Assurity Life Insurance Review (Coverage Comparisons & More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1890 |

| Current Executives | Chairman, President, & CEO - Thomas E. Henning CEO - Ryan D. Downs |

| Number of Employees | 400-500 |

| Total Assets | $2,600,000,000 |

| HQ Address | 2000 Q Street, Lincoln, NE 68503 |

| Phone Number | 1-800-869-0355 |

| Company Website | www.assurity.com |

| Premiums Written - Individual Life | $128,333,401 |

| Financial Standing | $271,400,000 |

| Best For | Smokers |

Get Your Rates Quote Now |

|

Life insurance can seem overwhelming. It’s hard to know which companies you should look at and which policies you should choose. With something as important as protecting your family later in life, you should have all the information before making your decision.

Assurity, a mutual life insurance company, provides a wide variety of policies to keep your family financially secure. Since it began in 1890, Assurity has worked to protect its customers during times of economic hardship.

Assurity in its current form was founded in 2007. Since then, the company’s total assets have accumulated to $2.6 billion.

This overview will give you the tools you need to decide if Assurity and their policies are the right fit for you and your family.

Get FREE life insurance quotes now by clicking the quote tool above.

Table of Contents

Assurity’s Ratings

These ratings from A.M. Best and the Better Business Bureau are objective overviews of Assurity’s financial standing and business practices.

A.M. Best

A.M. Best’s credit ratings are forward-looking and independent opinions regarding the insurer’s creditworthiness. Several factors are used to determine A.M. Best’s credit ratings, including operating performance and business profile.

Assurity has obtained an A- rating from A.M. Best, meaning the company is in excellent financial standing and is able to handle its financial obligations.

Better Business Bureau (BBB)

Ratings from the Better Business Bureau (BBB) do not focus on financial standing. Instead, these ratings are based on the interactions between a business and its consumers.

The BBB uses data directly from businesses and information available from public sources. Customer reviews are not a factor in the BBB’s rating, but customer complaints filed with the agency are taken into account.

A seven-factor system is used to determine the ratings. Assurity has an A+ rating from the BBB, indicating minimal complaints.

Company History

Assurity began as multiple companies in 1890 in Lincoln, Nebraska. What is now Assurity initially began as three different companies: The Royal Highlanders, Security Mutual Life, and the Modern Woodmen Accident Association.

Nebraskans were facing difficult times during the 1800s, including bank failures and drought.

The founders wanted to provide economic opportunities for their members while protecting them during times of hardship.

During the 1900s, the companies worked to protect their customers in the face of multiple recessions, the Great Depression, and two World Wars. In 1937, the Royal Highlanders became the Mutual Legal Reserve Life Insurance Company.

The 1990s brought significant changes to the three companies. State legislation in Nebraska regarding mutual holding companies led to re-structuring within the companies. In 1999, Security Mutual became Security Financial. During the same time, the Mutual Legal Reserve Life Insurance became Lincoln Mutual and changed once again to Lincoln Direct Life.

Three years later, the Modern Woodmen Accident Association became Assurity Life Insurance. Over the next several years, the companies consolidated and officially became Assurity in 2007.

Since 2007, Assurity has opened a new headquarters in Lincoln, Nebraska, and has grown to over 2.4 billion dollars in assets.

Assurity’s Market Share

In 2016, Assurity was responsible for .09 percent of the market share, with $132,407,098 in direct premiums. Over the past two years, Assurity’s market share has dropped slightly.

In 2017, Assurity was responsible for .08 percent of the market share, with $128,218,643 in direct premiums. The following year, the company remained at .08 percent of the market share but dropped to $128,279,481 in direct premiums.

| Year | Direct Premiums |

|---|---|

| 2016 | $132,407,098 |

| 2017 | $128,218,643 |

| 2018 | $128,279,481 |

Get Your Rates Quote Now |

|

Assurity’s Position for the Future

Though Assurity’s total market share has dropped in the last three years, they are still in good financial standing for the future. As indicated by their ratings from A.M. Best and BBB, Assurity is in a good position to handle their financial obligations.

In 2018, their net income was $11.1 million.

As a whole, the life insurance industry is on an upswing. The NAIC reports that the life insurance industry has earned $28 billion for the first six months of 2019. This is a 36% increase from the first six months of 2018.

This could be good news for Assurity. Not only is the industry seeing an increase in income, but Assurity has also taken steps to amplify the company’s message. In the next section, you will see the commercials the company is using to help create awareness of its policies.

With the life insurance industry in good standing and a marketing effort to amplify the company’s offerings, Assurity is in a good place for the future.

Assurity’s Online Presence

Assurity has many online features designed to help its customers. The contact page provides a customer service hotline number. The page also provides contact information for insurance agents.

The website has a portal called MyAssurity that allows customers to manage their accounts, check policy information, submit a claim electronically, or make a payment.

Assurity also has a social media presence, with accounts on Twitter, Facebook, LinkedIn, and YouTube.

Assurity’s Commercials

Assurity has a few commercials available on their YouTube channel. One of the commercials provides a general overview of the company and the rest provide information on specific policies.

This commercial provides an overview of Assuirty and what it values as a company. The ad places an emphasis on collaboration with customers and operating in the customer’s interest.

The other commercials provide more information on specific policies and plans Assurity offers.

This commercial gives customers an overview of Assurity’s Critical Illness Insurance. The policy covers life-threatening critical illnesses, and the benefit is paid regardless of any other insurance.

Assurity also has a commercial outlining the details of their Disability Income Insurance. The ad tells customers when they should get Disability Income Insurance and how Assuirty can help them when they don’t have a regular income.

Though Assurity only has a few commercials, they give customers an overview of the company’s values and specific details on plans and policies they offer.

Assurity in the Community

Assurity is a Certified B Corporation, meaning they are legally required to consider the social and environmental impacts their decisions will have on their customers and community. Companies go through a multi-step process examining their social and environmental performance before they earn the certification.

Assurity’s headquarters is designed to be sustainable and environmentally conscious. The building received a Leadership in Energy and Environmental Design (LEED) Gold Certification. Buildings certified by LEED are energy efficient and reduce the stress on the environment.

Assurity team members are also actively involved in the community. Employees are given time off to participate in over a dozen volunteer opportunities. Every week, employees help clean up trash in their town.

The company has also won several awards for their commitment to their community and sustainability:

- B Corporation’s Best for the World Governance 2018

- B Corporation’s Best for the World Governance 2019

- LEED Gold Certification

- Recycling Leadership Gold Level Award

Assurity’s Employees

Assurity has approximately 400 employees that work out of its home office in Lincoln, Nebraska. On Glassdoor, Assurity has an average overall employee review of 3.2 out of five stars. Employees have also rated the work/life balance with 3.7 out of five stars.

Assurity is in the 94th percentile in Gallup’s employee engagement database. The company has also been named a Best Place to Work in Lincoln.

Shopping for Life Insurance

In the 2018 Insurance Barometer Study from Life Happens and LIMRA, 90 percent of people surveyed thought the primary wage earner should have a life insurance policy. If you are the primary wage earner and are looking for life insurance, there are several factors you need to consider while shopping for a policy.

Two of the most important factors are your family’s immediate needs and long-term needs. Immediate needs will include funeral costs and medical bills.

When it comes to long-term needs, you need to determine exactly how many years’ worth of your current income you want to leave behind. Are there any expenses, such as college tuition or childcare, that your family will need to be covered?

Average Assurity Male vs Female Life Insurance Rates

The table below shows the average rates for 10-year and 20-year term policies for non-smokers.

| Assurity | $100,000/10-year | $100.000/20-year | ||

|---|---|---|---|---|

| Non-Smoker | Male | Female | Male | Female |

| 25 | $9.22 | $7.57 | $9.83 | $8.70 |

| 30 | $9.22 | $7.57 | $9.83 | $8.70 |

| 35 | $9.22 | $8.44 | $11.05 | $10.09 |

| 40 | $10.88 | $9.74 | $14.62 | $12.44 |

| 45 | $14.18 | $11.83 | $20.45 | $16.53 |

| 50 | $20.10 | $16.53 | $31.06 | $24.71 |

| 55 | $28.45 | $22.97 | $47.50 | $35.76 |

| 60 | $44.20 | $32.71 | $80.21 | $56.64 |

| 65 | $67.08 | $49.76 | $128.76 | $98.40 |

Get Your Rates Quote Now |

||||

As you can see in the table above, men have higher premiums than women. Since women have a longer life expectancy than men, they pay less for insurance.

| Smoker | Male | Female | Male | Female |

|---|---|---|---|---|

| 25 | $14.09 | $9.83 | $17.31 | $12.44 |

| 30 | $14.27 | $11.22 | $20.10 | $15.83 |

| 35 | $18.79 | $15.57 | $27.06 | $22.36 |

| 40 | $25.58 | $21.75 | $39.06 | $33.50 |

| 45 | $41.15 | $33.50 | $66.29 | $54.81 |

| 50 | $67.69 | $52.03 | $110.58 | $86.48 |

| 55 | $125.72 | $86.83 | $190.44 | $140.94 |

| 60 | $211.06 | $145.38 | $301.63 | $221.24 |

| 65 | $302.15 | $235.42 | $423.69 | $342.00 |

Get Your Rates Quote Now |

||||

If we compare the rates for the same policy, but for smokers, you can see the premium does increase. However, Assurity overall has some of the lowest premiums for smokers, making them a cost-efficient choice if you are a smoker.

Coverage Offered

Assurity offers multiple forms of life insurance and other types of insurance as well. In addition to their life insurance policies, Assurity offers the following policies:

- Disability income

- Accidental death

- Critical illness

- Annuities

Types of Coverage Offered

Assurity offers three main types of life insurance policies: term, whole, and universal. Let’s break down what each of these policies has to offer:

Term

Assurity’s term life insurance provides coverage that lasts for a specific amount of time. The policy has a guaranteed death benefit, which is the amount of money an insurance company pays when the insured dies.

Under Assurity’s term life policy, the death benefit is the total face value of the policy. For example, if you buy a $150,000 25-year term policy, the death benefit is $150,000.

Term life also has the lowest cost per month across Assurity’s policies. The monthly premium is determined based on your age when you take out the policy and the duration of the term period. Premiums for term life are stable and guaranteed for the initial period of the policy.

Term life does not have access to cash value or living benefits, though Assurity does have an option for term-life policies to convert to permanent life insurance policies.

Whole

Whole life insurance is a permanent policy that accumulates cash value over time. Whole life policies provide coverage for your entire life. Assurity’s whole life policies can have “level” death benefits or “increasing” death benefits.

A level benefit means the payout is the same whenever the insured person dies, whether their death occurs shortly after the policy is put in place or many years later. Whole life plans with level benefits pay out the face value of the policy. The cash value in the account goes toward the payout, making the overall premium lower.

An increasing benefit means the death benefit increases each year. This policy payout is the face value and any accumulated cash value. This means you pay a higher premium, but your money has a greater chance to grow.

Premiums for most whole life policies remain stable throughout your life. Some of Assurity’s policies let customers make a single payment or pay premiums for a shorter amount of time, such as 15 years. You can access the cash value of a whole life policy. The cash value is available to customers through policy loans or dividend withdrawals.

Universal

Universal life insurance is a cash value policy that gives customers more flexibility.

Like their whole life policies, Assurity’s universal life insurance plans offer level and increasing death benefit options. This allows you to adjust your coverage over time as your needs change.

Assurity’s universal life insurance lets you change the frequency or amount of your premium payments. Customers also have the option of paying a single lump sum. The flexibility of universal life plans allows you to change your policy as your needs change.

Universal life insurance policyholders also have access to the cash value of the plan. You can borrow against or make withdrawals from the policy’s cash value. Customers can use it for anything that may come up, such as emergencies or college tuition.

Riders

An Accelerated Death Benefit Rider is also available as part of Assurity’s whole life policies. An Accelerated Death Benefit Rider pays a portion of the death benefit to insured persons diagnosed with a chronic or terminal illness.

Assurity also offers the following optional riders for insured customers:

- Accident Only Disability Income

- Critical Illness Benefit

- Monthly Disability Income

The Accident Only Disability Income Rider provides a monthly benefit if the insured becomes totally disabled within 180 days of an accidental injury and before the insured turns 65. The benefit is available after a 90-day elimination period.

The Critical Illness Benefit Rider will pay a benefit if you receive a first-time diagnosis or procedure for a critical illness including a heart attack, stroke, or cancer.

The Monthly Disability Income Rider provides a monthly benefit if the insured becomes totally disabled before their 65th birthday. The benefit is available after a 90-day elimination period.

Factors That Affect Your Rate

Just like there are many variables that go into choosing which life insurance policy is best for you, there are many factors that affect your premium.

Let’s discuss some of these factors.

Demographics

Demographic information, such as age and gender, play a large role in determining your premium.

Essentially, the younger you are, the lower your rates. The older you are, the higher your rates. As you age, it becomes more likely an insurance company will have to pay out your policy, and the higher your premium becomes.

Gender is also an important factor in determining your rate. Premiums are generally higher for men than, as women have a longer life expectancy. The average life expectancy of a woman is 86.5 years, while the life expectancy of a man is 84 years.

Since women are expected to live longer, their rates are lower.

Current Health & Family Medical History

Your current health is also a significant factor in figuring out your premium. Healthy people are expected to live longer, and the longer you live, the lower your premiums are.

Insurance companies will usually have you fill out questions regarding your health and may request your medical records as part of the underwriting process. Some companies require a medical exam.

An attending physician statement is usually required as part of the underwriting process, as well. A doctor is able to accurately document your health to insurance companies. An attending physician statement could include an illness history and a list of medications you take.

Even if the insurer does not require a medical exam, the underwriter will still have access to public prescription and Medical Information Bureau records. Current health issues or a history of serious illnesses, such as heart disease, can lead to more expensive life insurance.

Family health history and a record of health conditions that have a hereditary component also factor in the cost of your premium. Insurance companies will ask about the health history of your immediate family to determine if there are any health risks that could also increase the price of your policy.

High-Risk Occupations

There are certain jobs and industries that are considered high-risk and more dangerous than your average occupation. High-risk occupations have a much higher number of fatal work injuries.

According to the Bureau of Labor Statistics, the following industries had the highest rate of fatal work injuries in 2017:

- Construction

- Transportation

- Warehousing

- Agriculture

- Forestry

- Fishing

- Hunting

Other high-risk occupations include police officers and firefighters. Jobs with a higher number of accidental deaths are considered to be high-risk. If you have a high-risk job, your insurance premium will be much higher.

High-Risk Habits

Habits and hobbies can also be considered high risk and can lead to higher life insurance premiums.

One of the most common high-risk habits that result in a more costly life insurance policy is smoking. Across gender and age demographics, smokers usually pay more for premiums. Though Assurity has better rates for smokers and a less significant price jump between smokers and non-smokers, people who smoke still pay a higher rate.

For example, a 25-year-old woman from South Carolina in good health who is a non-smoker could take out a 20-year term life policy starting at $6.87 a month. However, for a 25-year-old woman from South Carolina in good health who does smoke, the premium would start at $8.00 a month.

If the same non-smoking woman took out a 30-year term life policy instead of a 20-year policy, it would cost $7.84 a month. It would cost the smoker $10.19 a month.

Other high-risk hobbies that could drive up the cost of your premium include:

- Skydiving

- Private aviation

- Skiing

- Bungee jumping

- Scuba diving

- Parachuting

- Racing

- Hang gliding

- Rock climbing

A one-time skydiving or bungee jumping experience does not automatically place you in high-risk classification. However, if any of these activities are regular hobbies for you, they could drive up the costs of your life insurance premium.

Veteran or Active Military Status

Like the other jobs listed above, active military status is considered a high-risk occupation.

This means those currently serving the military face much higher premiums than the average customer. Some insurance companies do not sell policies to those in the military on active duty.

Getting the Best Rate with Assurity

Now that you have an overview of all of the moving parts of life insurance and how Assurity fits into the picture, you can figure out how to get the best rate possible.

The first step in the insurance-buying process is crucial in making sure you are getting the best rate: getting a quote. In the process of getting a quote, you assess your current needs to help determine how much life insurance coverage you want. Accurately assessing the amount of coverage you need helps you avoid overpaying.

If you’re younger, you may not think you need to worry about life insurance just yet, but that’s not the case. It’s best to get a life insurance policy as soon as possible. As we’ve mentioned previously, the younger you are, the lower your premiums will be. The older you are, the higher your premiums will be.

As you age, there becomes a greater chance the insurer will have to pay out your policy, driving up the cost of your premiums.

For example, a 25-year-old female non-smoker will pay a premium of $83.61 for Assurity’s Whole Life policy, while a 65-year-old female non-smoker will pay a premium of $350.09.

Don’t wait to protect yourself and your family. Assess your needs and figure out which policy is best for you.

Another important factor in getting the best rate possible is keeping yourself in good health. Both your current health and health history can factor into your life insurance premium.

If you are in good health, your premiums will cost less and remain stable. If you are not in good health or have a serious illness in your health history or in your family’s health history, your premium could increase.

Keep these three factors in mind as you purchase your life insurance policy so you can get the best rate possible.

Assurity’s Programs

Assurity does not have many easily accessible learning tools on their website. On the webpage for customers, a form library is available for frequently used forms.

On the page for agents, you can access a few brochures that go into more detail on certain policies. Most training and learning programs are done through AssureLink, a portal for Assurity agents and employees across the country.

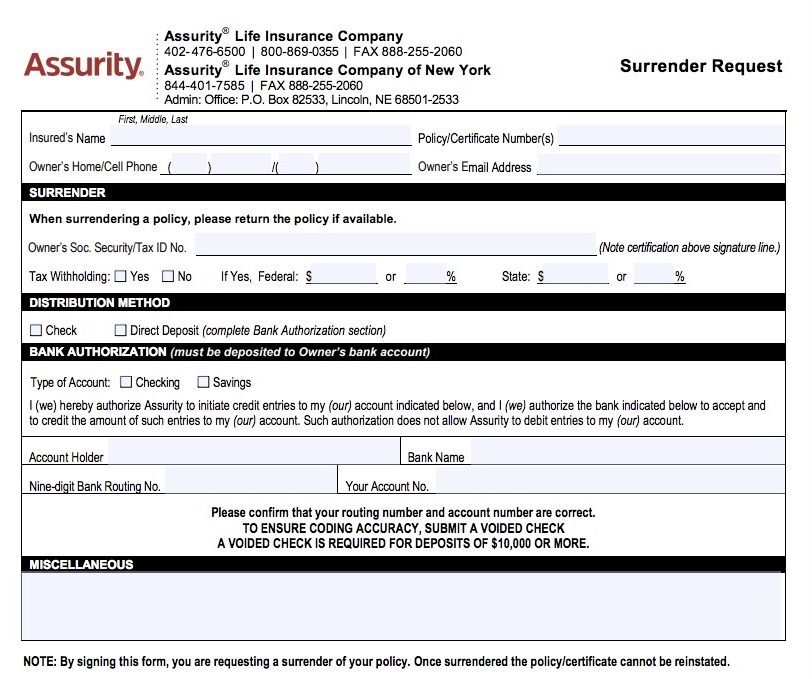

Canceling Your Policy

Many of Assurity’s policies give you flexibility so you can alter parts of your policy without having to actually cancel it. Assurity’s universal coverage allows you to change not only the amount you pay but also the frequency of the payments.

If cancellation is still your best option, follow these steps to make sure it is an efficient process:

How to Cancel

Assurity allows you to submit a surrender request form if you want to cancel your policy. There is not a fee if you surrender your policy.

#1 – Fill out Surrender Request

The first step is to fill out a surrender request form. You will provide information regarding your bank account and the way you want your money returned.

#2 – Send in Surrender Request

After you have filled out the form, send it back to Assurity so the changes can take place. Customers should fax the forms to 888-555-2060 or mail them to the administrative office at the following address: P.O. Box 82533, Lincoln, NE 68501.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

How to Make a Claim

Most insurance companies have the same basic process for filing a claim.

- Start the claim

- Fill out the paperwork specific to the company

- Submit that paperwork along with a death certificate

- Submit any other requested documents

- Choose how the money will be disbursed

- Receive your benefits

The process for filing a death benefit claim with Assurity does follow the above process very closely. The first step in filing a claim with Assurity is to notify the company of the death. Customers can call 800-869-0355 ext. 4484 or fill out a Notification of Death form.

You then contact the Assurity Claims Department to confirm the designations of beneficiaries and to learn what other forms or supporting documentation is needed for the claim to the reviewed. This can include documents such as copies of trust or estate documents and medical records.

The next step is to complete the Request for Proceeds form for each designated beneficiary. If the beneficiary is a trust or an estate, the trustee or personal representative of the estate must complete the form.

Assurity requires that one certified death certificate with a raised seal and listed cause of death is submitted for each death claim. You then return the original insurance policy or certificate to Assurity’s home office.

After the claim has been processed, the designated beneficiaries will receive payment.

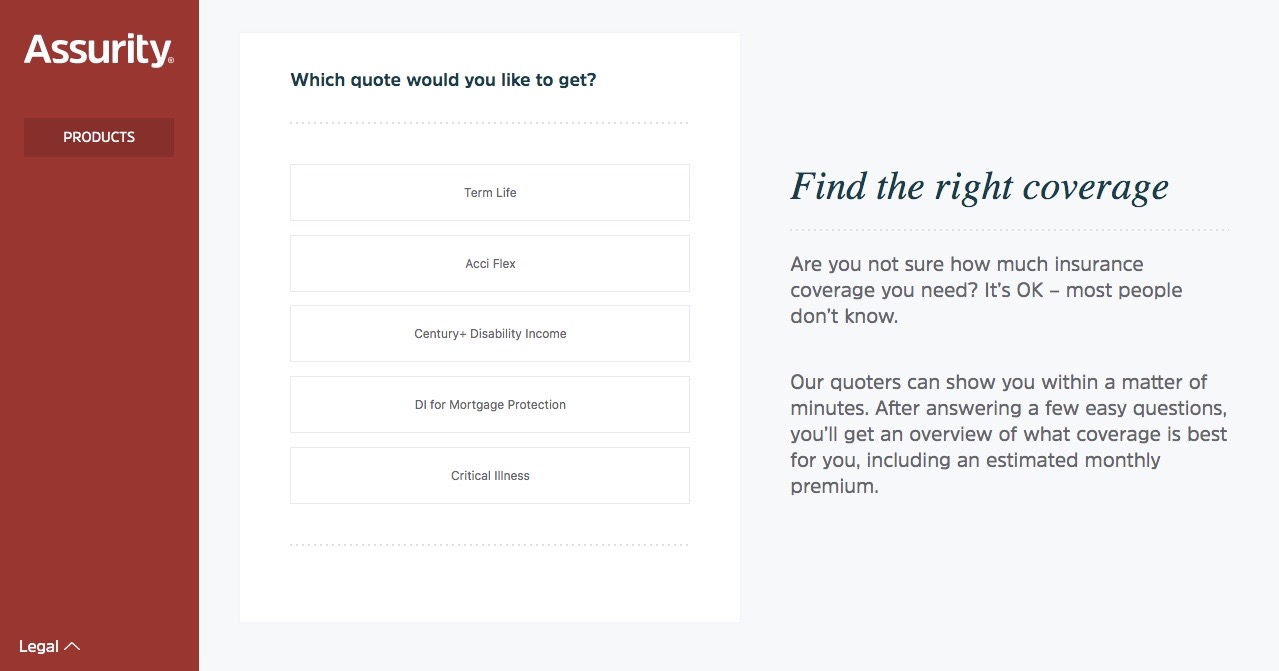

How to Get a Quote Online

You’ve read this article, you’ve learned about Assurity, and know you want to know exactly what they can offer you. Here’s how you can get a quote online from the Assurity website:

#1 – Click the “Get a Quote” Button

On the Assurity homepage, there is a red “Get a Quote” button in the bottom left-hand corner. Click that button to get started.

#2 – Select the Quote You Want

Here, you’re taken to a screen with a list of the different policies you can get quotes for. Click on “Term Life.”

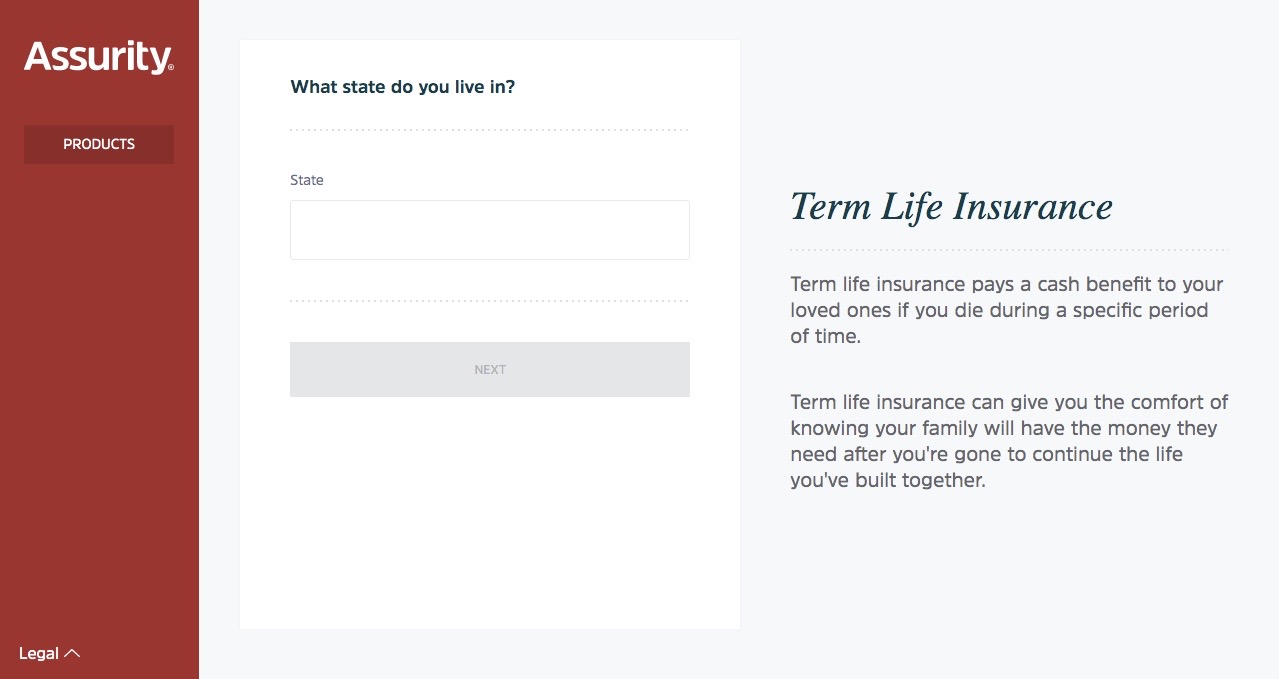

#3 – Enter Your State

Select the state you live in and click the “next” button.

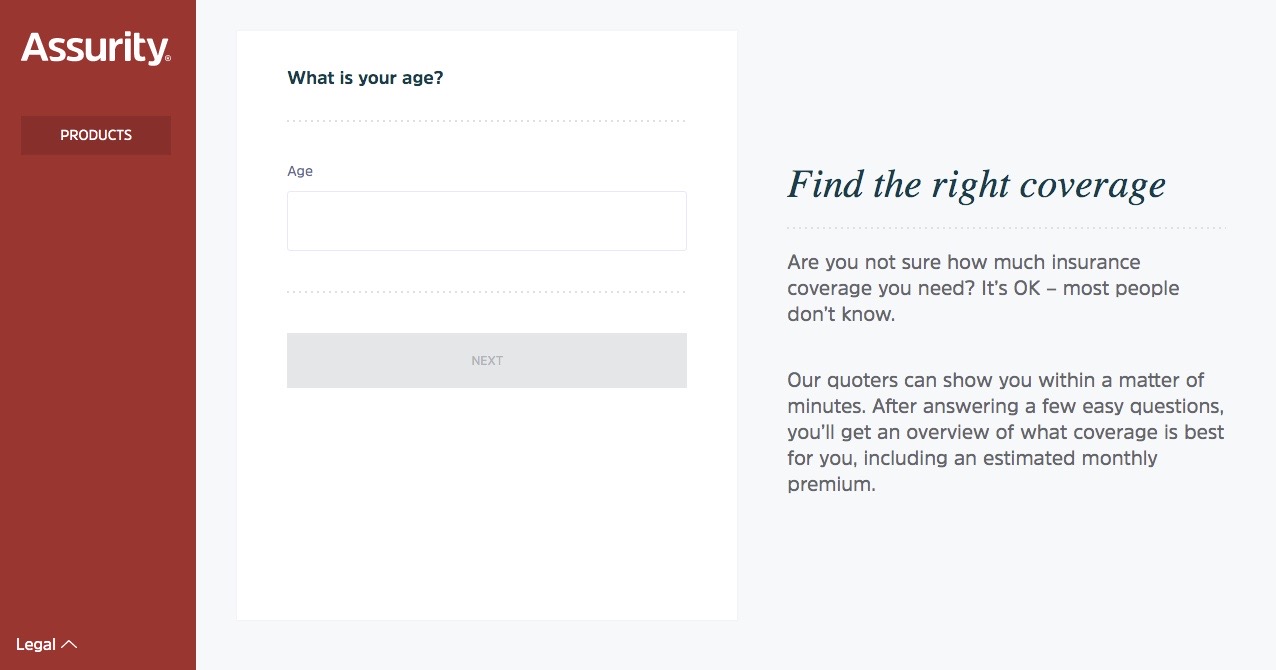

#4 – Enter Your Age

Enter your age and click the “next” button.

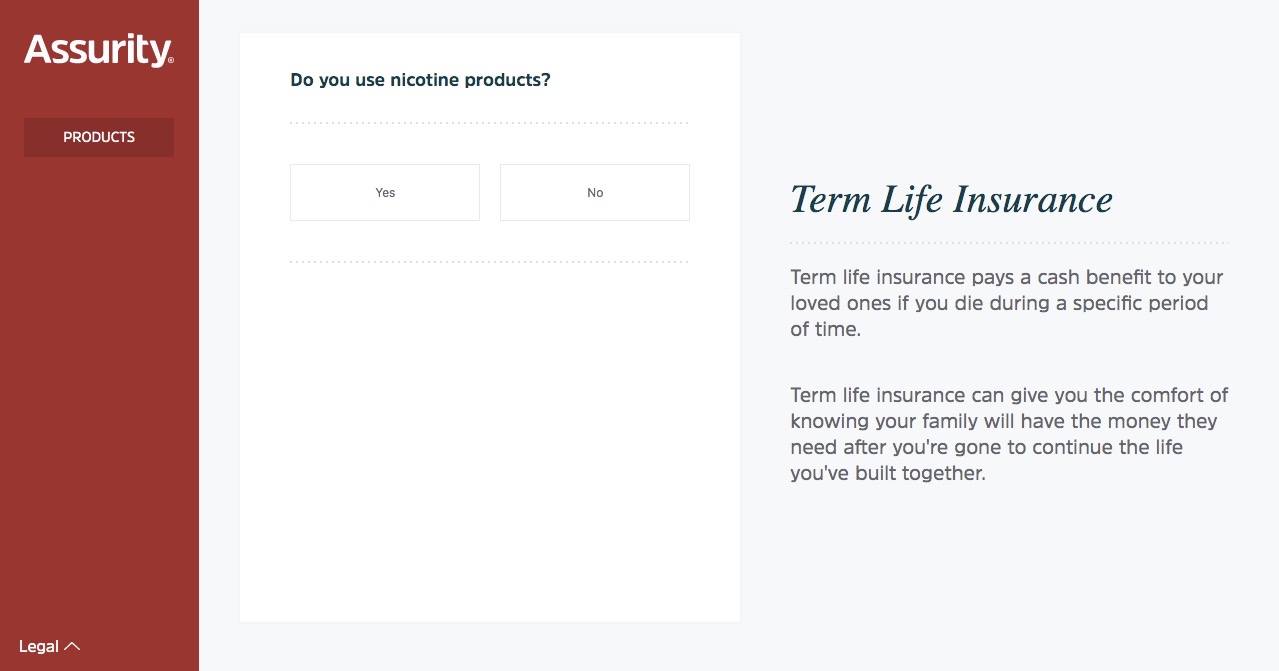

#5 – Nicotine Products

This section asks if you use nicotine products or not. Choose your answer and click the “next” button.

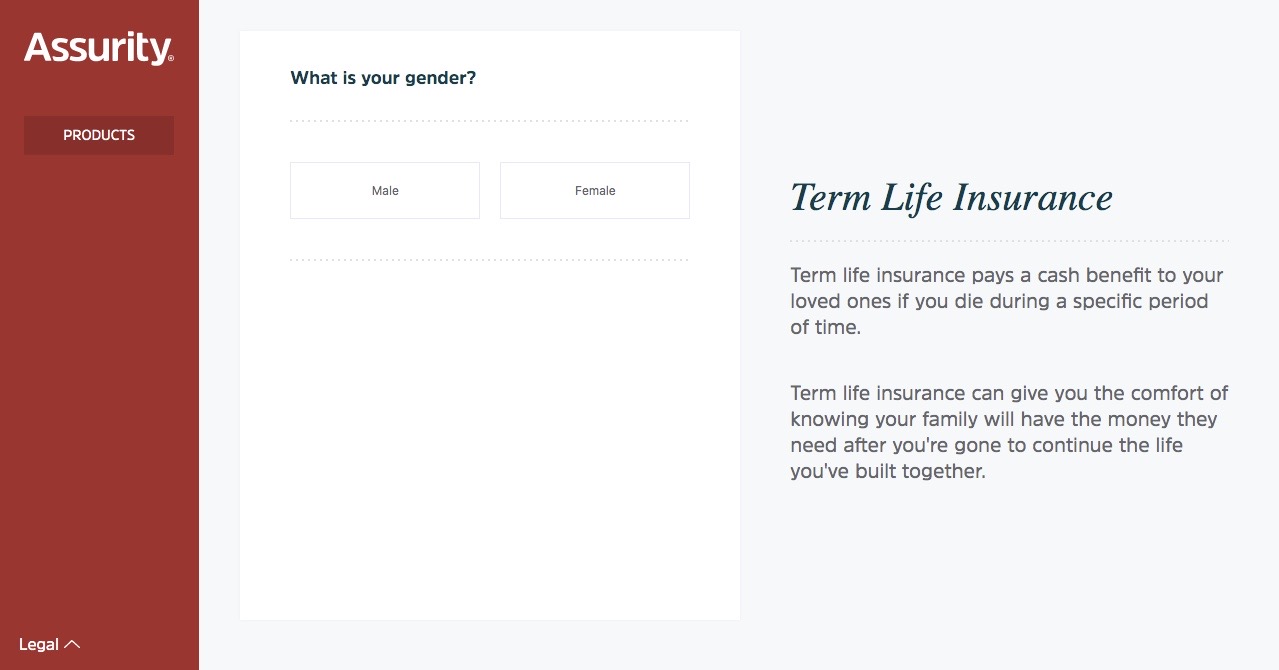

#6 – Choose Your Gender

Select your gender and click the “next” button.

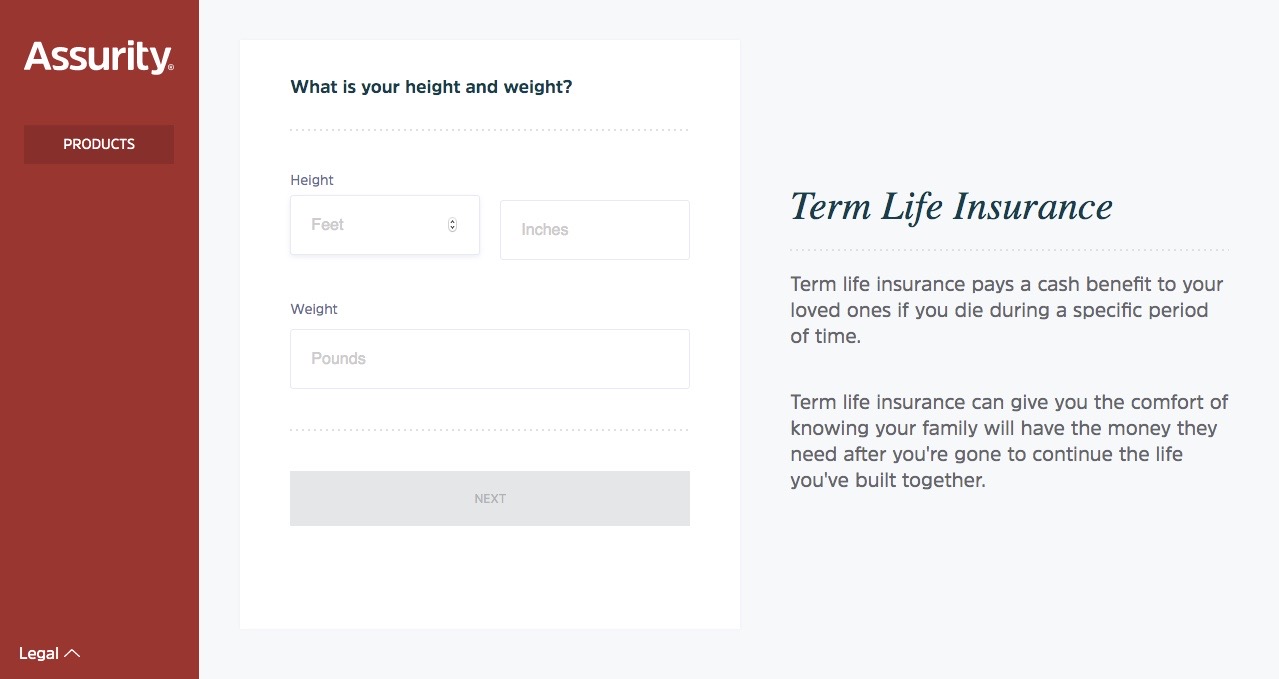

#7 – Enter Your Height & Weight

Enter your height and weight and click the “next” button.

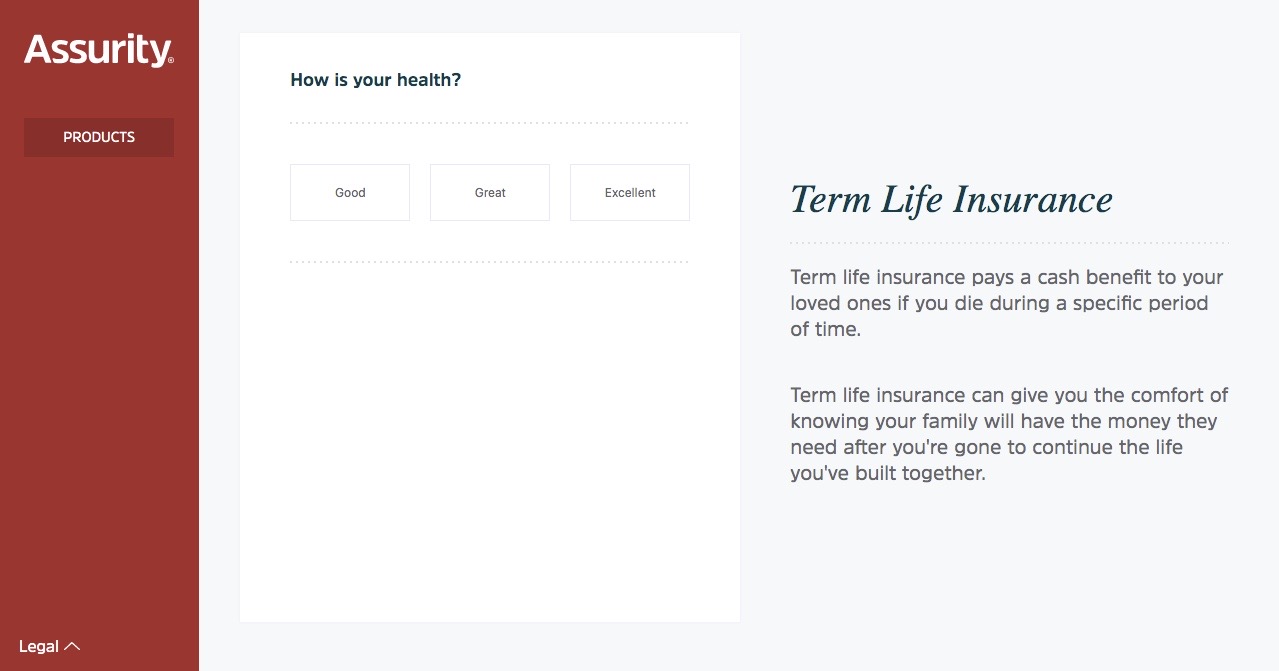

#8 – Health Status

This section asks if your health is “good,” “great,” or “excellent.” Select your answer.

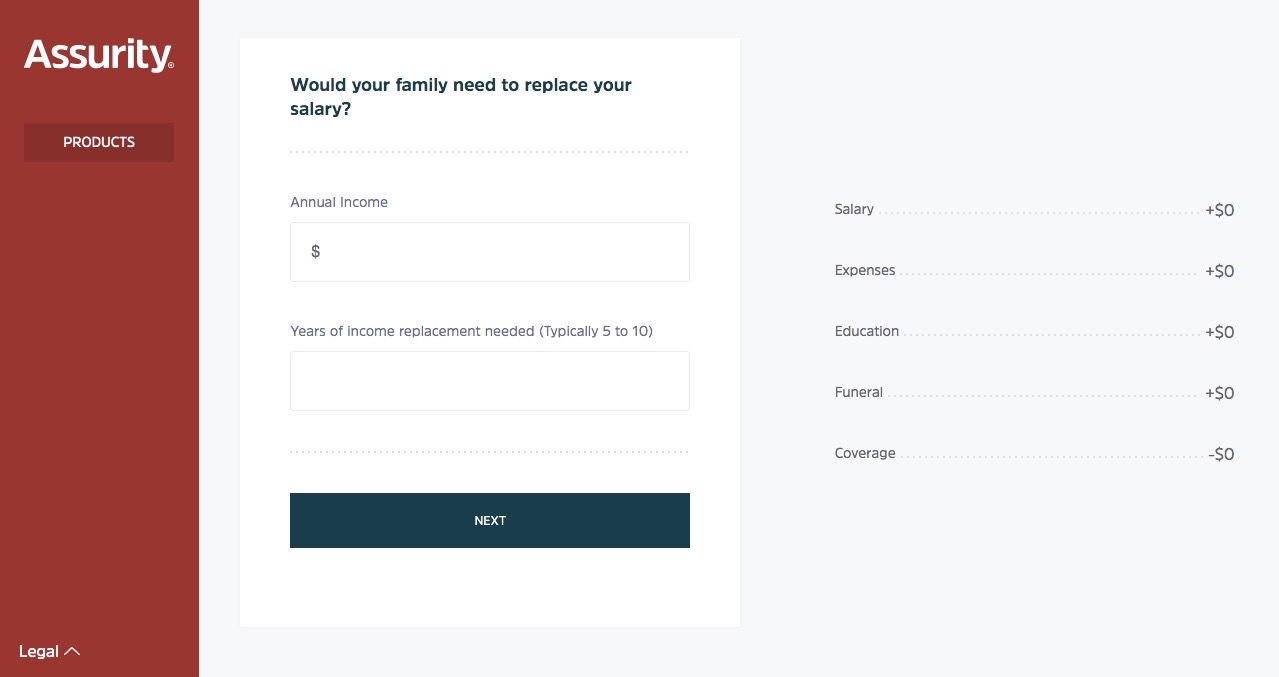

#9 – Complete a Needs Assessment

This section leads you to an optional needs assessment. If you decide to complete the assessment, you will answer questions about your annual income and the years of income replacement you would need for your policy. There are also salary, expenses, education, funeral, and coverage sections.

When completed, click the “next” button.

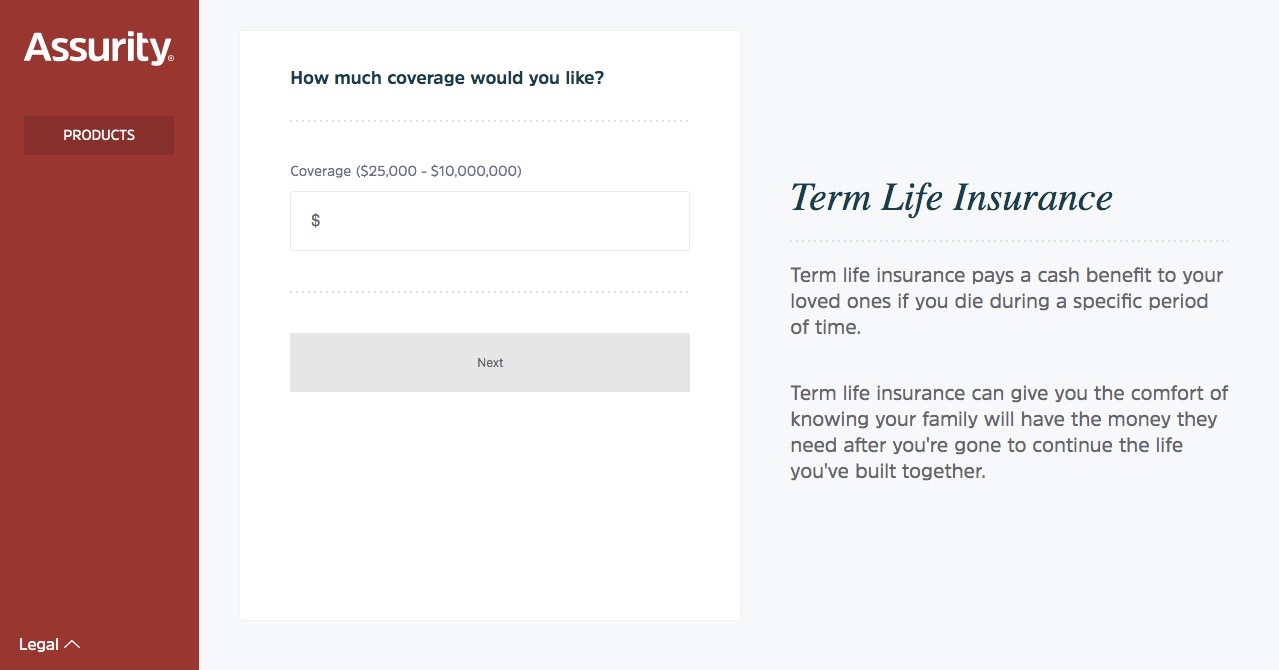

#10 – Choose Your Coverage

This is the last step of the process. You choose how much coverage you want and your quotes are calculated on the next page.

Design of Website/App

Assurity does not have a very user-friendly website. On the homepage, the navigation is in a small font that is difficult to read. The button for you to get a quote is in the bottom corner of the page, which is difficult to see.

Assurity’s social media icons are below the quote button, almost hidden on the page. There are not many mentions of the company’s social media platforms elsewhere on the site, so you may not notice that they have these accounts at first.

A design feature on their website that works is the prominence of the MyAssuirty link on the Customer Center page. This way, you can easily access your account and information without having to scroll through unnecessary links.

On the “About Us” page, a timeline with photos that tells Assurity’s story runs across the middle of the page. Unless you are significantly zoomed out, the timeline is cut off and you cannot finish reading the information.

Overall, there are forms and portals on the Assurity website that are useful to customers. However, the layout and design of the site makes it difficult to use and prevents you from getting to the information you need.

Assurity does not have an app.

Pros & Cons

Before you decide to purchase a policy with a life insurance company, it is important to know the benefits and disadvantages of the company and its policies.

Here are some things to keep in mind when choosing a plan with Assurity:

Pros

Assurity is a mutual organization, so if you have a policy with the company, you are a stakeholder. This means Assurity answers to you — the customer — instead of investors. The board of directors is elected by policyholders, so customers are able to hold the company accountable.

Assurity also offers a wide variety of term policies and riders, so you can have the flexibility to adjust your policy as your needs change.

Cons

One of the disadvantages of Assurity is the lack of detailed information about its policies online. The information provided on its website is not thorough and can be difficult to find.

If you have a specific question, you will probably have to reach out to an agent directly, as the information available on the website is limited.

The Bottom Line

Though Assurity in its current form is a relatively new company, the company’s origins go back almost 130 years. The company’s guiding principles have allowed them to continuously grow over the last century.

Assurity’s record of good financial standing makes them a trustworthy and credible organization.

When deciding what life insurance policy to buy, consider what your current needs are and what your family would need if something were to happen to you. Use this guide to help determine if Assurity is the right company for you.

Assurity’s FAQs

#1 – How can I make a payment?

There are three ways you can make a payment to Assurity:

- Pay your bill online through your MyAssurity account

- Pay by phone by calling Customer Connections at 800-869-0355 ext. 4279

- Remit payment by check to Assurity’s mailing address

#2 – Where I can find insurance forms?

Assurity has a form library on its website.

#3 – How can I review my current policy?

You can log into your MyAssurity account or call the company at 800-869-0355 to review your current policy. The company will ask you to verify details before they are able to provide policy information.

#4 – How do I get my lapsed policy back?

If your policy has lapsed, you will receive a notification letter in the mail along with reinstatement forms. Submit the reinstatement forms to Assurity in the included prepaid envelope.

Get life insurance now in your ZIP code by clicking on our FREE online quote tool.

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption