564,000,000 |

| Best For | Indexed Universal Life |

Get Your Rates Quote Now |

|

While finding the best life insurance rates or the most affordable life insurance companies, you might have come across the Global Atlantic Financial Group, or Global Atlantic. Global Atlantic is a specialized insurance company that offers some of the most innovative life insurance products around and is an expert provider of indexed universal life policies.

And if you have an existing plan with Accordia, Commonwealth, Forethought, or Allmerica, this Global Atlantic Life Insurance review will guide you through how to make a claim or service your existing account through Global Atlantic.

Ready to start shopping for rates? Before you read this Global Atlantic life insurance review, take a second to enter your ZIP code above and get a great life insurance rate in seconds.

Table of Contents

Shopping for Life Insurance Quotes

Rates will vary depending on your age, health, and other factors. You can get an idea for how Global Atlantic compares to other competitors by reviewing the tables below.

First, what is the average cost of life insurance that you can expect to pay if you’re in good health and have no preexisting conditions? We took an average of rate quotes from the top 10 insurance companies around for a 10-year term policy so that you can compare them against Global Atlantic’s life insurance rates by age.

You can compare the rates here against the average Global Atlantic life insurance rate chart in the following section.

| Age | $100,000 – Male | $100,000 – Female | $250,000 – Male | $250,000 – Female | $500,000 – Male | $500,000 – Female |

|---|---|---|---|---|---|---|

| 25 | $11.03 | $10.02 | $22.10 | $12.91 | $23.19 | $19.04 |

| 30 | $11.12 | $10.07 | $15.31 | $13.02 | $23.85 | $19.26 |

| 35 | $11.12 | $10.07 | $15.42 | $13.02 | $24.07 | $19.26 |

| 40 | $12.65 | $11.12 | $17.94 | $15.21 | $29.10 | $23.63 |

| 45 | $14.57 | $13.31 | $21.55 | $19.69 | $36.32 | $32.60 |

| 50 | $18.60 | $17.20 | $30.19 | $27.02 | $53.60 | $47.26 |

| 55 | $24.51 | $20.61 | $42.88 | $34.35 | $78.98 | $61.91 |

| 60 | $35.88 | $27.48 | $71.10 | $50.86 | $135.41 | $94.94 |

| 65 | $51.06 | $37.76 | $109.82 | $75.14 | $212.85 | $143.51 |

Get Your Rates Quote Now |

||||||

We’re providing rates for term policies because term policies are usually the cheapest life insurance plans available. Permanent life insurance, specifically whole or universal life insurance, will be priced higher.

As a baseline, average term life rates from the top companies will give you a good indication of where rates will fall.

Average Global Atlantic Life Insurance Rates by Age

Let’s compare the rates in the table above to Global Atlantic’s life insurance rates by age for a 10-year term policy. The chart below provides typical Global Atlantic sample rates by age for men and women.

| Age | $100,000 – Male | $100,000 – Female | $250,000 – Male | $250,000 – Female | $500,000 – Male | $500,000 – Female |

|---|---|---|---|---|---|---|

| 25 | $9.79 | $9.08 | $12.24 | $11.57 | $17.80 | $16.47 |

| 30 | $9.79 | $9.26 | $12.24 | $11.57 | $17.80 | $16.47 |

| 35 | $9.88 | $9.26 | $12.91 | $11.57 | $19.14 | $16.47 |

| 40 | $11.57 | $10.95 | $16.24 | $14.02 | $25.81 | $21.36 |

| 45 | $14.51 | $12.64 | $22.70 | $19.14 | $38.72 | $31.60 |

| 50 | $20.56 | $16.02 | $33.82 | $26.70 | $60.97 | $46.73 |

| 55 | $28.84 | $20.47 | $50.73 | $37.38 | $94.79 | $68.09 |

| 60 | $42.81 | $29.64 | $79.43 | $52.73 | $152.19 | $98.79 |

| 65 | $67.91 | $43.88 | $135.50 | $83.22 | $264.33 | $159.76 |

Get Your Rates Quote Now |

||||||

If you compare the two tables, you can see that the average Global Atlantic’s life insurance rates by age are competitive, coming in lower than the average rates for ages 20 to 45. If you’re 50 or older, the average Global Atlantic life insurance cost looks like a pricier option.

One important caveat is that Global Atlantic seems to have discontinued issuing new term policies but services legacy products issued by subsidiaries.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Global Atlantic’s Life Insurance Policies

Global Atlantic products and plans focus on life insurance policies for adults and seniors. This is evidenced by Global Atlantic’s limited product line of insurance products. The company only offers indexed universal life insurance and insurance for funeral planning.

Global Atlantic focuses on tools for mature clients and supports legacy term life and whole life policies from its acquisitions. Today, Global Atlantic is focused on providing long term solutions that extend beyond the policyholder and include life insurance policy for spouses and children.

Global Atlantic primarily focuses on permanent insurance products that offer tax advantages versus simpler products like term life insurance.

Term life insurance is the most affordable insurance and, as defined by the NAIC, is life insurance that is only payable if the insured dies within the specified number of years identified in the policy.

Term insurance is a great place to start for new shoppers because it is affordable. If you would like to get a quote to see how much insurance will cost you, enter your ZIP code above and get an instant quote from a leading insurance company.

After you get your quote, compare your plan with the Global Atlantic plans below.

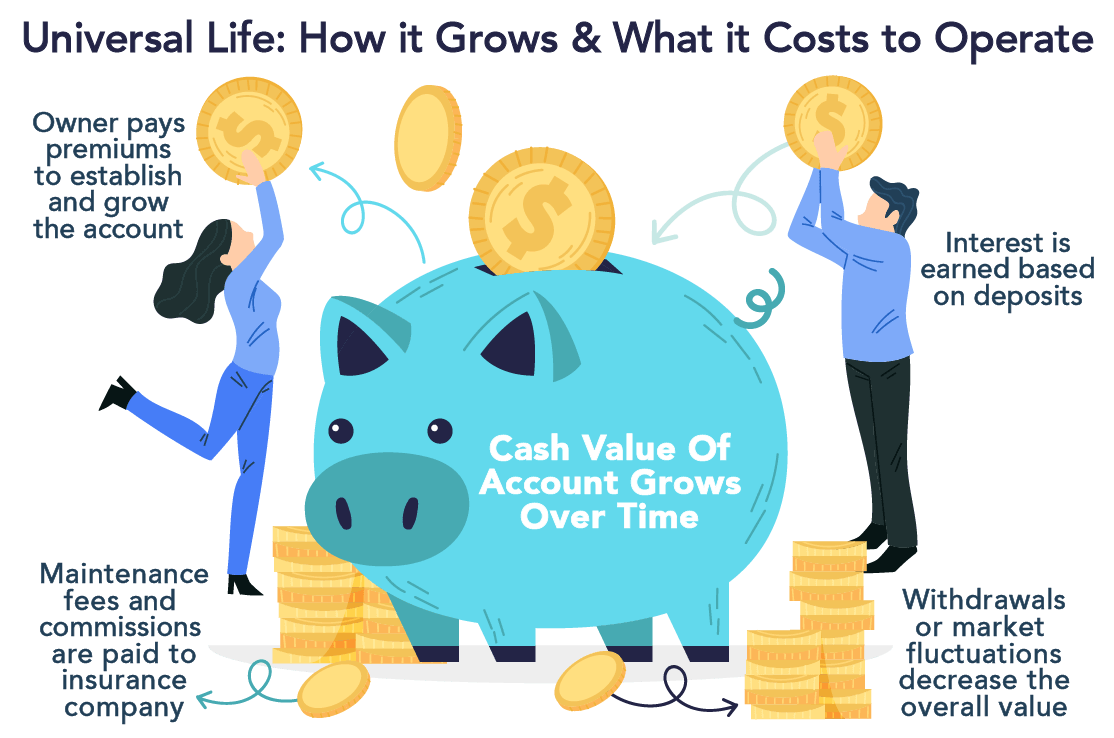

Universal Life Insurance

Universal life insurance is permanent life insurance that provides a potential for value growth over the life of the plan. With universal life, a component of your premium is allocated to pay for plan expenses and the value of benefit your beneficiaries will receive upon a claim, but an additional component of your premium is allocated to build cash value.

There are three types of universal life insurance:

- Traditional universal life insurance

- Indexed universal life insurance

- Variable universal life insurance

According to Global Atlantic product training information, Global Atlantic offers two indexed life insurance options: Lifetime Builder ELITE and Lifetime Foundation ELITE. Indexed universal life marks returns in line with the performance of a specific stock market index like the S&P 500.

The video below from Global Atlantic provides an overview of how index universal life plans work.

Let’s take a look at the specifics of Global Atlantic’s two indexed universal life options.

Lifetime Builder ELITE

The Lifetime Builder ELITE plan offers the same structure as most indexed universal life plans but provides options for death benefits and loans that other plans do not.

You can set up your plan so that your death benefit is structured in one of three ways.

- Option 1 – Higher premiums are contributed earlier on until cash value can be used to decrease the premium amount over time.

- Option 2 – Higher premiums contributed throughout the life of the plan to maximize the cash value in the account.

- Option 3 – Higher premiums contributed with payment for additional death benefit return of premium rider. The death benefit paid will be equal to the base death benefit plus the cumulative sum of any premiums plus 4 percent interest.

You should consider your current life situation to determine the best option to meet your needs.

Lifetime Foundation ELITE

The Lifetime Foundation ELITE plan is indexed universal life with a guaranteed death benefit up to a certain period of time. Depending on when you purchase the plan and your health status, the guaranteed term can range from 20 to 40 years.

This means that at the end of the predetermined term, you won’t have access to the death benefit any longer, but the plan will have built significant cash value to support your loved ones once the death benefit period expires.

This type of plan is useful for someone who wants cheaper insurance and permanent coverage. It works very much like a hybrid of term life insurance and permanent insurance.

Indexed universal life can have high expenses to look out for.

Burial & Final Expense Insurance

Global Atlantic has a plan for covering basic funeral expenses also known as preneed insurance. A preneed insurance plan provides two benefits. The first is that it allows a policyholder to express their wishes on how they would like to be laid to rest. The second benefit is that the plan covers funeral costs and memorial expenses and a medical exam is not required to qualify.

Life Insurance Riders

Global Atlantic offers an extensive list of common life insurance riders as options for its indexed universal plans. In addition to the common riders listed above, Global Atlantic offers a Waiver of Surrender Charge due to Confinement rider and a Guaranteed Option to Purchase rider.

The first rider allows a policyholder to waive any early cancellation surrender of policy charges if a policyholder is confined to a nursing home or other care facility. The Guaranteed Option to Purchase rider allows a policyholder to increase coverage amounts over the life of a policy.

How to Get a Quote Online with Global Atlantic

Global Atlantic doesn’t offer basic term life insurance. You’ll have to do some homework before you start shopping rates. The questions below will help you figure out how to get the best rate on term life insurance.

- How much insurance will you need?

- What type of insurance do you need?

- Do you need any additional features?

Review additional riders to see if you need any special options like coverage that extends to your children or spouse, options to convert your policy at the end of a term, or accidental death coverage.

The video below from Global Atlantic can help you understand the benefits of their programs and plans.

In the end, getting the best life insurance means that you’ll have to take a good look at what your specific needs are. You may want to use the help of a good financial advisor or agent to help you navigate the pricing and plan options at Global Atlantic.

You’ll want to pay attention to the factors that you can control to keep your insurance costs down. Some of the things that affect rates are:

- Your age

- Your well-being and regular exercise

- Avoiding tobacco and alcohol

Other factors that affect the cost of life insurance can be out of your control include gender, family medical history, and preexisting conditions.

A Global Atlantic actuarial analysis and full underwriting review will help to determine your rate class, which is used to determine your rate.

Global Atlantic does not provide quote information for its policies on its website. This is primarily because Global Atlantic is focused on indexed universal life insurance plans and pricing premiums for indexed universal life will depend largely on customized choices that a client will decide.

The best way to get a quote with Global Atlantic is to contact its sales contact line by visiting the website and following the navigation below.

When you’re ready to contact Global Atlantic, you can click on the Contact Us button located at the bottom page navigation.

The bottom page navigation also provides links to helpful tools and application forms. Each business line has its own contact page and tab. Click on the Life Insurance tab.

Reach out to the sales office to request an individual agent. You can reach the sales office at 1-877-462-8992.

Of course, if you are shopping for affordable term life insurance, you should try to get multiple life insurance quotes before you decide. The best way to get life insurance quotes instantly is to simply enter your ZIP code in our free quote tool.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Canceling Your Life Insurance Policy

Can you cancel your life insurance policy at any time? In many cases, canceling your life policy is as easy as stopping your premium payments. However, canceling your plan could have underlying unexpected costs. You will want to review your policy to understand any early cancellation penalties.

You should also be aware that if you cancel an indexed life insurance policy, any cash value will be returned to you. You might be thinking “it would great to cancel my Global Atlantic life insurance and collect the cash”. Before you do you should have a clear understanding of any tax implications that could arise.

How to Cancel

If you’re canceling your Global Atlantic insurance policy, you can start by reviewing your policy to see if there are any fees or fines for early termination.

For universal and indexed universal life, you’ll have to check your policy to see whether you have any cash value. How long does it take to payout on your life insurance policy? If you have cash value, any value in the policy will be returned to you as a lump sum once you cancel the policy.

Your cancellation will be processed and executed at the expiration of your last premium payment period. If you prepaid a number of periods you may not be able to get a refund.

How to Make a Claim With Global Atlantic

To make a claim with Global Atlantic, you’ll need to obtain the original copy of the insurance policy, have a copy of the death certificate, and then complete a Life Insurance Statement of Beneficiary for the proper subsidiary.

It’s difficult to determine exactly how long it will take to file a claim since each circumstance differs.

Global Atlantic is a collection of subsidiaries. The best way to make a life insurance claim is to determine the original insurance company, Accordia Life or First Allmerica Financial Life.

Once you have all of the forms and certificates, you can contact Global Atlantic’s claims department at 1-800-262-6976.

Global Atlantic’s Customer Experience

Global Atlantic seems to handle each of its customers with personalized relationship managers instead of through customer service centers. By having a direct line of contact, customer service issues are handed in a timely and convenient manner.

Global Atlantic’s Programs

One of the premier and innovative programs that Global Atlantic offers is the Wellness for Life program.

Level 1 rewards offer insurance premium discounts to customers who go to regular doctor visits and Level 2 offers bigger discounts for meeting weight management goals.

Design of Website/App

Global Atlantic’s website features several tools. A section entitled Education provides a series of articles on financial planning and products.

Global Atlantic also offers helpful calculator resources online.

Any Accordia Life insurance online payments are made today through the Global Atlantic customer site. In fact, any business previously conducted with Accordia Life is now facilitated through Global Atlantic’s site. This applies to brokers who may have worked with Accordia Life and commissions are still outstanding.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

About Global Atlantic Life Insurance

What does Global Atlantic do?

Officially known as the Global Atlantic Financial Group, Global Atlantic is a consolidated brand that provides retirement and life insurance products for all stages of life.

Global Atlantic has only been around since 2004 and was developed out of Goldman Sachs. Global Atlantic also provides access to investment products including Global Atlantic renewables energy offering. In fact, Global Atlantic Financial Group solar investments include a minority stakeholding in Southern Power Solar Portfolio North America.

Most of the investment offerings are administered by the Global Atlantic Investment Advisors LLC segment of the company.

Is Global Atlantic a public company?

Global Atlantic is a different kind of private company born from a public company. Originally known as the Goldman Sachs Reinsurance Group, the company acquired Allmerica Life and upon renaming it Commonwealth Life and Annuity, officially entered the market as a full-service life insurance provider.

For the next decade, the company built out its platform under the Commonwealth Life and Annuity brand until 2013, when Global Wealth Financial Group acquired Aviva USA Life. At that time, the company rebranded under the name Accordia Life.

In 2016, the company unified all of its acquisitions, products, and divisions under the single Global Atlantic brand.

Under the single brand, Global Atlantic is a privately held business with over 1500 shareholders with a vested interest in the company comprised of management, employees, institutions, and select individuals. Global Atlantic headquarters remain in New York City.

It is important to note that Global Atlantic did consider an IPO to take the company public in 2019 but current conditions indicate a Global Atlantic IPO is on hold.

Is Global Atlantic a good company for life insurance?

We’ve compiled a few of Global Atlantic’s 2019 life insurance ratings from the leading rating services to help you get a sense of Global Atlantic’s strengths.

- A.M. Best – A (Excellent) for financial stability and long term credit

- Moody’s – Positive Outlook (2015)

- S&P Ratings – Stable Rating (2016)

Overall, Global Atlantic seems well-capitalized and low risk.

How long has Global Atlantic been in business?

Established in 2014, Global Atlantic’s market share is insignificant when compared to the top 10 competitors in the industry. However, Global Atlantic does place within the top 50 ranked insurance providers, according to the 2018 NAIC Market Share Report. The company maintained the same NAIC ranking in 2017 at number 44 on the list.

If you’ve seen Forethought popping up when you search for Global Atlantic, you might have asked yourself, “What is Forethought Life Insurance Company?”

The Goldman Sachs Group was made up of a group of subsidiaries that included Accordia Life, Commonwealth Annuity and Life, First Allmerica Financial, and Forethought Life.

Global Atlantic and Ivy Co-Investment Vehicle, LLC have recently announced a reinsurance venture further expanding Global Atlantic’s portfolio. These subsidiaries were all reorganized under the single Global Atlantic logo and brand before the 2019 report.

The table below demonstrates the difference in size between Global Atlantic and typical Global Atlantic life insurance competitors that own the top 10 ranking spots.

| Rank | Companies | Direct premiums written | Market share |

|---|---|---|---|

| 1 | Northwestern Mutual Group | $10,517,115,452 | 6.42% |

| 2 | Metropolitan Group | $9,821,445,953 | 6.00% |

| 3 | New York Life Insurance Group | $9,295,848,300 | 5.68% |

| 4 | Prudential Financial Inc. | $9,128,805,060 | 5.57% |

| 5 | Lincoln National | $8,769,303,174 | 5.36% |

| 6 | MassMutual | $6,854,713,057 | 4.19% |

| 7 | Aegon | $4,809,856,650 | 2.94% |

| 8 | John Hancock | $4,640,905,017 | 2.83% |

| 9 | State Farm | $4,633,004,963 | 2.83% |

| 10 | Minnesota Mutual Group | $4,422,100,028 | 2.70% |

| 44 | Global Atlantic | $918,284,970 | 0.56% |

Get Your Rates Quote Now |

|||

As you can see, compared to the competition, Global Atlantic has a tremendous opportunity for market share growth.

Global Atlantic’s Online Presence

Global Atlantic’s online presence is limited to its website, customer service site, a LinkedIn page, and a Global Atlantic Facebook page.

The lack of a clear social media campaign, or information on the company through a Global Atlantic wiki page, is not so hard to believe. Global Atlantic is a newer insurance company that grew out of the Goldman Sachs corporate culture of actively managing clients through agent relationships.

Global Life uses the LinkedIn social media platform as part of its strategy to promote its products to professionals and recruit talent.

Global Atlantic’s Commercials

Global Atlantic doesn’t run nationwide media campaigns or life insurance TV commercials. However, short television spots are run in target areas and specific television markets.

Where other insurance providers focus on marketing to customers with specific insurance services, Global Atlantic TV commercials market life insurance as a component of their full offering.

Global Atlantic in the Community

Global Atlantic believes that corporations have a responsibility to help in the local communities and pursues a few specific channels to give back to the community including allocating a budget for charitable giving and volunteerism.

Global Atlantic does not appear in the best workplaces for giving back to the community in 2019.

Global Atlantic’s Employees

Global Atlantic has 10 corporate locations. Eight locations are located in the United States and internationally in Dublin and Bermuda. Global Atlantic also represents a diverse employee base with over 200 employees represented by working professionals of all ages.

According to Global Atlantic’s life insurance employee reviews on Glassdoor, employees at Global Atlantic enjoy their workplace. Although it’s not ranked as an official “Great Place to Work,” employees rate the company with 4.4 out of 5 stars through Glassdoor employee reviews. Global Atlantic still misses a placement on the Fortune “100 Best Companies to Work For” list.

Global Atlantic careers include a wide range of positions with an average Global Atlantic Financial Group salary range from $68,000 annually to $250,000 annually depending on the position and title.

Global Atlantic employees enjoy world-class employee benefits and was awarded the 2017 Milliman Best in Benefits award.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Pros & Cons of Global Atlantic Life Insurance

This summary of Global Atlantic’s Pros and Cons can help you figure out if they are right for you.

Pros of Global Atlantic Life Insurance

Here are the pros:

- Global Atlantic is focused on providing clients with guidance on a full retirement plan and can help clients who need life insurance as a component of their overall financial security.

- Indexed universal life plans offered by Global Atlantic are innovative and flexible allowing policyholders to make changes to their premiums payments, benefit amounts, and underlying investments over time.

- Global Atlantic has a strong financial foundation and is well capitalized to support clients for the longer term.

Now, let’s take a look at why you might want to keep researching life insurance companies.

Cons of Global Atlantic Life Insurance

Some of the cons might make you feel uneasy about buying life insurance from Global Atlantic.

- Global Atlantic has only been around since 2004 and doesn’t have the history or reputation of larger insurance companies.

- Only indexed universal life insurance and funeral expense insurance is offered by the company today, which does not meet the need of many clients.

- Products offered by Global Atlantic can be complicated and have high fee structures.

You should weigh all your options before selecting a life insurance plan.

Global Atlantic Life Insurance: The Bottom Line

At this point, we hope you are able to answer for yourself the question, “Is Global Atlantic Financial Group a good company?”

We hope that by reading this article, we’ve been able to answer your questions not only about Global Atlantic but also about life insurance products like indexed universal life and preneed insurance. After reading this article, do you think that indexed universal life is right for you?

If you’re looking at insurance, then comparing quotes is the first step and we can help. Enter your ZIP code to get a free instant term life insurance quote and start comparing this Global Atlantic life insurance review with the best insurance plans today.

Frequently Asked Questions: Global Atlantic Life Insurance

Check out these top FAQs for Global Atlantic.

#1 – Can I buy term life and whole life insurance at the same time?

You can purchase multiple insurance policies and have different types of policies at the same time. For some people, having multiple policies allows meeting short and long term goals while keeping costs down.

#2 – Does Global Atlantic offer products other than indexed universal life?

While Global Atlantic currently offers only indexed universal life plans and preneed insurance, legacy policies from Accordia and Allmerica Financial are still part of Global Atlantic’s portfolio.

#3 – How do I know what type of coverage I should purchase?

This will depend upon your individual needs and requirements. If you’re shopping for the most affordable rates and don’t need permanent insurance, you can shop term rates. To get an instant quote, simply enter your ZIP code below.

#4 – How long do I have to submit a life insurance claim?

You’ll typically be contacted by the life insurance company if you’re a beneficiary to file a claim immediately. You should contact the insurance company anytime afterward to file a claim if you’re the beneficiary although it may take longer for the claim to be paid.

#5 – Which additional riders are a good idea for life insurance?

Some riders are important to consider, like accidental death riders, or return of premium options. Review your options with your agent to understand which riders will add the best value to your policy.

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption