AAA Life Insurance Review (Coverage Comparisons & More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1969 |

| Company Executive | President & CEO – Jay DuBose |

| Number of Employees | 450 |

| Total Assets / Total Sales | $678,154,000 / $422,760,000 |

| HQ Address | 17900 N. Laurel Park Dr. Livonia, MI 48152-3992 |

| Phone Number | 1-888-223-6534 |

| Company Website | www.aaalife.com |

| Premiums Written - Individual Life | $899,063,000 |

| Financial Standing | $172,457,000 |

| Best For | Term Life Insurance |

Get Your Rates Quote Now |

|

Life insurance coverage isn’t an easy subject to jump into. If you don’t have coverage, you probably feel vulnerable about not having the right protection for your family and stressed by another item lingering on your to-do list. With so many plan options and providers to choose from, getting started can be a chore.

Get started with your journey by using this review of AAA Life not only to learn about what the company has to offer, but to also find great information, tools, and questions to ask as you wade through your research.

Shopping for life insurance doesn’t have to be so daunting. In fact, getting a life insurance quote is easier than ever before. If you’re anxious to see how much you can save on affordable insurance options, enter your ZIP code here and get an instant quote right now. Then come back to this article and compare and contrast.

Table of Contents

AAA Life’s Ratings

If you’re looking to compare life insurance providers, a great place to start is by reviewing a company’s ratings. Fortunately, there are a number of independent rating providers that can help you evaluate AAA Life’s financial health, credit stability, and customer service.

A.M. Best

A.M. Best is the only rating agency that focuses only on the insurance industry, which makes it a great place to start your research. A.M. Best ratings provide guidance on the financial strength and long-term credit stability of a company.

These are important metrics. You want to be sure that the insurance provider you select is never in danger of becoming bankrupt. Even though consumers can be protected by state insurance guaranty associations, things could get messy and cause delays when you need dependability the most.

As of August 2019, AAA life has an A (Excellent) rating for financial strength and an a (excellent) long-term credit rating affirmed by A.M. Best.

Better Business Bureau (BBB)

It’s helpful to check the reviews of any business you might be considering at the Better Business Bureau (BBB). The BBB gathers consumer complaints directly from customers and, in some cases, mediates between companies and customers to resolve issues.

A long list of unanswered complaints on the BBB site is a good indicator of poor customer service.

AAA life has an A+ rating with the BBB. However, they have a 1-star rating from customers that have submitted complaints. The company has 24 customer complaints and four customer reviews that are all critical of the company.

Although AAA Life has responded to all complaints and reviews listed on the site, most of the responses direct the unsatisfied customers to a case number and phone contact with no issue resolution provided.

Company History

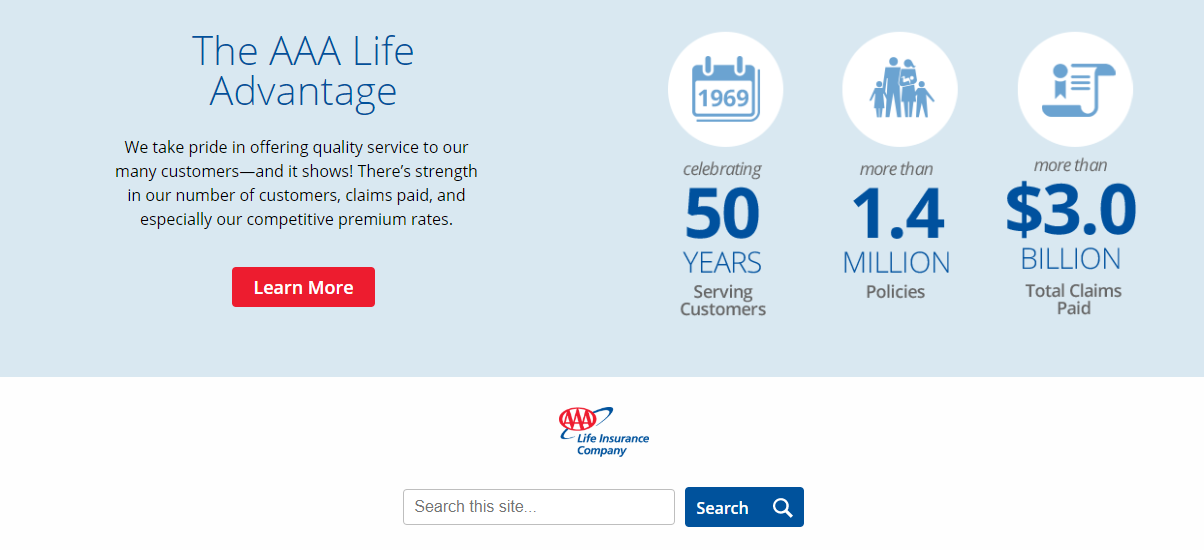

AAA Life was founded in 1969 as part of the Automobile Association of America (AAA). As part of the larger AAA organization, AAA Life began offering life insurance products, annuities, and even accident insurance to customers across the United States.

The company is headquartered about halfway between Detroit and Ann Arbor in Livonia, Michigan. AAA Life has over 1.3 million active policies and was highlighted by LIMRA for the company’s high scores in customer satisfaction as recently as 2015.

AAA Life strives to be on the cutting edge of innovation when it comes to insurance.

In the past year, the company licensed FAST Insurance Components from technology company FAST to streamline its policy administration services and expedite its underwriting and claims processing timelines.

The video below explains how AAA Life is pursuing innovative technology solutions to help its customers obtain insurance quickly and easily.

AAA Life is changing how insurance has traditionally been sold through the usual agent-to-customer channel with its online experience.

AAA Life’s Market Share

AAA Life isn’t one of the larger life insurance entities. The Michigan Department of Insurance and Financial Services doesn’t rank the company in the top 20 insurer list of life insurance providers in its 2018 DIFS Annual Report.

The table below highlights the top ten life insurance providers provided by the National Association of Insurance Commissioners (NAIC). AAA Life’s comparable numbers are listed to contrast the difference in size.

| Company | Domicile | Total Direct Premiums Written | Total Market Share |

|---|---|---|---|

| Northwestern Mutual | WI | $10,517, 115.452 | 6.42% |

| Metropolitan Group | NY | $9,821,445,953 | 6.00% |

| New York Life | NY | $9,295,848,300 | 5.68% |

| Prudential | NY | $9,128,805,060 | 5.57% |

| Lincoln National | PA | $8,769,303,174 | 5.36% |

| Mass Mutual | MA | $6,854,713,057 | 4.19% |

| Aegon | IA | $4,809,856,650 | 2.94% |

| John Hancock | MA | $4,640,905,017 | 2.83% |

| State Farm | IL | $4,633,004,963 | 2.83% |

| Minnesota Mutual Group | MN | $4,422,100,028 | 2.70% |

| AAA | MI | $899,063,000 | 0.43% |

Get Your Rates Quote Now |

|||

AAA Life reported $678.1 million in assets and $899 million in direct premiums written for 2018. By comparison, a larger competitor, Northwestern Mutual Life Insurance Company,$10 billion in direct premiums. The National Association of Insurance Commissioners (NAIC) reports AAA Life has only 0.43 percent market share.

To put that in perspective, the Northwestern Mutual Life Insurance Company was ranked at the top of the list in 2018 with a 6.42 percent market share. AAA Life has a way to go before it registers on the market share meter at even 1 percent.

AAA Life’s Position for the Future

As part of the AAA organization of companies, AAA Life had the benefit of an immediate distribution of consumers out of the gate. Known primarily for its roadside automobile assistance services, the AAA brand is widely known from television, magazines, and more recently, online advertisements.

AAA Life leverages a strong brand identity to help grow its customer base. The commercial below highlights AAA as an automobile insurer but then reaches out to consumers to “go beyond the brand” for its home and life insurance services.

AAA Life currently supports business growth through a network of AAA Life agents and agencies. However, AAA Life is investing in technologies to support customers directly online.

This is a huge move toward the future of insurance. According to the 2018 Insurance Barometer Study presented by Lifehappens.org and LIMRA, one in three consumers attempted to purchase insurance online.

The same study points out that almost 67 percent of consumers would not do business with an agent or advisor with an outdated website.

AAA Life’s investments in online support, education tools, and applications are an effort to reach and meet the needs of a new generation of customers.

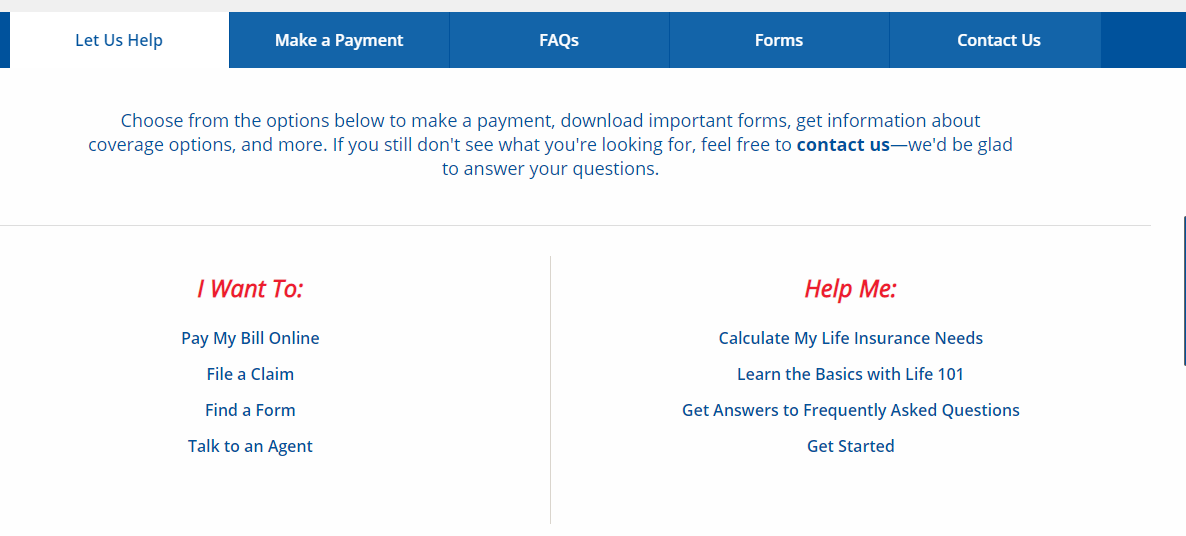

AAA Life’s Online Presence

AAA Life has a robust presence online and provides consumers with access to the company information with its online site and supports customer awareness and engagement through Facebook.

Although AAA Life isn’t present on other social media channels like Twitter, the parent AAA organization has a defined presence on these sites. Although it’s not a top 100 brand, consumers familiar with the brand visit the AAA organization’s main site and gain access to information and links to AAA Life.

From the main AAA site, the “Insurance” tab provides a redirection to information on AAA insurance products. You can select from auto, health, and life options. If you select life, you can obtain information on AAA Life products available within your region and find an agent near you. A quote tool is also available from this site.

However, to get the most direct information, visiting aaalife.com is your best bet. From the main aaalife.com site, customers have access to better information, blog articles, and quote tools.

Aside from its website and social media presence, AAA Life is also available on YouTube with some educational videos and commercials. However, AAA Life does not manage its own channel, and videos are posted by individual agents and subject matter experts.

AAA Life’s Commercials

AAA Life has two main channels to reach customers. For larger, more costly markets, AAA Life partners with AAA’s other insurance channels to feature AAA as a one-stop home, auto, and life insurance provider. If you missed it, check out the video posted above in this article for an example.

AAA Life also produces its own video content and advertising for release in more focused markets.

AAA Life takes a refreshing break from other insurance commercials by not trying to go for the comic route or having a brand spokesperson. Instead, the company’s commercials speak to you directly about why you may need comprehensive life insurance and how AAA Life can be a benefit.

AAA Life in the Community

AAA Life is an active participant in local and national community support programs. With the company headquarters in Livonia, Michigan, and the company support center in Omaha, Nebraska, AAA Life engages with the local community to provide support.

On a larger scale, AAA Life supports three world-class community service organizations: United Way, Relay for Life, and the Sons & Daughters Scholarship Program.

The United Way provides local communities support in whichever way can help support that community the most. This includes everything from building classrooms in the Philippines to providing job training in Ohio for local job seekers.

AAA Life provides donations and supports employees that take time off to work with the United Way in Southeastern Michigan, and Omaha, Nebraska.

Relay for Life is an event-based charity founded by the American Cancer Society. Relay for Life hosts regional events across the country that encourage participants to raise funds and awareness in the fight against cancer.

In 2018, AAA Life raised over $30,000 for the charity.

The Sons & Daughters College Scholarship program is for the children of associates of the company. The scholarships are awarded to the children of employees seeking education at a college, university, or any vocational school program.

AAA Life’s support of local and global community efforts is one component of its strong culture and mission. Let’s take a look at AAA Life’s workplace culture.

AAA Life’s Employees

AAA Life posts a strong message of employee culture on its website. The core message tenants are trust and service. Employee ratings for the company provide a strong view of management but a critical view of the company as a place to work.

Glassdoor.com compiles employee reviews and ratings to provide overall assessments on workplaces. Glassdoor reviews for AAA Life rank the company with a 2.7-star rating out of a possible 5 stars. Highlights for the company are a strong rating for the company CEO, who had an 83 percent favorability rating.

Employee concerns seemed to focus on growth opportunities and middle management support.

AAA Life ranks slightly higher on Indeed with a 3.2-star rating out of 5 stars. On Indeed.com, the CEO again receives high marks with a 74 percent approval and compensation, and benefits rank high with employee satisfaction.

Shopping for Life Insurance

Your need for life insurance doesn’t depend upon whether you’re young or old. If you’re financially responsible for family, friends, debt obligations, or even pets, you want to rest assured that if anything were to happen to you, your family isn’t left with an overwhelming financial burden.

Check out this interview with AAA spokesperson Skyler McKinley on why life insurance might be necessary for you and how you might get started with finding insurance options.

The interview breaks down why life insurance is a good idea, but we can dive a bit deeper into how you might find your way to the right policy or policies.

Shopping for life insurance requires that you answer these questions:

- How much insurance do I need or can I afford?

- What type of insurance is best for me?

- Who do I buy life insurance from?

Let’s start with how much life insurance you need.

To estimate how much insurance you’ll need, a simple guideline is to add up the following:

- About seven to 10 years of salary.

- Any outstanding debts including home mortgages, student loan debts, car loans, or other personal financing obligations.

- Your total savings goal for your children’s education. You may be putting a bit away every paycheck for education, so estimate the total you will have saved when your child is ready for college.

- Any money you contribute to care for loved ones such as elderly parents or grandparents.

Your number might come out a lot higher than you thought. A 2019 survey conducted by Haven Life found that when respondents were asked how much life insurance they thought they might need, women responded with an average of $175,423, while men came back with an average number of $355,348.

So the next question is how much insurance you can afford. For us to break down the costs of insurance, we need to understand the various options you have available.

There are three main types of insurance. The table below provides a quick summary of each type and the features of each type.

| TYPE | Permanent or Expiring | Cash Value | Key Features |

|---|---|---|---|

| Term life | Expiring | No | - Most affordable - Easiest to obtain - Premiums do not change - Benefits paid are not taxable income |

| Whole life | Permanent | Yes | - Premiums don't change - Can borrow against Cash Value - Benefits paid are not taxable income |

| Universal life | Permanent | Yes | - Premiums and benefits are adjustable - Can borrow against cash value - Customizable to your needs |

| Final expense or burial | Permanent | No | - Easy to obtain - Faster claim processing |

Get Your Rates Quote Now |

|||

The type of insurance that will address your specific needs will be defined by your age, health, and income.

For example, if you’re younger and just want basic coverage to take care of big liabilities such as a mortgage or family care, you might opt for the most affordable and temporary option with term coverage.

On the other hand, if you’re middle-aged and have a high income, kids approaching or in college, and retirement to look forward to, you might want to investigate permanent insurance options with whole life or universal insurance.

This brings us to how you might figure all of this out: In many instances, you’ll want to shop around with three or four providers. Comparing quotes is a great place to start.

In fact, you can take a break from this article to obtain a FREE quote right now. Just enter your ZIP code and use our quote generator to obtain an instant term quote. After you have that quote, let’s look at some comparison numbers for AAA Life.

Average AAA Life Male vs Female Life Insurance Rates

Life insurance rates for men and women for the same insurance product and benefit amount are always different. This is simply because actuaries calculate rates based on life expectancy.

The average life expectancy for a male in the United States is 73.4 years; for females, it’s 80.1 years.

Because of this, AAA Life and all other insurance companies will quote rates higher for males than females of the same age and with the same health profile.

The rate table below provides term life insurance rates for male and female candidates in good health who don’t use any tobacco products.

| Non-Smoker Age | $250,000/ 10-year Male | $250,000/ 10-year Female | $250,000/ 20-year Male | $250,000/ 20-year Female | $250,000/ 30-year Male | $250,000/ 30-year Female |

|---|---|---|---|---|---|---|

| 25 | $10.78 | $9.46 | $13.86 | $12.54 | $20.68 | $17.16 |

| 30 | $10.78 | $9.68 | $14.52 | $13.20 | $22.22 | $18.70 |

| 35 | $10.78 | $9.68 | $15.40 | $13.64 | $24.64 | $21.56 |

| 40 | $13.86 | $12.32 | $20.68 | $18.04 | $33.22 | $26.84 |

| 45 | $20.68 | $18.48 | $31.90 | $27.50 | $52.80 | $41.36 |

| 50 | $30.36 | $23.76 | $47.74 | $36.74 | $81.18 | $57.86 |

| 55 | $43.12 | $32.78 | $73.92 | $55.88 | $149.38 | $107.36 |

| 60 | $70.18 | $48.18 | $123.86 | $85.80 | N/A | N/A |

| 65 | $119.90 | $75.56 | $239.80 | $154.66 | N/A | N/A |

Get Your Rates Quote Now |

||||||

As you can see from the chart, the average rate for men can range anywhere from 10 to 30 percent higher than for women. Over a lifetime this can add up.

Coverage Offered

While some insurance providers specialize in only one or two types of insurance offerings, AAA Life offers a full range of products. It’s not necessary to be a member of the AAA Auto Club to qualify and obtain coverage for any AAA Life products, except for the Member Loyalty® Accident Insurance program explained below.

Types of Coverage Offered

In reviewing the descriptions of AAA Life’s offerings, you can start to identify which insurance types might fit best with your needs. You aren’t limited to one policy or policy type.

In many cases, it might be best for you to work with an agent or financial advisor to determine a strategy of coverage that will keep your overall costs down but provide the maximum amount of coverage.

Here’s a detailed overview of AAA Life’s products.

Term

Term life coverage is the most affordable type of coverage. Term life coverage is purchased only for a specific period of years or terms. After the term is expired, you can let the coverage expire, renew the coverage yearly, or convert coverage to a permanent insurance option.

AAA Life offers term coverage for 10-, 15-, 20- or 30-year terms. They offer two types of plans.

ExpressTerm Life Coverage

ExpressTerm coverage features an online application process that can approve your coverage in as few as 10 minutes. For this type of coverage, you can apply for a minimum of $25,000 up to a maximum of $500,000 in coverage.

If you’re the independent type and would prefer to avoid working with an agent, another feature of ExpressTerm coverage is that you can apply directly online and avoid sales agents or call centers.

Although you may receive approval instantly, AAA Life doesn’t indicate whether you might have to submit medical exam work or complete a physical to qualify for and maintain coverage.

Traditional Term Coverage

If you feel more comfortable working with an agent and would like to obtain the lowest rate possible, then the traditional term coverage option offered by AAA Life might be a better route. Similar to ExpressTerm, you can obtain coverage for 10, 15, 20 or 30 years.

With traditional term coverage, the minimum term policy benefit starts at $100,000, and policies are available to even more than $5 billion if needed.

A return of premium rider is also available with AAA Life’s traditional term coverage.

A term policy with return of premium costs means that you’ll pay more to maintain the policy, but if you outlive the term, you’ll have all of your premiums returned to you minus fees and plan administrative expenses.

For example, let’s say you pay $100 per year for a 10-year term with a $100,000 benefit. With traditional term, if you outlive the 10-year term, you would have never used the $100,000 benefit, and you would have paid $1,000 in insurance premiums.

With term a return of premium, you might be required to pay $150 per year for the same benefit. In this case, if you outlive your policy, you would receive a returned lump-sum payment of $1,500 minus expenses and costs that AAA Life requires to maintain the plan.

Although there’s a lot more to comparing plans than just price, here’s how traditional AAA Life term policy rates compare with the average rates from the top 10 ranked insurers.

| Non-Smoker Age | $100,000 / 20-Year Term – AAA | $100,000 / 20-Year Term - Industry Average | $250,000 / 20-Year Term - AAA | $250,000 / 20-Year Term - Industry Average | $500,000 / 20-Year Term – AAA | $500,000 / 20-Year Term – Industry Average |

|---|---|---|---|---|---|---|

| 25 | $10.03 | $11.03 | $13.86 | $22.10 | $22.44 | $23.19 |

| 30 | $10.12 | $11.12 | $14.52 | $15.31 | $23.32 | $23.85 |

| 35 | $10.12 | $11.12 | $15.40 | $15.42 | $24.20 | $24.07 |

| 40 | $12.50 | $12.65 | $20.68 | $17.94 | $34.76 | $29.10 |

| 45 | $17.95 | $14.57 | $31.90 | $21.55 | $58.08 | $36.32 |

| 50 | $27.19 | $18.60 | $47.74 | $30.19 | $89.92 | $53.60 |

| 55 | $38.37 | $24.51 | $73.92 | $42.88 | $141.24 | $78.98 |

| 60 | $68.64 | $35.88 | $123.86 | $71.10 | $238.48 | $135.41 |

| 65 | $113.61 | $51.06 | $239.80 | $109.82 | $463.32 | $212.85 |

Get Your Rates Quote Now |

||||||

As you can see from the table, AAA Life offers competitive rates for younger candidates but can be quite a bit more expensive for the higher age ranges.

Whole

Whole life insurance is permanent insurance. That means that if you keep up with your premiums, you’re covered for your entire life. With select providers, whole life insurance can be offered as a type of insurance that provides insurance benefit coverage and allows policyholders to save a component of premiums to build value in the policy

AAA Life offers two types of whole life insurance. The first type is similar to other conventional whole life policies. Minimum coverage starts at $5,000 and extends to a maximum of $75,000.

As with other whole life policies, the premium will never change and the benefit will remain constant.

The AAA Life policy has a cash savings component that allows you to build value in the policy.

To obtain coverage, you’ll need to provide medical information and family history and submit for an exam. Approval for coverage can take anywhere from one to six weeks.

Here’s the best part. If you live past 100, you remain covered, but you no longer have to make premium payments. Both AAA members and non-members can apply for this insurance product. AAA members receive a 10 percent discount on base premiums.

AAA Life also offers a guaranteed issue whole life policy. This policy is set up like a final expense insurance product.

Final expense insurance traditionally offers lower maximum benefit coverage options, but does not require you to answer any health questions or submit to a medical exam.

The AAA Life product offers an easy application process that can be completed online, by mail, or by phone. Coverage can be obtained for amounts ranging from $5,000 to $25,000.

Coverage is available for both AAA members and non-members ages 45 to 85, and acceptance is guaranteed. No premium discount is offered for AAA members, but a $60 annual fee is waived if you do have a membership. This policy type also features a cash value component.

Universal

Universal life is another type of permanent insurance. In this category, AAA Life again offers two options: Lifetime Universal Life and Accumulator Universal Life.

Lifetime Universal Life

This acts very much like other traditional whole life policies in that benefits and premiums remain fixed. Coverage amounts can range from a minimum of $100,000 to upwards of $5 million.

The cash value component of your policy will be guaranteed and will grow interest at a predetermined rate. As you build value in your policy, you can withdraw the cash, borrow against the cash value, or use the value that is built up to maintain premium payments on the policy.

Accumulator Universal Life

This acts more like traditional universal life products. With the accumulator universal life product, you can adjust premiums and your benefit amount inline with how your life changes. While you have a higher income when you are in your prime working years, you may opt to pay higher premiums and look to maximize the cash value in your account.

Later in life, you may not want to pay as much to maintain your policy and may feel that you don’t need to leave as much coverage for your loved ones.

You may opt to reduce premium payments and even borrow against the value in the policy to help enrich your lifestyle. If planned properly, when you pass away, any remaining value in the policy can pay off the loaned amount.

Popular additional riders like child term insurance, accidental death, and guaranteed purchase options are available for this policy type

Accident Insurance

AAA Life offers accident insurance exclusively to AAA members. This insurance is a guaranteed acceptance policy for any AAA member. Most life insurance covers only death from natural causes but offers additional riders for accidental death. However, it’s rare to find accident insurance available on its own.

The AAA Life accident insurance has several exciting features. After paying five years of premiums, members receive four-way accident protection. This extends coverage to include expenses from loss of life, hospital stays, emergency and urgent care visits, and costs that occur from recuperation.

Although not a suitable substitution form disability insurance, this might help people who don’t qualify for disability insurance to alleviate some of the burdens of costs that come from an accident.

While disability insurance covers any type of injury, AAA Life accident insurance might have specific limitations on what constitutes an accident.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Factors That Affect Your Rate

At the end of the day, you want to know exactly how much you’ll have to pay to obtain the insurance you need. Although sample tables and instant quotes are a good place to start your research, your quoted rate will depend upon several factors.

Final rates aren’t usually established until you go through a process called underwriting.

Underwriters review several lifestyle factors to determine overall risk, and in some cases where risks are very high, coverage could be denied.

AAA Life has traditionally required a full underwriting process for most of its policies. However, today the company is investing in technology tools and online application processes.

The investment in new technology is intended to expedite the application and approval process. Technology tools with access to your medical history could eventually eliminate the need for medical exams and bloodwork.

If you’re looking for life insurance while you’re younger and in good health, you may be able to qualify for an affordable plan without submitting bloodwork or a medical exam.

Whether you complete a medical exam or not, the underwriters will assess each of the factors below to build out your individual risk profile. Once they’ve established a risk score for you, they’ll put you in a risk pool with other customers that fall in the same range. This risk pool will determine your final quoted rate.

Let’s take a look at the factors that affect your risk profile.

Demographics

Underwriters want to know common statistical information about you. Some of the prominent characteristics an insurer might ask about are:

- Your gender

- Where you live

- Your ethnicity

- Whether you’re single, married, or divorced

- Whether you have children

Each of the characteristics above provides information for the insurer. Underwriters have data for millions of people like you and, based on these characteristics, can identify whether you’re prone to a higher risk of particular diseases, or whether your profile is a good indication that you will live a long, healthy life.

Current Health & Family Medical History

Your health and family medical history are important factors in determining risk. Even if you’re otherwise healthy, insurance companies will want to look at whether you have any family history of diseases such as various types of cancer, hereditary heart disease, mental health issues, or Type 1 or Type 2 diabetes.

If you have a family history that indicates certain preventable diseases such as diabetes or heart disease, you’ll want to pay extra attention to your medical evaluation to show you take care of yourself.

Your medical evaluation might require blood work. Before you take your life insurance physical exam, you’ll want to make sure you’re eating well, exercising, and avoiding alcohol and tobacco products.

After you complete your physical exam, you want to make sure any data the doctor recorded is accurate. Something as simple as recording the wrong height or weight could throw off your BMI and signal a higher risk for diabetes.

Submitting a clean bill of health to the insurer could help counteract any concerns with your family’s medical history.

High-Risk Occupations

Your underwriter will want to know what you do for a living. Even if you don’t have a dangerous job, if you work in a field that is stressful or are exposed to conditions that might affect your health, you might fall into a higher risk pool.

For example, if you work at a factory that has poor air quality, your insurer might assign you as a higher risk.

High-Risk Habits

Risky behaviors will cost you when it comes to getting insurance. If you smoke cigarettes or vape, drink alcohol regularly, or use illegal substances, you may not be able to get a life insurance policy.

At the very least, you’ll have to shop around to get a decent rate. If you’ve ever received a DUI conviction, you may find it difficult to get affordable insurance.

Insurance companies do check the Department of Motor Vehicle records, so even a lead foot or a few tickets for talking on your cellphone while driving could cost you.

Insurers might also conduct a criminal background check. Insurers will review any criminal record on a case-by-case basis.

Veteran or Active Military Status

If you’re a military service member, whether you’re a veteran or on active duty will affect your policy rates. Most companies that offer coverage to active members and veterans will have different policy types.

Military active duty and veterans can usually get the most affordable coverage through the Veterans Administration, but supplemental options are available.

Getting the Best Rate with AAA Life

Getting a great life insurance rate doesn’t imply getting a cheap rate.

The last thing you want is to be sold too much or too little insurance. Getting value from life insurance means getting the right coverage for your life needs at the best rate.

Calculating how much insurance you need is the easy part. By using an insurance calculator or the guide provided earlier in this article, you should be able to get a general sense of how much insurance coverage you need.

Once you have a general number, you’ll want to speak with an agent or advisor to determine what type, or types, of insurance you should have.

Consider this scenario. Let’s say that you’re financially secure but have a mortgage to pay down, college tuition to assist your child with, and about 15 years before retirement. You might think that getting cheap term coverage is your most affordable bet. You might also think that you’re saving money by putting off getting permanent insurance until later.

However, you may get a better value out of a universal life policy. By paying higher premiums now, you can build cash value in your policy. Since you have higher income now, managing a higher premium payment could help later on.

When you retire, you might have enough cash value in the policy to lower your premiums or eliminate them altogether.

Another way to keep your insurance rates low is to review any insurance options your employer might provide.

Purchasing life insurance through an employee benefit program usually gets you the best rate; however, if it isn’t enough to cover your full need, you can purchase supplemental insurance from AAA Life.

After determining the amount and type of insurance, the last step is to identify what your actual budget is for premiums. No matter how cheap your insurance seems, if your policy gets canceled because you failed to make premiums, then you’ve really wasted a lot of time and expense.

AAA Life’s Programs

AAA Life provides customers and consumers with valuable learning resources directly from its website. Navigating to the “Learn & Plan” tab allows access to informational pages with educational material, a life insurance calculator and a “Life Resources” section.

The “Life Resources” tab is a well-organized section aggregating blog articles, videos, infographics, and more.

If you’re looking to learn about AAA Life, or just learn more about life insurance, the “Life Resources” section of the site is a useful place to visit.

Canceling Your Policy

AAA Life customers are provided a customer login that can be accessed from a login tab on the top right corner of the company’s home page.

From your login, you can either navigate to find your policy and cancel online or follow the steps below to cancel without login access.

How to Cancel

Before you start canceling your policy, you’ll want to make sure that you understand the risks for potential fees or lost benefits.

In some instances, canceling your policy is as easy as stopping premium payments, but before you do anything drastic, review the steps below to determine how to cancel your policy to avoid getting hit with fees and penalties.

#1 – Read Your Policy

Go over your policy and read the fine print. Check to see if there are any fees or fines for early termination. For term policies, you won’t get back any premiums paid to date.

For universal, you’ll have to check your policy to see whether you can retrieve the cash value or have any premium payment amounts returned. You’ll also lose final expense insurance premiums if you cancel.

#2 – Contact Your Financial Advisor

Work with your financial advisor to understand any risk you might be assuming and any tax liability you might get from early termination. For a term policy, canceling early just means you’ll lose your benefits. Since there is no cash value, you won’t have tax implications.

However, for universal life, you might receive a return of premiums and have the cash value of the policy returned. An advisor can speak to you about whether you’ll need to pay taxes on any payout.

A financial advisor can also help you understand your risk exposure. If you’re canceling your policy and don’t have another one in place, you should be aware of any risks and exposures.

If you’re getting a new policy to replace your current policy, your advisor can help you determine whether your policy needs have changed.

#3 – Reach Out to Your Agent

Contact your agent. They may be able to help you with the cancellation process. If you’re looking to replace your policy, an agent can help time the cancellation to align with creating the new policy.

#4 – Submit a Letter in Writing & Keep a Copy

Always request a policy cancellation. Provide specific dates informing when you last paid premiums and when you expect your coverage to end. Keep copies for yourself.

#5 – Cancel Auto Payments

Don’t forget to cancel any automatic payments that might be set up. Check to make sure that you don’t have a credit card or bank account with an automatic payment setup.

How to Make a Claim

If you’re the beneficiary or are helping a beneficiary to make a claim on an AAA Life policy, you’ll have to gather the following documents first.

- A certificate of death for the policyholder

- A copy of the original insurance policy

If you can’t find or obtain the original insurance policy, you can reach out to AAA Life at 1-800-684-4222 to request a copy. From there, you can initiate the claims process by submitting a request in writing to AAA Life through one of the following methods:

- By Mail – AAA Life Insurance Company, 17900 N. Laurel Park Drive, Livonia, MI 48152

- By FAX – 1-888-223-1509

- By Email – claimssvc@aaalife.com

Claims processing can take anywhere from a few weeks to a few months to complete depending on the complexity of the claim.

How to Get a Quote Online

Getting a term quote from AAA Life is as easy as three easy steps if you’re comfortable using the internet. However, for more complex insurance types, like whole life or universal, you’ll need to contact an AAA Life agent.

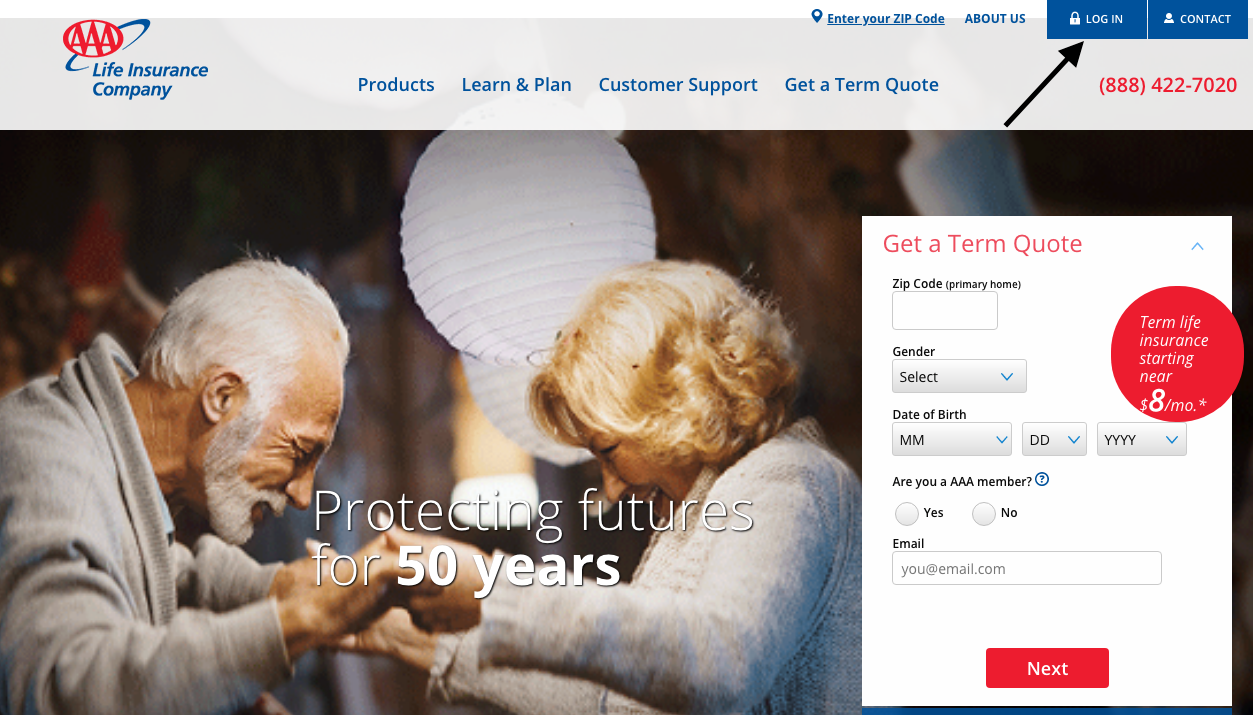

#1 – Visit the AAA Life Site Online

From the AAA Life homepage, you’ll see a form requesting your ZIP code and birth date. Enter your information to get started.

Once you’ve entered your info, you can click “Next” to take you to your insurance plan options.

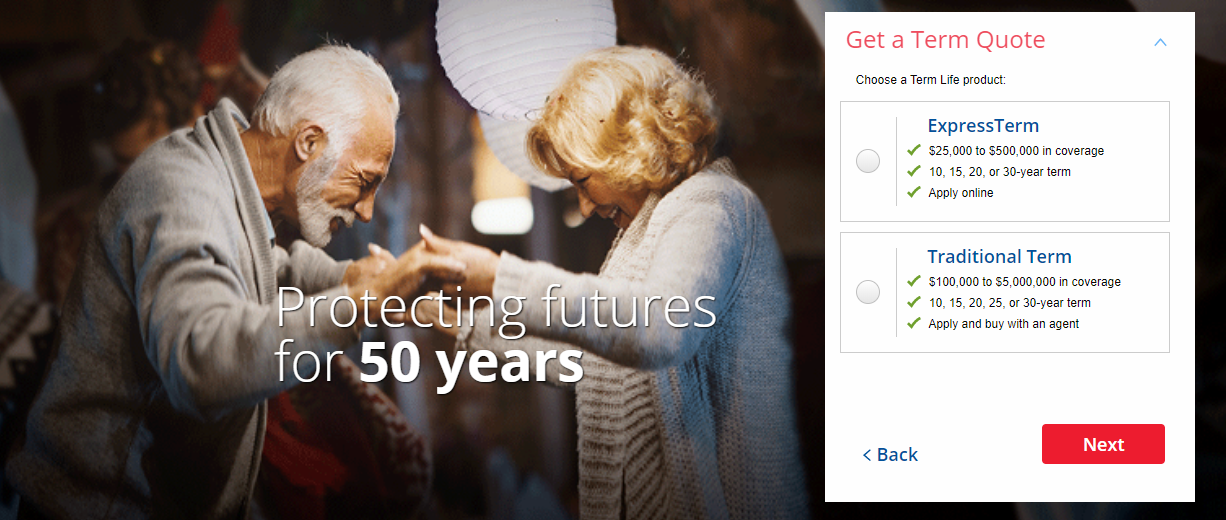

#2 – Select a Type of Insurance

There are two plan options to select from in the next step: Express Term or Traditional Term.

You can decide on your insurance type based on the coverage amount you’d like and whether you want to complete your application online or work with an agent.

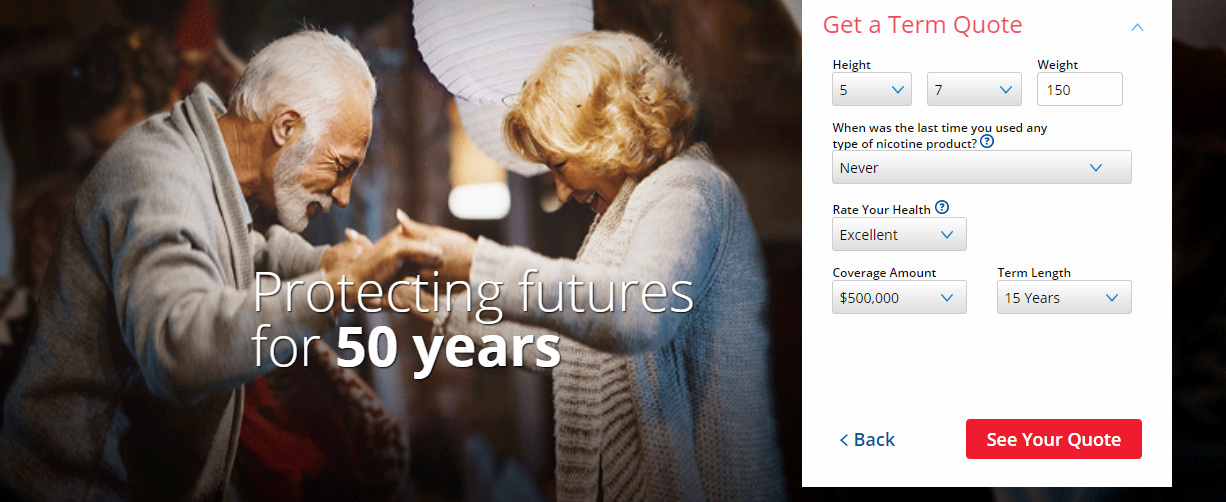

#3 – Enter a Few Final Details

For the final step, you’ll need to enter your height, weight, and information regarding any tobacco use.

You’ll also need to select your coverage amount and term length. Simply click “See Your Quote” and obtain your quote.

Design of Website/App

AAA Life doesn’t provide policyholders with a dedicated mobile app. To access AAA Life online, you’ll need to go through a web browser. From the site, AAA Life does provide users with a full set of educational and account service tools.

The AAA Life site has a nice flow and is very well designed. A chat tool provides instant customer support and insurance calculators are available on the site.

AAA Life is ahead of many competitors with its site design in its ability to provide customers with a full application and approval process online.

Pros & Cons

AAA Life is a well-known insurance provider representing a trusted national brand. If you’re considering AAA Life for your insurance needs, compare the pros and cons below to help you with your decision.

Pros

- The company offers a wide variety of products including term life, whole life, and universal life insurance

- It offers an online application process that consumers can use to get instant approval and obtain insurance quickly

- Investments in technology tools are helping the company provide users with a faster service experience and claims process

- AAA Life is part of the larger AAA group of companies and is well-backed and financially strong

- For AAA members, additional policy discounts and incentives are available

Cons

- Pricing for AAA Life term products is competitive for younger consumers but can be costly for older customers

- Most products require that consumers complete a medical exam to qualify

- Coverage amounts for certain insurance types like whole life are limited and costly

- Some products have high annual fees

The Bottom Line

At the end of the day, most customers want an insurance company that will provide them with affordable insurance options that are easy to understand and easy to acquire. AAA Life checks those boxes.

Of course, rushing into a life insurance policy can be a mistake. Although AAA Life presents a good set of product options, what else should you consider when you make your decision?

The bottom line is that AAA Life products should be compared against the products of at least three or four other products before you make your decision.

There’s more to price when it comes to insurance. Are you considering how easy it is to reach your agent or customer service representative? If you forget to make a payment, will your provider work with you to get your coverage back on track?

If you want to compare and contrast a few providers, the best way to dive in is to gather a few quotes. Get started right now by simply entering your ZIP code here and obtain a free, customized quote in seconds.

AAA Life’s FAQs

Use this guide to some of the most common questions consumers ask about AAA Life products.

#1 – Why might AAA Life be a good choice for you?

AAA Life represents a widely known and respected brand with a strong credit position. The company offers a wide variety of products to serve consumers of all age groups and income levels and is competitive in pricing with many of the leading insurance providers.

#2 – Do I have to be an AAA member to purchase AAA Life products?

AAA Life products are available to everyone whether you enjoy AAA membership or not. However, members receive additional discounts and incentives.

#3 – If I want to purchase coverage for a family member, what do I need to do?

Although you can complete all of the paperwork and work with an agent to set up the policy, your family member will need to be present to sign any documents and might have to complete blood work or a medical exam.

#4 – How do I know what type of coverage I should purchase?

This will depend upon your individual needs and requirements. However, as a starting point check out our helpful guide on shopping for insurance.

#5 – What type of medical information do I have to provide to AAA Life to qualify for a policy?

Underwriting requirements for each plan can be different. For an accelerated term plan, you may simply need to submit information on your height, weight, age, and answer some family history information.

For higher benefit plans or permanent insurance, a full underwriting process might require completion of a medical exam.

#6 – What is a permanent insurance maturity date?

All life insurance plans must expire at some point. For permanent insurance plans, your provider selects a date far into the future for when your plan will expire and any value in the plan will be returned to you. However, they expect that the date is so far away, you will have used or closed the plan in advance.

#7 – I already have disability and health insurance. Why do I need life insurance?

Different types of insurance are intended to protect you from different issues. Health insurance will help you meet day-to-day medical bills and manage any costs from medical emergencies. Disability insurance is meant to help you cover your living expenses if you’re unable to work for a period of time.

Life insurance is meant to provide financial protection for your family and cover expenses that you might be paying for with your income and financial contribution.

#8 – If I find cheaper insurance with AAA Life, should I cancel my policy and buy AAA Life?

Before you make any quick decisions, it’s best to sit down with an agent or advisor and do a detailed comparison of plans. While some plans might seem cheaper, you may have hidden costs and fees to consider.

You should also consider any cancellation penalties and fees. In some instances, it may be cheaper to keep your policy and use supplemental insurance to cover any risks while keeping your costs lower.

#9 – Can I own multiple life insurance policies?

Yes, and in some cases, you probably might want to. Using cheaper insurance to cover higher coverage amounts for responsibilities you have today and permanent insurance to cover you over the long haul can sometimes be a more cost-effective plan. Speak with your financial advisor to see what is right for you.

#10 – Are additional riders a good idea for life insurance?

Some riders are important to consider, like accidental death riders, or return of premium options. Review your options with your agent to understand which riders will add the best value to your policy.

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption