Protective Life Insurance Review (Coverage Comparisons & More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1907 |

| Current Executives | President- Richard J Bielen COO- Michael G. Temple |

| Number of Employees | 2,500-3,000 |

| Total Sales / Total Assets | $5,000,000,000 / $4,925,289,696 |

| HQ Address | 2801 US-280, Birmingham, AL 35223 |

| Phone Number | 1-800-866-9933 |

| Company Website | www.protective.com |

| Premiums Written - Individual | 2,406,628,653 |

| Financial Standing | $321,113,441 |

| Best For | Competitive Term Rates |

Get Your Rates Quote Now |

|

When shopping for life insurance, you want to get the best policy for you and your family. Between deciding which company and policy to choose, life insurance can get overwhelming. You need to have as much information as possible before choosing the company that will protect your loved ones.

Protective Life has multiple policies designed to help keep your family financially secure. The company offers whole, term, and multiple universal life insurance policy options.

Keep reading to determine if Protective is the best choice for your family’s needs.

Get FREE life insurance quotes now by clicking the quote tool above.

Table of Contents

Protective’s Ratings

The following ratings provide an overview of Protective Life’s financial standing and business practices.

A.M. Best

A.M. Best’s credit ratings are independent and objective opinions regarding a company’s creditworthiness. Their ratings are based on qualitative and quantitative data including balance sheet strength, operating performance, and business profile.

Protective has received a superior A+ rating from A.M. Best for the past five years. This means the company is in excellent financial standing and is able to handle its financial obligations.

Better Business Bureau (BBB)

The Better Business Bureau’s ratings don’t have a financial component but are based on the way a business interacts with its customers. The BBB uses information directly from businesses, as well as public data sources, including complaints received from the public.

Ratings from A+ (highest) to F (lowest) are assigned to companies by the BBB. Protective has an A+ rating, indicating minimal complaints that were resolved quickly.

The majority of complaints filed with the BBB are regarding a problem with a Protective product or service.

Protective is not a BBB-accredited organization.

Moody’s

Similar to A.M. Best, Moody’s measures a company’s short-term and long-term credit risk. Protective currently has an A1 rating from Moody’s, indicating they have a stable financial outlook and low credit risk.

NAIC Complaint Index

The National Association of Insurance Commissioners’ Complaint Index shows the number of complaints filed against an insurance company.

In 2018, two complaints were filed against Protective regarding claim delays.

Company History

Protective Life Insurance Company was founded in Birmingham, Ala. in 1907. Two years later, the company paid its first death claim.

Since its founding, the company has continued to grow and acquire new companies. In 1957, the company celebrated its 50-year anniversary and began approaching $1 billion in active policies.

Over the years, the company continued to evolve, and in 1997, it acquired West Coast Life, expanding its national presence. In 2007, Protective celebrated its 100th anniversary with insurance in force of $252 billion.

The company acquired United Investors Life and Liberty four years later, increasing active policies by 50 percent.

In 2015, Protective became a wholly-owned subsidiary of the Dai-ichi Life Insurance Company. In 2019, the company acquired all the individual life and annuity business of Great-West Life and Annuity Insurance Company. This marked Protective’s 57th and largest acquisition to date.

Protective’s Market Share

In 2016, Protective Life Insurance was responsible for 1.59 percent of the life insurance market share, with $2,468,179,517 written in direct premiums.

The following year, the company dropped slightly to 1.49 percent of the market share. Protective had $2,444,518,881 written in direct premiums in 2017. In 2018, Protective’s market share decreased slightly again, dropping to 1.47 percent of the market share and $2,403,640,825 written in direct premiums.

| Year | Direct Premiums Written | Market Share |

|---|---|---|

| 2016 | $2,468,179,517 | 1.59% |

| 2017 | $2,444,518,881 | 1.49% |

| 2018 | $2,403,640,825 | 1.47% |

Get Your Rates Quote Now |

||

Although Protective’s market share has decreased over the last three years, the company has remained among the top 20 life insurance companies on the market.

Protective’s Position for the Future

In the last two years, Protective has made major acquisitions. As mentioned, in 2019, Protective acquired Great-West Life and Annuity Insurance Company. The move represented a capital investment by Protective of an estimated $1.2 billion.

The previous year, Protective also acquired Liberty Life Assurance Company of Boston, also representing a capital investment of $1.2 billion.

The company continues to expand its profile and customers. Although the company’s market share decreased over the last three years, Protective is in a good position for the future.

The company’s financial ratings indicate they are in excellent standing to handle the new financial responsibilities that came with these acquisitions.

Protective’s Online Presence

Protective has multiple social media platforms including a Facebook page, Twitter account, Instagram account, LinkedIn account, and YouTube Channel.

The company has 154,605 likes on Facebook and almost 7,900 followers on Twitter. Protective updates both platforms regularly and answers customer service questions on Twitter. The company’s other platforms are not updated frequently.

Protective has an online portal for its customers. Through this portal, customers can access tax forms, change beneficiaries, check cash value, and pay premiums.

Their website also has a virtual assistant that can help guide you through the site and answer frequently asked questions. The site also has a claims center. Through the claims center online portal, you can file a claim and check the status of it. The claims center also provides grief resources, including articles and videos.

Protective’s Commercials

Protective doesn’t have many commercials on their YouTube channel, but the ones that are available share a common theme: protecting your family.

Here’s another one.

These ads focus on life’s more stressful moments and how Protective can help you protect your family and the life you’re working hard to build.

The company also has a series of videos titled “Life Gets Awkward” that promote the learning center on the company’s website. The videos contrast life’s smaller, awkward moments with the bigger life moments, such as marriage, that Protective can help you plan for.

Now, let’s discuss their presence in the community.

Protective in the Community

The Protective Life Foundation was created to help the company serve its community. Through financial contributions and volunteer hours, the Protective Life Foundation allows employees to give back to numerous non-profit organizations.

Since it began 24 years ago, the foundation has donated $68.7 million to a variety of organizations. In 2018, the foundation contributed $4.5 million in gifts.

The foundation’s website outlines the following objectives for its charitable giving mission:

- Contribute to the welfare and quality of life of the local community

- Be a corporate leader in giving

- Work with organizations, corporations, and individuals to solve the difficult human and economic situations in local communities

In 2018, Protective employees dedicated over 1,000 hours to volunteer work with non-profit organizations. The Protective Life Foundation supports 238 groups and organizations in its community.

Protective’s Employees

Protective has more than 2,500 employees working at its headquarters in Birmingham, Ala. and in offices in California, Illinois, Missouri, New York, Ohio, South Carolina, and Tennessee.

The company offers careers in life insurance, acquisitions, asset protection, annuities, and corporate services.

On Glassdoor, the company has an overall rating of three out of five stars. About 95 percent of Protective employees approve of the CEO. Employees have also given the culture and values of the company 3.2 out of five stars and the work/life balance of the company 3.4 out of five stars.

The average salary of an employee at Protective varies greatly due to the wide range of careers at the company. A customer service representative at Protective makes $15 an hour. A claims manager can make $76,000 to $82,000 a year, according to employee information provided on Glassdoor.

Protective has also been recognized with the following recognition and awards:

- America’s Best Midsize Employers (Forbes)

- Best Places to Work (Birmingham Business Journal)

- Healthiest Employers (Birmingham Business Journal)

- Fit-Friendly Worksite (American Heart Association)

- Top Work Places (The Cincinnati Enquirer)

Shopping for Life Insurance

The 2018 Insurance Barometer Study from Life Happens and LIMRA found that 35 percent of households would feel the financial impact within one month of the primary wage earner’s death. As you shop for life insurance, you need to know what immediate and future expenses you need covered, so your family is protected.

Immediate expenses to consider are medical bills, funeral costs, and any outstanding debts. You should also think about future, long-term expenses, such as income replacement, mortgages, and college tuition.

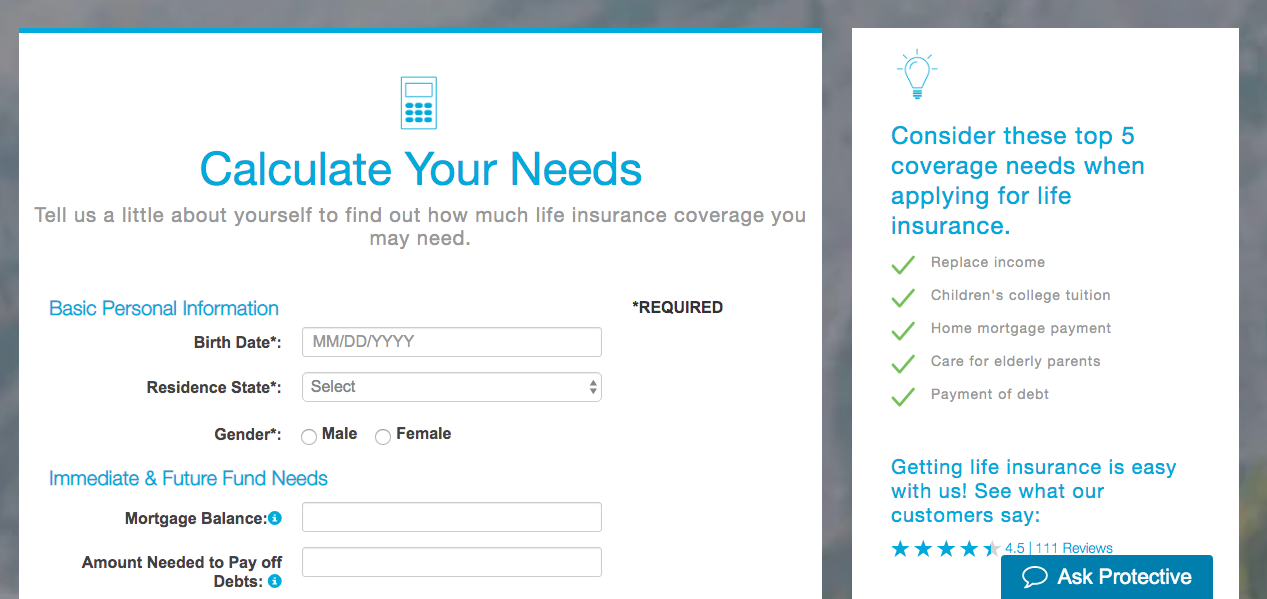

Protective has a needs assessment tool on their website that will give you an idea of how much coverage you need based on your estimated immediate and future needs.

Keep these expenses in mind as you shop for life insurance to make sure your family has the amount of coverage they need.

Average Protective Male vs Female Life Insurance Rates

As we’ve continued to discuss throughout this article, women have lower life insurance rates than men because they’re expected to live longer. In the table below, you can see the difference in Protective’s premiums for men and women who don’t smoke.

| Non-Smoker Age | $100,000/10-year Male | $100,000/10-year Female | $100.000/20-year Male | $100.000/20-year Female |

|---|---|---|---|---|

| 25 | $7.30 | $7.04 | $8.89 | $8.13 |

| 30 | $7.30 | $7.04 | $8.92 | $8.13 |

| 35 | $7.30 | $7.04 | $9.36 | $8.76 |

| 40 | $8.52 | $7.91 | $11.22 | $10.08 |

| 45 | $11.12 | $10.16 | $15.84 | $13.21 |

| 50 | $14.41 | $12.92 | $21.93 | $18.06 |

| 55 | $19.96 | $17.44 | $33.19 | $24.72 |

| 60 | $29.14 | $23.86 | $52.41 | $36.41 |

Get Your Rates Quote Now |

||||

This table shows how much higher Protective’s premiums are for smokers.

| Smoker Age | $100,000/10-year Male | $100,000/10-year Female | $100.000/20-year Male | $100.000/20-year Female |

|---|---|---|---|---|

| 25 | $24.82 | $21.59 | $33.66 | $29.84 |

| 30 | $24.82 | $21.68 | $35.19 | $31.96 |

| 35 | $26.01 | $22.87 | $36.98 | $35.87 |

| 40 | $32.98 | $29.50 | $52.28 | $40.80 |

| 45 | $48.88 | $42.08 | $79.48 | $60.86 |

| 50 | $78.54 | $63.58 | $112.12 | $89.08 |

| 55 | $112.46 | $93.93 | $168.56 | $146.63 |

| 60 | $149.35 | $143.82 | $249.99 | $209.87 |

Get Your Rates Quote Now |

||||

The cost difference between men and women may seem small, but those numbers add up over time. It’s also worth noting that while rates for life insurance always go up with age, they are drastically higher for those who smoke at around 4 to 5 times as much!

Coverage Offered

Protective offers a variety of life insurance policies to help protect your family. Think about how much coverage you want and how long you want it for. With that in mind, keep reading to see if Protective’s life insurance policies are right for you.

Types of Coverage Offered

Protective offers a variety of policies, including term, whole, and universal life insurance policies. The company offers multiple forms of universal life insurance policies, including traditional, variable, indexed, survivorship, and custom choice.

Let’s take a closer look at what each of these policies has to offer.

Term

Term life insurance policies provide coverage and a guaranteed death benefit during a specific time period. Term life policies are usually less expensive than permanent life insurance.

Protective offers term life insurance policies with coverage periods of 10 to 30 years. The policies cover amounts from $100,000 to $50 million. Protective’s term life policies have fixed, level premiums.

If you decide you want permanent coverage, you can convert your term life policy to a permanent policy. Protective doesn’t require a medical exam if you convert your policy.

Whole

Whole life insurance is a policy with a fixed premium that covers a policyholder’s lifetime, as long as payments are made on a regular basis. Whole life policies are more expensive than term life policies, but they provide permanent coverage. These policies also grow tax-deferred cash value.

Protective’s whole life insurance policies offer a guaranteed death benefit and guaranteed cash value accumulation. You can access the cash value of your policy through a loan, but a loan will reduce the cash value and death benefit of your policy.

Universal

Universal life insurance policies also offer permanent coverage and the potential for cash value growth, but they provide more flexibility than whole life policies.

Universal policies give you flexibility in your premiums and death benefits. With universal coverage, you can change the amount and frequency of your payments. Depending on the cash value of your policy, your premiums can be increased or decreased.

If your needs and circumstances change, you can also change your death benefit within the limits of the policy. If your policy has been in place for a few years, you can lower it. However, if you want to increase the death benefit, you’ll have to go through another underwriting process.

Protective offers the following universal life insurance policies:

- Traditional universal life insurance

- Variable universal life insurance

- Indexed universal life insurance

- Survivorship UL

- Protective Custom Choice UL

Variable universal life insurance allows you to invest the cash value of the policy into investment portfolios. This means you have a higher potential for cash value growth, but the policy also comes with higher risk, since your cash value depends on the market.

Variable life policies also have additional investment expenses other life insurance policies don’t have. If your investments decrease in value, your premiums may go up to keep your policy in place.

Like other forms of universal life insurance, indexed universal life offers lifetime coverage and flexibility. Its unique characteristic is that it allows for cash value growth based on the performance of at least one market index.

Protective’s policies have two main types of interest accounts available with an indexed universal life policy:

- Fixed account

- Indexed account

Premiums in a fixed account earn interest at a specific rate. An indexed account credits interest to your policy based on the performance of a particular index. Indexed accounts are subject to caps and floors.

Essentially, if the market performs well, so does your policy.

A survivorship life insurance policy covers two people under one policy and pays out the death benefit when the second person dies. Survivorship life insurance policies are generally more affordable than taking out two separate policies. These policies are often set up so beneficiaries have money to cover estate taxes.

Protective’s survivorship life insurance policy offers the following:

- Lifetime lapse protection: guarantees you won’t lose your coverage as long as your premium is paid

- Estate protection endorsement: gives beneficiaries an increased death benefit to help cover estate taxes

- Split option endorsement: gives you the option to split the policy into two separate policies in case of divorce

- Death benefit coverage flexibility: allows you to reduce your coverage without having to purchase a new policy

The company also offers Protective Custom Choice UL policies, which allow you to choose the amount of coverage you need and a level benefit period of 10 to 30 years.

After the initial benefit period ends, premium payments remain the same while the coverage amount begins to decrease, which allows you to remain covered while you assess your needs.

You can convert the policy into traditional permanent coverage without another medical exam. The policy has to be exchanged within the first 20 years of the policy and before you turn 70.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Factors That Affect Your Rate

There are many factors that can affect your life insurance premium. Your demographic information, occupation, and hobbies can all play a role in your rate.

Let’s take a closer look at how these factors can affect your premium.

Demographics

Demographic information, especially your age and gender, can affect your premium.

As you age and it becomes more likely an insurance company will have to pay out your policy, your premium will become higher. If you’re younger, your rates will be lower. If you’re older, your rates will be higher.

Gender can also affect your life insurance policy premium. Generally, women have lower premiums than men because women are expected to live longer. The average life expectancy of a woman is 86.5 years and the life expectancy of a man is 84 years.

Since men are not expected to live as long as women, they have higher life insurance premiums.

Current Health & Family Medical History

Your overall health and your family’s health history can also affect the price of your premium.

Insurance companies may require a medical exam and your medical records as part of the application process. Most life insurance medical exams take less than 30 minutes and the paramedical examiner will come to your home or office to conduct the exam.

Generally, the exams consist of two parts: the actual exam and a medical questionnaire. The physical exam will consist of a blood draw and recording your height and weight. After the exam, the test results are sent to the insurance underwriter.

An underwriter will still have access to public prescription and Medical Information Bureau records even if your life insurance company does not require a medical exam.

Both current and previous health issues can affect the price of your premium. A history of a serious illness can drive up the price of your premium.

Your family’s health also plays a role in your premium. If there is a history of serious illness in your family, especially diseases that are hereditary, your rate may be higher.

High-Risk Occupations

Your occupation can also lead to an increase in your premium. If you have a job that falls into the category of high-risk occupations, you will pay more for life insurance. High-risk occupations are jobs with higher numbers of fatal work accidents or injuries.

According to the Bureau of Labor Statistics, the following industries had the highest rate of fatal work injuries in 2017:

- Construction

- Transportation

- Warehousing

- Agriculture

- Forestry

- Fishing

- Hunting

Police officers and firefighters are also considered to be high-risk positions. If your job is considered high-risk, you will pay more for life insurance.

High-Risk Habits

Though it may not be the first thing that comes to mind when you’re shopping for life insurance, your habits and hobbies can also affect your premium. High-risk hobbies such as skydiving, private aviation, and bungee jumping can cause your rate to go up.

A one-time bungee jumping experience won’t change your premium, but if it’s a regular occurrence, your rate will be affected.

The main habit that causes premiums to increase is smoking. Regardless of your age or gender, you will pay more for life insurance if you smoke.

For example, a 35-year-old female non-smoker would pay $8.76 a month for a $100,000 20-year term life policy with Protective. A smoker of the same gender would pay $35.87 for the same policy.

Veteran or Active Military Status

Like the jobs previously mentioned, being an active member of the military is considered a high-risk occupation. Generally speaking, active military members pay much higher premiums for life insurance.

Some life insurance companies don’t offer policies for members of the military.

Getting the Best Rate with Protective

As you shop for life insurance, you need to set yourself up for success and make sure you get the best rate possible. The first step in getting a good rate is getting a quote. By getting a quote, you can have an idea of how much coverage you’ll need and how much it should cost.

If you’re not sure how much coverage you need, use a needs assessment tool to help you calculate the expenses you want covered. Determining how much coverage you need will help make sure you’re not overpaying for too much life insurance coverage.

Even though life insurance may not be on the minds of most young people, buying life insurance when you’re younger will mean a lower premium. As you age and it becomes more likely your insurance company will have to pay out your policy, your premium will go up.

Another way to keep your premiums low is to stay healthy. Generally speaking, healthier people are expected to live longer, so they pay less for life insurance.

As we’ve previously discussed, smoking can cause your premiums to be much higher than non-smokers. By staying in good health and not smoking, you can make sure your rate stays low.

Protective’s Programs

Protective’s website features a learning center with informative articles for customers about a wide range of topics related to life insurance. Here are some of the articles available in the learning center:

- Five Questions to Consider Before Buying Life Insurance

- Get a Better Understanding of Your Medical Exam

- Seven Life Stages that Affect Your Life Insurance Needs

The articles provide more information regarding Protective’s policies, but they also cover topics relating to life insurance in general.

The Life 101 section of the learning center has articles to help you better understand the basics of life insurance. The articles cover why you should get life insurance, policy types, and the next steps you should take after purchasing a policy.

The learning center also has information and articles on financial, retirement, and college planning. These are articles on topics including:

- Disability income insurance

- Understanding annuities

- Understanding 539 plans

Canceling Your Policy

There are some life insurance policies that let you adjust your coverage or premiums so you don’t have to cancel your policy, but you may still find that your policy is no longer working for you. If you want to switch policies to another company or you can no longer afford it, you can cancel your policy.

How to Cancel

You can cancel a life insurance policy at any time, but you may have to pay extra fees if you cancel within a particular time frame. For example, you may have to pay a fee if you cancel before five years have passed on a 10-year term life policy.

Insurance companies may charge a surrender fee. The company will pay the cash value minus the cost of the surrender fees, known as the surrender value.

Protective does not have cancellation information on their website, so be sure to contact a customer service representative or your agent for more information.

How to Make a Claim

Most life insurance companies follow a similar standard for the claim filing process. Generally, you will need to start a claim, fill out the required paperwork, submit a death certificate and other requested documentation, and determine how benefits will be disbursed.

After this process, you receive the benefits.

Protective has a claims center on its website to help make the claim filing process as streamlined as possible. The claims center gives you step-by-step instructions on how to file a claim, access to any documents needed for the process, and answers to frequently asked questions about the claims process.

To begin the claims process with Protective, you need to notify the company of the death. There is a notification of death on the company’s website, or you can call the company at 1-800-424-1592.

For this step in the process, you’ll need the following information:

- Your name and contact information

- The deceased’s name, policy number, or Social Security number

- Birthdate and death date

- Cause, manner, and country of death

After you notify Protective of the insured’s death, you’ll fill out a packet that asks for basic information regarding your claim. You’ll need to submit a certified copy of the death certificate and any other requested documentation with the packet.

After your claim is approved, Protective will send out your benefit payment within one business day. In the claim packet, you may have options to choose how you want to receive your benefit.

If the benefit amount is $10,000 or higher, you may qualify for an Immediate Benefit Account. You can choose to set up the account, which works like a checking account, instead of receiving your funds in a one-time, lump-sum check.

You can write checks directly from the Immediate Benefit Account. You can close the account at any time. To close the account, you write a check for the entire balance on the account.

How to Get a Quote Online

Now that you’ve learned about Protective’s policies, you can find out what exactly they can offer you by getting a quote. Here’s how to get a quote on Protective’s website:

#1 – Complete a Needs Assessment

Before you get a quote, use Protective’s needs assessment tool to determine how much coverage you need. The needs assessment will first ask you for basic personal information.

Then, you’ll fill out information regarding your current and future financial needs. This includes your mortgage balance, debts, income replacement, and college tuition.

You’ll also fill out information about your available funds, including current savings and existing life insurance policies.

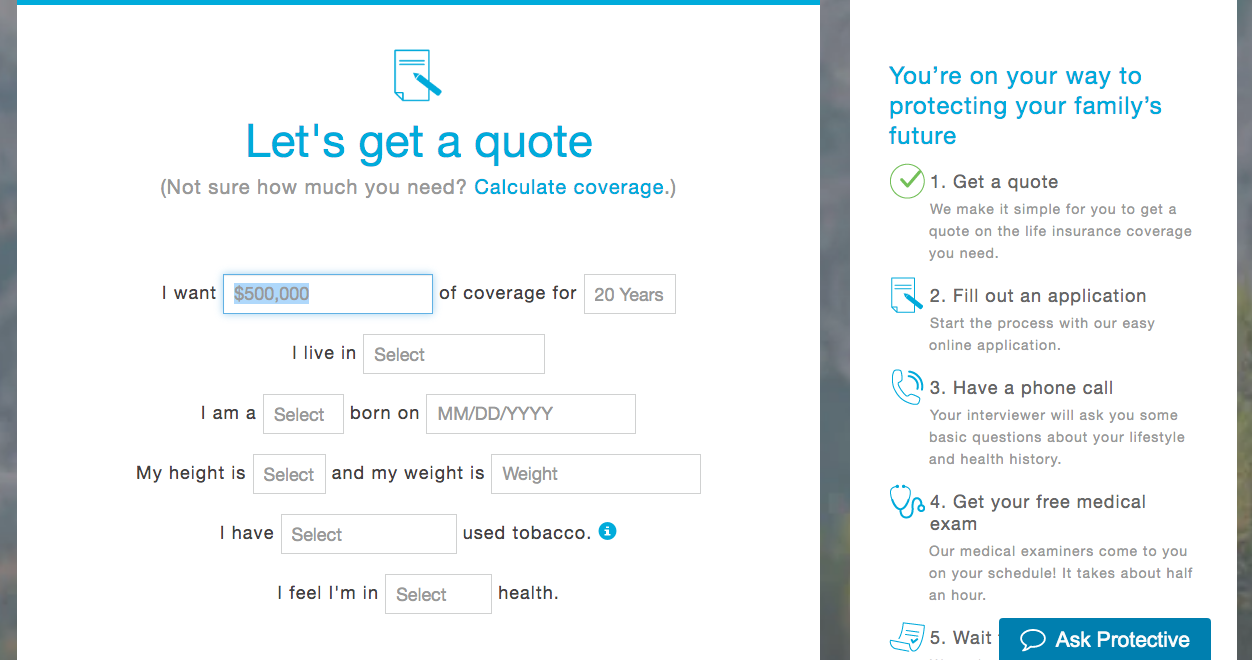

#2 – Use Protective’s Online Quote Tool

After you determine how much life insurance coverage you need, you can use Protective’s online quote tool to get an estimate.

First, you’ll enter how much coverage you want and for how long. Then, you’ll fill out personal information, including your state of residence, sex, birth date, height, and weight.

You will also answer questions regarding your tobacco usage and current health status.

#3 – Click the See My Quote Button

After you’ve filled out all the necessary information, click the green See My Quote button to get your Protective Life Insurance quote.

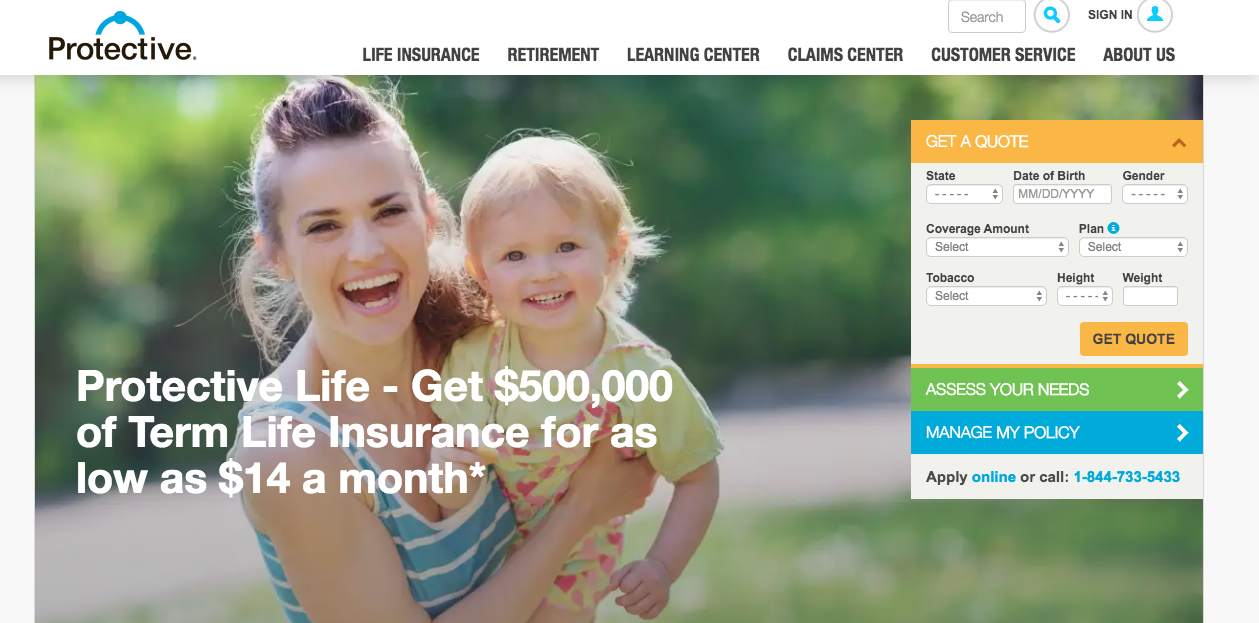

Design of Website/App

Overall, the design of Protective’s website makes it relatively easy to use. The tools you’ll use the most — the quote tool, customer service portal, and online application — are easily accessible and visible in the upper right-hand corner of the website.

One of the negative aspects of the website’s design is the large font. The website has a large amount of information on all of its webpages, so the large font can be visually overwhelming. The learning center webpage is very busy, and it can be difficult to find exactly what you’re looking for.

The page has a video right in the middle that is surrounded by text, links, photos, and a Twitter widget. Though the learning center has interesting and informative articles, it can be difficult to find one on a particular topic due to the layout of the webpage.

Protective doesn’t have a mobile app for its services.

Pros & Cons

Before you take out a life insurance policy with any company, you should know the advantages and disadvantages of the company. Let’s take a look at the pros and cons of choosing a policy with Protective Life:

Pros

- Protective offers a wide variety of insurance plans, including term, whole, and five variations of universal life insurance policies.

- With this many plans and the company’s CustomChoice UL policy, you can tailor coverage to make sure Protective’s plans are working the best way possible for you and your family.

- The company also has an extensive website that allows you to apply for life insurance, make a claim, and change any personal information.

- With this variety of online tools, Protective has made many of the processes that go along with having a life insurance policy more streamlined and accessible.

Cons

- One of the drawbacks of Protective Life is the higher rates for current and previous tobacco users. A 45-year-old male non-smoker will pay $17.19 a month for $250,000 10-year term coverage with Protective.

- However, a smoker of the same age and gender will pay $110.50 a month for the same policy.

- If you are using or have previously used tobacco, Protective may not be the best choice for you.

The Bottom Line

Overall, Protective offers a wide variety of life insurance policies for relatively low costs. The company’s CustomChoice UL plan offers unique coverage that will provide you with a level premium and make sure you’re still covered after the initial policy ends.

The company is continuously growing and acquiring new assets and customers while maintaining its financial stability.

When buying life insurance, you want to make sure your family will be protected. Use this guide to help you decide if Protective is the right choice for you and your family.

Protective’s FAQs

#1 – What life insurance policies does Protective have?

Protective offers term, whole, and universal life insurance policies. The company offers multiple forms of universal life insurance policies, including traditional, variable, indexed, survivorship, and custom choices.

#2 – How much life insurance do I need?

Use Protective’s needs assessment and quote tool to determine the amount of life insurance coverage that’s right for you and your family.

#3 – Can I still get a Protective policy if I have a medical condition?

Protective’s policies do require a medical exam, but you can still get coverage from Protective if you have a medical condition.

Get life insurance now by clicking on our FREE online quote tool.

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption