American Family Life Insurance Review (Coverage Comparisons & More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1927 |

| Current Executives | CEO- Jack Salzwedel CFO- Daniel J. Kelly |

| Number of Employees | 8,100 |

| Total Sales / Total Assets | $10,177,770 / $27,502,251,000 |

| HQ Address | 6000 American Parkway Madison, WI 53783 |

| Phone Number | 1-800-692-6326 |

| Company Website | www.amfam.com |

| Premiums Written - Individual Life | $425,026,677 |

| Financial Standing | -$295,292 |

| Best For | No Exams |

Get Your Rates Quote Now |

|

Shopping for life insurance can be an overwhelming process as you try to figure out which policies and which companies are the best fit for you and your family. When it comes to something as important as protecting your family, you want to make sure you have all the information to make the best decision.

American Family, a mutual insurance company, offers a wide variety of life insurance policies. Use this guide to help you decide if American Family is the best option for you.

Don’t wait! Get FREE life insurance quotes now by clicking the quote tool above.

Table of Contents

American Family’s Ratings

The following ratings look at American Family’s credit risk and financial stability as well as the company’s interactions with its customers.

A.M. Best

A.M. Best’s ratings are forward-looking, objective opinions regarding a company’s creditworthiness. American Family has an A (excellent) rating from A.M. Best. This indicates the company has a low credit risk and can handle its financial obligations.

Better Business Bureau (BBB)

The Better Business Bureau doesn’t look at a company’s financial standing, but rather how a business is likely to interact with its customers. The BBB gathers information directly from businesses and public data sources to assign ratings.

The BBB assigns companies a rating on a scale from A+ to F. American Family has an A rating from the BBB, indicating minimal customer complaints.

American Family isn’t a BBB accredited business.

NAIC Complaint Index

The National Association of Insurance Commissioners’ or NAIC Complaint Index compares a company’s performance to other companies in the market. The complaint index begins at 1.00.

If a company has a score under 1, they have a lower number of complaints expected for the market. If a company has a score higher than 1, they have a higher number of complaints expected for the market.

American Family has a score of 1.17 on the NAIC Complaint Index, indicating they have a slightly higher number of complaints than expected for the market.

Company History

American Family Life Insurance was founded in 1927 by Herman Wittwer as Farmers Mutual Automobile Insurance Company. In 1930, the company founded the National Mutual Casualty Company, which expanded its coverage to include protection for non-farmers.

The company continued to grow and in 1957 introduced sickness and accident insurance. The following year, the company introduced homeowners insurance and opened the American Family Life Insurance Company.

In 1963, the company had a final name change and became American Family Mutual Insurance Company.

American Family’s Market Share

In 2016, American Family had 0.26 percent of the market share, with $401.74 million in direct written premiums. The following year, the company had 0.24 percent of the market share with $411.4 million written in direct premiums.

In 2018, the company’s market share slightly increased with 0.26 percent and $425 million.

| Rank | Company | Direct Written Premiums | Market Share | Cummulative Market Share |

|---|---|---|---|---|

| 1 | Metropolitan Group | $11,890,212,278 | 7.65% | 7.65% |

| 2 | Northwestern Mutual | $10,067,144,919 | 6.48% | 14.13% |

| 3 | New York Life | $8,714,565,090 | 5.61% | 19.73% |

| 4 | Prudential of America | $8,530,929,470 | 5.49% | 25.22% |

| 5 | Lincoln National | $6,902,867,866 | 4.44% | 29.66% |

| 6 | Mass Mutual Life Insurance | $6,638,837,098 | 4.27% | 33.93% |

| 7 | Aegon US Holding | $4,602,544,288 | 2.96% | 36.90% |

| 8 | John Hancock | $4,552,016,364 | 2.93% | 39.82% |

| 9 | State Farm | $4,387,432,631 | 2.82% | 42.65% |

| 10 | Minnesota Mutual | $3,902,003,708 | 2.51% | 45.16% |

| 66 | American Family | $425,026,677 | 0.26% | 92.18% |

Get Your Rates Quote Now |

||||

The table above shows American Family’s market share in comparison to the top 10 life insurance companies in the market.

American Family’s Position for the Future

American Family’s future looks bright. The company experienced an increase in assets and revenue from 2017 to 2018.

The company’s assets increased from $24.2 million in 2017 to $27.5 million in 2018. American Family’s revenue increased from $9.25 million to $10,17 million.

Given the company’s recent growth and its strong financial ratings, American Family is in a good position for the future.

American Family’s Online Presence

American Family has multiple social media accounts including a Facebook page, a Twitter account, a YouTube channel, and an Instagram account.

The company’s website has a chat option that is available Monday-Friday from 8 a.m. to 8 p.m. CST. The website also has a tool that lets you locate an insurance agent near you. You can find an agent by your location or by looking up their name.

American Family’s website also has a customer service portal that lets you access forms, make payments, and update personal information.

American Family’s Commercials

American Family’s slogan is “Insure carefully, dream fearlessly.” The company’s commercials try to capture how American Family helps customers achieve their dreams.

The commercials feature the company’s celebrity ambassadors, Derek Jeter and J.J. Watt, helping American Family’s customers with projects they’re passionate about.

The following commercial shows J.J. Watt helping a group cleaning a river in their community.

The second commercial shows Derek Jeter helping a young girl and her mom make bracelets to help raise money to fight hunger in their community.

Next up, we’ll discuss American Family’s philanthropic work.

American Family in the Community

American Family’s Dream Foundation supports employees’ and agents’ philanthropic efforts and provides grants for non-profits. The foundation supports organizations that focus on providing tools for lifelong learning and organizations that help provide basic needs for individuals and families.

In 2018, the company donated $2.9 million to match employee donations and $1.4 million to match agent donations.

The company also supported over 2,000 organizations through its Community of Dreamers program. The Community of Dreamers program allows customers to nominate non-profits for a $1,000 grant. In 2018, more than $250,000 was donated to non-profit organizations nominated by American Family customers.

More than 1,800 American Family employees volunteered and served 10,272 hours in 2018.

The company also raises money through its work with the Steve Stricker American Family Insurance Foundation. The foundation is in partnership with brand ambassador and PGA Tour professional Steve Stricker.

Every year, the foundation hosts a PGA Tour Champions golf tournament in Madison, Wisc. to raise money for various organizations dedicated to helping children and their families.

In 2018, the golf tournament raised $2 million for 83 non-profit organizations.

American Family’s Employees

American Family has 8,100 employees. In addition to agent positions, the company offers career opportunities in the following areas:

- Engineering, science, and technology

- Claims

- Finance and actuarial

- Human resources

- Product management

- Legal

- Marketing

- Sales, service, and support

On Glassdoor, employees have given the company a 3.5-of-five-star review. On Glassdoor, 74 percent of employees say they approve of the CEO.

American Family has business resource groups for employees. The groups include:

- Abilities Business Research Group

- Multicultural Business Resource Group

- Women’s Business Resource Group

- LGBTQA Business Resource Group

- Veterans and Military Business Resource Group

The company has also been recognized as a top employer for diversity and women. American Family has received the following recognitions:

- Top 50 Companies for Diversity 2019 – Diversity Inc.

- Best Employers for Diversity 2019 – Forbes

- Best Place to Work for LGBTQ Equality – Human Rights Campaign

- Best Employers for Women 2019 – Forbes

- Best Employers for Diversity in Wisconsin 2019 – Forbes

- Best Employers for New Grads 2019 – Forbes

- America’s Best Employers 2019 – Forbes

Shopping for Life Insurance

According to the 2018 Insurance Barometer Study from Life Happens and LIMRA, one in five people with life insurance doesn’t think they have enough coverage. As you begin to shop for life insurance, there are some things to keep in mind to make sure you’re getting the right amount of coverage for you and your family.

As you start to look at life insurance policies, you need to consider your short-term needs and long-term needs.

Short-term expenses include funeral and burial costs and medical bills. Long-term expenses can include mortgages, child care costs, college tuition, and any other outstanding debt, such as student loans.

You also need to determine how much of your income you want to replace.

Keep these in mind as you shop for life insurance so you can make sure your family is protected and has the right amount of coverage.

Coverage Offered

American Family offers many forms of insurance including life, home, auto, and health. Let’s take a closer look at the various life insurance policies the company has to offer.

Types of Coverage Offered

American Family offers three main types of coverage: term, whole, and flexible life insurance. Within those main types of coverage, the company also offers:

- DreamSecure Simplified Term Life insurance

- DreamSecure 15 Pay Whole Life Insurance

- DreamSecure Pay to 65 Whole Life Insurance

- DreamSecure Senior Whole Life Insurance

- Dream Secure Children’s Whole Life Insurance

Let’s break down what each of the policies has to offer.

Term

Term life insurance policies guarantee the payment of a death benefit during a specified time period. The policy will remain in effect for the chosen term as long as you pay your premiums.

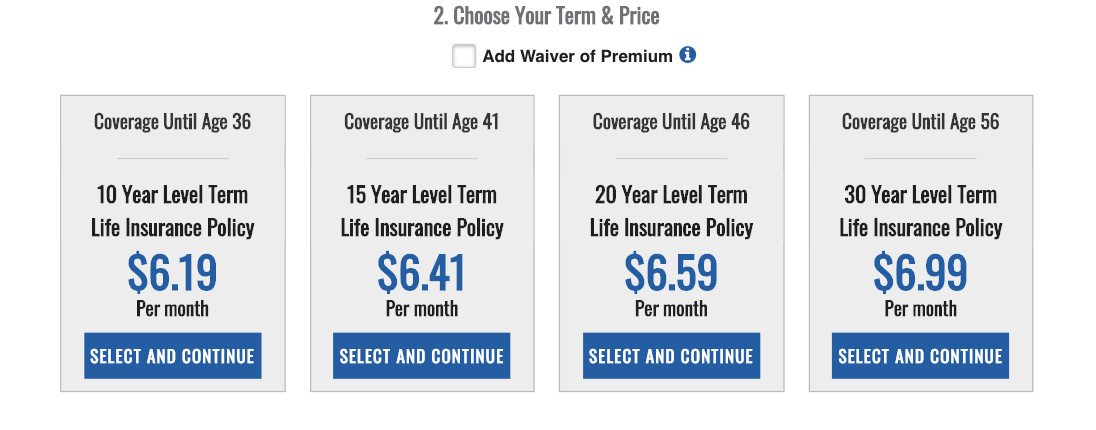

American Family’s DreamSecure Term Life Insurance offers 10-year, 15-year, 20-year, and 30-year policies. These policies are level term policies, meaning the premiums and death benefit remain the same for the duration of your policy.

American Family also offers DreamSecure Simplified Term Life policies, which have a simplified application process. Medical exams aren’t required for these policies.

The application has only twelve questions and if your application is approved, your policy will likely be issued within 10 days.

DreamSecure Simplified Term Life offers coverage for 10-, 15-, 20-, and 30-year terms with $50,000 to $150,000 coverage.

Whole

Whole life insurance policies provide permanent coverage and a guaranteed death benefit, as long as premiums are paid on time. These policies also build a tax-deferred cash value.

American Family offers many types of whole life coverage including:

- DreamSecure Whole Life Insurance: Provides permanent coverage with a guaranteed death benefit

- DreamSecure 15 Pay Whole Life Insurance: Provides permanent coverage but allows you to pay off your policy within the first 15 years

- DreamSecure Pay to 65 Whole Life Insurance: Provides permanent coverage but allows you to pay off your policy before you reach age 65

The company also offers whole life policies for children and seniors. DreamSecure Senior Whole Life policies offer coverage for those aged 50-80 with two coverage levels: $10,000 and $15,000.

A medical exam isn’t required as part of the application process.

American Family’s DreamSecure Children’s Whole Life Insurance policies offer three coverage levels:

- $25,000

- $50,000

- $75,000

The policies have two payment options: 10- and 20-year. The premiums won’t increase, no matter which option you choose.

Flexible Life

American Family also offers DreamSecure Flexible Life Insurance. These policies allow you to make changes to your policy and premiums at different stages throughout your life.

DreamSecure Flexible Life policies last as long as you want coverage, as long as premiums are paid. These policies also build cash value.

DreamSecure Flexible Life policies also provide a paid-up insurance option. This means you can choose to increase your coverage and then decrease it as your life insurance needs change.

Riders

American Family’s life insurance policies also offer multiple riders to help you further customize your coverage. The following riders are available:

- Children’s insurance: Provides $15,000 worth of coverage for biological, adopted, and stepchildren of the primary policyholder

- Available with DreamSecure Term Life, DreamSecure Flexible Life, and DreamSecure Whole Life policies

- Waiver of premium benefit: Waives the premium if the policyholder becomes disabled

- Available with DreamSecure Term Life, DreamSecure Simplified Term Life, and DreamSecure Whole Life policies

- Guaranteed purchase option: Allows you to purchase more life insurance coverage without having to undergo a medical exam

- Available with DreamSecure Whole Life policies

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Factors That Affect Your Rate

As you shop for life insurance, there are several factors to keep in mind that could affect your rate. Your gender, age, medical history, occupation, and habits can all impact your premium.

Demographics

Your demographic information, such as your age and gender, play a large role in determining your rate. As you age, it becomes more likely that a company will have to pay out your policy.

So the older you are, the more expensive your premium will be. The younger you are, the less expensive your premium will be. Buying life insurance when you’re younger will allow you to lock into a lower premium.

Your gender can also affect the cost of your life insurance policy. Women have a longer life expectancy than men. The life expectancy for a woman is 86.5 years, while the life expectancy of a man is 84 years.

Since men have a shorter life expectancy, they have higher premiums.

Current Health & Family Medical History

Your health and medical history also play a part in the cost of your premium. Generally, healthy people are expected to live longer, so their rates are lower.

As part of the underwriting process, an insurance company will have you fill out a medical questionnaire regarding your medical history and current medications you’re taking. After an underwriter has viewed your application, they’ll view your Medical Information Bureau profile and ask for your medical records.

Some life insurance companies also require a medical exam. During a life insurance medical exam, a paramedical service will come to you and take blood and urine samples, record your height and weight, and take your vitals. Other tests may be required if you have a history of serious illnesses.

Not all of American Family’s life insurance policies require an exam.

If you have a personal or family history of serious illnesses, you may have to pay a higher premium.

High-Risk Occupations

Your job could also potentially impact the price of your premium, as well. If you work in an industry that’s considered high-risk, you could pay a higher price for insurance. Industries that have a higher number of fatal work-related accidents are considered high-risk.

According to the Bureau of Labor Statistics, the following industries had the highest rate of fatal work injuries in 2018:

- Construction

- Transportation and warehousing

- Professional and business services

- Agriculture, forestry, fishing, and hunting

- Government

- Manufacturing

Police officers and firefighters are also considered to be high-risk occupations.

High-Risk Habits

Certain habits and hobbies are also considered high-risk and could lead to an increase in your life insurance premium.

One of the habits that has the most significant impact on your premium is smoking. Regardless of your age or gender, if you smoke, you’ll pay a higher premium for life insurance.

Other high-risk hobbies that could drive up the cost of your premium include:

- Skydiving

- Private aviation

- Bungee jumping

- Parachuting

- Racing

- Hang gliding

- Rock climbing

A one-time excursion won’t affect your premium, but a pattern of high-risk behavior could negatively affect your rate.

Veteran or Active Military Status

Similar to the other occupations listed above, active military status is considered a high-risk occupation.

Those with an active military status will pay a higher rate for life insurance. Some life insurance companies don’t offer policies to members of the military.

Getting the Best Rate with American Family

The first step in making sure you’re getting the best rate is to get a quote. By getting a quote, you can assess your needs and have a much better idea of how much coverage you need. This way, you can make sure you’re not overpaying for coverage you don’t need.

It’s also important to buy life insurance when you’re younger. Although most young people probably aren’t thinking about life insurance yet, buying a policy earlier in life will help lock you into a lower premium. The younger you are, the lower your premiums are.

As we noted earlier, your health plays a significant role in how much you’ll pay for life insurance. Be sure you’re keeping yourself in good health so your premiums will remain low. If you have a serious illness in your personal or family medical history, your premiums could go up.

American Family offers various discounts for its customers. You can bundle your life insurance policy with most of their other insurance offerings, including home and auto. On the company’s website, you can get a bundled quote by selecting the policies you want to combine.

Bundling your American Family insurance policies could save you up to 30 percent.

The company also offers discounts for using paperless billing and autopay. If you pay your American Family policy in full at the time of purchase, you’ll receive a discount.

American Family’s Programs

American Family offers many programs for its customers. The company’s website features tools and information not only for their life insurance policies, but their home, auto, and business coverage as well.

The website has a calculator for both home and life insurance to allow you to assess your needs before you get a quote. By determining what exactly you want to be covered, you can get a more accurate estimate and make sure you’re not overpaying for coverage you don’t need.

American Family’s website also has articles about various insurance-related topics that are broken down into the following categories:

- Insurance 101

- On the Road

- At Home

- Navigating Life Insurance

- Motorcycle Mindset

- Financial Well-Being

- Hobby and Recreational Vehicles

American Family also has a rewards program for customers. Through the DreamKeep Rewards program, customers can earn points that can be redeemed for rewards.

To earn points, you complete 10 real-life activities a month. You can complete the activities by uploading a photo, watching a YouTube video, or completing a quiz. The activities fall into five categories: all about you, do good things, family matters most, on the road, and safe at home.

Rewards can include gift cards, tickets to concerts and sporting events, and hotel stays. Joining the DreamKeep Rewards program is free.

Canceling Your Policy

Though some life insurance companies offer policies with flexibility, you may find your policy no longer works for you and your family. If so, you can cancel your policy.

Let’s take a closer look at the steps you need to take to cancel your life insurance policy.

How to Cancel

You can cancel a life insurance policy at any time, but some companies may charge a fee for early termination. Some term policies have fees if you cancel before a certain time, such as within five years on a 10-year term policy.

If you cancel your life insurance policy, you’ll likely be charged with a surrender fee. The surrender fee is assessed against the cash value. You then receive a surrender value, which is the cash value minus the fees.

American Family doesn’t have information on how to cancel a policy on their website, so be sure to get in contact with an agent if you want to cancel.

How to Make a Claim

Most life insurance companies follow a similar process when it comes to filing a claim: notify the company of the death, fill out the paperwork, submit the paperwork and any requested supplemental documentation, choose how you want your benefit to be disbursed, and receive your benefit.

American Family has a claims center on its website to help make the claim filing process easier. To file a life insurance claim with American Family, you need to provide the following information about the insured:

- Their first and last name

- Their birth date

- Their state of residence

- Their state of death

The company also suggests providing the following information to help process your claim more quickly:

- Life insurance policy number

- Date and manner of death

- Contact information for the beneficiaries

- Relationships of the beneficiaries to the insured

- The date of birth of the beneficiaries

Once your claim is approved, you can decide how to receive the death benefit. American Family offers the following options:

- Lump-sum payment: You receive the entire death benefit at once as a lump sum payment. American Family will issue you a check or electronic funds transfer. This option will allow you to have immediate access to the funds.

- Retained asset account (RAA): RAAs are draft accounts with interest that work similarly to a checking account. You can withdraw money from the account at any time, but there is a $500 withdrawal minimum.

There are a variety of settlement payments you can receive as well.

- Interest income: American Family holds the proceeds and sends you payments of the accrued interest annually. You can make cash withdrawals or receive the full pay-out at any time.

- Fixed period: Proceeds and interest are paid in equal installments over a certain time of your choosing, from five to 30 years.

- Fixed amount: Equal periodic payments in the amount of your choosing will be paid as long as the funds last.

How to Get a Quote Online

Now that you have an overview of American Family’s policies, you need to get a quote to see the full picture of what they can offer you.

On American Family’s website, you can only get quotes for term life insurance, children’s whole life insurance, and senior whole life insurance. You’ll need to contact an agent directly if you want a quote for another policy.

Here’s how to get a term life insurance quote from American Family online:

#1 – Click the “Get a Quote” Button

Click the blue “Get a Term Life Quote” button at the bottom of the description of term life insurance.

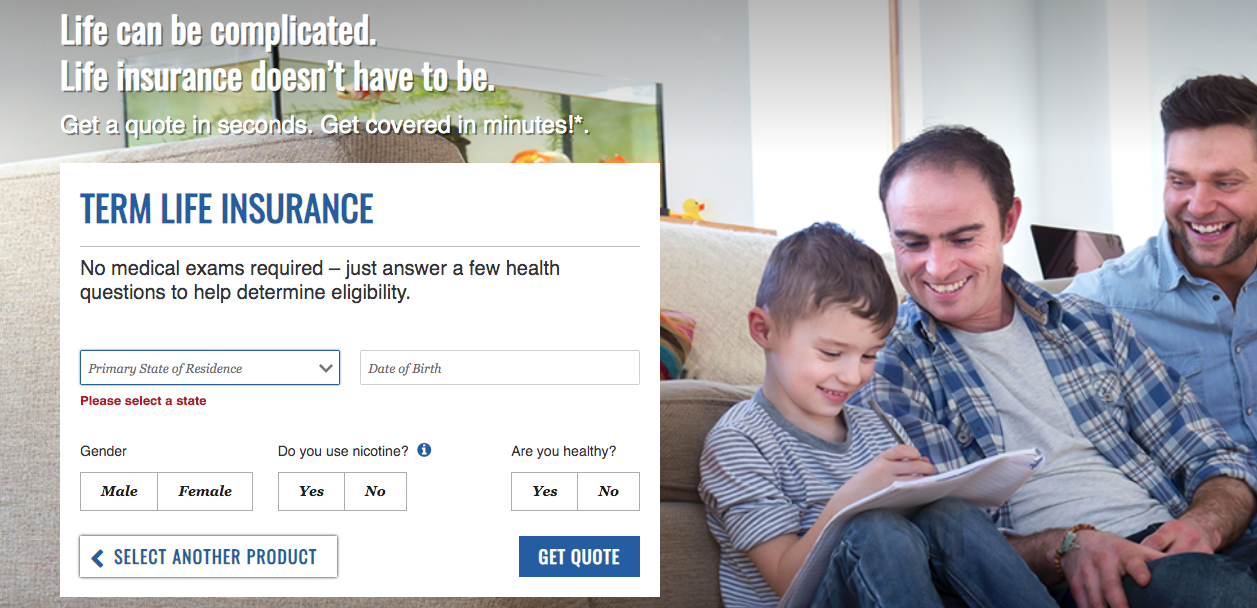

#2 – Fill Out Your Personal Information

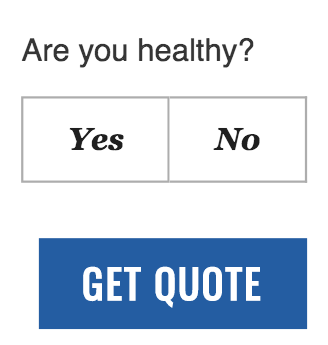

Fill out the information on the screen including your primary state of residence, date of birth, and gender. You’ll also need to answer the questions about nicotine use and your overall health.

#3 – Click the “Get Quote” Button

After you’ve filled out your personal information, click the blue “Get Quote” button in the bottom right-hand corner of the white box.

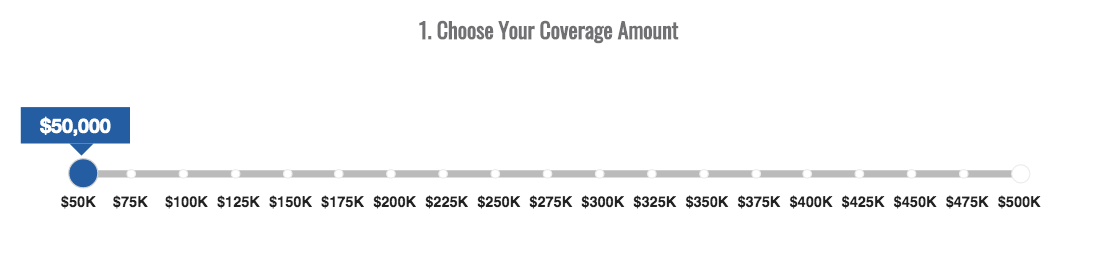

#4 – Choose Your Coverage Amount

Next, select the amount of coverage you want, from $50,000 to $500,000.

#5 – Choose Your Term and Price

After you have selected the amount of coverage you want, you need to select your term of coverage, from 10 to 30 years.

Once you choose your term and price, you’ll receive your quote.

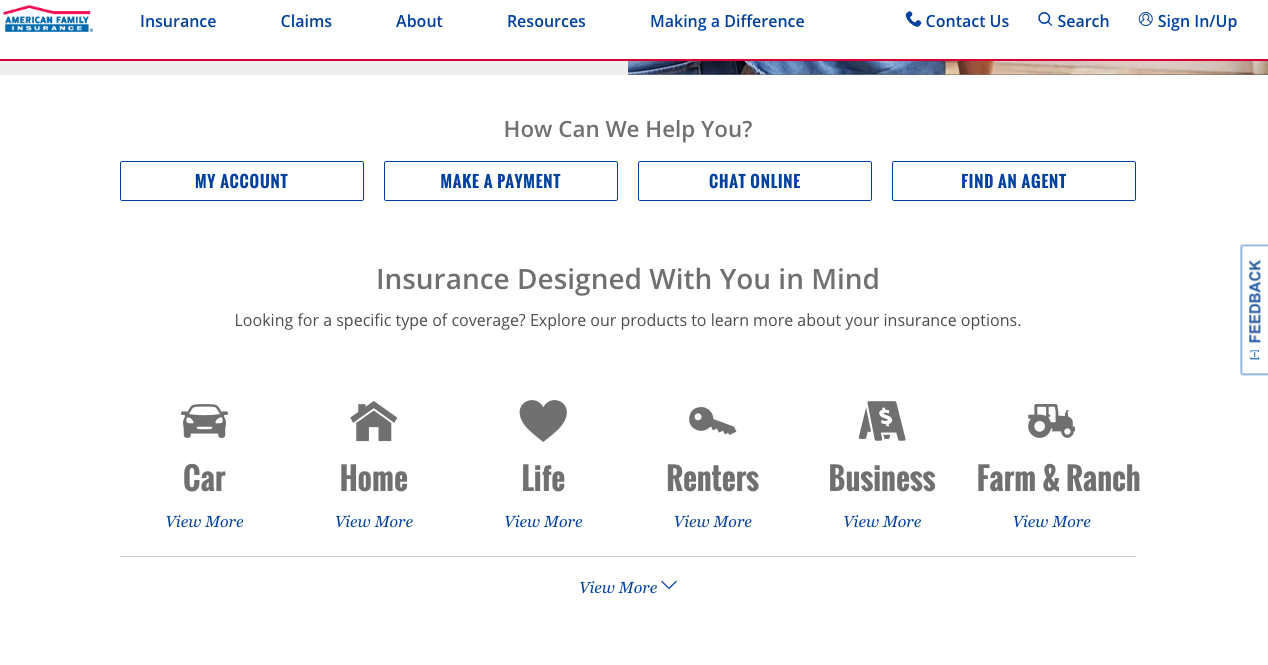

Design of Website/App

Overall, the design of the American Family website is easy to read and use. Important and frequently used aspects of the website such as quote tools, contact information, and the customer service portal are easily accessible.

The homepage also has links to pages for each type of insurance coverage the company offers, such as home, life, and auto.

The biggest design flaw with American’s Family’s website is its use of white text over header images. This white text is often difficult to read because it blends into something in the background.

The company also has an app called My AmFam. The app has strong reviews with 4.8 out of five stars from 38,000 reviewers. On the app, customers can make payments, access their insurance cards, find an agent, make a claim, and get a quote.

Pros & Cons

Before you make a final decision and purchase a life insurance policy, you need to understand the advantages and disadvantages of the company and its coverage.

Let’s break down the pros and cons of American Family’s life insurance coverage:

Pros

American Family offers a wide variety of policies with the flexibility that will allow you to get the coverage that’s best suited for your family’s needs. The riders offered by American Family allow you to further adjust your policy.

The company doesn’t require a medical exam for all of its policies. If you have previously been unable to get life insurance coverage due to your health or medical history, American Family may be a good option for you.

American Family also offers a variety of discounts to its customers. Between bundling and the other available discounts such as paperless billing and autopay, you have opportunities to save money with American Family policies.

Cons

The biggest disadvantage to American Family’s life insurance coverage is that the company doesn’t operate in every state. Be sure to check online to see if you have the option to purchase a policy with American Family in your state.

The Bottom Line

American Family provides a large variety of policies and discounts to its customers. As a mutual company, American Family puts the needs of its customers first.

If you’re looking for a wide range of policy options with the ability to get a discount, American Family may be the right company for you.

Don’t wait! Compare life insurance rates now by using our FREE tool below!

American Family’s FAQs

#1 – How do scheduled payments work?

Scheduled payments are one-time payments that draw from a source that you’ve set up in My Account. Generally, you can choose the payment amount, date, and method. Scheduled payments have to be made before the due date on your account.

#2 – What is “paid-up” life insurance?

“Paid-up” life insurance policies are permanent policies that don’t have payments after a specified time period. If your policy comes with this option, you continue to make payments on the policy until it’s paid in full. You’ll still have permanent coverage after you stop making payments.

#3 – Do I need a medical exam to get life insurance?

Every policy at American Family has different requirements regarding medical exams. Some policies require medical exams while others, such as the DreamSecure Simplified Term Life policies, do not.

#4 – Is my employer-provided life insurance policy enough coverage?

The truth is, for most, it probably isn’t. That’s why it’s important to evaluate your financial needs, both short-term and long-term, throughout the various stages of your life.

For example, if you’re planning to have a child, starting a business, or caring for a loved one suddenly, then you should consider purchasing additional life insurance to help meet the financial needs of those you leave behind in the event of your untimely passing.

#5 – How do I request a copy of my MIB consumer file?

There are two ways in which you can request a copy of your MIB consumer file. The first way is to access and complete the Request for Disclosure of MIB Record Information online form via the MIB website.

The second way is to call 1-866-692-6901. A voice queue is available Monday through Friday, 6 a.m. to 12 a.m. EST (closed on holidays).

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption