Farmers Insurance Life Insurance Review (Coverage Comparisons & More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1928 |

| Company Executives | CEO - Jeffrey Dailey CAO - Deborah Aldridge CFO - Scott Lindquist |

| Number of Employees | 20,111 |

| Total Sales / Total Assets | $11,650,400,000 / $17,016,300,000 |

| HQ Address | 6301 Owensmouth Ave Woodland Hills, CA 91367-2216 |

| Phone Number | 1-866-857-5052 |

| Company Website | www.farmers.com |

| Premiums Written - Individual Life | $1,316,224,248 |

| Best For | Affordable Term Life |

Get Your Rates Quote Now |

|

Farmers Insurance is a well-known provider in the United States offering auto, home, and life insurance solutions to customers since 1928. As a larger insurance provider, the company has a diverse set of product options for term, whole, and universal life to help meet the demands of customers at various life stages.

Farmers Insurance provides life insurance products through the Farmers New World Insurance Company. However, since all products are offered to customers under the single Farmers Insurance brand, this review will simply refer to the company as Farmers Insurance and the life insurance component of the company as Farmers Insurance.

When you start shopping for life insurance, jumping into all the different options can be overwhelming. Use this guide to learn the ins and outs of Farmers Insurance options and see how they compare.

If you’re ready to get a FREE quote, enter your ZIP code above now to get started.

Table of Contents

Farmers Insurance Ratings

When you’re shopping for life insurance, you want to know that you can depend on the company you end up choosing. A company’s reputation, financial standing, and attention to customer service are important metrics when comparing providers. A summary of Farmers Insurance reviews and ratings is provided below.

A.M. Best

A.M. Best is the only rating provider solely dedicated to the insurance industry and provides a Financial Strength Rating (FSR) and an Issuer Credit Strength Rating (ICR) to companies.

The A.M. Best FSR shows how well-financed an insurer is for meeting any ongoing insurance obligations, which is important because you want to make sure a company is financially stable and able to pay your claim. A.M. Best categories are presented in the table below.

| Ratings Categories | Ratings Symbols | Definition |

|---|---|---|

| Superior | A+ | Companies with a superior ability to meet ongoing insurance obligations. |

| Excellent | A | Companies with an excellent ability to meet ongoing insurance obligations. |

| Good | B+ | Companies with a good ability to meet ongoing insurance obligations. |

| Fair | B | Companies with a fair ability to meet ongoing insurance obligations but with possible exposure to adverse changes in underwriting and economic conditions. |

| Marginal | C+ | Companies with a marginal ability to meet ongoing insurance obligations but with possible exposure to adverse economic conditions. |

| Weak | C | Companies with an already weak ability to meet ongoing insurance obligations. |

| Poor | D | Companies with a poor ability to meet ongoing insurance obligations. |

Get Your Rates Quote Now |

||

To measure long-term obligations and stability, A.M. Best provides an ICR. A company’s ICR is something to consider if you’re shopping for life insurance, as you’ll want to make sure the insurer you choose will be here for the long haul. A.M. Best categories for ICR are listed in the table below.

| Ratings Categories | Ratings Symbols | Description |

|---|---|---|

| Exceptional | aaa | Entities with an exceptional ability to meet senior financial obligations. |

| Superior | aa | Entities with a superior ability to meet senior financial obligations. |

| Excellent | a | Entities with an excellent ability to meet senior financial obligations. |

| Good | bbb | Entities with a good ability to meet senior financial obligations. |

| Fair | bb | Credit quality may be vulnerable to adverse conditions but the company has a fair ability to meet its senior financial obligations. |

| Marginal | b | Credit quality may be vulnerable to adverse conditions but the company has a marginal ability to meet its senior financial obligations. |

| Weak | ccc | Credit quality may be vulnerable to adverse conditions and the company has a weak ability to meet its senior financial obligations. |

| Very Weak | cc | Credit quality may be vulnerable to adverse conditions and the company has a very weak ability to meet its senior financial obligations. |

| Poor | c | Credit quality may be vulnerable to adverse conditions and the company is in a poor position to meet its senior financial obligations. |

Get Your Rates Quote Now |

||

In February 2019, A.M. Best gave a Financial Strength Rating of A and a Long-Term Issuer Credit Rating of A. Although these aren’t the highest ratings, they are good indicators for the financial strength of Farmers Insurance and any subsidiary entities.

Better Business Bureau (BBB)

Most people are familiar with the Better Business Bureau for its tracking of customer complaints filed against companies for reasons including poor customer service and faulty products. When it comes to life insurance, you want to make sure your insurer tracks complaints and addresses customer concerns quickly and appropriately.

Farmers Insurance is an accredited business and carries an A+ rating with the BBB. Customers have logged more than 60 complaints on the BBB site, but most have responses from Farmers Insurance. This is a good sign that Farmers Insurance is an attentive company and addresses customer issues.

Moody’s

Moody’s rating services are primarily used by financial investors to perform due diligence on a company’s financial status. In October 2019, Moody’s gave a financial strength rating of A2 to Farmers Insurance, suggesting that Farmers Insurance offers a medium grade investment opportunity with low credit risk.

NAIC Complaint Index

The National Association of Insurance Commissioners (NAIC) provides an index that tracks complaints about individual insurers. A search for Farmers Insurance shows no complaints logged in 2018 under the individual life or group life insurance categories.

Company History

Farmers Insurance was founded in 1928 by John C. Tyler and Thomas E. Leavey as a vehicle insurer for farmers. The two men realized that farmers were prone to fewer accidents and began offering policies with better rates, eventually opening an office in downtown Los Angeles.

The company survived the Great Depression and continued through the 40s and 50s primarily as an auto insurer. In the 1950s, Farmers Insurance acquired the New World Life Company of Seattle and expanded to provide life insurance products.

Farmers Insurance has continued to grow and expand through a series of acquisitions. The company now has a presence in all 50 states and offers products across all insurance segments including auto, life, home, and even innovative renters insurance.

In 1998, Farmers Insurance was acquired by Zurich Financial Services. The company still operates under the well-known and widely recognized Farmers Insurance brand.

Farmers Insurance Market Share

According to the NAIC 2018 Market Share Report, Farmers Insurance (a member entity of Zurich Financial Services) ranked as the 32nd-largest life insurance provider in the country with a 0.8 percent market share and 1,316,224,148 direct premiums written.

The 2018 market share ranking is a considerable decrease in the parent company’s ranking in 2017. In 2017, Farmers Insurance ranked 16th on the list of insurers with a 1.75 percent market share and 2,955,465,275 direct premiums written.

There isn’t much news or data on why the company market share has dropped so significantly in just one year, but this should be a consideration to factor in when comparing providers.

Farmers Insurance Position for the Future

As part of the Zurich Financial Group, Farmers Insurance as a whole, including its life insurance, auto insurance, and other segments, is one of the largest insurers in the United States. Zurich Financial Group is well-financed and seems to be making a big investment in advertising its home and auto insurance businesses while relying on its agents to sell and grow its life insurance business.

The 2019 Zurich Insurance Group Half Year Financial Report indicated that Farmers Insurance had an operating profit of $120,000,000, a $39,000,000 year over year improvement.

A recent news release indicates that Farmers Insurance, a key part of the Zurich Financial Group business, will continue to grow by trying to enhance customer experience, improve agent productivity, and grow their life and business insurance segments.

Farmers Insurance Online Presence

Farmers Insurance provides insurance for almost all your needs including auto, home, motorcycle, and even pet insurance. Farmers Insurance offers information and tools to help you learn about and use all these products on its website.

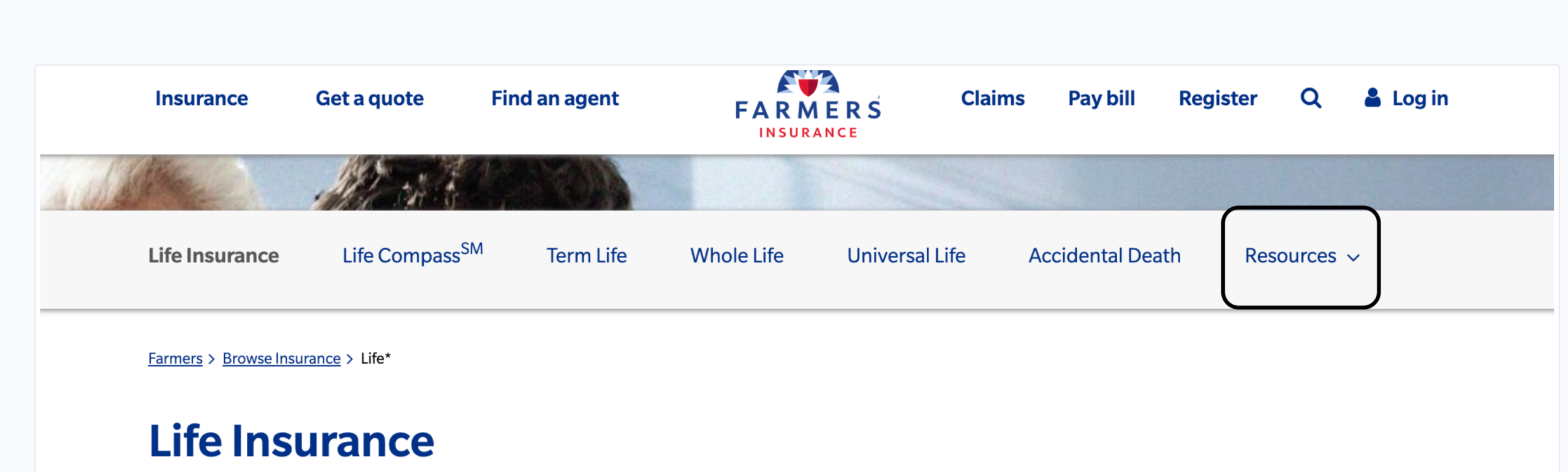

For this review, we’ll focus on the Farmers Insurance life insurance webpages. To get to the life insurance section of the website, click on Insurance from the main homepage banner menu and a drop-down menu will appear with various options. Clicking on Life will forward you to the life insurance-specific section of the site.

The insurance section of the site lands on a helpful overview page with some information on the different types of insurance, along with a menu to go to pages for more specific information.

The life insurance section of the site is informative. The main life insurance page provides an overview of products that you can review on the site or download as a PDF and has a link that gives you options to dive deeper into each insurance type. You can choose from:

- Life Compass™

- Term Life

- Whole Life

- Universal Life

- Accidental Death

- Resources

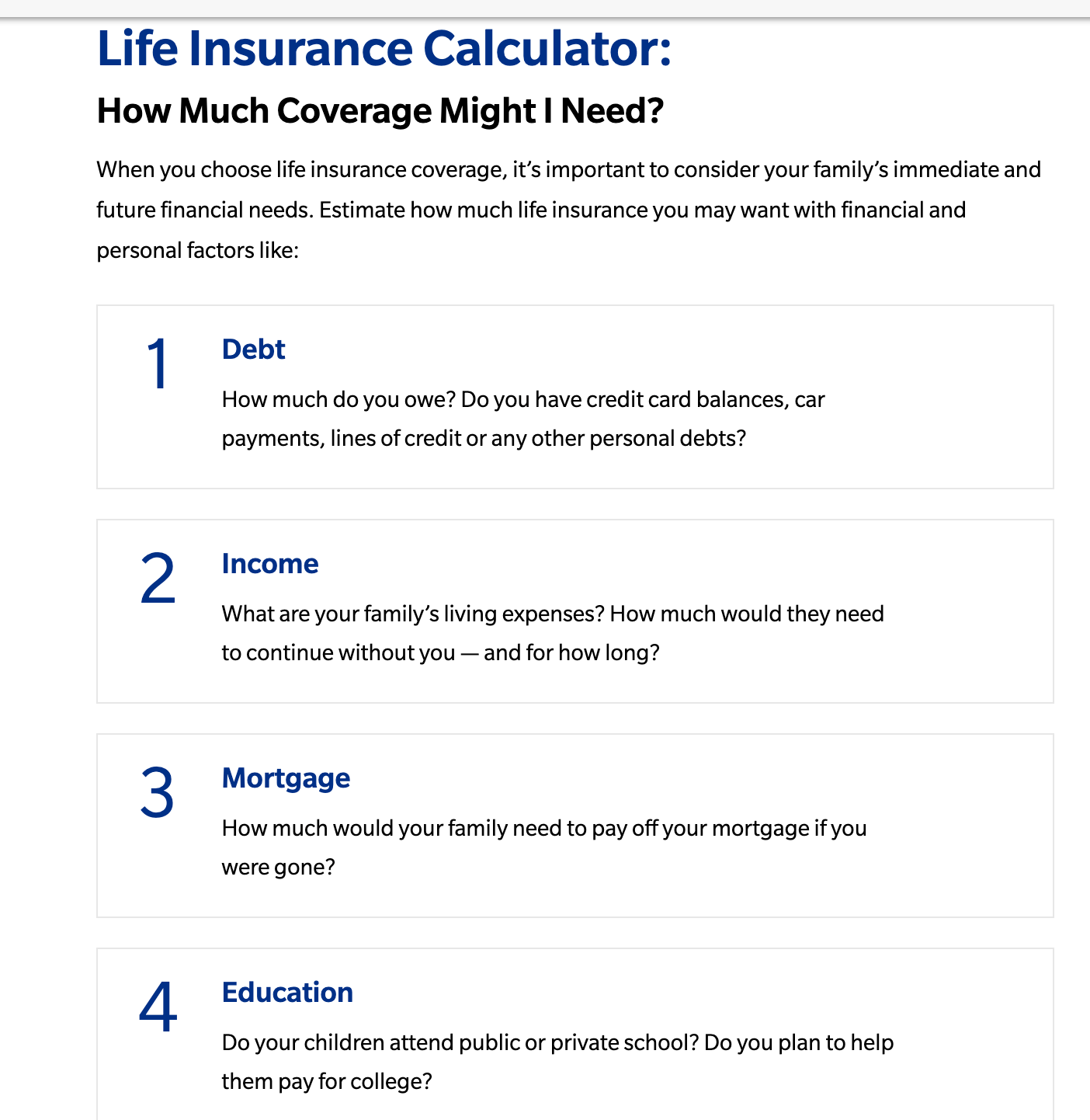

Clicking through the different menu options will provide more detail on that type of life insurance. The Resources page has links and tools that include a life insurance calculator and sections to help answer common questions.

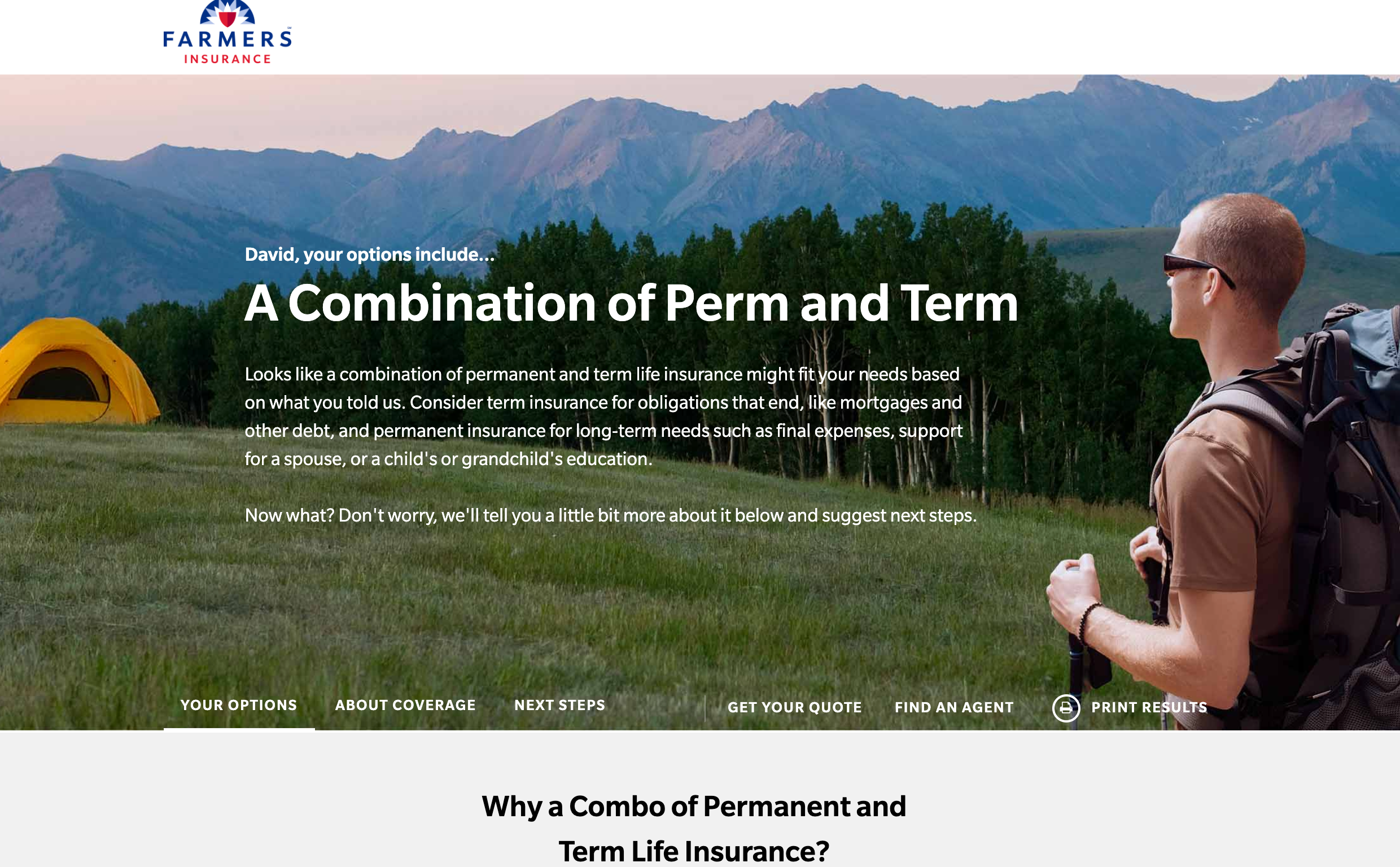

The Life Compass™ tool on the site creates an interactive Q&A to get some pieces of data without having to provide any real personal information.

By clicking Get Started, you’ll go through several pages asking you for the state you live in, your name, age, and how many dependents you have.

You will then need to provide some information on your income and employment status and answer several lifestyle questions.

When you have finished entering your information, the tool will generate suggested insurance options customized around the information you provided.

The tool provides helpful information and details on the suggested insurance options and even calculates the suggested amount of insurance coverage you might require.

Overall, the Farmers Insurance website is easy to use and engaging and provides helpful links to get quotes, find an agent, pay your bills or login to manage your account.

Farmers Insurance Commercials

Do the lyrics “We are Farmers, ba ba da ba bom bom bom” ring a bell?

Farmers Insurance has a pretty large television advertisement presence. The current spokesperson, actor J.K. Simmons, replaced John Goodman in 1996.

As a familiar face from television and movies and a familiar voice from animated movies such as Netflix’s new holiday hit, Klaus, Simmons appears in Farmers Insurance commercials as the calm sage attesting to Farmers Insurance strong history and experience through examples from its “Hall of Claims.” This ad is primarily for the company’s home and auto insurance.

Lately, Farmers Insurance has teamed up with the crew from Sesame Street to put together some entertaining ads. The ad below is just one of a series featuring Sesame Street and J.K. Simmons.

The Farmers Insurance “Hall of Fame” campaign puts the company on par with competitors Allstate, Geico, and Nationwide for brand awareness.

Farmers Insurance in the Community

Farmers Insurance has an active presence in various community support projects throughout the United States. The company preaches three pillars of corporate responsibility:

- Disaster resilience

- Education

- Civic engagement

Currently, Farmers Insurance is sponsoring disaster relief efforts by the Red Cross, the SBP, Operation BBQ Relief, and Team Rubicon. Farmers Insurance has also teamed up with pro golfer Rickie Fowler to help in hurricane relief efforts rebuilding housing in Oklahoma, New Jersey, and Texas.

Farmers Insurance Employees

Farmers Insurance is a large company and employs over 20,000 people across its various business segments. With so many employees working in different positions at different levels, the average employee age is difficult to determine. The company is an equal opportunity employer and has a diverse employee profile.

Employee reviews compiled on Glassdoor rate the company 3.5 out of 5 stars. The company rates higher for compensation and company values than it does for business outlook or senior management, although the CEO, Jeff Dailey, has a 71 percent approval rating.

Farmers Insurance is also certified as a 2019-2020 Great Place to Work. On Great Place to Work, 81 percent of employees providing feedback give the company a positive rating. Employees speak highly of the benefits they are provided, the welcoming environment the company offers, and their co-workers.

In 2019, Farmers Insurance was ranked number 26 in Best Workplaces in Financial Services and Insurance on the Fortune 100 List of Best Places to Work For. In 2018, the company was ranked number 55 for Best Places for Workplace Diversity on the same list.

Overall they have the number 91 ranking of 100 ranked companies on the Fortune list.

Shopping for Life Insurance

To find a good and affordable life insurance policy, you’ll need to examine your current lifestyle needs and think about what you might have in the future. Similar to other providers, Farmers Insurance offers term, whole, universal, and final expense insurance.

Your needs, based on your age, income, family size, current health, and other indicators, will determine which type of life insurance is right for you.

The first question most consumers have is when exactly is the right time to buy life insurance?

Buying a life insurance policy is a good idea if you have responsibilities such as:

- Having a home mortgage or student loan, credit card or car loan debt. You wouldn’t want to burden family members with any debts if something happens. Also, some policies can help you make ends meet if you’re disabled and can’t work or are temporarily unemployed.

- Living with a loved one or family.

- Providing care or financial help for an elderly family member.

- Having a business or partnership that would suffer losses if you could no longer work in your current capacity.

- Protecting your estate and pass on inheritance to your heirs with some tax protection.

Check out this quick video from Farmers Insurance that provides a bit more guidance on how it can help you.

Selecting the right type of insurance will depend on your specific needs and goals. For many people, it might involve a combination of an affordable term policy, with supplemental insurance for whole life or universal life.

For instance, if you look at the features for each policy type listed in the table below, a 40-year-old male head of household might opt for term coverage for 30 years to ensure that most of his family’s needs, including his salary for a number of years, his mortgage, and other baseline costs, are met.

He may also choose to buy a supplemental universal life policy to help build a bit of a nest egg and cover expenses for his wife if something should happen later in life when most of his major expenses are paid for.

Let’s break down each type of coverage and get a summary of term, whole, universal, and final expense.

Term

- Insurance that provides coverage for a set period of time. Usually 10, 20 or 30 years.

- Coverage is ideal for individuals who need to protect their loved ones and cover any debt obligations like student loans, mortgage debt or other commitments.

- Insurance for insurance purposes only. Term insurance will not provide an investment return.

Whole

- Coverage is for life as long as premiums are met.

- Offers consistent premiums and a guaranteed cash value.

- Offers annual dividends that can accumulate or be taken yearly.

Universal

- Also provides coverage for life, as long as premiums are met.

- Offers flexibility in premium payment amounts, death benefit amount, and savings element.

- Allows you to take loans against the cash value component of the policy.

Final Expense

- Covers expenses that arise at the time of death. Is usually intended to cover burial expense and other expenses that arise when a loved one passes.

- This is an affordable insurance option to alleviate the burden of funeral costs on loved ones.

Now that you have an overview of the various types of coverage, let’s look at Farmers Insurance and the product features it has available.

Average Farmers Insurance Male vs Female Life Insurance Rates

The life insurance underwriting process is meant to assess your life expectancy. Statistically, women have a longer life expectancy. Because of this, insurance options are cheaper for women versus men in every age category.

The table below shows sample term rates for non-smoker Farmers Insurance customers in each age category for a $250,000 benefit policy.

| Age | $250,000/10-Year: Male | $250,000/10-Year: Female | $250,000/20-Year: Male | $250,000/20-Year: Female | $250,000/30-Year: Male | $250,000/30-Year: Female |

|---|---|---|---|---|---|---|

| 25 | $16.64 | $12.06 | $25.81 | $16.43 | $38.10 | $22.27 |

| 30 | $16.64 | $13.10 | $25.81 | $19.14 | $39.97 | $29.35 |

| 35 | $16.85 | $15.60 | $29.14 | $26.02 | $44.14 | $35.39 |

| 40 | $23.10 | $21.22 | $36.85 | $36.02 | $59.97 | $50.60 |

| 45 | $29.77 | $24.97 | $52.89 | $41.02 | $91.85 | $69.76 |

| 50 | $45.60 | $38.93 | $78.10 | $73.72 | $176.22 | $153.72 |

| 55 | $71.43 | $45.60 | $131.22 | $88.72 | N/A | N/A |

| 60 | $123.93 | $97.89 | $257.88 | $226.63 | N/A | N/A |

| 65 | $161.01 | N/A | N/A | N/A | N/A | N/A |

Get Your Rates Quote Now |

||||||

You can see a difference in premiums for younger customers. Men are paying anywhere from 30 percent to 40 percent more for an equivalent policy. However, as age becomes more of a risk factor, the gap between equivalent policies can come down to about 12 percent.

Coverage Offered

When it comes to purchasing life insurance, your options are pretty endless. However, for the most part, coverage options come down to four main types.

- Term

- Whole life

- Universal life

- Final expense

Although most companies offer some combination of each of the above, many providers offer unique options and features. Let’s take a look at how Farmers Insurance is set up.

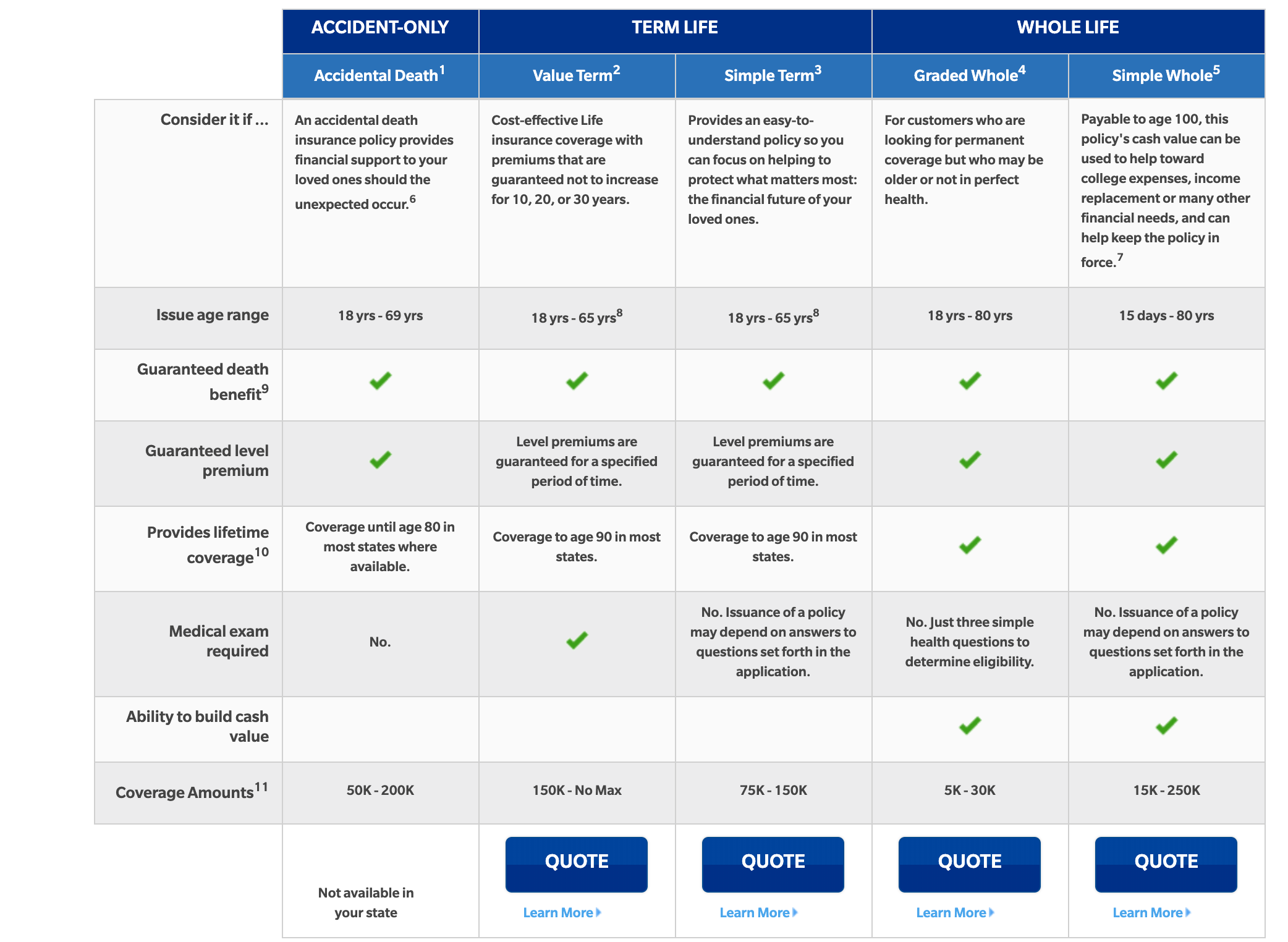

Types of Coverage Offered

Farmers Insurance offers options for term, whole, and universal, but does not have a distinct final expense product. Farmers Insurance does offer another policy type to cover accidental death. Accidental death and final expense are two different coverage options and should not be confused.

The table below provides a summary and basic features of the full line of Farmers Insurance products and a detailed description is provided below for each product.

| Policy | Type | Features |

|---|---|---|

| Farmers Simple Term | Term | Affordable and basic life insurance. Level premiums. No medical exam required. |

| Farmers Value Term | Term | Affordable insurance but requires a medical exam. Premium payments durations can be adjusted. |

| EssentialLife Simple Whole Life | Whole | Basic whole life. No medical exam required. |

| Graded Benefit Whole Life | Whole | Covers only essentials and can be an afforable option for someone that doesn't need much coverage. |

| Premier Whole Life | Whole | Robust whole life product that can cover any amount. Good option for small business professionals. |

| EssentialLife Universal Life | Universal | Whole life coverage but with the ability to adjust premium payment amounts and costs. |

| Index Universal Life | Universal | Cash value of the policy can be tied to S&P 500 or Russel 2000 indices. |

| Accidental Death | Other | Death benefits for those with dangerous occupations or lifestyles. |

Get Your Rates Quote Now |

||

You can refer to the table above for a quick view, but let’s dig a little deeper into product specifics.

Term

Term insurance provides coverage for a specific number of years. Most commonly, term insurance policy durations are 10, 20, or 30 years. At the end of the term, your policy will expire, but in most cases, you will have the option to renew or convert to a universal or whole life policy.

Term insurance is a more affordable option than whole life or universal but doesn’t have any cash value component. Simply put, you’re covered for the amount of benefit while the policy is in effect if you keep up with your premium payments.

Farmers Insurance offers two options for term insurance: Farmers Simple Term and Farmers Value Term®

Farmers Simple Term provides coverage for consumers between the ages of 18 and 65. Term options are 10, 20, or 30 years with level premiums for the duration of the term. Policies provide a guaranteed death benefit and are convertible at the end of the term to a Farmers Insurance whole life policy.

In most cases, a medical exam or lab test is not required and a decision on your application can be determined within one business day.

Farmers Value Term® also provides term options for 10, 20, or 30 years and covers consumers between the ages of 18 and 65. However, the value term option does require a medical exam in most cases.

Value term provides coverage for a specific period of time and can be used to help supplement other insurance, such as those offered through your employer, to cover other obligations such as mortgages or tuition payments.

The tables below provide sample monthly rate comparisons of Farmers Simple Term versus a similar offering from a primary competitor, State Farm. In the first table, a 10-year, $250,000 policy for non-smokers is compared.

| Age | $250,000/10-Year: Male - Farmers | $250,000/10-Year: Female - Farmers | $250,000/10-Year: Male - State Farm | $250,000/10-Year: Female - State Farm |

|---|---|---|---|---|

| 25 | $16.64 | $12.06 | $20.02 | $17.62 |

| 30 | $16.64 | $13.10 | $20.67 | $18.49 |

| 35 | $16.85 | $15.60 | $21.74 | $19.37 |

| 40 | $23.10 | $21.22 | $25.67 | $23.49 |

| 45 | $29.77 | $24.97 | $30.44 | $28.72 |

| 50 | $45.60 | $38.93 | $44.59 | $37.64 |

| 55 | $71.43 | $45.60 | $67.22 | $50.02 |

| 60 | $123.93 | $97.89 | $105.27 | $78.09 |

| 65 | $161.01 | N/A | $167.27 | $123.97 |

Get Your Rates Quote Now |

||||

You can see that for younger consumers, Farmers Insurance provides more competitive rates. However, for older shoppers, State Farm provides cheaper quotes.

For the 10-year, $500,000 policy comparison for non-smokers in the second table, you can see Farmers Insurance is cheaper for most ages, but State Farm seems to be cheaper for ages 45-60.

| Age | $500,000/10-Year: Male - Farmers | $500,000/10-Year: Female - Farmers | $500,000/10-Year: Male - State Farm | $500,000/10-Year: Female - State Farm |

|---|---|---|---|---|

| 25 | $25.18 | $17.27 | $30.04 | $22.19 |

| 30 | $25.18 | $19.35 | $30.04 | $24.34 |

| 35 | $25.18 | $23.10 | $30.04 | $26.54 |

| 40 | $39.35 | $35.60 | $39.14 | $34.39 |

| 45 | $48.10 | $39.77 | $52.19 | $44.79 |

| 50 | $83.51 | $71.01 | $77.89 | $63.09 |

| 55 | $135.18 | $76.01 | $117.44 | $89.59 |

| 60 | $238.92 | $187.26 | $194.89 | $140.49 |

| 65 | $281.84 | N/A | $326.24 | $234.49 |

Get Your Rates Quote Now |

||||

Considering that most people might need more coverage than $250,000, let’s take a look at $5000,000 in coverage for the same policyholder scenarios and see how the premiums are adjusted.

You can baseline your expectations on what you might pay for insurance from the pricing tables above. Whole life and universal coverage will be more expensive.

Whole

Whole life insurance covers you throughout your life as long as you meet your premiums. Premiums remain level for the life of the policy, and a cash component is built into the payment. So, a whole life policy allows you to accumulate value as you pay, which you can take in the form of periodic dividend payments or as a lump sum if you decide to exit the policy.

Farmers has three options for whole life insurance, as well.

- Farmers EssentialLife Simple Whole Life is the most basic offering. Policy coverage can start as low as $15,000 and premiums remain level for the life of the policy. Coverage is available for consumers ages 15–80 and payments are made up to age 121. This option is for those who can qualify easily with no health concerns. A medical exam is not required.

- Farmers Graded Whole Life provides an option for those that don’t need a lot of coverage. Coverage is only available from $5,000 to $30,000. This option features a simplified underwriting process, A medical exam is not required. If you are older and want to just make sure you are covered for any final expenses, this might be a good option for you. Even if you have some medical issues or concerns, you can qualify. This seems like a decent alternative to final expense insurance.

- Farmers Premier Whole Life is a high-end product. To get a policy, a medical exam is required. Larger coverage amounts are available starting at $50,000 with no maximum limit. For independent professionals such as business owners, doctors, and lawyers who have their own practice, this insurance provides extended coverage to ensure that your business and family will be okay should anything happen.

Universal

Similar to whole life, universal life plans keep you covered throughout your lifetime. However, where whole life provides stability in premium payments and benefit amounts, universal life provides flexibility. For most people, coverage needs and financial status will change over time.

Right now, you might need to be covered for your salary income, mortgage payment, and college tuition for your kids. When you get older, you might not want or need that much coverage. A universal plan provides some flexibility to accommodate your changing needs.

Farmers Insurance has two plan options for universal life:

- Farmers EssentialLife Universal Life provides coverage starting at $50,000 from any age from newborn to 80. You get to adjust the frequency of payments and the cost of premiums as your needs change. Depending on how you set up the plan, you may have access to income tax-deferred interest over the life of the policy.

- Farmers Index Universal Life allows you to allocate part of your premium to index funds for either the S&P 500 or Russell 2000 markets. This plan features a 0 percent floor that protects you from negative losses in years where markets underperform. You get all of the same flexibility and options of EssentialLife, but you have the opportunity to grow the asset component of your plan more aggressively.

Accidental Death

Farmers Insurance offers a separate type of policy for people who may work in dangerous situations or feel they need to protect their loved ones because of the higher risk and exposure they might have on a day-to-day basis.

For instance, if you have to drive overnight for your job, you may feel you are susceptible to a serious car accident. Accidental death insurance provides an affordable way to ensure your family will be protected from the higher risks of your occupation.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Factors That Affect Your Rate

At the end of the day, you want to know exactly how much you’ll have to pay for insurance. The tables provided in this review give you some guidance on what Farmers Insurance rates will look like, but final rates aren’t usually established until you go through a process called underwriting. Underwriters compile several factors around your life to determine overall risk, and in some cases, they might deny coverage.

The higher the risk, the higher your rate.

For some policies, even though you don’t have to submit to a full physical exam or provide blood work, you’ll need to attest to your health. You’ll also have to provide some details about your financial status and may even have to provide information on family history.

Demographics

Underwriters want to know common statistical information about you. Whether you are male or female could affect your life expectancy, and in turn, your rate. Your height, weight, and age are important for an underwriter to assess your risk. If you’re outside of the normal ranges for your weight you may be considered a higher risk.

Underwriters will also factor in where you live. Insurance companies want to know if you have a physically demanding occupation and whether where you live could affect your health. Additionally, your financial well-being could be a factor.

Current Health & Family Medical History

Your health and family medical history is an important factor in determining risk. Even if you’re otherwise healthy, insurance companies will want to look at whether you have any family history of diseases such as cancer, heart disease, mental health issues, or diabetes, Type 1 or 2.

Most companies will want to know if you have a history of high blood pressure and will ask whether you exercise regularly and watch your diet. Taking care of yourself with good exercise and diet could help keep your rates low. In some instances, you might have to submit blood work or undergo a full physical exam.

Some policy types require certain pieces of information. For instance, even for life insurance that requires no exam, you might still be required to complete a medical history questionnaire.

High-Risk Occupations

If you have a dangerous occupation, you may find it difficult to get an affordable policy. Your job may not seem high-risk, but jobs that are high stress could be a high risk for insurance companies. Insurance companies may even factor in whether your overall day leads to higher health risks. For instance, a two-hour daily commute could be a factor.

Of course, those in obviously dangerous occupations such as police officers, firemen, or lumberjacks will have policy rates affected. One option for people with high than average risk occupations that Farmers Insurance provides is Accidental Death Insurance.

High-Risk Habits

Risky behaviors will cost you when it comes to getting insurance. If you smoke, if you drink alcohol regularly, or if you use illegal substances, you may not be able to get a life insurance policy. At the very least, you’ll have to shop around to get a decent rate. If you’ve ever received a DUI conviction, you may find it difficult to get affordable insurance.

Even hobbies that seem benign could affect your rate. Something a simple as taking your motorcycle out on sunny days could affect your risk and make getting a policy costlier. Underwriters factor in the risks of hobbies such as hunting, mountain climbing, skydiving, and surfing.

Veteran or Active Military Status

If you’re a military service member, whether you are a veteran or currently on active duty, will affect your policy rates. Most companies that offer coverage to active members and veterans will have different policy types.

Military active duty and veterans can get coverage through the Veterans Administration, but supplemental options are available. Farmers Insurance doesn’t provide insurance options specifically for military veterans or active duty service members.

Getting the Best Rate with Farmers Insurance

Insurance companies’ best rates are reserved for those with the lowest risk profiles, so shopping for life insurance while you’re younger can help you lock in lower premiums.

Since Farmers Insurance sells policies across multiple business types, they offer discounts to loyal customers. Discount offers are different in different states, but Farmers Insurance has discounts for customers that combine their policies for home, auto, and life insurance. Farmers Insurance also offers a discount for home and life insurance to nonsmokers.

Farmers Insurance Programs

Farmers Insurance offers quite a bit of information and helpful tools on its website. The previously mentioned Life Compass™ section of the site provides an interactive user experience helping customers drill down on good options for their specific needs. Additionally, Farmers Insurance has a resources section that can be accessed from the Life Insurance landing page.

The resource section of the site provides helpful guidance by answering common questions about how life insurance works, tips on how to select coverage, and an insurance calculator.

Each page on the Farmers Insurance section of the site has links to get a quote or find an agent. There is also an entire section of the site dedicated to helping customers file and track claims.

Canceling Your Policy

Canceling your life policy can be as easy as stopping your premium payments. However, it may not be the best thing for you. It’s always best to understand your risks. Also, you should understand why canceling your current policy is necessary. Perhaps you’ve found a better, more affordable option with a new provider, or your needs have changed and your current policy is insufficient.

How to Cancel

If you’re thinking about canceling your policy, you’ll want to make sure you understand the risks for potential fees or lost benefits. In some instances, canceling your policy is as easy as stopping premium payments, but before you do anything drastic, complete the following steps:

#1 – Read Your Policy

Go over your policy and read the fine print. Check to see if there are any fees or fines for early termination. For term policies, you won’t get back any premiums paid to date. For universal, you’ll have to check your policy to see whether you can retrieve the cash value or have any premium payment amounts returned. You’ll also lose final expense insurance premiums if you cancel.

#2 – Contact Your Financial Advisor

Work with your financial advisor to understand any risk you might be assuming and any tax liability you might get from early termination. For a term policy, canceling early just means you’ll lose your benefits. Since there is no cash value, you won’t have tax implications.

However, for universal life, you might receive a return of premiums and have the cash value of the policy returned. An advisor can speak to you about whether you’ll need to pay taxes on any payout.

A financial advisor can also help you understand your risk exposure. If you’re canceling your policy and don’t have another in place, you might not want to go do something dangerous, such as skydiving. If you’re getting a new policy to replace your current policy, your advisor can help you determine whether your policy needs have changed.

#3 – Reach Out to Your Agent

Contact your insurance sales agent. They may be able to help you with the cancellation process. If you’re looking to replace your policy, an agent can help time the cancellation with creating the new policy.

#4 – Submit a Letter in Writing and Keep a Copy

Always request a policy cancellation. Provide specific dates informing when you last paid premiums and when you expect your coverage to end. Keep copies for yourself.

#5 – Cancel Auto-Payments

Don’t forget to cancel any automatic payment that might be set up. Check to make sure that you don’t have a credit card or bank account with an automatic payment setup. You may have to log in to your Farmers Insurance account to change any account payment information.

How to Make a Claim

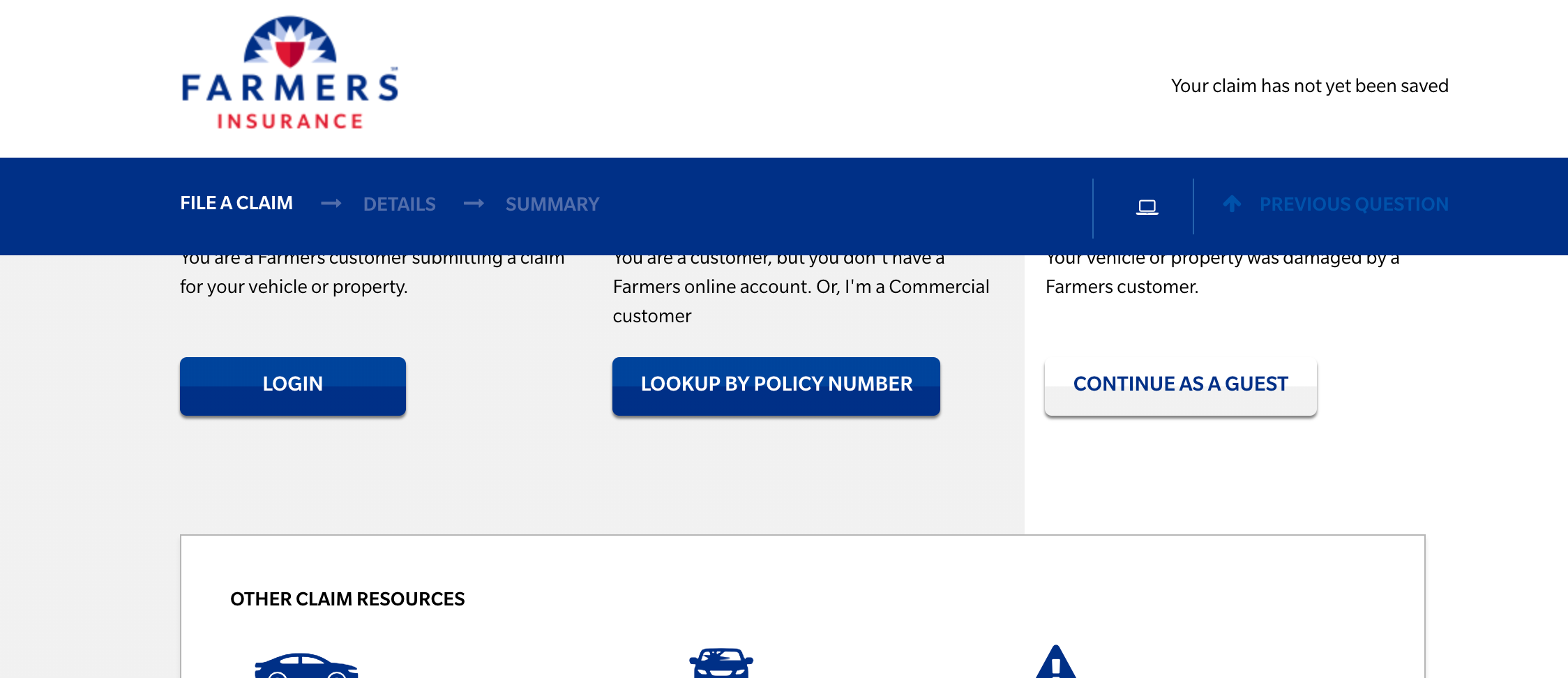

Farmers Insurance has a claims section accessible from the homepage. Most of the information in the claims section seems directed for quick support of auto accident reporting and claims.

For life insurance claims, you’ll need to access your account by logging in or providing your policy number. You can also kick off the claims process by sending a text message, downloading the Farmers Insurance mobile app, or calling the Claims Contact Center.

When filing a life insurance claim, you will usually need the original policy, a death certificate or medical report for the deceased, and information on the beneficiary or beneficiaries.

How to Get a Quote Online

Getting a life insurance quote from Farmers Insurance is a simple process. Before you sit down to get a quote, it might help for you to use the Farmers Life Compass™ tool and the calculator in the resources section described above. Then follow these steps to get a quote.

#1 – Click the “Get a Quote” Link from the Farmers® Life Insurance Page

From the main Farmers.com homepage, use the main navigation to go to the Life section. The life insurance landing page will present you with a Get A Quote link right well displayed on the page.

Although you won’t have to enter much personal information, you will need to provide some basic information in order to obtain a quote.

#2 – Enter Your ZIP Code

You will need to enter your ZIP code. Since Farmers Insurance operates in all 50 states, different options are available to customers depending upon where you live. By entering your ZIP code, Farmers.com can help direct you to specific programs available in your area and help guide you to an agent convenient to your location.

Your zip code allows the quote calculator to determine the right state of residence. Insurance rates will vary from state to state.

#3 – Choose a Type of Insurance

Once you enter your ZIP code, you will be presented with the available options for your area. You’ll see a helpful summary page with each option and associated features. Click on the Get Quote link at the bottom of the page for the option you select to get a quote.

Only options available in your state will be presented to you.

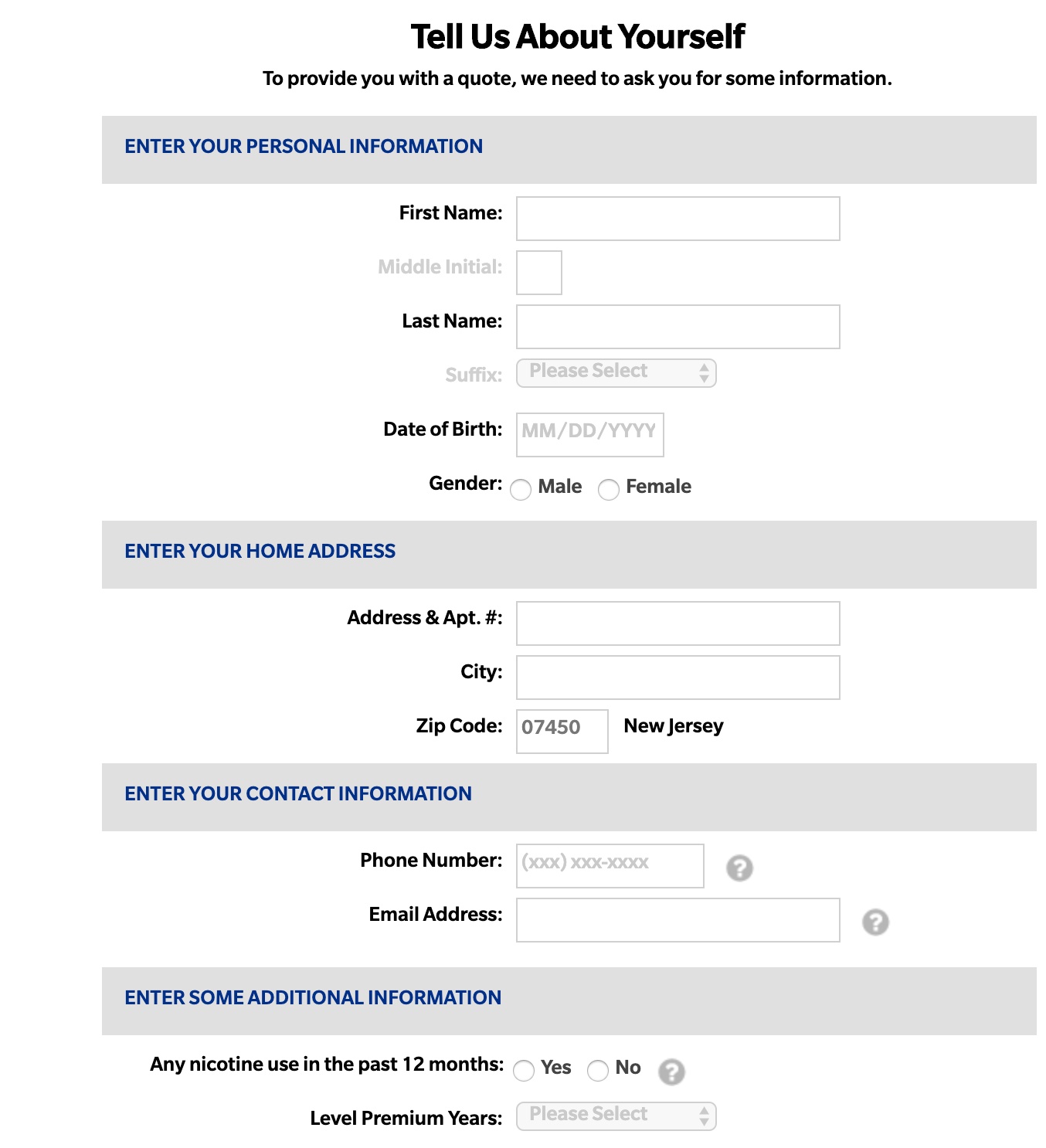

#4 – Submit Your Information

A web form will appear requesting more information. You will need to fill out the form. Farmers Insurance will collect the information and provide you a sample quote, but you will need to work with an agent to get an actual quote.

Be sure to select the right option for nicotine use. Selecting the wrong selection could significantly change your quote.

#5 – An Agent Will Contact You

A Farmers Insurance agent will be assigned to follow up with you. The agent will likely need some more information from you before passing your information along to the underwriting team.

#6 – Obtain an Initial Quote from Your Agent

The agent should be able to give you an indication of a rate for you. At this time, the agent may request additional medical information or even require a physical exam or blood work based on the type of insurance you selected.

#7 – Provide Any Follow-Up Information

Work with your agent to provide any requested information The faster you can submit this information, the quicker you will get a final quote.

#8 – Receive a Final Quote

Once you receive your final quote, be sure to factor the premium payments into your household budget for the duration of the policy.

Design of Website/App

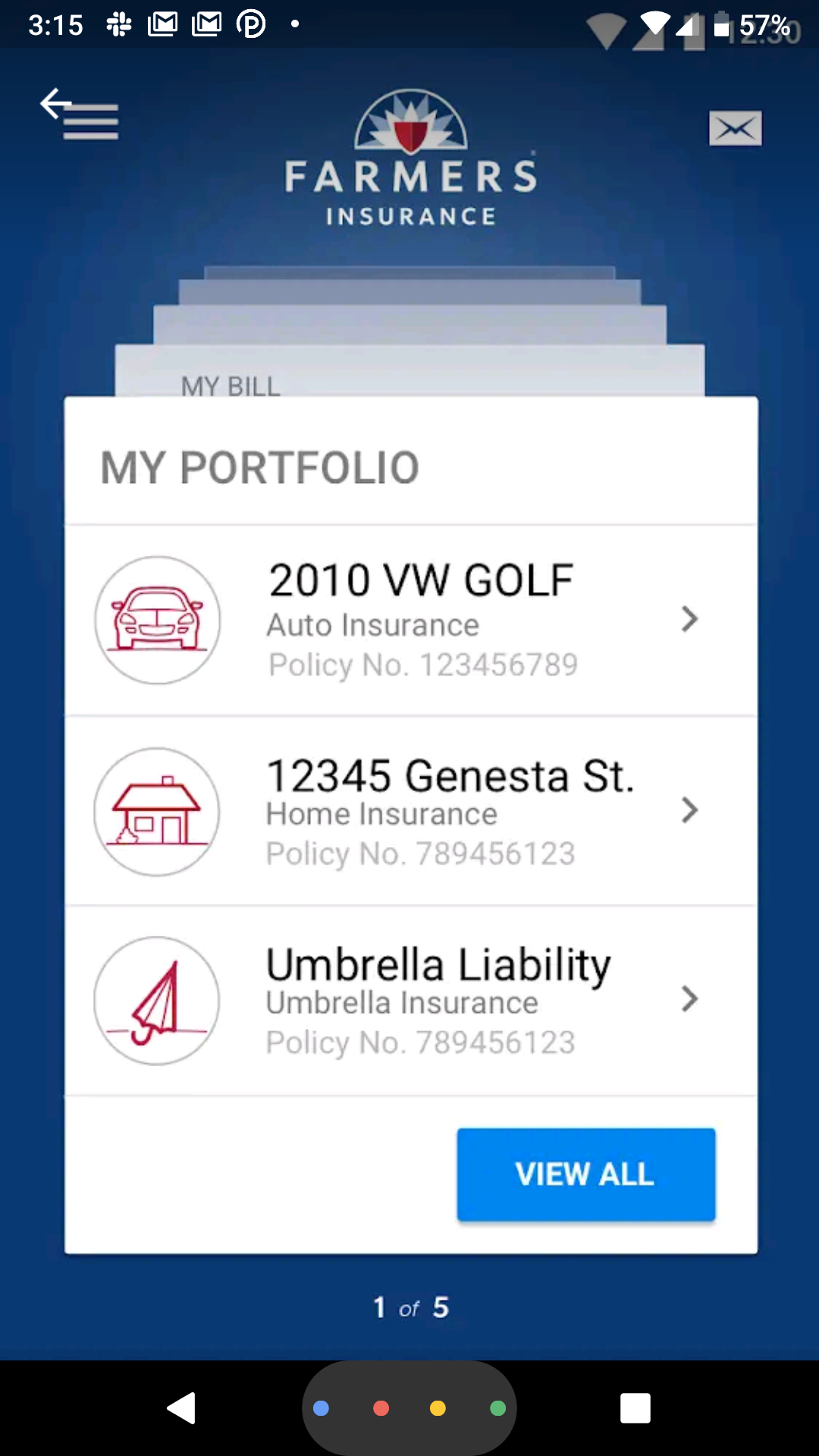

Farmers Insurance provides customers with a good online experience. It also gives smartphone users the ability to access and manage their insurance portfolios from their devices. The app is available for both iPhone and Android users and has a high 4.7-star rating.

To access the app, you will need to go to the proper app store for your device. When you go to the store, you can search for Farmers Insurance and select the Farmers Insurance app for install.

From there, you can log in to your account and use your policy numbers to link to any policies.

Downloading the app will give you access to your account information and can be helpful to keep track of your policy and any changes that might occur over time.

Pros & Cons

Farmers Insurance is a well-known brand throughout the United States. As a member of the Zurich Financial Group of companies, they are well-financed and have a very strong brand identity.

However, understanding whether Farmers Insurance is right for you may depend on whether their strengths align with your needs and their weaknesses are things you don’t require. Check out the pros and cons below to see how your needs line up.

Pros

- Farmers Insurance provides multi-line insurance and even provides discounts for customers that hold multiple policies. If you’re looking to consolidate home, life, and auto policies, this can work to your advantage.

- Farmers Insurance has great technology tools. If you are comfortable with using your phone or a web browser to get things done, you’ll enjoy the Farmers Insurance online site and web app.

- Farmers Insurance provides flexible products. If your needs don’t align with out-of-the-box solutions, Farmers Insurance may have an option for you.

- Farmers Insurance has a wide network of agents. A local agency is likely available for you.

- Farmers Insurance has a robust claim servicing process that can help you report and settle claims easily.

Cons

- Farmers Insurance agents are incentivized by selling you multiple policies. If you may be exposed to aggressive cross-selling.

- Farmers Insurance has competitive rates for middle-aged consumers, but cheaper options might be available for younger and older consumers.

- To get a Farmers Insurance policy, you’ll have to work exclusively with a Farmers Insurance agent. This may limit your understanding of what competitive options there are in the market.

- Farmers Insurance doesn’t offer final expense insurance.

The Bottom Line

Farmers Insurance is well known as a home and auto insurance provider. If you turn on your television, odds are you’ll see a Farmers Insurance advertisement.

The life insurance segment of Farmers Insurance provides a range of products for consumers of different ages and income levels, and if you are shopping for insurance, Farmers Insurance is a worthwhile option to investigate.

However, getting a good rate from Farmers Insurance might depend on whether you want different components of your insurance profile all under one provider. For consumers that hold auto, home, and life insurance and want all their policies in one place, this could be an advantage.

If your needs are specific and require different providers, working with Farmers Insurance for any single component of insurance might be difficult. The features provided in this article will help you to compare and contrast between providers.

So did this article spark your interest in learning more about insurance options and prices that may be available to you? Do you feel better equipped with questions to ask your insurance agent? Are you ready to take the next big step?

Jump in by getting a FREE instant quote today. Simply enter your ZIP code here to get a customized quote.

Farmers Insurance FAQs

Insurance shoppers usually have a lot of questions in common. Check out the list below to answer some basic questions you might have.

#1 – When do I need life insurance?

The right time to purchase life insurance depends on your stage of life. If you’re the head of your household and are responsible for providing income to cover mortgage or living expenses then you may want to start shopping for insurance.

If you’re older and are looking to secure your nest egg and pass it along to your heirs, then an insurance policy might be a good option.

#2 – Why is Farmers Insurance a good option for me?

Farmers Insurance agents can help you with all of your insurance needs. By working with an individual Farmers Insurance agent you can assure continuity of coverage for all of your risks. Farmers Insurance also provides great online and smartphone tools to help manage your account on the go.

Farmers Insurance has several options to suit different lifestyles and ages. If you don’t want to be hassled with looking for different providers for different insurance needs, Farmers Insurance can provide a holistic solution with potential discounts.

#3 – Can I have multiple policies at the same time?

Yes. In fact, there are situations where this is advisable. For most customers, needs change over time. You may be able to afford a higher premium now while you are working and secure some value in policy for your later years.

Working with your agent, you might find a good affordable term solution supplemented by a universal policy to ensure you are covered for just what you need.

#4 – If I buy all of my insurance through Farmers Insurance, can I get a discount?

Discounts are available for customers with multiple lines of insurance through Farmers Insurance. Speak with your agent to determine which discounts you may be eligible for.

#5 – How can I determine how much life insurance I will need?

Work with an agent to finalize the numbers, but to get a head start, use the Farmers.com life insurance calculator to figure out a starting number.

#6 – How many quotes should I get before I choose a provider?

With so many options out there, you may want to look at three to five quotes to give you a good idea of your choices. For more complex policy types, like universal life, you may want to consult with a financial advisor or skilled insurance agent to breakdown any features or special terms.

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption